Distribution Transformer Market Overview

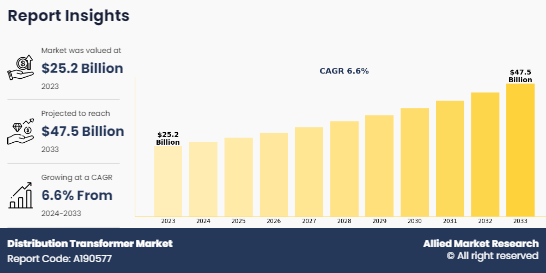

The global distribution transformer market was valued at USD 25.2 billion in 2023, and is projected to reach USD 47.5 billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033. Rise in demand for electricity drives the growth of distribution transformer market. As industrialization progresses and manufacturing activities grow, there is a corresponding increase in the demand for electricity. Distribution transformers are essential for delivering high voltage electricity from transmission lines to industrial facilities at lower voltages suitable for industrial use. However, volatility in raw material prices is expected to restrain the growth of the market during the forecast period. The adoption of smart grid technologies is expected to present opportunities for the integration of advanced distribution transformers equipped with monitoring and communication capabilities.

Key Market Trend & Insights

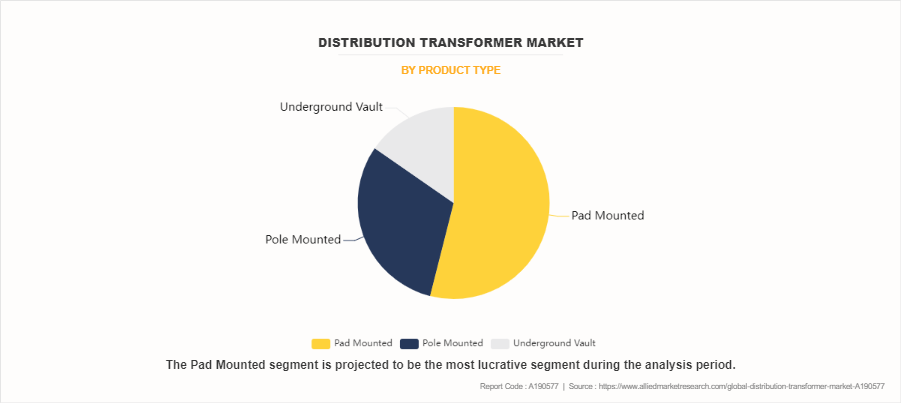

- Pad-mounted transformers lead the product type segment, featuring advanced fire protection and real-time monitoring systems.

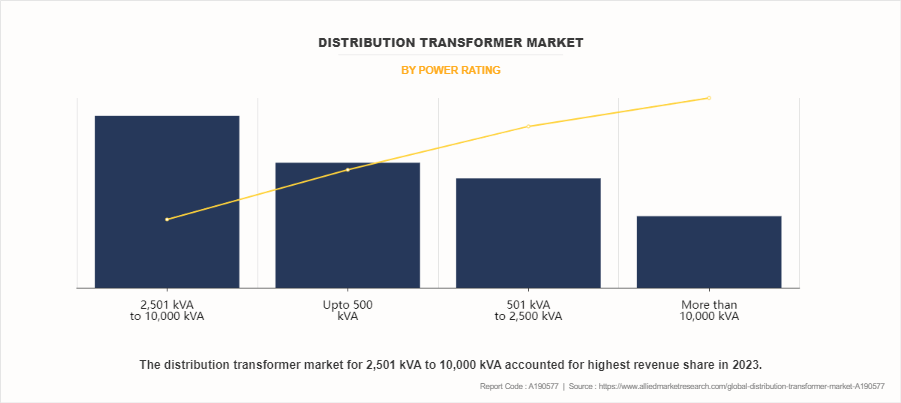

- The 2,501–10,000 kVA power rating segment dominates, especially in petrochemical and heavy industries.

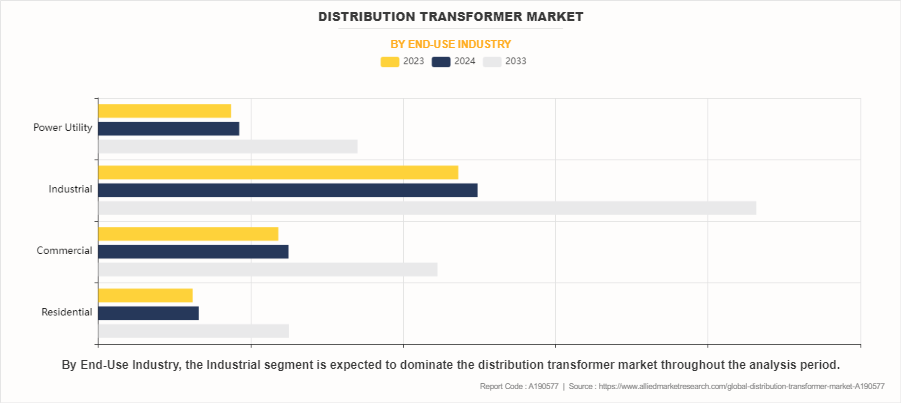

- Industrial sector is the most lucrative end-use market, prioritizing reliable power with redundancy to avoid production downtime.

- Underground vault segment to grow fastest at 7.0% CAGR.

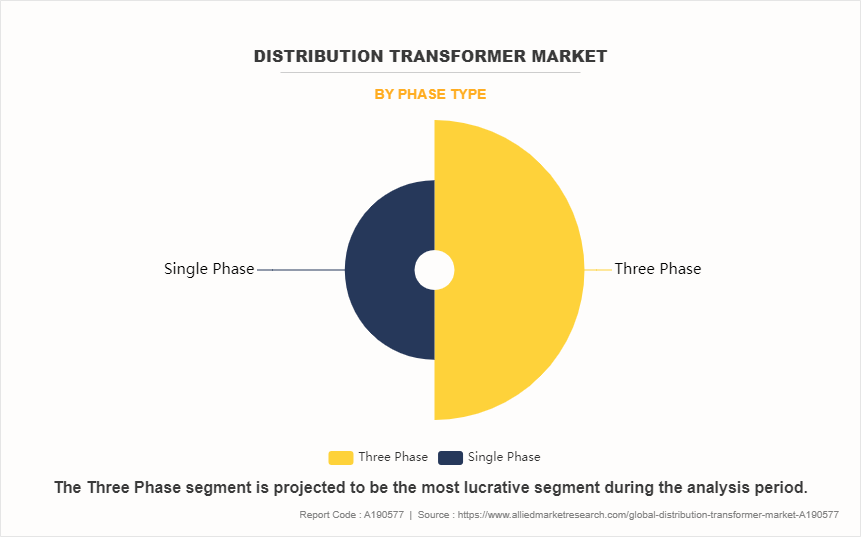

- Three-phase type holds over half of market revenue.

Market Size & Forecast

- 2033 Projected Market Size: USD 47.5 billion

- 2023 Market Size: USD 25.2 billion

- Compound Annual Growth Rate (CAGR) (2024-2033): 6.6%

Introduction

A distribution transformer is a type of electrical transformer designed to step down high-voltage electricity from transmission lines to lower voltage levels suitable for distribution to end-users. Distribution transformers are integral to electrical grids, where they facilitate the distribution of electricity across vast networks. They are strategically placed at various points within the grid to regulate voltage levels and ensure that electricity is delivered efficiently and reliably to consumers.

A distribution transformer is a type of electrical transformer that is primarily used to step down the voltage of electricity from the high levels typically found in transmission lines to lower levels suitable for distribution to end-users. It typically operates at lower voltages, such as 11 kV, 22 kV, or 33 kV on the primary side, and provides output voltages ranging from 400 volts to 415 volts on the secondary side, depending on the requirements of the local distribution network. Distribution transformers are designed to handle relatively lower power capacities compared to their larger counterparts, such as power transformers, making them suitable for localized distribution networks.

Distribution transformers find extensive applications in powering machinery, equipment, and facilities. Industries rely on these transformers to step down voltage levels and provide a stable power supply for various manufacturing processes, production lines, and industrial operations. The commercial sector also heavily relies on distribution transformers to meet the diverse electrical needs of office buildings, shopping malls, hotels, and other commercial establishments. These transformers enable the provision of reliable power for lighting, heating, air conditioning, elevators, and other essential systems in commercial buildings. By stepping down voltage levels and ensuring consistent power distribution, distribution transformers help maintain a comfortable and productive environment for occupants while also supporting various business operations. Moreover, they play a crucial role in enhancing the energy efficiency and sustainability of commercial facilities, aligning with modern trends toward green building practices and energy conservation.

In the residential sector, distribution transformers are integral to delivering electricity to homes and apartment buildings. They form a crucial link between the utility grid and residential properties, ensuring that households receive safe and reliable power for lighting, appliances, electronics, and other electrical devices. Distribution transformers installed in neighborhoods and communities step down voltage levels to the appropriate levels for residential consumption, allowing households to access electricity conveniently.

Key Takeaways:

The distribution transformer magnet industry covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period (2024-2032).

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global distribution transformer market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the distribution transformer market size.

The distribution transformer market share is highly fragmented, with several players including ABB, Siemens, Schneider Electric, Eaton, General Electric Company, HD HYUNDAI ELECTRIC CO., LTD, Fuji Electric Co., Ltd., Toshiba Corporation, Padmavahini Transformers Private Limited, and Lemi Trafo Jsc. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the market growth.

Market Dynamics

Infrastructure development in residential and commercial buildings plays a pivotal role in driving the growth of the distribution transformer market. As cities expand and new residential and commercial buildings are constructed, there is expected to be a significant increase in demand for reliable and efficient power distribution systems. This surge in infrastructure development necessitates the installation of distribution transformers to ensure that electricity is effectively delivered to various end-users.

Moreover, the expansion of power grids is a key factor contributing to market growth. As power grids are extended to reach underserved and developing areas, the need for distribution transformers becomes more pronounced. These transformers are essential for reducing high-voltage electricity from transmission lines to lower voltages suitable for local distribution. The ongoing upgrades and expansions of power infrastructure to accommodate rise in populations and economic activities further fuel the demand for distribution transformers. In March 2023, HOCHTIEF, a prominent construction company, teamed up with infrastructure investor Palladio Partners to develop and manage an advanced, sustainable data center located in Heiligenhaus, North Rhine-Westphalia. The collaboration involves the creation of a new YEXIO facility in the Innovation Park of the university town.

However, high initial costs associated with purchasing and installing distribution transformers are expected to significantly restrain the market growth. These transformers require substantial financial investment, both in terms of equipment procurement and the necessary infrastructure for installation. For many organizations, especially in developing regions or smaller-scale operations, this capital expenditure can be a deterrent, thus slowing the pace of adoption. The costs include installation that requires skilled labor, specialized equipment, and often, system upgrades to ensure compatibility with existing power networks. Furthermore, the costs of transportation and logistics, especially in remote or difficult-to-access areas, can further escalate the overall financial burden. This creates a barrier, particularly for smaller utilities, municipalities, or businesses operating with limited budgets, thereby hindering their ability to invest in new or upgraded distribution transformers.

Moreover, an increase in demand for energy-efficient transformers is expected to provide lucrative opportunities in the distribution transformer market. Energy-efficient transformers help utilities reduce energy losses during electricity distribution, thereby enhancing overall system efficiency and reducing operational costs. Smart transformers incorporate advanced monitoring, control, and communication capabilities, enabling real-time monitoring of transformer performance, remote diagnostics, and predictive maintenance, which improves reliability and reduces downtime. As per the Reuters, Australia is prioritizing the modernization and enhancement of its electricity infrastructure to accommodate the growing capacity of renewable energy sources. With an annual investment of nearly $5 billion from the government, efforts are underway to refurbish and renovate the electricity distribution network, ensuring it effectively integrates renewable energy generation.

In March 2024, the U.S. Department of Energy (DOE) announced an $18 million funding opportunity for Flexible Innovative Transformer Technologies (FITT). Through this funding opportunity announcement (FOA), DOE select up to nine awardees who are able to research, develop, and demonstrate advanced transformers across a range of distribution to transmission scale applications, improving grid reliability and easing transformer supply chain constraints.

Raw materials such as copper, aluminum, and steel are essential components in the manufacturing of distribution transformers. Fluctuations in the prices of these raw materials significantly impact the production costs and profit margins of transformer manufacturers. Moreover, the volatility in raw material prices affects the profitability of transformer manufacturers, especially if they are unable to pass on the increased costs to customers due to competitive pressures or contractual obligations. This results in margin compression and financial strain on companies operating in the distribution transformer market.

Segments Overview

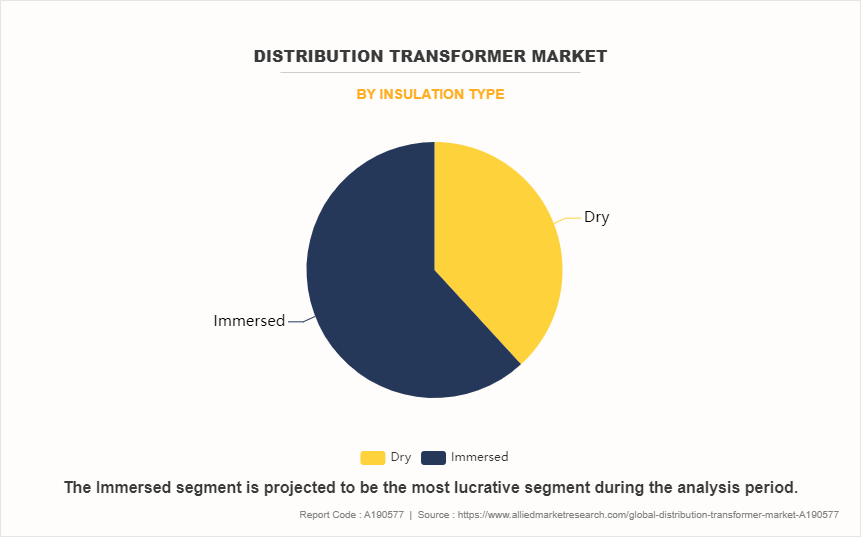

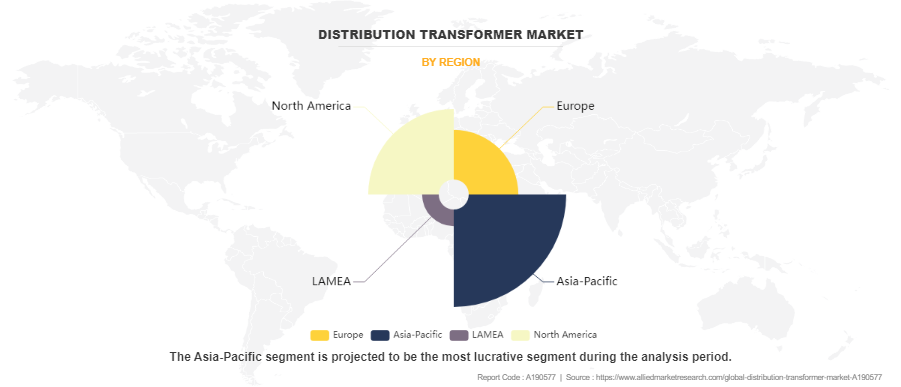

The distribution transformer market is segmented into product type, phase type, insulation type, power rating, end-use industry, and region. On the basis of product type, the market is classified into pad mounted, pole mounted, and underground vault. On the basis of the phase type, the market is divided into single phase and three phase. On the basis of the insulation type, the market is bifurcated into dry and immersed. On the basis of the power rating, the market is categorized into up to 500 kVA, 501 kVA to 2,500 kVA, 2,501 kVA to 10,000 kVA, and more than 10,000 kVA. On the basis of the end-use industry, the market is classified into residential, commercial, industrial, and power utility. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

By Prduct Type

On the basis of product type, the pad mounted segment dominated the distribution transformer market accounting for half of the market share. Pad-mounted transformers are designed to be installed outdoors, typically on a concrete pad. This outdoor installation eliminates the need for a separate building to house the transformer, saving space and construction costs. Pad-mounted transformers are commonly found in urban and suburban areas where space is limited and aesthetics are important. Placing transformers underground helps maintain the visual appeal of the surroundings.

By Phase Type

On the basis of phase type, the three phase segment dominated the distribution transformer market accounting for more than half of the market share growing with the CAGR of 6.5% during the forecast period. In a three-phase system, the load is ideally distributed evenly across all three phases to ensure balanced operation. Distribution transformers play a crucial role in maintaining this balance by providing equal voltage output on all three phases.

By Insulation Type

On the basis of insulation type, the immersed segment dominated the distribution transformer market accounting for more than half of the market share. The immersed type of distribution transformer is widely used in various applications due to its reliability, efficiency, and relatively low maintenance requirements. Its design allows for efficient heat dissipation, making it suitable for continuous operation under varying load conditions. Additionally, the use of insulating oil helps to protect the transformer components from moisture and contaminants, further enhancing its durability and longevity.

By Power Rating

On the basis of power rating, the 2,501 kVA to 10,000 kVA segment dominated the distribution transformer market accounting for more than one third of the market share. Distribution transformers in the 2,501 kVA to 10,000 kVA range are deployed to support the electricity grid. These transformers are strategically positioned throughout the distribution network to cater to the high demand from residential buildings, commercial establishments, and infrastructure facilities. They play a crucial role in voltage regulation and load management, optimizing the efficiency and reliability of the distribution system.

By End Use Industry

On the basis of end-use industry, the industrial segment dominated the distribution transformer market accounting for more than one third of the market share. One common application of distribution transformers in industrial equipment is in motor-driven machinery. Electric motors are widely used in industrial processes for driving conveyor belts, pumps, fans, compressors, and various types of machinery. Distribution transformers provide the necessary voltage levels to power these motors efficiently, enabling them to operate smoothly and reliably.

Why is Asia-Pacific Seen as an Opportune Region?

Asia-Pacific dominated the distribution transformer, growing with a CAGR of 7.0% during the forecast period. In countries such as China and India, which boast rapidly growing populations and burgeoning industrial sectors, the demand for electricity is constantly increasing. This necessitates a robust network of distribution transformers to ensure reliable power supply to urban centers, manufacturing facilities, and remote villages. In India, for instance, the government's ambitious electrification initiatives, such as the Saubhagya scheme, have led to a significant expansion of the distribution transformer market.

Which are the Top Distribution Transformer companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the distribution transformer industry.

- ABB

- Siemens

- Schneider Electric

- Eaton

- General Electric Company

- HD HYUNDAI ELECTRIC CO., LTD

- Fuji Electric Co., Ltd.

- Toshiba Corporation

- Padmavahini Transformers Private Limited

- Lemi Trafo Jsc

What are the recent key developments in the distribution transformer market?

The Indian government is strengthening its electrical network to build a strong and smart electrical grid throughout the country. As of February 2022, the Indian government approved projects worth $4.12 billion under the Integrated Power Development Program to strengthen sub-transmission and distribution networks in urban areas of the country, which is expected to aid in the growth of the distribution transformer market.

In August 2022, RESA Power, LLC, a leading global provider of transformer service, power systems, electrical testing, and solutions for extending the lifespan of power distribution equipment, revealed its acquisition of Advanced Electrical Services, Ltd. Headquartered in Alberta, Canada, Advanced Electrical Services (AES) is recognized for its NETA accreditation and specializes in delivering electrical testing services across Western Canada.

In March 2022, Integrated Power Services (IPS), a leading North American company specializing in the service and repair of distribution transformers and power transmission products, finalized an agreement to purchase ABB's U.S. and Canadian transformers repair operations. This acquisition includes ABB's coil manufacturing facility in Beloeil, Quebec, and its service center in Denver, Colorado.

According to the U.S. Energy Information Administration's data from 2022, the U.S. ranked second in global energy consumption. This positions the country as a major player in the world's energy landscape, reflected in its extensive Transmission and Distribution (T&D) networks. Among the crucial components of these networks are distribution transformers, which play a vital role in reducing power voltages to deliver electricity to end consumers.

Historic Trends of the Distribution Transformer Market

In 1880, the first commercial electrical distribution system was established in London by the Edison Electric Light Company. The Pearl Street Station, the first central power plant in the U.S., began operation in New York City. It utilized Edison's DC system to supply electricity to customers in the area.

The 1920s saw widespread adoption of distribution transformers as electricity distribution networks expanded rapidly in urban areas. These transformers played a crucial role in delivering electricity to homes, businesses, and industries.

In the 1960s, the integration of solid-state components such as diodes, transistors, and semiconductor devices into distribution transformer designs revolutionized their operation. Solid-state technology enabled more precise control of voltage regulation, reduced losses, and improved overall performance. In addition, solid-state devices allowed for the development of protection and monitoring systems that enhanced the safety and reliability of distribution transformer industry.

In the 1990s, advances in computer-aided design (CAD) and simulation software allowed for the optimization of distribution transformer designs, leading to improvements in efficiency and performance. Digital monitoring and control systems were also developed, enabling remote management of transformer networks.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the distribution transformer market analysis from 2023 to 2033 to identify the prevailing distribution transformer market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the distribution transformer market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global distribution transformer market demand.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global distribution transformer market trends, key players, market segments, application areas, and market growth strategies.

Distribution Transformer Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 47.5 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By End-Use Industry |

|

| By Product Type |

|

| By Phase Type |

|

| By Insulation Type |

|

| By Power Rating |

|

| By Region |

|

| Key Market Players | HD HYUNDAI ELECTRIC CO., LTD., Schneider Electric, TOSHIBA CORPORATION, Siemens, Fuji Electric Co., Ltd., Padmavahini Transformers Private Limited, General Electric Company, ABB, Eaton, Lemi Trafo Jsc |

Analyst Review

According to the opinions of various CXOs of leading companies, the global distribution transformer market was dominated by the three phase segment. In three-phase systems, the power is distributed evenly across the three phases, resulting in smoother power transmission and reduced load on individual transformers. Three-phase distribution transformers are commonly found in various applications, including industrial plants, commercial buildings, and residential complexes. They are often used to power large machinery, HVAC systems, lighting systems, and other electrical loads requiring three-phase power. Additionally, three-phase distribution transformers are integral components of utility substations, where they step down the high-voltage electricity from transmission lines to lower voltages suitable for local distribution.

Integration of renewable energy drives the growth of distribution transformer market. Wind and solar power generation often occurs in remote or distributed locations, necessitating the transmission of electricity over long distances to reach consumption centers. Distribution transformers step up or step down the voltage of electricity as needed to ensure compatibility with the grid and efficient transmission over long distances. Moreover, distribution transformers facilitate the integration of distributed energy resources (DERs), such as rooftop solar panels and small-scale wind turbines, into the grid. These DERs generate electricity locally and feed it into the distribution network, often at lower voltage levels. Distribution transformers step up the voltage of electricity from DERs to match grid requirements, enabling seamless integration into the broader electricity distribution system.

Competition from substitutes restrain the growth of distribution transformer market. The emergence of alternatives such as decentralized power generation and energy storage systems presents a potential threat to the demand for traditional distribution transformers. Decentralized power generation, including technologies such as rooftop solar panels, small-scale wind turbines, and microgrids allow consumers to generate electricity locally and reduce their dependence on centralized power distribution networks. As decentralized power generation becomes more widespread, there is a diminished need for traditional distribution transformers to transmit electricity over long distances from centralized power plants to end-users.

The growing demand for electricity, coupled with the increasing integration of renewable energy sources, is driving the growth of the distribution transformer market.

Pad mounted is the leading product type of distribution transformer market.

The adoption of smart grid technologies is an emerging trend driving growth in the global distribution transformer market.

Asia-Pacific is the largest region for distribution transformer market.

The global distribution transformer market was valued at $25.2 billion in 2023, and is projected to reach $47.5 billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033.

The report features detailed profiles of leading industry players, including ABB, Siemens, Schneider Electric, Eaton, General Electric Company, HD Hyundai Electric Co., Ltd., Fuji Electric Co., Ltd., Toshiba Corporation, Padmavahini Transformers Private Limited, and Lemi Trafo JSC.

Loading Table Of Content...

Loading Research Methodology...