Global Oil Storage Fee Rental Market Research, 2032

The global oil storage fee rental market was valued at $9.3 billion in 2022, and is projected to reach $13.7 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032.

Oil storage tanks are tanks that are used to keep oil except altering their bodily and chemical properties. Carbon steel, stainless steel, industrial-strength plastic, and bolstered concrete are some of the most common materials used to manufacture oil storage tanks. The substances utilized to construct oil tanks are robust, long-lasting, and resistant to corrosion with the aid of crude oil and petroleum-based products.

The report includes the oil storage fee rental market study regarding the growth prospects and restraints based on the regional analysis. The study includes Porters five forces analysis of the oil storage fee rental industry to determine the impact of suppliers, competitors, new entrants, substitutes, and buyers on the market growth. Oil firms may benefit from oil storage facilities in many ways, including the cost-effective production of higher-quality fuel products which boosts the demand for oil storage fee rental services in the market.

Rise in urbanization and infrastructural development across the globe led to increase in the demand for oil & gas which led to increase the demand for oil storage fee rental business and may act as the major driving factor for the market. In addition, oil storage tanks are used to store fuel products and rapid expansion of refineries industry and oil terminals act as the major driving factor for the market.

In addition, oil storage fee rental has several benefits such as lower investment costs, ensure the safety of oil products which is expected to support the escalating oil storage fee rental market share in the coming years. Oil storage fee rental services are the best solution to increase the production capacity for oil producers at remote locations as oil storage facilities ensure east transportation of crude oil to production units. This boosts the growth of the global oil storage fee rental market size during the forecast period.

Oil storage tanks are widely used to store crude products and also used to store fuel products. Transforming crude oil into finished products such as gasoline and petrochemicals is a complex and lengthy process. Oil storage tanks are used to hold and store oil and derivatives throughout the production and manufacturing stages. There are multiple factors to consider while choosing storage tanks, including the unique physical and chemical properties of the product being stored. In addition, oil storage tanks are covered with silica gel breather and the inlet and outlet valves are kept diagonal and designed to suit the requirement of transportation of filtrated oil. Moreover, the tank is designed to keep in mind the transportation to ensure low-cost transportation at site.

Oil storage tanks come in a myriad of shapes, sizes, styles, and materials. Moreover, oil storage tanks are available on rental basis in the market with different capacity as per usage. Oil storage tanks require to be painted with heat and transformer oil resistant paint from inside which ensure to store the products for longer duration. In addition, they are covered with silica gel breather and the inlet and outlet valves are kept diagonal and designed to suit the requirement of transportation of filtrated oil. Moreover, the tanks are designed to keep in mind transportation to ensure low-cost transportation at site.

The global oil storage fee rental market analysis covers in-depth information about the major industry participants. The key players operating and profiled in the report include PSA International, Royal Vopak, Singapore Petroleum Company Limited., HORIZON TERMINALS, Jurong Port Universal Terminal Pte. Ltd., Feoso Group, VTTI., Oiltanking GmbH, Sinopec Kantons Holdings Limited, PT Pertamina (Persero) and Dialog Group Berhad.

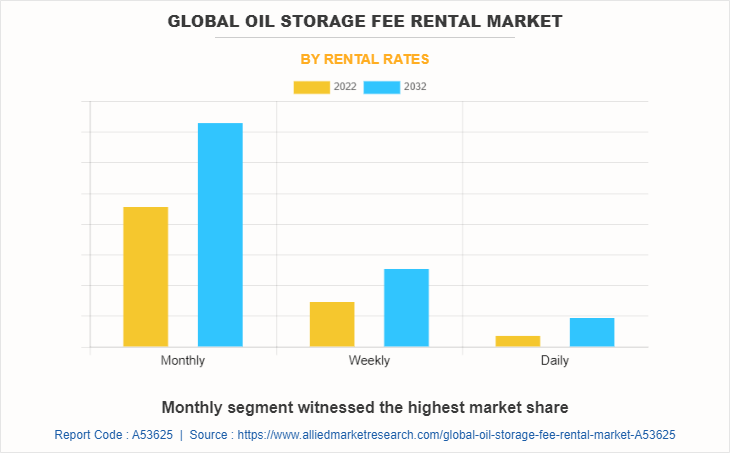

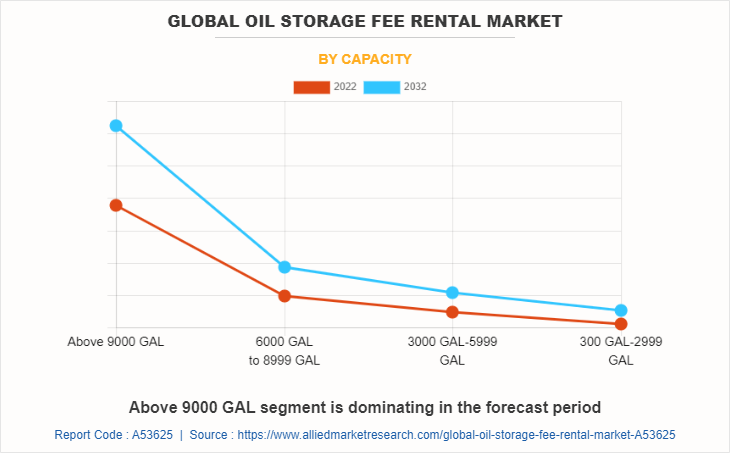

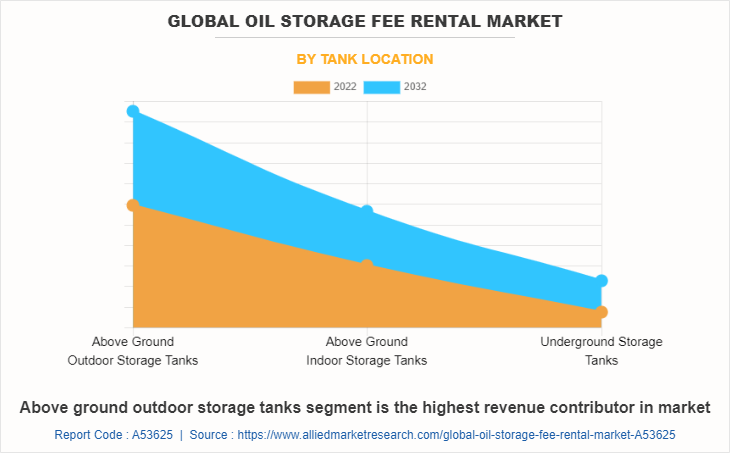

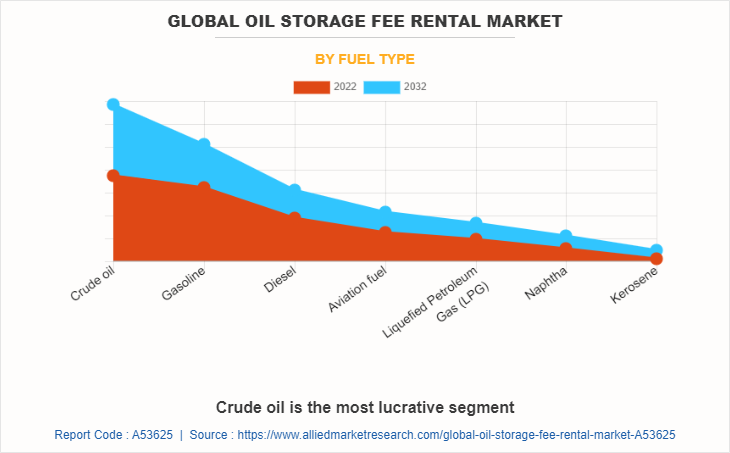

The global oil storage fee rental market is segmented on the basis of rental rates, capacity, tank location, fuel type and country. On the basis of rental rates, the market is categorized into daily, weekly, monthly. On the basis of capacity, it is divided into 300Gal. To 2,999-Gal., 3,000-Gal. To 5,999-Gal., 6,000-Gal. To 8,999-Gal., and Above 9,000-Gal. On the basis of tank location, it is classified into above ground indoor storage tanks, above ground outdoor storage tank and underground storage tanks. On the basis of fuel type, it is classified into crude oil, gasoline, aviation fuel, naphtha, diesel, kerosene, and liquefied petroleum gas. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific and LAMEA.

On the basis of rental rates, the market is classified into daily, weekly, monthly. In 2022, the monthly segment dominated the market owing to cost effectiveness. Oil production companies have decided to increase the production capacity and have entered long-term storage services which make monthly rental rates segment to dominate in the market.

On the basis of capacity tank, the market is classified into 300Gal. To 2,999-Gal., 3,000-Gal. To 5,999-Gal., 6,000-Gal. To 8,999-Gal., and Above 9,000-Gal. In 2022, the Above 9000-GAL segment dominated the market as Above 9000-GAL as oil production plants require significant storage capacity facility for crude oil, intermediate products, and finished petroleum products. Tanks with capacities above 9,000 gallons are essential for accommodating the large volumes associated with these facilities.

On the basis of location, the market is classified into above ground indoor storage tanks, above ground outdoor storage tank and underground storage tanks. In 2022, the above ground outdoor storage tanks segment dominated the market as outdoor tanks are used for the storage of large quantity of liquids products. Above ground outdoor storage tanks come in many sizes and capacities and ensure the proper handling of crude oil which increases its demand in the market.

On the basis of fuel type, the market is classified into crude oil, gasoline, aviation fuel, naphtha, diesel, kerosene, and liquefied petroleum gas. In 2022, the crude oil segment dominated the market as the demand for crude oil rose on a daily basis. Oil storage tanks are used to store unrefined petroleum before it is processed in refineries or transported to other locations. Oil storage tanks service play a crucial role in the oil industry, providing temporary storage for crude oil.

On the basis of region, the market is classified into North America, Europe, Asia-Pacific and LAMEA. In 2022, North America dominated the oil storage fee rental market owing to an increase in oil extraction and refinery projects in the region. In U.S., a total of 11.3 million barrels of crude oil is produced on daily basis which creates huge market for oil storage fee rental in the North America region. Several countries in the Middle East and Africa are investing in oil exploration and oil reserve projects which are projected to create opportunities for the oil storage fee rental market during the forecast period.

Increase in investment for industrialization and modernization has corresponding increases the demand for fossil fuels in developing nations. The growth of countries in various regions has led to a rise in demand for fuel to power factories and transportation. Consequently, the storing, transporting, and drilling of oil and gas products has become a significant source of income for people around the world. Large volumes of crude oil and other petroleum products are imported and exported between countries which need a large space for storing the products. Oil storage tanks are provided at seaports, where crude oil and other petroleum products are unloaded in the tanks and transported in tiny quantities to refineries which drives the oil storage fee rental market trend in near future.

Oil trading involves buying and selling oil in different markets, often requiring storage of oil in various locations. This increased demand for storage helps improve the utilization of oil storage terminals. The storage terminals have a higher volume of oil passing through which leads to increases in efficiency and utilization of their storage capacity as more oil is traded. Oil storage allows traders to hold onto their inventory until a more favorable market condition arises. However, rapid expansion of oil trading business may create oil storage fee rental market opportunities in coming years.

The conflict between Russia and Ukraine has a significant impact on the oil sector. Russia invasion of Ukraine has created shock waves in the global oil market, leading to price volatility, supply shortages, and security issues. The war further affected oil production activities due to the economic sanctions and foreign policy directives issued by Western countries. A global disruption in oil and gas supply due to the Russia-Ukraine war affected not only the prices of oil commodities but also impacted several economic activities.

Oil storage service companies are hesitant to invest in large oil tank storage facilities due to an increase in instability factors for manufactures in the EU region. The war may significantly decline the growth of the oil storage industry of Europe. Several oil companies have shifted the oil storing unit from Russia and buying crude oil from other countries. On the other hand, Russia started storing oil products in Asian countries which becoming the opportunity for Asia oil storage fee rental market growth in forecast period.

For instance:

- In February 2022, the U.S. government signed an executive order banning imports of Russian oil, natural gas, and coal on March 8, 2022

- European Union (EU) countries have committed to reducing gas imports from Russia by two-thirds. EU countries stopped seaborne imports of Russian oil. Refined oil products from Russia to Europe

The booming world economy has caused exponential population growth and increased demand for oil products. Oil production companies are ready to invest in oil storage facilities for timely delivery of crude oil and oil products which boosts the oil storage fee rental market trends. According to oil storage fee rental market forecast, oil storage companies are focusing on expansion and entering into agreements and contracts to remain competitive in the market.

Key Strategies

- In April 2023, PSA International has decided to sign an agreement to buy 75% stake in privately held ALISAN logistics company. The company is engaged in logistics of goods in various industries. This development helps the company to increase the global presence and revenue in near future

- In November 2022, VTTI decided to acquire IPTF (IL&FS Prime Terminals FZC). The IPTF storage terminal is situated in the heart of Fujairah. The acquisition means that VTTI will own 90% of the terminal, while the other 10% will remain with the Fujairah Government. This development helps the company to increase its global presence and revenue in near future.

Report Key Highlighters

- The report provides an exhaustive list related to the capacity of oil terminals companies.

- The study will provide you with in-depth analysis of the rent rates and pricing analysis.

- The study also includes the projection data for storage requirements in the coming future.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the global oil storage fee rental market analysis from 2022 to 2032 to identify the prevailing global oil storage fee rental market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the global oil storage fee rental market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global global oil storage fee rental market trends, key players, market segments, application areas, and market growth strategies.

Global Oil Storage Fee Rental Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 13.7 billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 350 |

| By Rental Rates |

|

| By Capacity |

|

| By Tank Location |

|

| By Fuel Type |

|

| By Region |

|

| Key Market Players | PSA International, PT Pertamina(Persero), Feoso Group., HORIZON TERMINALS, Oiltanking GmbH, Sinopec Kantons Holdings Limited, Dialog Group Berhad, Jurong Port Universal Terminal Pte. Ltd, Royal Vopak, VTTI., Singapore Petroleum Company Limited. |

Analyst Review

The global oil storage fee rental market has registered a dynamic growth over the past few years, owing to drastic growth in oil & gas industry. In addition, huge investment plans of government of every nation with respect to oil and energy infrastructure development led to boost the global oil storage fee rental market across the globe.

Moreover, Oil storage tanks serve to store enormous quantities of oil or petroleum products in bulk. These tanks are used by oil producers, refineries, and distributors to store surplus oil during periods of oversupply or low demand. It allows them to balance the supply and demand dynamics, ensuring a steady flow of oil to meet market needs. In addition, oil storage tanks enable efficient transportation logistics by storing oil close to consumption centres or transportation infrastructure, such as pipelines, railways, or ports.

This helps in the smooth and timely delivery of oil to end-users, including power plants, manufacturing facilities, and fuel stations. Furthermore, oil storage tanks play a crucial role in managing seasonal variations in oil demand. For example, during the winter season, the demand for heating oil increases, while gasoline demand rises during the summer months. Storage tanks allow companies to stockpile oil during low-demand periods and release it during peak seasons to meet consumer needs.

Increase in demand of oil & gas across the world and seasonal demand management of oil products are upcoming trends of global oil Storage fee rental market in the world.

North America is the largest regional market for global oil storage fee rental.

The global oil storage fee rental market was valued at $9.3 billion in 2022, and is projected to reach $13.7 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032.

PSA International, Royal Vopak, Oiltanking GmbH, Singapore Petroleum Company Limited., HORIZON TERMINALS are the top companies to hold the market share in global oil storage fee rental.

Crude oil is majorly stored in the oil storage fee rental.

Loading Table Of Content...

Loading Research Methodology...