The Germany unsecured business loans market has witnessed significant growth due to several factors. The robust German economy serves as a significant driving force in this market, creating a conducive environment for businesses to flourish and grow. Germany's position as a dominant economic force in Europe entices both local and global enterprises, resulting in an increased need for loans to facilitate expansion endeavors.

On the other hand, businesses seeking unsecured loans face significant challenges due to regulatory compliance and bureaucracy, which limit accessibility to loans. Furthermore, stricter lending criteria and credit assessments compound the issue, making it a daunting task for some enterprises. Moreover, economic downturns, such as one experienced during the global financial crisis, trigger heightened caution among lenders, leading to reduced loan availability.

However, the Germany unsecured business loans market presents a plethora of opportunities. Technological advancements have paved the way for the evolution of this market, with fintech innovations streamlining application processes and enabling faster disbursements. This has made it more convenient for SMEs to obtain capital. Furthermore, rise in emphasis on sustainability among businesses has led to an increased demand for green financing and loans for eco-friendly initiatives, which are expected to gain popularity in the future.

In the future, the Germany unsecured business loans market is expected to experience various transformative trends. Primarily, momentum of peer-to-peer lending platforms and online marketplaces are expected to persist. These platforms present an alternative to conventional banks and financial institutions, granting borrowers a wider range of options and competitive interest rates.

In addition, emergence of personalized lending solutions is a significant trend in the lending industry. Through the utilization of advanced data analytics and artificial intelligence, lenders customize loan packages to cater to the unique requirements of businesses. This development is especially advantageous for small and medium-sized enterprises (SMEs) that necessitate flexible and tailored financing. Moreover, the market is anticipated to experience heightened regulation and standardization. Regulatory bodies are expected to enforce more stringent measures on lenders to guarantee responsible lending practices and safeguard borrowers from potential abuse.

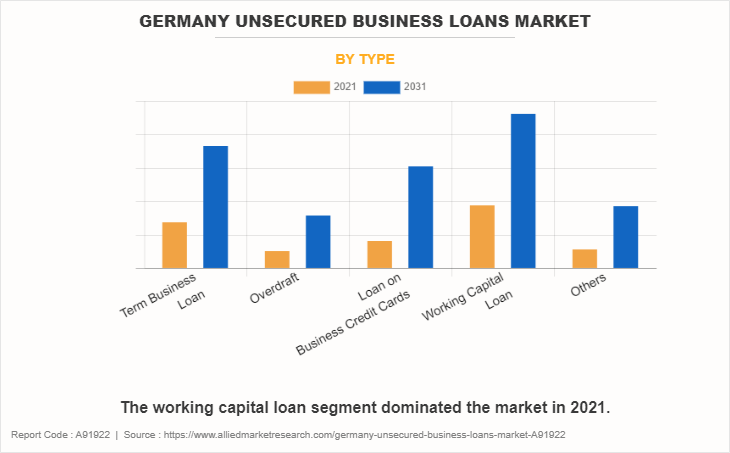

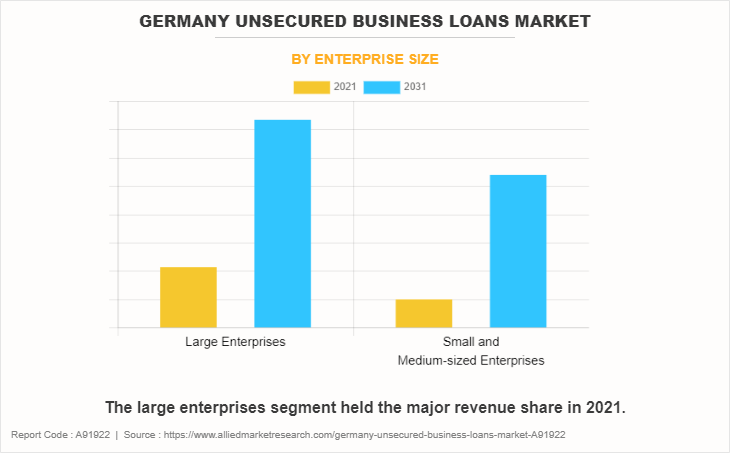

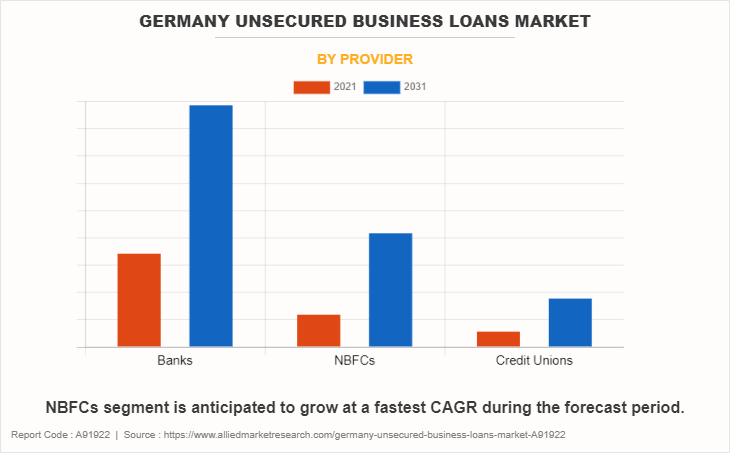

The Germany unsecured business loans market is segmented into type, enterprise size, and provider. Further, on the basis of type, the market is segregated into term business loan, overdraft, loan on business credit cards, working capital loan, and others. Depending on enterprise size, it is bifurcated into large enterprises, small and medium-sized enterprises. By provider, the market is classified into banks, NBFCs, and credit unions.

New product development and research and development efforts by lending institutions play a crucial role in shaping the market's landscape. Loan products have witnessed innovative advancements, including revenue-based financing and convertible notes, which offer distinct financing options to businesses with diverse capital requirements.

Consumer and end-user perceptions have a significant impact on the market. Trust and reputation play a crucial role in the relationship between borrowers and lenders. Businesses that have positive experiences with a lender are more inclined to utilize their services in the future and recommend them to others. Hence, it is imperative for lenders to maintain a favorable reputation in the market.

Moreover, pricing strategies hold great importance. Borrowers are attracted to transparent and competitive interest rates. However, lenders strike a balance between profitability and customer satisfaction. The competitive nature of the market requires careful consideration of pricing to remain competitive while ensuring financial sustainability and meeting varying capital needs.

The Porter’s five forces analysis analyzes the competitive scenario of the Germany unsecured business loans market and role of each stakeholder. These forces include the bargaining power of suppliers, bargaining power of buyers, threat of substitutes, threat of new entrants, and competitive rivalry.

The market experiences a relatively low threat of new entrants due to strict regulatory requirements and trust established by major financial institutions. Nevertheless, fintech startups and peer-to-peer lending platforms are gradually causing disruptions in the market. The bargaining power of suppliers who are lending institutions is relatively high as they have control over the supply of capital. However, this power is balanced by increased competition and borrower awareness.

In the Germany unsecured business loans market, the bargaining power of buyers is moderate with their lender selection which is influenced by factors such as interest rates, terms, and reputation. However, due to nature of lending, their negotiating power is not expected to be significant. Alternative financing options, such as equity investments and government grants, serve as substitutes in this market and impact the demand for unsecured loans, thus increasing the threat of substitutes. The Germany unsecured business loans market is characterized by intense competitive rivalry, with traditional banks, NBFCs, and credit unions competing for market share. Fintech companies and online lenders intensify the competition, leading to innovation and improved terms for borrowers.

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats in the Germany unsecured business loans market. Strengths in the market encompass strong and stable German economy, wide range of loan products to cater to diverse business needs, and presence of established financial institutions with a proven track record. Weaknesses in this market include stringent regulatory requirements that slow down the loan approval process and limited accessibility for small businesses with less financial history.

Opportunities in the Germany unsecured business loans market include technological advancements and fintech innovations, increase in demand for sustainable and green financing, personalized lending solutions, and rise in popularity of online marketplaces for loans. Threats to this market include economic downturns and market uncertainties, competition from alternative financing options, and regulatory changes and increased scrutiny.

Key players in the Germany unsecured business loans market are Deutsche Bank, Commerzbank, KfW Bankengruppe, ING-DiBa, HypoVereinsbank, DZ Bank, Landesbank Baden-Württemberg, Bayerische Landesbank, N26, and Funding Circle.

Key Benefits For Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in Germany unsecured business loans market.

- Assess and rank the top factors that are expected to affect the growth of the Germany unsecured business loans market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the Germany unsecured business loans market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

Germany Unsecured Business Loans Market Report Highlights

| Aspects | Details |

| Forecast period | 2021 - 2031 |

| Report Pages | 77 |

| By Type |

|

| By Enterprise Size |

|

| By Provider |

|

| Key Market Players | DZ Bank, Deutsche Bank, ING-DiBa, N26, Funding Circle, Landesbank Baden-Württemberg, HypoVereinsbank, Bayerische Landesbank, Commerzbank, KfW Bankengruppe |

The Germany Unsecured Business Loans Market is estimated to reach $736.6 billion by 2031

Deutsche Bank, Commerzbank, KfW Bankengruppe, ING-DiBa, HypoVereinsbank, DZ Bank, Landesbank Baden-Württemberg, Bayerische Landesbank, N26, and Funding Circle are the leading players in Germany Unsecured Business Loans Market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in germany unsecured business loans market.

3. Assess and rank the top factors that are expected to affect the growth of germany unsecured business loans market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the germany unsecured business loans market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

Germany Unsecured Business Loans Market is classified as by type, by enterprise size, by provider

Loading Table Of Content...

Loading Research Methodology...