Glass Fiber Reinforcement Materials Market Overview:

Glass Fiber Reinforcement Materials Market was valued at $8,468 million in 2015, and is expected to reach $14,084 million by 2022, growing at a CAGR of 7.6% from 2016 to 2022.

Glass fibers are the most versatile industrial materials known today and are produced from raw materials like silica sand, limestone, and soda ash, which are available in virtually unlimited supply. They exhibit useful properties such as hardness, transparency, resistance to chemical attack, stability, and inertness, and desirable fiber properties such as strength, flexibility, and stiffness. Glass fibers glass fiber reinforcement materials are used to manufacture structural composites, printed circuit boards, and a wide range of special-purpose products.

The global glass fiber reinforcement materials market is driven by the growth in demand for glass fiber from the aerospace industry as a substitute for heavy metal parts and advantages of using glass fiber over other reinforcement materials such as low cost, durability, and light weight. However, certain environmental issues related with recycling of glass fiber products such as glass fiber reinforced plastics (GFRP) are expected to hinder the glass fiber reinforcement materials market growth during the forecast period. This restraint can be overcome in the future, due to the rise in awareness among the manufacturers and efforts made by them to recycle glass fiber by developing in-house facilities. Furthermore, the increase in use of glass fiber in wind turbines and development of carbon/glass hybrid structures are creating numerous growth opportunities in the global glass fiber reinforcement materials market.

Glass Fiber Reinforcement Materials Market Segmentation

The global glass fiber reinforcement materials market is segmented based on product type, end-use industry, and geography. Based on product type, it is classified into roving, woven roving, fabrics, Chopped Strand Mat (CSM) / Continuous Filament Mat (CFM), chopped strand, and others, including multi-axial. Based on end-use industry, it is categorized into construction, transportation, industrial, consumer goods, and wind energy.

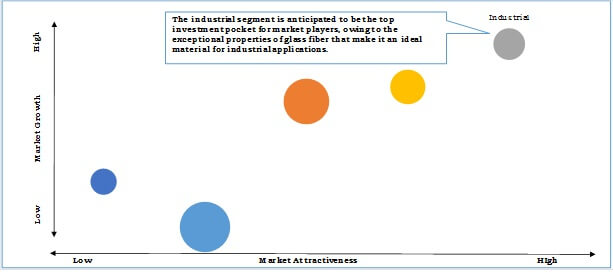

Top investment Pocket

The industrial segment is anticipated to be the top investment pocket for market players, owing to the exceptional properties of glass fiber that make it an ideal material for industrial applications. It is anticipated to show fastest growth, registering a CAGR of 8.3%, throughout the forecast period. Glass fiber reinforced plastics are an excellent option for the power industry as they are devoid of any magnetic field and can offer considerable resistance to electric sparks.

Top investment Pockets

Geography Review

Geographically, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific dominated the glass fiber reinforcement materials market in 2015, and is anticipated to maintain its lead throughout the forecast period, growing with the highest CAGR. This is attributed to the expanding applications of glass fiber in the construction sector and increase in infrastructural activities in the developing nations, such as China, Korea, Japan, and India.

Glass Fiber Reinforcement Materials Market, By Geography, 2015 & 2022

China Review

China accounted for the maximum revenue in the Asia-Pacific glass fiber reinforcement materials market in 2015, as it is the largest producer of glass fiber globally. Glass fiber in China is consumed in transportation, construction, and wind power industries. The Chinese glass fiber reinforcement materials market possesses high potential for growth, owing to the rapid development and expansion of these industries.

The key players operating in the glass fiber reinforcement materials market include Owens Corning, 3B-Fiberglass, Jushi Group, PPG Fiberglass, Taishan Fiberglass, Chongqing Polycomp International Corp (CPIC), Saint-Gobain Vetrotex, Asahi Glass, Nippon Electric Glass Co., Ltd., and BASF SE.

Other major glass fiber reinforcement materials players in the glass fiber market (not included in the report) are AGY Holding Corp., Jiangsu Jiuding New Material Co. Ltd, Formax (UK) Ltd., Gunther Kast GmbH, LANXESS AG, Johns Manville, Ahlstrom GlassFibre OY, Shanghai Xiao-Bao FRP, China Fiberglass Company, and Advanced Glassfiber Yarns.

Key Benefits of Glass Fiber Reinforcement Materials Market:

- This report provides a detailed study of glass fiber reinforcement materials market trends and forecast from 2014 to 2022, which assist to identify the prevailing market opportunities.

- In-depth coverage of the global market, including drivers, restraints, and opportunities, helps professionals to understand the market behavior in a better way.

- This study further includes market share analysis in terms of product type and end-use industry globally.

- Detailed analysis of the strategies of key leaders, partnerships, and acquisitions in the market is provided.

- Porter’s Five Forces analysis examines the competitive structure of the market and assists strategists in better decision-making.

Glass Fiber Reinforcement Materials Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By End Use Industry |

|

| By Geography |

|

| Key Market Players | OWENS CORNING, SAINT-GOBAIN VETROTEX, NIPPON ELECTRIC GLASS CO., LTD., TAISHAN FIBERGLASS, ASAHI GLASS, 3B-FIBERGLASS, CHONGQING POLYCOMP INTERNATIONAL CORP (CPIC), BASF SE, PPG FIBERGLASS, JUSHI GROUP |

Analyst Review

The global glass fiber reinforcement materials market is driven by the demand from aerospace and automotive industries. The aerospace and automotive industries are seeking materials that can replace heavy metal parts, considerably reducing the weight of the vehicle. In addition to the lightweight, glass fiber composites are also advantageous when it comes to reduction in manufacturing & raw material cost, higher tensile strength, and improved fuel efficiency. Glass fiber is preferred over carbon fiber for making automotive parts such as body panels, bumpers, dashboards, intake manifolds, and several others. Automotive manufacturers focus more towards reducing the weight of the vehicle and making it more fuel efficient in terms of fuel usage. Thus, due to the abovementioned advantages of glass fiber, there is a rapid increase in the demand from the automotive & aerospace and other industrial sectors, which drives the glass fiber reinforcement materials market globally.

The glass fiber industry is highly concentrated in the Asia-Pacific market, owing to the dominance of Chinese glass fiber overcapacity. In 2012, China produced around 3 million MT versus domestic demand of less than 1.9 million MT, while the EU market was around 900,000 MT. China accounted for the highest percentage of market share in the Asia-Pacific glass fiber reinforcement materials market and is gaining global dominance in glass fibers, despite the lack of competitive advantage, through aggressive state‐planning, subsidies, and overcapacity.

Loading Table Of Content...