The global gluten free confectionary market was valued at $3.2 billion in 2022, and is projected to reach $6.6 billion by 2032, growing at a CAGR of 7.6% from 2023 to 2032.

Gluten Free Confectionary Market refers to a category of sweet treats and desserts that are specifically formulated to be free from gluten. Gluten is a protein found in wheat, barley, and rye, and individuals with gluten-related disorders, such as celiac disease or gluten sensitivity, need to avoid gluten in their diet. Gluten-free confectionery products are made using alternative flours and ingredients that do not contain gluten. They are designed to provide a safe and enjoyable indulgence for individuals who follow a gluten-free diet. These confectionery products may include a wide range of items such as chocolates, candies, cookies, cakes, pastries, and other sweet treats. The gluten-free confectionery market refers to the segment of the food industry that focuses on the production, marketing, and distribution of confectioneries that are free from gluten-containing ingredients. Gluten-free confectionery products include a wide range of sweets, candies, chocolates, and other treats that are enjoyed by consumers of all ages. However, individuals with gluten-related disorders are unable to consume them without risking their health due to the presence of gluten in many traditional gluten-free confectionery items. The gluten-free confectionery market addresses this need by providing alternative products that are safe and suitable for individuals with gluten sensitivities.

The Gluten Free Confectionary Market are projected to be fueled by the increase in awareness of gluten-related disorders. Increase in awareness and diagnosis of gluten-related disorders, such as celiac disease and gluten sensitivity, is a significant driver of the growth of the gluten-free confectionery market. There is a growth in demand for gluten-free products that cater to their dietary needs as more people have become aware of these conditions and get diagnosed. According to the National Institutes of Health (NIH), approximately 1% of the global population has celiac disease, a lifelong autoimmune disorder triggered by the ingestion of gluten. Moreover, the prevalence of non-celiac gluten sensitivity is estimated to be even higher, affecting a larger segment of the population. The rise in prevalence of these disorders has resulted in increased awareness among consumers and healthcare professionals, leading to more diagnoses. As a result, individuals with gluten-related disorders must strictly adhere to a gluten-free diet, which includes eliminating gluten from their gluten-free confectionery choices.

Moreover, the influence of health and wellness trends has emerged as a significant driver in the gluten-free confectionery market. The growth in emphasis on personal well-being, healthy eating habits, and dietary choices has led to an increased demand for gluten-free products, including gluten-free confectionery items. Health-conscious consumers seek products that align with their wellness goals, and many perceive gluten-free diets as beneficial for various reasons. These include weight management, improved digestion, reduced inflammation, and overall well-being. As a result, a broader consumer base is seeking gluten-free alternatives, even beyond those diagnosed with gluten-related disorders. The gluten-free confectionery market has responded to this demand by offering a wide range of delectable and satisfying gluten-free options. Manufacturers have formulated gluten-free confectionery products with healthier ingredients, reduced sugar content, and natural flavorings to cater to wellness-conscious consumers.

In addition, food labeling regulations establish clear guidelines for labeling gluten-free products, including confectionery items. These regulations ensure that products labeled as "gluten-free" meet specific criteria and standards, providing consumers with confidence and trust in the gluten-free claim of the product. The presence of reliable labeling helps consumers easily identify and choose gluten-free confectionery options, thereby driving market demand.

However, the absence of gluten may pose challenges in achieving the desired texture and quality in gluten-free confectionery products. Manufacturers need to invest in research and development to overcome these challenges and offer gluten-free products that are on par with their gluten-containing counterparts in terms of taste and texture. In addition, gluten-free products, including confectionery items, often come at a higher price point compared to their gluten-containing counterparts. The cost of alternative gluten-free ingredients, specialized production processes, and certification requirements contribute to the higher pricing. This cost barrier may limit the affordability and accessibility of gluten-free confectionery for some consumers.

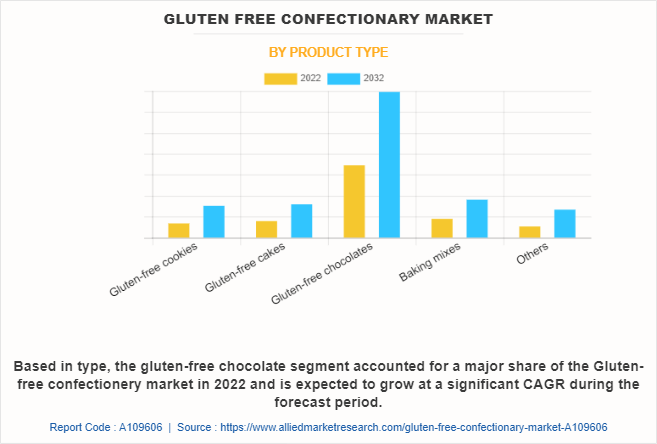

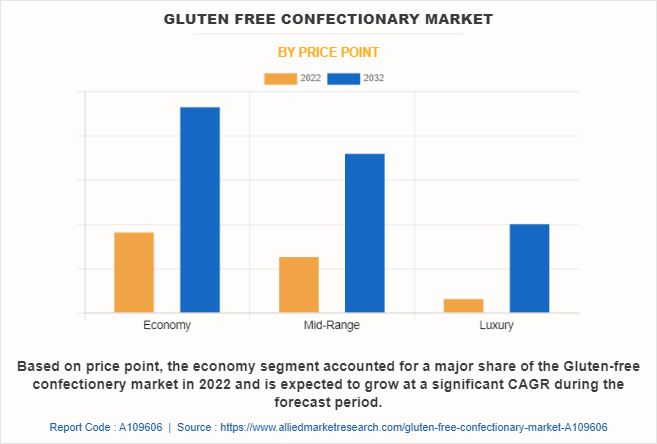

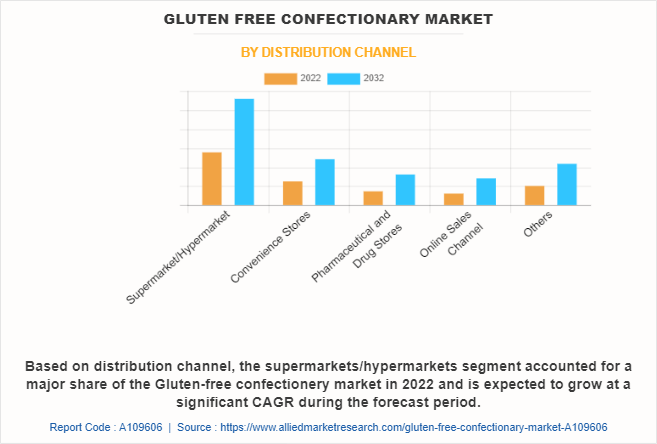

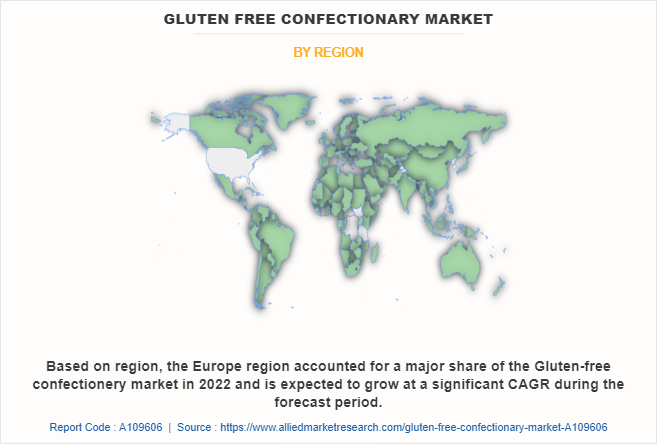

The Gluten Free Confectionary Industry is segmented on the basis of product type, price point, distribution channel, and region. On the basis of product type, the market is classified into gluten-free cookies, gluten-free cakes, gluten-free chocolates, baking mixes, and others. On the basis of price point, the market is classified into economy, mid-range, and luxury. On the basis of distribution channel, the market is classified into supermarkets/hypermarkets, convenience stores, pharmaceutical and drug stores, online sales channels, and others. On the basis of region, it is analyzed across North America (the U.S., Canada, Mexico), Europe (France, Germany, Italy, Spain, the UK, Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, and the Rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, Turkey, and Rest of LAMEA).

On the basis of product type, the market is classified into gluten-free cookies, gluten-free cakes, gluten-free chocolates, baking mixes, and others. The gluten-free chocolate segment accounted for a major share of the gluten-free confectionery market in 2022 and is expected to grow at a significant CAGR during the forecast period. The adoption of gluten-free diets by individuals without diagnosed gluten-related disorders is a significant driver. Many people choose gluten-free options as part of a perceived healthier lifestyle or to address digestive discomfort, contributing to the demand for gluten-free chocolates.

On the basis of price point, the market is classified into economy, mid-range, and luxury. The economy segment accounted for a major share of the gluten-free confectionery market in 2022 and is expected to grow at a significant CAGR during the forecast period. The economy segment comprises products that are considered affordable by larger masses of growing economies. In most markets, value is a trending topic. For instance, in the U.S., roughly 79% of gluten-free confectionery consumers look for an economical value when choosing chocolates. These factors cumulatively have enabled the creation of lucrative opportunities for the economy segment.

On the basis of distribution channels, the market is classified into supermarkets/hypermarkets, convenience stores, pharmaceutical and drug stores, online sales channels, and others. The supermarkets/hypermarkets segment accounted for a major share of the Gluten-free confectionery market in 2022 and is expected to grow at a significant CAGR during the forecast period. The growth of the supermarket/hypermarket segment in the gluten-free confectionery market is attributed to an increase in the adoption of supermarkets/hypermarkets in both mature and emerging markets. Moreover, the one-stop solution provided by these retail formats makes it a very popular option for shopping consumers.

On the basis of region, it is analyzed across North America (the U.S., Canada, Mexico), Europe (France, Germany, Italy, Spain, the UK, Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, and the Rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, Turkey, and Rest of LAMEA). The Europe region accounted for a major share of the Gluten-free confectionery market in 2022 and is expected to grow at a significant CAGR during the forecast period. Europe has a higher prevalence of gluten-related disorders, creating a larger consumer base for gluten-free products. Moreover, strict food labeling regulations in Europe ensure clear and reliable labeling of gluten-free products, enhancing consumer trust. In addition, European consumers are more health-conscious and have a higher disposable income, making them more inclined to purchase gluten-free confectionery.

Key Developments:

- In 2021, Mondelez International acquired Enjoy Life Foods, a leading manufacturer of gluten-free snacks.

- In 2022, Hershey's launched a line of gluten-free chocolate bars, and Nestle launched a line of gluten-free KitKat bars.

The major players operating in the market focus on key market strategies, such as mergers, product launches, acquisitions, collaborations, and partnerships. They have been also focusing on strengthening their market reach to maintain their goodwill in the ever-competitive market. Some of the key players in the gluten-free confectionery market include Bob's Red Mill Natural Foods, Inc., Pamelas Products, Simple Mills, Inc., Unreal Brands Inc., Hail Merry LLC, SmartSweets Inc., King Arthur Baking Company, Inc., MONDELEZ INTERNATIONAL, INC., The GFB: Gluten Free Bar, and Conagra Brands, Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gluten free confectionary market analysis from 2022 to 2032 to identify the prevailing gluten free confectionary market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gluten free confectionary market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global gluten free confectionary market trends, key players, market segments, application areas, and market growth strategies.

Gluten Free Confectionary Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6.6 billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 433 |

| By Product Type |

|

| By Price Point |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Simple Mills, Inc., Unreal Brands Inc., Conagra Brands, Inc., SmartSweets Inc., The GFB, Hail Merry LLC, Pamelas Products, Bob's Red Mill Natural Foods, Inc., King Arthur Baking Company, Inc., MONDELEZ INTERNATIONAL, INC. |

Analyst Review

According to the insights of the CXOs, the global gluten-free confectionery market is expected to witness robust growth during the forecast period. This is attributed to the increasing awareness and diagnosis of gluten-related disorders. According to the National Institutes of Health (NIH), approximately 1% of the global population has celiac disease, a lifelong autoimmune disorder triggered by the ingestion of gluten. Moreover, the prevalence of non-celiac gluten sensitivity is estimated to be even higher, affecting a larger segment of the population. The rising prevalence of these disorders has resulted in increased awareness among consumers and healthcare professionals, leading to more diagnoses. As a result, individuals with gluten-related disorders must strictly adhere to a gluten-free diet, which includes eliminating gluten from their gluten-free confectionery choices. Furthermore, key players in the market are investing in R&D activities and advertising & promotion of products to attract consumers around the globe.

CXOs further added about collaboration and partnerships. Collaboration and partnerships between gluten-free confectionery manufacturers and ingredient suppliers may lead to mutually beneficial outcomes. Ingredient suppliers with expertise in gluten-free formulations may closely with manufacturers to develop innovative products that meet consumer expectations in terms of taste, texture, and nutritional value. Such collaborations may drive product differentiation and provide a competitive edge in the market. However, the high cost of gluten-free confectionery is a major restraint that hampers market growth.

The global gluten free confectionary market was valued at $3.2 billion in 2022, and is projected to reach $6.6 billion by 2032

The global Gluten Free Confectionary market is projected to grow at a compound annual growth rate of 7.6% from 2023 to 2032 $6.6 billion by 2032

Some of the key players in the gluten-free confectionery market include Bob's Red Mill Natural Foods, Inc., Pamelas Products, Simple Mills, Inc., Unreal Brands Inc., Hail Merry LLC, SmartSweets Inc., King Arthur Baking Company, Inc., MONDELEZ INTERNATIONAL, INC., The GFB: Gluten Free Bar, and Conagra Brands, Inc.

The Europe region accounted for a major share of the Gluten-free confectionery market in 2022 and is expected to grow at a significant CAGR during the forecast period.

Increase in awareness and diagnosis of gluten-related disorders, Expansion of product offerings and innovation, Influence of health and wellness trends

Loading Table Of Content...

Loading Research Methodology...