Continuous Glucose Monitoring Systems Market Size & Trends

The global continuous glucose monitoring devices market size was valued at $6,626.6 million in 2021, and is projected to reach $31,708.2 million by 2031, growing at a CAGR of 17.0% from 2022 to 2031.Continuous glucose monitoring systems (CGMs) are medical devices that measure and track glucose levels in real time throughout the day and night. These systems usually consist of a small sensor inserted just beneath the skin that measures glucose levels every few minutes, a transmitter to send the data to a display device, and a display device to interpret the data. CGMs are used to help people with diabetes and other conditions to monitor their glucose levels and adjust their insulin or medication accordingly. They can also be used to detect patterns in glucose levels and alert users about potential problems earlier.

Historical overview

The continuous glucose monitoring systems market size was analyzed qualitatively and quantitatively from 2022 to 2031. The continuous glucose monitoring devices market is expected to increase at a CAGR of around 22% during 2022-2031. Most of the growth during this period was derived from the North America owing to the rise in the number of key players that manufacture continuous glucose monitoring devices, increase in prevalence of diabetics as well as well-established presence of domestic companies in the region.

Key Market Dynamics

Growth & innovations in the medical device industry for the manufacturing of continuous glucose monitoring systems, creates an opportunity for the continuous glucose monitoring market. The increase in the number of continuous glucose monitoring systems industry for development of continuous glucose monitoring systems drives the continuous glucose monitoring systems market growth. For instance, in September 2022, GlucoRx, a medical technology company in the UK, along with Cardiff University, announced the development of the world's first multi-sensor non-invasive continuous glucose monitoring system. It uses radiofrequency technology, along with a multisensory approach to accurately and non-invasively measure the blood glucose level every minute.

In addition, the growth of the continuous glucose monitoring systems market share is expected to be driven by increase in number of geriatric populations, increase in prevalence of diabetics' population, surge in demand for diagnosis, and increase in unmet healthcare needs. According to the International Diabetic Federation, in 2021, around 31,000 Europeans are diagnosed with type 1 diabetics. For instance, according to the International Diabetes Federation (IDF), in 2021, 51 million people were living with diabetes in North America. 1 in 7 adults is diagnosed with diabetes. As per the same source, the number of adults with diabetes is expected to reach 57 million by 2030 and 63 million by 2045. In addition, according to Journal of J Diabetes Sci Technol, in 2021, it was reported that around 48% of type 1 diabetics population use continuous glucose monitoring system in the U.S.

Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced healthcare services, significant investments by government to improve healthcare infrastructure, and advancement in R&D activities in medical industry in emerging countries. According to the International Diabetics Federation, in 2021, it was reported that around $189 billion are spent for diabetic related expenditure in Europe, which is 19.6% of the global expenditure. This is attributed to further supports CGM devices market growth.

Factors such as rise in adoption of medical devices and increase in awareness among population regarding continuous glucose monitoring system, further drive the growth of the continuous glucose monitoring devices market.

In addition, a rise in geriatric population fuels market growth, as aged individuals are susceptible to diabetes. According to the International Diabetic Federation, in 2021, it was reported that around 20% of the population above the age of 50 years is diagnosed with diabetics, in the Southeast Asia Region. The aging population increases the demand for continuous glucose monitoring systems.

For instance, in June 2022, the Senseonics Holdings, Inc., one of the leading manufacturers of implantable continuous glucose monitoring systems, announced the CE Mark approval for the next-generation Eversense E3 CGM System, in Europe. Thus, the increase in the number of product approvals of continuous glucose monitoring systems propels the growth of the market. However, the high cost associated with continuous glucose monitoring systems is expected to restrict the market growth during the forecast period.

The COVID-19 pandemic has led to a rise in demand for remote patient monitoring systems, including CGMs, as patients and healthcare providers strive to minimize in-person visits to hospitals during the outbreak. This has led to increased sales and growth for CGM companies. Thus, the continuous glucose monitoring systems market was positively impacted by the COVID-19 pandemic.

Market Segmentation

The continuous glucose monitoring systems market is segmented into Component, Demography and End User. By component, the market is categorized into sensors and transmitters & receivers. On the basis of demography, the market is segmented into child population (≤14 years) and adult population (>14 years). By end user, the market is classified into hospitals & clinics, home healthcare, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

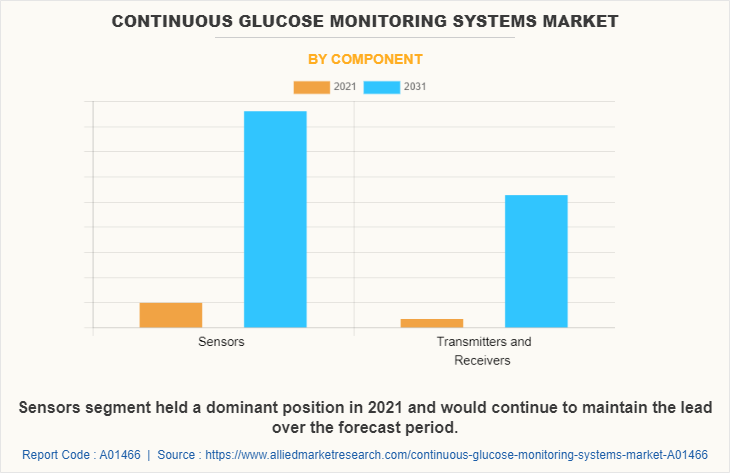

By component, the market is classified into sensors and transmitters & receivers. The sensor segment dominated the global market in 2021 and is anticipated to continue this trend during the continuous glucose monitoring systems market forecast period. This is attributed to advancement in technology in development of continuous glucose monitoring systems. The continuous glucose monitoring systems works through a tiny sensor and monitor the glucose level every minute. The sensor consists of a small adhesive to hold it in place and lasts for around one week. The sensor sends the data to a receiver, which can be a smartphone, a computer, or a CGM device.

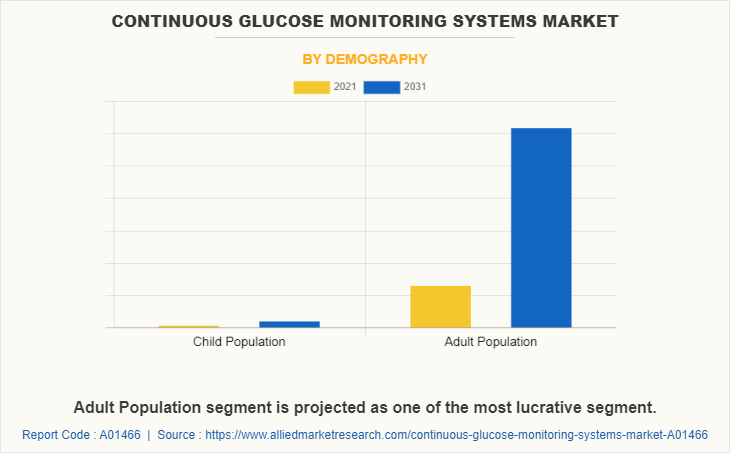

By demography, the market is classified into child population (≤14 years) and adult population (>14 years). The adult population segment dominated the global market in 2021 and is anticipated to continue this trend during the forecast period. This is attributed to rise in prevalence of diabetics and an increase in the number of geriatric populations. According to the International Diabetic Federation (IDF), in 2021, it was reported that around 537 million adults aged 20 to 79 years were diagnosed with diabetics. As per the same source, it was also analyzed that around 643 million adults are projected to live with diabetics, by 2030.

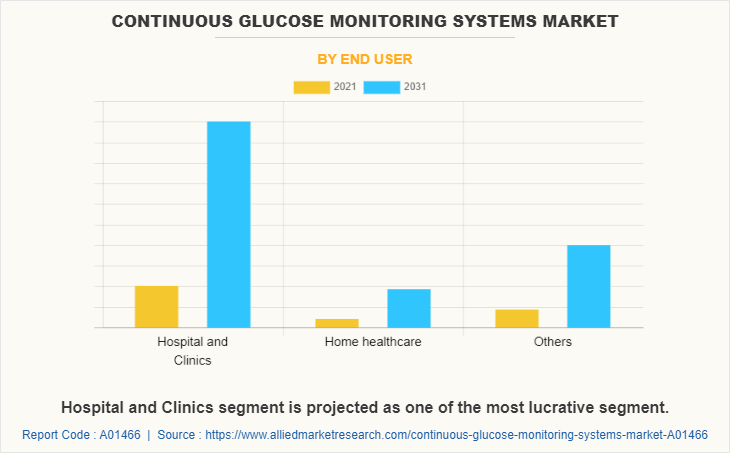

By end user, the market is classified into hospitals & clinics, home healthcare, and others. The hospitals segment held the largest market share in 2021 and is expected to remain dominant throughout the forecast period, owing to a rise in the number of continuous glucose monitoring systems in hospitals. On the other hand, home healthcare was the second-largest contributor in the market in 2021 and is expected to register fastest CAGR during the forecast period, owing to rise in number for early diagnosis of disease, and increase in demand for home-based diagnosis.

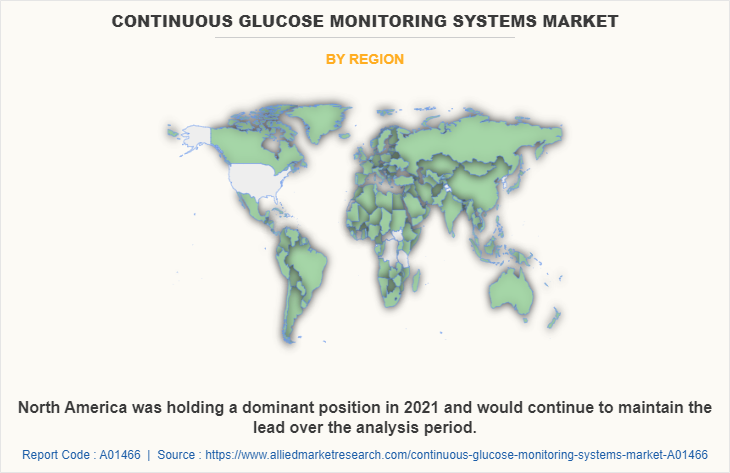

By region, the continuous glucose monitoring devices market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the continuous glucose monitoring systems market in 2021 and is expected to maintain its dominance during the forecast period.

The presence of several major players, such as A. Menarini, Diagnostics S.r.l, Abbott Laboratories, DexCom, Inc., F. Hoffman-La Roche Ltd, GlySens Incorporated, Johnson & Johnson, Medtronic plc, Novo Nordisk A/S, Senseonics, and Ypsomed AG, and advancement in manufacturing of continuous glucose monitoring systems in the region drive the growth of the market.

In addition, the increase in development of the medical device sector is expected to propel the growth of the market. The use of high technology medical devices such as advanced sensors used in continuous glucose monitoring systems propel the growth of the market.

Furthermore, the presence of well-established healthcare infrastructure, high purchasing power, and rise in adoption rate of continuous glucose monitoring systems in hospitals, and clinics are expected to drive the market growth.

Furthermore, product launch, product approval, and acquisitions adopted by the key players in this region boost the growth of the market. For instance, in November 2022, Senseonics Holdings, Inc., one of the leading medical technology companies, announced the collaboration with Nurse Practitioner Group (NPG). The collaboration aims to expand patient access by providing at-home and in-home insertion option Eversense E3 Continuous Glucose Monitoring System (CGM).

Regional/Country Market Outlook

Asia-Pacific is expected to witness growth at the highest rate during the forecast period. The market growth in this region is attributed to the presence of continuous glucose monitoring systems industry that manufacture continuous glucose monitoring systems in the region. In addition, an increase in the number of geriatric population and advancement in continuous glucose monitoring system is set to propel the growth of Asia-Pacific continuous glucose monitoring system market. Furthermore, development in healthcare infrastructure, and increase in number of hospitals and clinics is expected to contribute toward growth of the continuous glucose monitoring system market in India. This system is used in ICU, to reduce the number of fingerstick points of care capillary blood glucose testing, decrease hypoglycemic episodes, and decrease hyperglycemic episodes. This increases the need for continuous glucose monitoring system. Thus, increasing awareness and spreading of knowledge among population regarding CGMs supplement the market growth.

Competitive Landscape

Competitive analysis and profiles of the major players in the continuous glucose monitoring systems, such as A. Menarini, Diagnostics S.r.l, Abbott Laboratories, DexCom, Inc., F. Hoffman-La Roche Ltd, GlySens Incorporated, Johnson & Johnson, Medtronic plc, Novo Nordisk A/S, Senseonics, and Ypsomed AG., are provided in this report. Major players have adopted product approval, collaboration, and agreement as key developmental strategies to improve the product portfolio of the continuous glucose monitoring systems market.

Recent Key Strategies and Development

In December 2022, the U.S. Food and Drug Administration (FDA) cleared Dexcom's Continuous Glucose Monitoring System G7. It is the most accurate integrated continuous glucose monitoring (iCGM) system and approval of Dexcom G7 will help the company to gain a strong foothold in the continuous glucose monitoring systems market.

In May 2022, the U.S. Food and Drug Administration (FDA) cleared Abbott's FreeStyle Libre 3 system for continuous glucose monitoring in the children population. Thus, the approval of FreeStyle Libre 3 system will help the company to gain strong foothold in the continuous glucose monitoring systems market.

In September 2022, Nemaura Medical, Inc, one of the leading global medical technology companies, announced a definitive agreement with EVERSANA. The agreement aims to cover the U.S. and global sale of Nemaura’s Diabetes Management Solution.

In November 2022, Senseonics Holdings, Inc., one of the leading medical technology companies, announced the collaboration with Nurse Practitioner Group (NPG). The collaboration aims to expand patient access by providing at-home and in-home insertion option Eversense E3 Continuous Glucose Monitoring System (CGM). They also aim to expand the initiative to other key markets across the U.S, in future.

Furthermore, Senseonics collaborated with University Hospitals Accountable Care Organization (UHACO), in September 2021, to offer Eversense CGMs to patients of accountable care organization (ACO).

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the continuous glucose monitoring systems market analysis from 2021 to 2031 to identify the prevailing continuous glucose monitoring market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the continuous glucose monitoring systems market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global continuous glucose monitoring devices market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global continuous glucose monitoring systems market trends, key players, market segments, application areas, and market growth strategies.

Continuous Glucose Monitoring Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 31.7 billion |

| Growth Rate | CAGR of 17% |

| Forecast period | 2021 - 2031 |

| Report Pages | 284 |

| By Demography |

|

| By End User |

|

| By Component |

|

| By Region |

|

| Key Market Players | A. Menarini Diagnostics S.r.l, Ypsomed AG, Medtronic plc, Senseonics, Novo Nordisk A/S, GlySens Incorporated, DexCom, Inc., Abbott Laboratories, F. Hoffman-La Roche Ltd, Johnson & Johnson |

Analyst Review

This section provides various opinions of the top-level CXOs in the global continuous glucose monitoring industry. In accordance with several interviews conducted, the continuous glucose monitoring systems market is expected to witness healthy growth with the rise in the research and development for minimally invasive CGM systems. In addition, the increase in number of geriatric populations suffering from diabetes leads to high adoption of CGMs, which are expected to significantly boost the growth of the continuous glucose monitoring systems market. However, the high cost of CGMs and complications of CGMs limit the growth of the market.

For instance, in May 2022, the U.S. Food and Drug Administration (FDA) cleared Abbott's FreeStyle Libre 3 system for continuous glucose monitoring in the child population. Thus, the approval of FreeStyle Libre 3 system will help the company to gain a strong foothold in the continuous glucose monitoring systems market. In addition, Senseonics collaborated with University Hospitals Accountable Care Organization (UHACO), in September 2021, to offer Eversense CGMs to patients of accountable care organization (ACO).

The top companies that hold the market share in continuous glucose monitoring systems Market are include A. Menarini, Diagnostics S.r.l, Abbott Laboratories, DexCom, Inc., F. Hoffman-La Roche Ltd, GlySens Incorporated, Johnson & Johnson, Medtronic plc, Novo Nordisk A/S, Senseonics, and Ypsomed AG.

Asia-Pacific is anticipated to witness lucrative growth during the forecast period, owing to high prevalence of diabetic population in India, improvement in healthcare awareness, rise in R&D activities for developing innovative CGM systems, development in healthcare facilities, and surge in healthcare expenditure.

The key trends in the continuous glucose monitoring systems Market are rise in number of product launches and product approvals for continuous glucose monitoring systems and increase in prevalence diabetics

The base year for the report is 2021.

Yes, continuous glucose monitoring systems companies are profiled in the report

The total market value of continuous glucose monitoring systems Market market is $6,626.6 million in 2021 .

The forecast period in the report is from 2022 to 2032

The market value of continuous glucose monitoring systems Market in 2022 was $7,694.8 million

Loading Table Of Content...