Gloves Market Research, 2025

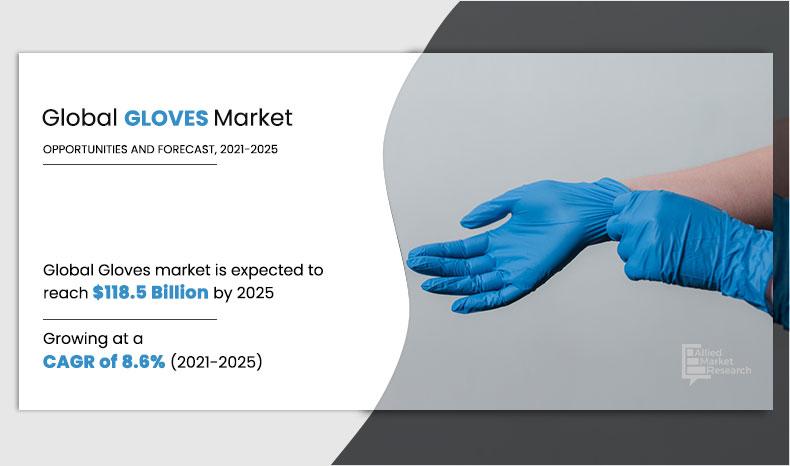

The global gloves market size is accounted to be at value $48,011.33 in 2017 and expected to reach $1,18,508.55 million by 2025, registering a CAGR of 8.6% during 2021-2025. Gloves play a major role in controlling the cross-transmission, as gloves help in protecting microbial contamination, and from other chemicals of healthcare associated infections in patients. Further, protective gloves should be selected on the basis of the hazards involved. The gloves are categorized into medical/examination glove and industrial glove.Further, latex and nitrile gloves are commonly used when dealing with high-risk situations involving blood, bodily fluids or patients with infectious diseases in healthcare field.

Continuous need of gloves is the emerging signs of a possible new world order post-COVID-19 crisis is a must for aspiring businesses and their astute leaders seeking to find success in the now changing gloves market landscape. Medical gloves are essential during the COVID-19 outbreak as they are a part of personal protective equipment (PPE). In addition,rise in cases of COVID-19 cases across the globe is leading to increase in manufacturing and distribution of gloves. For instance, in March 2020, Supermax Corporation Berhad donated 1 million nitrile powder-free medical gloves to COVID-19 frontliners. They are to be distributed to Malaysian government hospitals, police stations and the healthcare industry’s first responders, to combat the Covid-19 outbreak in Malaysia. Therefore, this has concluded that due to the everyday rise in number of cases of corona virus across the globe has made an impact on the disposable gloves industry, by giving opportunities to the key players for expanding the manufacturing of disposable gloves to uplift the industry.

The major factors that contribute toward the growth of the gloves market include increase in concerns regarding safety and hygiene, increase in rubber production, and rise in number of end users. In addition, increase in awareness regarding hygiene among healthcare service providers and advancements in technology of gloves. However,toxic reaction to certain gloves and high price competitionare expected to restrain the market growth. On the contrary,developing economies and untapped marketsare anticipated to provide lucrative growth opportunity for the market growthduring the forecast period.

Global Gloves Market Segmentation

The global gloves market is segmented on the basis of type, industry, and country. Based on the type, the market is segmented into disposable sterile gloves, disposable examination and protective gloves, and consumer gloves. In addition, disposable sterile gloves is further divided into disposable surgical sterile gloves, disposable examination sterile gloves, and other sterile gloves. Further, disposable examination and protective gloves is further divided into disposable nitrile examination and protective gloves, disposable latex examination and protective gloves, disposable vinyl examination and protective gloves, and other disposable examination and protective gloves. Based on industry, the market is segmented into medical, horeca, cleaning, beauty, food and drinks, pharmaceutical, chemical, automotive, electronics, construction, and others. Region wise, North America, Europe, Asia-Pacific, and LAMEA.

Segment Overview

By Product Type

On the basis of type, the disposable sterile gloves segment held the dominant share in 2017, owing to the factors such as wide usage of these gloves by medical practitioners during surgical or examining procedures. Increase in surgical procedures across the globe due to increase in infectious diseases. Further, disposable gloves made using vinyl or natural rubber are generally used for low-risk general procedures, including non-invasive physical examination applications.

By Type

Disposable examination and protective gloves segment holds a dominant position in 2017.

By Industry Type

By industries, the electronics and automotive segment occupied the largest gloves devices market share in 2017. The growth of the segment is due to factors such as precision electronic components and equipment installation handling.

By Region

By Region, the Europe is accounted for the largest growth in 2017. This is attributed due to the increase in spread of covid-19 and infectious disease within the European region are expected to drive the growth of the gloves market during the forecast period. In addition, government in the European region favors the use of medical disposable gloves, as these provide superior protection against infections during medical diagnosis or surgeries. Furthermore, rise in health awareness, increase in healthcare income have fueled the adoption of disposable gloves in Europe, which in turn has contributed to the market growth. On the other hand, Asia-Pacific is expected to be the largest growth during the forecast period. Owing to increase in compliance to the standards and presence of large population base are the major contributing factors toward the robust growth of the Asia-Pacific market.

In addition, the healthcare infrastructure has witnessed a paradigm shift in this region over the last few decades, which has fueled the growth of the market. Further, due to increased compliance and sheer size of population in countries such as Australia and Korea. Key countries, such as India and China, have witnessed an increased demand for disposable gloves in medical and food sector, which in turn is expected to augment the growth of the disposable gloves market in Asia-Pacific region.

By Industry

Medical gloves segment holds a dominant position in 2017.

The global gloves market is highly competitive, and prominent players have adopted various strategies for garnering maximum market share. These include collaboration, product launch, partnership, and acquisition. Major players operating in the market include 3M Co., Ansell Ltd., Cardinal Health, Inc., Semperit AG Holding, Hartalega Holdings Berhad, Honeywell International Inc., Kimberly-Clark Corp., Kossan Rubber Industries Bhd, rubberex corporation (m) berhad, and Top Glove Corp. Bhd.

By Region

Asia-Pacific is projected as one of the most lucrative segment.

Key Benefits For Stakeholders

- This report entails a detailed quantitative analysis along with the current global gloves market trends from 2017 to 2025 to identify the prevailing opportunities along with the strategic assessment.

- The gloves market forecast is studied from 2021 to 2025.

- The gloves market share and estimations are based on a comprehensive analysis of key developments in the industry.

- A qualitative analysis based on innovative products facilitates strategic business planning.

- The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the market.

Gloves Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Industry |

|

| By Region |

|

| Key Market Players | HARTALEGA HOLDINGS BERHAD, TOP GLOVE CORPORATION BHD, HONEYWELL INTERNATIONAL INC., KIMBERLY-CLARK CORPORATION, CARDINAL HEALTH, INC., SEMPERIT AG HOLDING, KOSSAN RUBBER INDUSTRIES BHD, ANSELL LIMITED, RUBBEREX CORPORATION (M) BERHAD, 3M COMPANY |

Analyst Review

Gloves are a type of personal protective equipment (PPE), which is designed to protect staff from microbial contamination, or from contact with certain chemicals.The gloves are categorized into medical/examination glove and industrial glove. As a general policy, selection of non-powdered gloves is recommended since this avoids reactions with the alcohol-based handrub in use within the health-care facility. For instance, according to the Eagle Protect it was estimated that in the U.S around 300 billion disposable gloves are used annually across various industries.

The major factors that contribute toward the growth of the gloves market include rising concerns for safety and hygiene, growing number of end users, and increase in rubber production. In addition, increase in awareness regarding hygiene among healthcare service providers and advancements in technology. However, high price competitionand toxic reaction to certain gloves are expected to restrain the market growth. On the contrary, developing economies and untapped markets are anticipated to provide lucrative growth opportunity for the market growth in the near future.

The total market value of gloves market is $48,011.33 million in 2017

The forcast period for gloves market is 2021-2025

The market value of gloves market in 2025 is $1,18,508.55 million

The base year is 2017 in gloves market

Top companies such as, Ansell Ltd., Cardinal Health, Inc., Hartalega Holdings Berhad, Top Glove Corp. Bhd held a high market position in 2019. These key players held a high market postion owing to the strong geographical foothold in different regions.

Disposable sterile gloves segment is the most influencing segment owing increase in surgical procesdures across the globe

The major factor that fuels the growth of the global gloves market includes rise in concerns regarding safety and hygiene, and surge in number of end users. In addition, rise in awareness among the healthcare service provider regarding hygiene and advancements in technology are further uplifting the growth of the market

Asia-Pacific has the highest growth rate in the market which is growing with a CAGR of 11.1% as Asia-Pacific is expected to be the largest growth during the forecast period. Owing to increase in compliance to the standards and presence of large population base are the major contributing factors toward the robust growth of the Asia-Pacific market. In addition, the healthcare infrastructure has witnessed a paradigm shift in this region over the last few decades, which has fueled the growth of the market.

Gloves are a type of personal protective equipment (PPE). Gloves create a barrier between germs and hands

It is designed to protect staff from microbial contamination, or from contact with certain chemicals, and cross-transmission from healthcare associated infections

Loading Table Of Content...