Geothermal Power Market Research, 2034

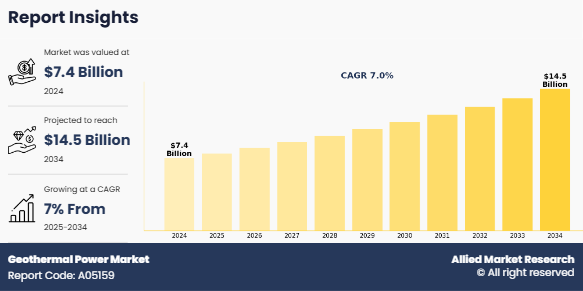

The global geothermal power market size was valued at $7.4 billion in 2024, and is projected to reach $14.5 billion by 2034, growing at a CAGR of 7.0% from 2025 to 2034. Geothermal power is a form of renewable energy that harnesses the heat stored within the Earth’s crust to generate electricity or provide direct heating. It utilizes steam or hot water produced from underground reservoirs of geothermal energy to drive turbines connected to electricity generators. Since it relies on the Earth's internal heat, which is continuously produced by natural radioactive decay, geothermal power is a sustainable, reliable, and environmentally friendly energy source with minimal greenhouse gas emissions.

.Introduction

Geothermal power is the energy generated by using the natural heat from within the Earth. This heat comes from the planet’s core and is stored in rocks, hot water, and steam beneath the Earth’s surface. Power plants use this geothermal heat to produce steam, which drives turbines to generate electricity. It is a clean, renewable, and sustainable energy source that provides a continuous supply of power with very low environmental impact.

Key Takeaways

- The global geothermal power industry has been analyzed in terms of value ($billion). The analysis in the report is provided on the basis of power station type, end-use, and 4 major regions, and more than 15 countries.

- The global geothermal power market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

- The key players in the geothermal power market include Yokogawa Electric Corporation, Enel Spa, ABB Ltd, Toshiba Corporation, General Electric, Korea Electric Power Corporation, Siemens AG, Tata Power Company Limited, Mitsubishi Heavy Industries Ltd, Ormat Technologies, Inc.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the alternators industry.

- Countries such as China, the U.S., Canada, Germany, and Brazil hold a significant share in the global geothermal power market.

Market Dynamics

The growing demand for renewable and sustainable energy sources is a major driver for the geothermal power market. It is an increasing emphasis on reducing dependence on fossil fuels and transitioning toward clean energy solutions that help mitigate climate change as global energy consumption continues to rise. It offers a reliable and consistent energy supply, as compared to intermittent sources such as solar and wind, making it an attractive option for meeting base-load electricity needs. Governments, businesses, and consumers are pushing for energy solutions that are both environmentally friendly and economically viable. Geothermal energy produces minimal greenhouse gas emissions, requires relatively small land areas compared to other renewable sources, and has long operational lifespans, making it a sustainable alternative. Moreover, supportive policies, subsidies, and investments in renewable infrastructure are accelerating geothermal project development worldwide. All these factors are expected to drive the demand for the geothermal power market during the forecast period.

The geothermal power market is segmented into power station type, end-use, and region. On the basis of power station type, market is divided into dry steam power stations, flash steam power stations, binary cycle power stations. On the basis of end-use, the market is classified into residential, commercial, industrial, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

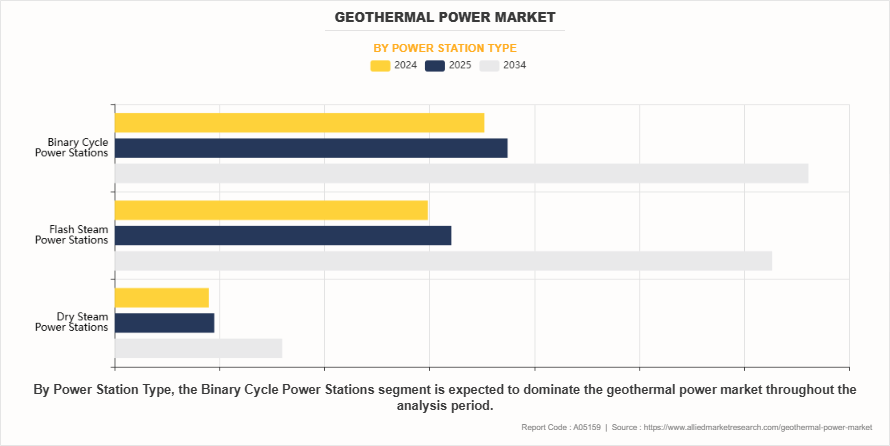

On the basis of power station type, market is divided into dry steam power stations, flash steam power stations, binary cycle power stations. The binary cycle power stations segment accounted for 47% of the geothermal power market share in 2024 and is expected to maintain its dominance during the forecast period. This dominance is primarily attributed to the technology’s ability to utilize low- to medium-temperature geothermal resources, which are more abundant and geographically widespread compared to high-temperature resources required by flash or dry steam systems.

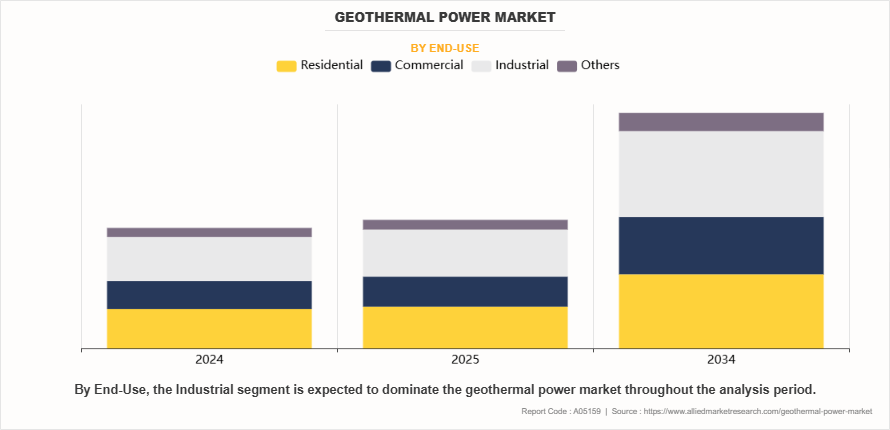

On the basis of end-use, the market is classified into residential, commercial, industrial, and others. The industrial segment accounted for 36% of the geothermal power market share in 2024 and is expected to maintain its dominance during the forecast period. This dominance is primarily attributed to the rising demand for sustainable and continuous power supply in energy-intensive industries such as manufacturing, mining, and processing. Industrial facilities benefit from geothermal power’s high reliability, low operational costs, and minimal carbon emissions, making it a preferred choice for operations requiring constant and large-scale energy output.

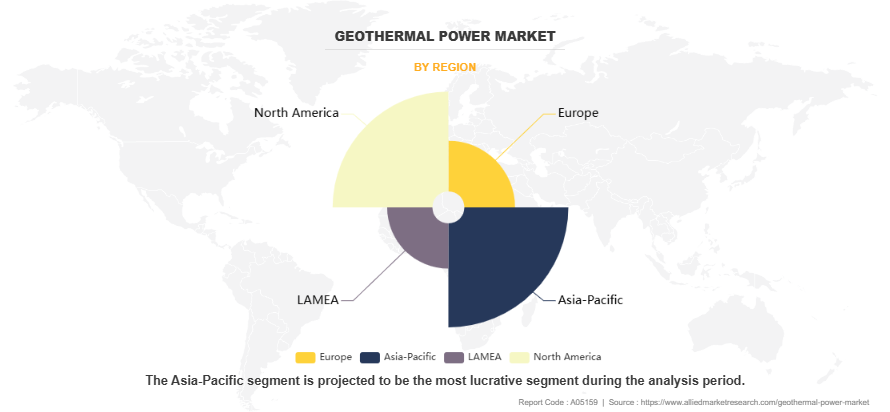

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region accounted for 35% of the geothermal power market share in 2024 and is expected to maintain its dominance during the forecast period. This growth is primarily driven by the abundant availability of geothermal resources in countries such as Indonesia, the Philippines, Japan, and New Zealand, which are situated along the Pacific Ring of Fire.

Increasing investments in clean energy infrastructure are generating significant growth opportunities for the geothermal power market. The sector is witnessing enhanced financial support for exploration, drilling, and plant development as governments, development banks, and private investors expand funding for renewable energy initiatives. These investments are primarily aimed at establishing resilient, low-carbon energy systems, where geothermal power plays a crucial role owing to its capacity to provide stable, base-load electricity independent of weather fluctuations. In addition, international climate goals and net-zero commitments are driving large-scale infrastructure programs aimed at expanding renewable capacity. This trend is encouraging the deployment of advanced geothermal technologies, including enhanced geothermal systems (EGS) and hybrid plants, which can improve efficiency and reduce costs over time. With long-term operational stability, low emissions, and the potential to complement intermittent renewables such as wind and solar, geothermal power is increasingly seen as a valuable asset within the clean energy investment landscape, opening new growth avenues in both developed and emerging markets. All these factors are anticipated to offer new growth opportunities for the geothermal power market during the forecast period.

However, high exploration and drilling risks significantly hamper the growth of the geothermal power market. Geothermal energy requires extensive geological surveys, seismic studies, and test drilling to confirm the presence of viable heat reservoirs as compared to solar and wind energy projects, where resource availability are easily measured. These activities are expensive and carry a high degree of uncertainty there is always the possibility that exploration may fail to identify commercially exploitable resources. Such uncertainties make investors cautious, as unsuccessful drilling are lead to substantial financial losses without any return.

Key players in the geothermal power market include Yokogawa Electric Corporation, Enel Spa, ABB Ltd, Toshiba Corporation, General Electric, Korea Electric Power Corporation, Siemens AG, Tata Power Company Limited, Mitsubishi Electric Corporation, and Ormat Technologies, Inc.

Segments Overview

The geothermal power market is segmented into power station type, end-use, and region. On the basis of power station type, market is divided into dry steam power stations, flash steam power stations, binary cycle power stations. On the basis of end-use, the market is classified into residential, commercial, industrial, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Analysis

Key players in the geothermal power market include Yokogawa Electric Corporation, Enel Spa, ABB Ltd, Toshiba Corporation, General Electric, Korea Electric Power Corporation, Siemens AG, Tata Power Company Limited, Mitsubishi Electric Corporation, and Ormat Technologies, Inc..

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the geothermal power market growth segments, current trends, estimations, and dynamics of the geothermal power market analysis from 2024 to 2034 to identify the prevailing geothermal power market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the geothermal power market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global geothermal power market trends, key players, market segments, application areas, and geothermal power market forecast growth strategies.

Geothermal Power Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 14.5 billion |

| Growth Rate | CAGR of 7% |

| Forecast period | 2024 - 2034 |

| Report Pages | 350 |

| By Power Station Type |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | TOSHIBA CORPORATION, Korea Electric Power Corporation, Mitsubishi Electric Corporation, Ormat Technologies, Inc., ABB Ltd, General Electric, Enel Spa, Yokogawa Electric Corporation, Tata Power Company Limited, Siemens AG |

Analyst Review

According to the opinions of various CXOs of leading companies, the geothermal power market is expected to witness significant growth during the forecast period. The increasing demand for renewable baseload power generation and the global shift toward decarbonization are key factors driving this demand. Geothermal power plants provide a constant and reliable source of electricity by harnessing the Earth’s internal heat, thats make them a crucial component in the renewable energy mix. As energy security and grid stability become top priorities, geothermal energy offers the advantage of 24/7 power generation, as compared to intermittent sources such as wind and solar. This reliability, combined with its minimal greenhouse gas emissions, positions geothermal as an attractive option for countries aiming to diversify their clean energy portfolios. Moreover, the growing focus on decarbonization is further accelerating the adoption of geothermal power. With nations committing to carbon neutrality targets and phasing out fossil fuels, geothermal energy offers a sustainable alternative that generates electricity without combustion. Its compatibility with renewable electricity infrastructure and potential to integrate with hybrid energy systems further align with global climate goals. In addition, technological advancements in exploration, drilling, and enhanced geothermal systems (EGS) are making previously inaccessible resources economically viable, encouraging investment and project development worldwide. As governments, utilities, and private investors seek long-term, low-emission energy solutions, geothermal power is expected to play a vital role in achieving both environmental and economic sustainability.

Growing demand for renewable and sustainable energy sources and increasing focus on reducing greenhouse gas emissions are the upcoming trends of geothermal power market in the world.

Industrial is the leading application of Geothermal Power Market.

Asia-Pacific is the largest regional market for Geothermal Power

$14.5 billion is the estimated industry size of Geothermal Power.

Yokogawa Electric Corporation, Enel Spa, ABB Ltd, Toshiba Corporation, General Electric, Korea Electric Power Corporation, Siemens AG, Tata Power Company Limited, Mitsubishi Electric Corporation, and Ormat Technologies, Inc are the top companies to hold the market share in Geothermal Power.

Loading Table Of Content...

Loading Research Methodology...