Glycerol Market Overview:

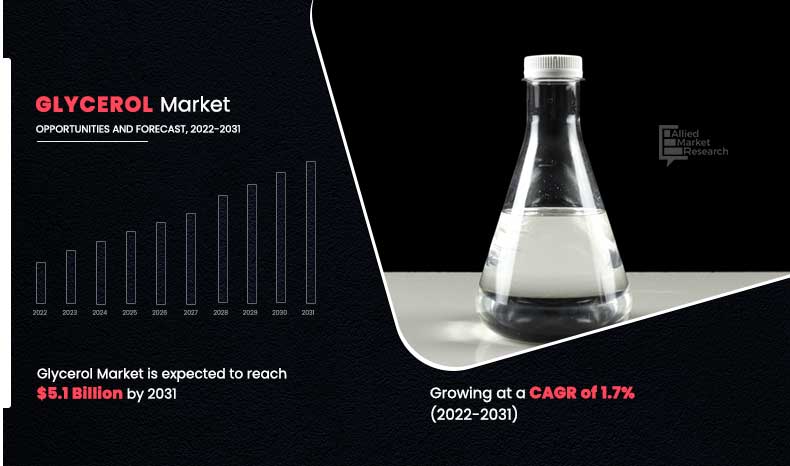

The global glycerol market was valued at $4.3 billion in 2021, and is projected to reach $5.1 billion by 2031, growing at a CAGR of 1.7% from 2022 to 2031.

Key Market Insights

By Source: Biodiesel held the largest market share and remains the most lucrative segment.

By Product: Refined glycerol dominated with a 77.1% share.

By End-Use Industry: Personal care led with 28.3% and is expected to grow at a CAGR of 2.1%.

By Region: Asia-Pacific accounted for 54.1% in 2021 and is projected to grow at a CAGR of 1.9%.Market Size & Forecast

2031 Projected Market Size: USD 5.1 Billion

2021 Market Size: USD 4.3 Billion

Compound Annual Growth Rate (CAGR) (2021-2031): 1.7%

How to Describe Glycerol

Glycerol (C3H8O3) is an odorless, transparent polyol that belongs to the alcohol family of chemical molecules. The hydrolysis of natural oils and fats found in plants and animals is used to produce glycerol. It is used as a solvent, humectant, stabilizer, plasticizer, emollient, filler, sweetener, and softening agent in the food & beverage industry as it is biodegradable, hygroscopic, and miscible with water. Serums, cough syrups, vaccinations, heart medicines, suppositories, expectorants, and drug solvents are all manufactured using glycerol.

Market Dynamics

Increased demand from end-use industries such as personal care, pharmaceutical, and food & beverages is driving the demand for glycerol. Rapid industrialization and urbanization have increased the demand for glycerol form personal care, food & beverages, and pharmaceutical industries. In addition, the need for bio-based fuel is driving the market growth. The need for renewable fuels increased as fossil fuel stocks is limited. Biodiesel is made from natural resources such as animal fats and vegetable oils and has shown to be a more environmentally friendly alternative to fossil fuels. It is produced as a by-product of the biodiesel production process. As a result of increased biodiesel production, glycerol supply is expected to rise during the forecast period.

However, fluctuating prices of raw material is hindering the glycerol market growth. Biodiesel production is uncertain in many of the regions, owing to the changing demand patterns. In addition, glycerol is a key by-product in the biodiesel manufacturing process, and variations in production of biodiesel would result into fluctuating downstream prices of glycerol. On the contrary, increase in demand from emerging economies is expected to provide lucrative opportunity for the glycerol industry expansion during the forecast period.

Glycerol Market Segments Overview

The glycerol market is segmented into source, product, end-use industry, and region. By source, the market is classified into biodiesel, fatty alcohol, fatty acid, and others. Depending on product, the glycerol market is bifurcated into crude glycerol and refined glycerol. On the basis of end-user industry, it is segregated into personal care, food & beverages, pharmaceutical, and others. Region wise, the glycerol market is studied across North America, Europe, Asia-Pacific, and LAMEA. The glycerol market share is analyzed across all significant regions and countries.

Glycerol Market, by Source

The biodiesel segment accounted for 2,781.0 million in 2021 and is projected to attain 3,579.1 million in 2031, is expected to grow at a CAGR of 2.6% during the forecast period. This is attributed to the fact that glycerol is a key by-product in the manufacturing process of biodiesel and increased demand for biofuels.

By Source

Biodiesel segment major market share in the glycerol market and is projected as the most lucrative segment.

Glycerol Market, by Product

The refined glycerol segment accounted for the largest share of 77.1%, followed by crude glycerol segment, and is projected to grow at around 1.8% CAGR during the forecast period in terms of revenue. This is attributed to increased demand for refined glycerol from end-use industries such as pharmaceutical, personal care, and food & beverages.

By Product

Refined glycerol segment holds a dominant position in 2021 and would continue to maintain the lead over the forecast period.

Glycerol Market, by End-Use Industry

On the basis of end-use industry, the personal care industry accounted for largest share of 28.3%, and is projected to grow at a CAGR of 2.1%. This is attributed to increase in consciousness regarding personal hygiene and appearance. Increased population will further boost the demand for personal care products, thus boosting the demand for glycerol.

By End-use Industry

Personal Care industry has garner major share in the glycerol market in 2021 and Pharmaceutical industry is projected as the most lucrative segment.

Glycerol Market, by region

Asia-Pacific contributed the 54.1% market share in 2021, and is projected to grow at CAGR of 1.9% during the forecast period. The increasing population in the region is the major factor driving the demand for personal care products, food & beverages, and pharmaceutical, thus driving the demand for glycerol.

By Region

Asia-Pacific holds a dominant position in 2021 and would continue to maintain the lead over the forecast period.

Which are the Leading Companies in Glycerol

Major players operating in the glycerol market include IOI Oleochemical, Emery Oleochemicals, Kao Corporation, KLK OLEO, Oleon NV, Procter & Gamble Chemicals, Wilmar International Ltd., Musim Mas Group, Ecogreen Oleochemicals, and Croda International.

Other player operating in the glycerol market are Avenit AG, Suzhou Yuanfang Chemical Co. Ltd., Luojiang Chenming Biological Products Co., Ajinomoto Health & Nutrition North America, Inc., IRIS BIOTECH GMBH, Global Bio-chem Technology Group Company Limited, and Akzo Nobel N.V

What are the Key Benefits For Stakeholders

- The report provides in-depth analysis of the global glycerol market along with the current trends and future estimations.

- The glycerol market size is provided in terms of kilotons and $million.

- This report highlights the key drivers, opportunities, and restraints of the market along with the impact analysis during the forecast period.

- Porter’s five forces analysis helps to analyze the potential of the buyers & suppliers and the competitive scenario of the global glycerol market for strategy building.

- A comprehensive market analysis covers the factors that drive and restrain the global glycerol market growth.

- The qualitative data about glycerol market dynamics, trends, and developments is provided in the report.

Glycerol Market Report Highlights

| Aspects | Details |

| By Source |

|

| By Product |

|

| By End-use Industry |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

According to the insights of the CXOs of leading companies, the global glycerol market is anticipated to exhibit high growth potential, owing to increased demand for glycerol from end-user industries such as personal care, food & beverages, pharmaceutical, and manufacturing & processing. The demand from food & beverages industry is increasing as glycerol is used in many foods glycerol is a humectant, solvent, and sweetener that may improve in the preservation of foods. Furthermore, it is used as a thickening agent in liqueurs and utilized as a filler in low-fat dishes that are manufactured commercially. Owing to the COVID-19 pandemic, the use of sanitizers increased the demand from pharmaceutical industry.

Rapid urbanization and industrialization is boosting the demand for glycerol.

The glycerol market was valued at $4.3 billion in 2021, and is projected to reach $5.1 billion by 2031, growing at a CAGR of 1.7% from 2022 to 2031.

IOI Oleochemical, Emery Oleochemicals, Kao Corporation, KLK OLEO, Oleon NV are some of the most established players.

Pharmaceutical industry is projected to increase the demand for glycerol.

By Source o Biodiesel o Fatty Alcohol o Fatty Acid o Others • By Product o Refined Glycerol o Crude Glycerol • By End-use Industry o Personal Care o Food & Beverage o Pharmaceutical o Others

Increased demand from end-use industries like pharmaceutical and personal care is the main driver of glycerol market.

Increased demand for hand sanitizer during covid-19 has increased the demand for glycerol. The demand for personal hygiene products is predicted to increase owing to increased awareness about personal cleanliness. This will increased the demand for glycerol in 2022.

Loading Table Of Content...