Global Solvents Market Overview

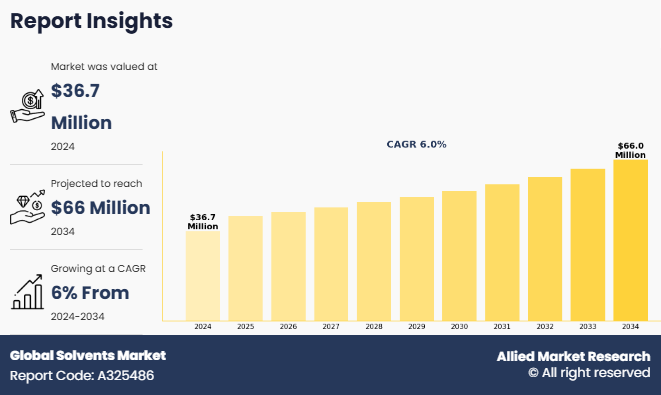

The global solvents market was valued at $36.7 million in 2024, and is projected to reach $66 million by 2034, growing at a CAGR of 6% from 2024 to 2034.

Report Key Highlighters

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The global solvents market is fragmented in nature among prominent companies such as ACE CHEMICAL COMPANY, Agilent Technologies Inc., AUSTRALIAN SCIENTIFIC PTY LTD, CHEMSUPPLY AUSTRALIA, Research Solutions Group, Inc., Honeywell International Inc., Shimadzu Corporation, Thermo Fisher Scientific Inc., WESTLAB PTY. LTD., ROWE SCIENTIFIC PTY LTD.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), key regulation analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global solvents industry such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 3,500 solvents-related product literatures, industry releases, annual reports, and other such documents of key solvents industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global solvents market.

Solvents are chemical substances capable of dissolving, suspending, or extracting other materials without chemically changing themselves or the solute. They are widely used in numerous industrial applications to facilitate processes such as cleaning, degreasing, coating formulation, and chemical synthesis. Solvents can be organic (carbon-based) or inorganic, with the former being the most prevalent in commercial and industrial settings. Organic solvents include hydrocarbons, alcohols, ketones, esters, and chlorinated compounds, while inorganic solvents include water and certain liquid salts.

Globally, solvents play a vital role in various industries, including manufacturing, pharmaceuticals, agriculture, automotive, and environmental sectors. Regulations and sustainability concerns are increasingly shaping the use of solvents, driving the industry toward environmentally friendly and low-toxicity alternatives.

The paints and coatings sector is one of the largest consumers of solvents in globally. Solvents in this industry help in dissolving binders and pigments, improving application consistency, and controlling drying times. Common solvents used include toluene, xylene, and acetone. These solvents ensure smooth application and durability of paints, whether used in architectural coatings, automotive finishes, or industrial coatings. Solvents play a significant role in pharmaceutical manufacturing, facilitating drug formulation, extraction of active pharmaceutical ingredients (APIs), and purification processes. Ethanol, methanol, and ethyl acetate are commonly used in drug production.

The global solvents market has witnessed robust growth over the past decade, driven by a confluence of factors related to industrial expansion, environmental policy shifts, technological innovation, and changing consumer behavior. One of the primary drivers is the surging demand from the paints and coatings industry. Solvents are essential in formulations used for architectural, automotive, and industrial applications. With urbanization and infrastructure development expanding rapidly in emerging economies such as India, China, and Brazil, the consumption of paints and coatings is climbing, consequently boosting the solvents market. Additionally, as disposable incomes rise, demand for personal and home aesthetics also increases, stimulating market growth in decorative paints. Automotive refinishing and OEM coatings further amplify the demand due to the global uptrend in vehicle ownership and manufacturing.

Another critical driver is the pharmaceuticals and cosmetics sector, where solvents are integral in extraction, purification, formulation, and synthesis processes. In the pharmaceutical industry, the increasing global population, aging demographics, and the rise in chronic disease prevalence have created a sustained need for high-performance drugs, which in turn require efficient and precise solvent systems. Moreover, with the rise of the wellness industry and consumer preference for beauty and skincare products, solvents used in cosmetics — such as ethanol and glycerol — are in greater demand. Growth in these sectors is bolstered by expanding healthcare access in developing countries and innovation in drug delivery systems, which often depend on customized solvents. Regulatory bodies like the FDA and EMA also influence solvent use, driving the development of greener, more sustainable alternatives.

However, the global solvents market, while experiencing significant growth, is also constrained by several key factors that hinder its full potential. One of the primary restraints is the growing environmental and health concerns associated with the use of conventional solvents, particularly those derived from petrochemicals. Many organic solvents release volatile organic compounds (VOCs), which contribute to air pollution, ozone layer depletion, and pose serious health risks such as respiratory issues, skin irritation, and even long-term chronic diseases. These health and environmental hazards have led to increasingly stringent regulations imposed by governments and international organizations such as the Environmental Protection Agency (EPA) in the United States and the European Chemicals Agency (ECHA). These regulations restrict the use of high-VOC solvents, forcing manufacturers to reformulate products or invest in expensive alternatives, thereby slowing market growth and increasing production costs.

On the contrary, the global solvents market holds substantial opportunities for growth, driven largely by the increasing demand for environmentally friendly and bio-based solvents. As environmental regulations tighten globally, especially in North America and Europe, industries are under pressure to reduce emissions and switch to safer alternatives. This trend is pushing manufacturers toward developing green solvents derived from renewable resources such as corn, sugarcane, and other biomass materials. These solvents not only help companies comply with stringent environmental norms but also align with the growing consumer preference for sustainable products. The push for circular economies and low-carbon technologies further amplifies the market opportunity for biosolvents. Companies investing in research and development to improve the efficiency, compatibility, and costeffectiveness of green solvents are likely to gain a competitive edge in this evolving landscape.

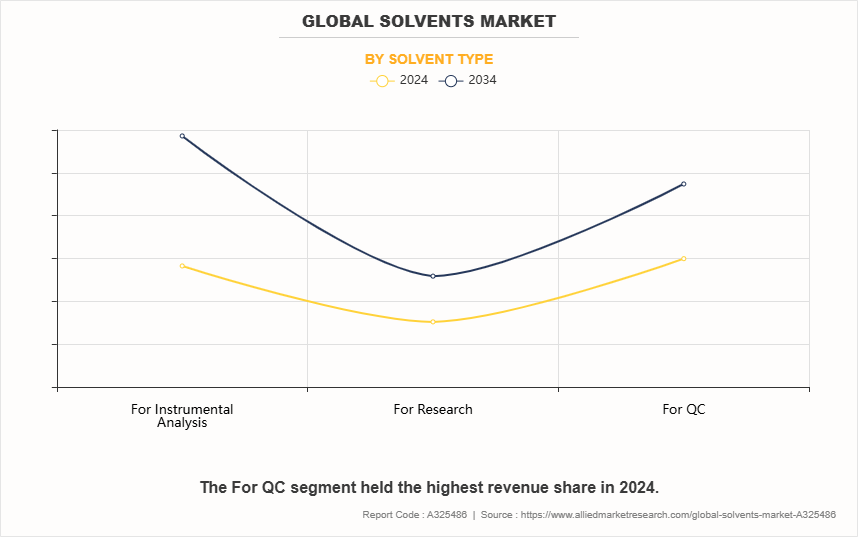

The global solvents market is segmented on the basis of solvent type and region. On the basis of solvent type, the market is categorized into for instrumental analysis (Methanol, Acetonitrile, 2-Propanol, Chloroform, Dichloromethane, and Acetone), for research (Dimethyl Sulfoxide, Ethyl Alcohol, Chloroform, Methanol, 2-Propanol, and Tetrahydrofuran), and for QC (Ethanol, Acetone, Toluene, 2-Propanol, Isobutyl Methyl Ketone, Methanol, and Tetrahydrofuran). Region-wise, the global solvents industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In 2024, for QC segment was the largest revenue generator, and is anticipated to grow at a CAGR of 4.7% during the forecast period. The demand for solvents in quality control applications is increasing due to their essential role in ensuring the accuracy, consistency, and reliability of products across various industries. In sectors like pharmaceuticals, food and beverage, chemicals, and electronics, solvents are crucial in analytical techniques such as chromatography, spectroscopy, and titration. These processes require high-purity solvents to extract, dissolve, or separate specific components within a sample for precise measurement. As regulatory standards become more stringent, especially under agencies like the FDA, EMA, and ISO, companies must implement advanced quality control protocols — significantly increasing the use of high-grade solvents.

Another reason for rising demand is the complexity of modern manufacturing processes, which require more frequent and detailed testing at each stage of production. In industries like pharmaceuticals and semiconductors, even slight deviations in formulation can compromise product safety or functionality. Solvents are used in sample preparation and analytical testing to detect impurities, verify compound stability, and confirm material identity. As manufacturers aim to reduce batch failures and recalls, the role of solvents in lab-based quality control and in-line process monitoring becomes more prominent. The move toward precision manufacturing and zero-defect production has made reliable quality control practices, and thus solvent usage, indispensable.

The North America solvents market size is projected to grow at a CAGR of 6.7% during the forecast period and accounted for 54.5% of the solvents market share in 2024. The solvents market in North America is driven by several key factors rooted in industrial activity, regulatory shifts, and innovation. One major driver is the strong presence of end-use industries such as pharmaceuticals, automotive, construction, and personal care. These sectors rely heavily on solvents for applications like formulation, cleaning, degreasing, and chemical synthesis. With the U.S. being a global leader in pharmaceutical production and R&D, demand for high-purity and specialized solvents remains high. The region's growing construction and renovation activities also drive solvent use in paints, coatings, and adhesives.

Another critical factor responsible for the solvents market growth is the rising demand for environmentally friendly and bio-based solvents, propelled by stringent regulations from agencies like the EPA. Companies are investing in low-VOC and non-toxic solvent alternatives to meet sustainability goals and comply with air quality standards. This regulatory environment encourages innovation and market differentiation through green chemistry.

Competitive Analysis

The global solvents market profiles leading players that include ACE CHEMICAL COMPANY, Agilent Technologies Inc., AUSTRALIAN SCIENTIFIC PTY LTD, CHEMSUPPLY AUSTRALIA, Research Solutions Group, Inc., Honeywell International Inc., Shimadzu Corporation, Thermo Fisher Scientific Inc., WESTLAB PTY. LTD., ROWE SCIENTIFIC PTY LTD.

Industry Trends

The global solvents market is witnessing dynamic growth, driven by rapid industrialization, expanding end-user industries, and shifting regulatory landscapes. One key trend is the increasing demand for bio-based and green solvents, fueled by rising environmental concerns and stringent regulations on volatile organic compounds (VOCs). Traditional petroleum-based solvents are being gradually replaced with environmentally friendly alternatives derived from renewable sources like corn, sugarcane, and soy. These sustainable solvents offer comparable performance while minimizing health and ecological impacts, making them popular across coatings, adhesives, and cleaning applications.

Another major trend is the strong demand for solvents in the paints and coatings, pharmaceuticals, and personal care sectors. Solvents are integral to formulating products with desired consistency, drying properties, and active ingredient delivery. The construction and automotive industries are increasing which in turn is driving up the use of industrial coatings, lacquers, and sealants that rely on various solvent types. Additionally, the pharmaceutical industry's growth particularly in emerging markets has boosted the use of high-purity solvents for drug formulation and synthesis. In personal care, solvents are used in perfumes, lotions, and aerosols, and demand is growing in tandem with increased consumer spending on cosmetics and hygiene.

Technological advancements are also shaping the market, with manufacturers investing in solvent recycling technologies and low-VOC product development. Solvent recovery systems are becoming more common in manufacturing facilities to reduce operational costs and minimize waste. Moreover, digitalization and automation in chemical processing are helping optimize solvent use and improve efficiency. Geographically, Asia-Pacific continues to dominate the market due to its large industrial base, followed by North America and Europe. However, regulations like REACH in Europe are pushing for the adoption of safer alternatives, which is influencing global market dynamics. Overall, the solvents market is evolving rapidly, balancing industrial demand with sustainability goals.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the global solvents market analysis from 2024 to 2034 to identify the prevailing global solvents market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the global solvents market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global global solvents market trends, key players, market segments, application areas, and market growth strategies.

Solvents Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 66 million |

| Growth Rate | CAGR of 6% |

| Forecast period | 2024 - 2034 |

| Report Pages | 458 |

| By Solvent Type |

|

| By Region |

|

| Key Market Players | Shimadzu Corporation, Thermo Fisher Scientific Inc., ROWE SCIENTIFIC PTY LTD, Honeywell International Inc., ACE CHEMICAL COMPANY, AUSTRALIAN SCIENTIFIC PTY LTD, Research Solutions Group, Inc., Agilent Technologies Inc., CHEMSUPPLY AUSTRALIA, WESTLAB PTY. LTD. |

Analyst Review

According to the CXOs of leading companies, the solvents market presents a strategic growth opportunity, especially in quality control (QC), instrumental analysis, and research applications. The demand for high-purity solvents is driven by industries such as pharmaceuticals, biotechnology, environmental testing, and advanced material sciences, where precision and compliance with international standards are critical. Regulatory frameworks in both countries, including strict guidelines from the Therapeutic Goods Administration (TGA) in Australia and Medsafe in New Zealand, mandate the use of high-quality solvents in laboratory and industrial testing. This compliance-driven market ensures sustained demand for analytical-grade solvents, creating opportunities for suppliers to establish strong partnerships with research institutions, healthcare sectors, and industrial laboratories. In addition, the increasing focus on sustainability has led to growing interest in bio-based and green solvents, aligning with global trends toward reducing environmental impact while maintaining analytical accuracy.

For CXOs, investment in supply chain resilience, innovation in solvent purification technologies, and strategic collaborations with research and QC laboratories are key priorities. The Asia-Pacific region’s rising economic influence and integration with global pharmaceutical and biotech supply chains make globally essential players in the high-purity solvents market. Digital transformation in laboratory workflows, including AI-driven data analysis and automated solvent handling, further enhances operational efficiencies, reducing waste and improving analytical precision. Companies that focus on expanding local manufacturing capabilities and securing reliable distribution networks will gain a competitive edge.

Rapid advancement in chemical research and development, Technological advancements in analytical instrumentation, and technical advancements and increase in demand for precision are the upcoming trends of global solvents market in the globe.

For QC is the leading application of global solvents market.

North America is the largest regional market for global solvents.

The global solvents market was valued at $36.7 million in 2024 and is estimated to reach $65.9 million by 2034, exhibiting a CAGR of 6.0% from 2024 to 2034.

Honeywell International Inc, ChemSupply Australia, Thermo Fisher Scientific Inc., Westlab Pty. Ltd, Rowe Scientific Pty Ltd, ACE Chemical Company, Australian Scientific Pty Ltd, Agilent, Shimadzu Corporation, and Research Solutions Group, Inc. are the top companies to hold the market share in the global solvents market.

Loading Table Of Content...

Loading Research Methodology...