GNSS Simulators Market Research, 2033

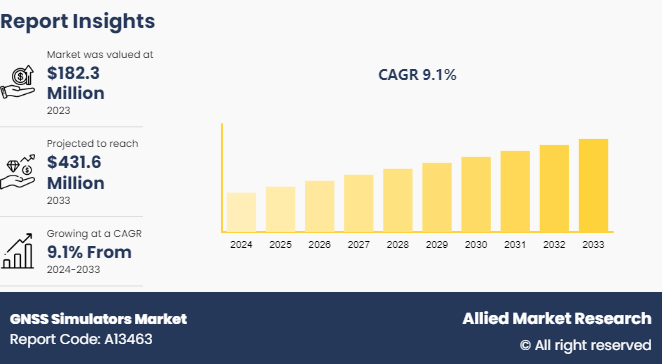

The global GNSS simulators market size was valued at $182.3 million in 2023, and is projected to reach $431.6 million by 2033, growing at a CAGR of 9.1% from 2024 to 2033.

Market Introduction and Definition

GNSS simulators are specialized devices or software systems used to emulate the signals and conditions of Global Navigation Satellite Systems (GNSS) such as GPS, Galileo, GLONASS, and BeiDou. They are essential tools for testing, validating, and developing GNSS receivers and systems under controlled, repeatable conditions without needing to rely on actual satellite signals. GNSS simulator simulates the environment of a global navigation satellite system receiver on a dynamic platform by modeling vehicle and satellite motion, signal characteristics, atmospheric and other effects, causing the receiver to navigate according to the parameters of the test scenario.

Key Takeaways

The GNSS simulators industry covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major GNSS simulators industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

On December 4, 2023, Rohde & Schwarz announced its 5G FR1 A-GNSS OTA test solution approved by CTIA Certification. This new solution measures the performance of the global navigation satellite system (GNSS) receiver in a wireless device. This system consists of the R&S CM500 5G one-box signaling tester; the R&S SMBV100B satellite simulator utilizes an anechoic wireless performance test chamber. The new system features a high degree of system integration and is easily upgraded. Every component of the system is controlled using the R&S CONTEST software, which allows fully automated OTA measurements. The new R&S SMBV100B satellite simulator supports all major satellite navigation technologies and satellite constellations. Moreover, the R&S CMX500 location-based services also support all 3GPP-based Assisted GNSS technologies.

Key Market Dynamics

The global GNSS simulators market share is growing due to several factors, such as the growing adoption of IoT-based electronics like tablets, cameras and smartphones, advancement in autonomous technology and increasing use in aerospace and military applications. However, regulatory constraints and high initial costs hamper the development of the market. In addition, growth in 5G Technologies and an increase in space exploration and satellite development programs provide GNSS simulators market opportunity during the forecast period.

The growing penetration of consumer IoT connected consumer devices, such as self-driving cars, drones, smart sensors, connected homes, and wearable devices equipped with GNSS chips to enable real-time data communication, has increased. IoT plays a significant role in a wide range of applications, including navigation, mapping, and location-based services. For example, in China, the Internet of Vehicles is gaining traction to provide consumers with more convenient and seamless ride. - GNSS chips are integrated into IoT enabled cars, assisting the drivers in driving the vehicles efficiently, and allowing regulatory agencies to track their locations for response and in case of emergencies.?GNSS chips are also being integrated into sensors and wearables to track data from human activities, such as walking, running, cycling, trekking, and swimming. Such IoT applications are increasing the demand for precise GNSS simulators to test various consumer devices. Thus, the growing penetration of consumer IoT products is projected to drive the growth of GNSS simulators market Forecast.

However, a key factor restraining the adoption of digital, location-based business models and services is a lack of advanced digital infrastructures, such as internet connectivity and information and communications technology infrastructure. While some countries have taken steps to build digital infrastructure, many developing countries are still lagging in terms of digital advancements. The lack of internet and ICT infrastructure results in real-time transfer of data, thus hindering the overall market growth from GNSS simulators.

Parent Market Overview

Global navigation satellite systems (GNSS) are any satellite constellation that provides positioning, navigation, and timing (PNT) services on a global or regional basis. The major GNSS satellite system is BeiDou Navigation Satellite System (China) , Galileo (European Union) , GLONASS (Russia) , Indian Regional Navigation Satellite System? (India) and Quasi-Zenith Satellite System (Japan) .

The graph below depicts the Global navigation satellite systems (GNSS) and the number of satellites it consists of.

Number of satellites in Global Navigation Satellite Systems (GNSS)

Global Navigation Satellite Systems (GNSS) | Number of Satellites |

BeiDou Navigation Satellite System (BDS) | 35 |

Galileo | 24 |

GLONASS (Globalnaya Navigazionnaya Sputnikovaya Sistema, or Global Navigation Satellite System) | 24 |

Indian Regional Navigation Satellite System (IRNSS) / Navigation Indian Constellation (NavIC) | 7 |

Quasi-Zenith Satellite System (QZSS) | 7 |

Market Segmentation

The GNSS simulators market is segmented into component, type, GNSS receiver, application, end-use industry, and region. By component, the market is analyzed across hardware, software and services. On the basis of type, the market is bifurcated into single-channel and multichannel. On the basis of GNSS receiver the market is segregated into GPS, Galileo, GLONASS, BeiDou, and others. On the basis of application, the global market is segregated into mapping and surveying, navigation, vehicle assistance systems, location-based services and others. By end-use industry, the market is fragmented into automotive, aerospace, defense, consumer electronics and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Rise in investment worldwide in GNSS is due to the increasing demand for navigation and timing in transportation, agriculture, telecommunications, defense, and other industries. Moreover, the growth of autonomous vehicles, drones, and smart cities also depends heavily on reliable GNSS data. Similarly, developing countries are also investing heavily in developing their global navigation satellite systems as strong GNSS infrastructure improves national security, lowers reliance on foreign systems, and provides critical information for a variety of economic activities.

In North America the U.S. government spend a large sum of money in development and modernization of its global navigation satellites. The U.S. owned GPS system is one of the most widely used GNSS system worldwide. Moreover, the country continues to fund research and development to further enhance its GNSS such as for the development of GPS 3. The country has also placed certain regulations, such as the National Timing Resilience and Security Act?and Next-Generation Operational Control System, which further promote the development and growth of its global navigation satellite systems.

In the European region, the countries work collaboratively to develop and maintain their global navigation satellite system market. The region also has the Galileo satellite navigation system, and the region has witnessed a huge sum of investment for the development and modernization of the satellite system. For instance, in January 2024, Qualinx, a Netherland-based high-tech fabless semiconductor company, partnered with the European Union Agency for the Space Program (EUSPA) to create a low-power GNSS receiver specifically tailored for EUSPA's GNSS authentication service. The project aims to ensure users accurately receive data from Galileo satellites while also tackling spoofing incidents.

In the Asia-Pacific region, the growing economic activities have resulted in an increase in expenditure on space-based programs. The region has China's BeiDou, India's NAVIC, and Japan's QZSS global navigation satellite systems. Countries across the region have recognized the importance of GNSS in enabling a wide range of applications such as national security and infrastructure development to commercial and scientific uses. Furthermore, government initiatives to support infrastructure development, smart city projects, and digitalization efforts fuel the demand for GNSS technologies in the region.

Competitive Landscape

The major players operating in the GNSS simulators market include Rohde & Schwarz, Syntony GNSS, CAST Navigation, VIAVI Solutions, u-blox, Hexagon, Spirent Communications, Accord Software and System, Keysight Technologies and Orolia.

Other players in the GNSS simulators market include Averna, RACELOGIC, GMV NSL, Cast Navigation, IFEN, TeleOrbit, ip-Solutions, Jackson Labs Technologies, WORK Microwave, M3 System, Qascom, Saluki Technologies, MaxEye Technologies, Tersus GNSS, Digilogic, NOFFZ Technologies, Elkay, and so on.

Industry Trends

Miniaturization of technology

Over the last decade, the development in semiconductor technology has experienced strong growth, which has led to the miniaturization of components used in GNSS simulator systems. The miniaturization of components has enabled the development of smaller and more efficient GNSS simulators that can be used in a wide range of applications. Miniaturized components allow for the creation of smaller and more portable GNSS simulators. This compact design makes it easier to integrate into various devices and systems, increasing its versatility and usability. Miniaturized components also consume less power and generate less heat, making them more energy-efficient and reliable.?The miniaturization of components resulted in compact and efficient autonomous vehicle systems that require accurate location and navigation data to operate efficiently.

Increased multi-constellation and multi-frequency support

Modern GNSS simulators are increasingly supporting multiple GNSS constellations beyond GPS, such as GLONASS, Galileo, BeiDou, and regional systems like QZSS and IRNSS. This capability is crucial for testing multi-constellation receivers that use signals from various systems to improve accuracy and reliability. Furthermore, modern simulators are incorporating more realistic environmental models, including urban areas, high terrain environments, and other signal obstruction scenarios these realistic scenarios help in testing GNSS receivers perform at complex and harsh environments. Currently, there are more than 120 navigation satellites in space on average, around 30 satellites are visible from most locations around the world at a given time, each of these satellites provides multiple positioning on different frequencies thus implementation of multi-constellation and multi frequency support will shape the future of GNSS simulators.

Key Sources Referred

National Aeronautics and Space Administration (NASA)

European Space Agency (ESA)

Russian Federal Space Agency (Roscosmos)

China National Space Administration (CNSA)

Indian Space Research Organization (ISRO)

Japan Aerospace Exploration Agency (JAXA)

United Launch Alliance (ULA)

Space Agency of the United Arab Emirates (UAE Space Agency)

Airports Council International (ACI)

Federal Aviation Administration (FAA)

European Union Aviation Safety Agency (EASA)

Motor & Equipment Manufacturers Association (MEMA) ?

Society of Automotive Engineers (SAE) ?

Aerospace Component Manufacturers Association (ACMA)

European Association of Aerospace Industries (ASD)

Aerospace Industries Association (AIA)

International Aerospace Quality Group (IAQG)

Japan Aerospace Exploration Agency (JAXA)

National Aerospace Standards (NAS)

German Aerospace Industries Association (BDLI)

Key Benefits For Stakeholders

This report provides a quantitative analysis of the GNSS simulators market growth, segments, current trends, estimations, and dynamics of the GNSS simulators market analysis from 2024 to 2033 to identify the prevailing GNSS simulators market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the GNSS simulators market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global GNSS simulators market size and statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global GNSS simulators market trends, key players, market segments, application areas, and market growth strategies.

GNSS Simulators Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 431.6 Million |

| Growth Rate | CAGR of 9.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Component |

|

| By GNSS Receiver |

|

| By Application |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Keysight Technologies, Hexagon, Rohde & Schwarz, CAST Navigation, Orolia, u-blox AG, Spirent Communications Plc., Syntony GNSS, Inc., VIAVI Solutions, Accord Software and System. |

Integration with 5G and IoT are the upcoming trend in the GNSS simulators market.

Mapping and Surveying is the major application in the GNSS simulators market.

North America is the largest market for GNSS simulators market.

The GNSS simulators market was valued at $182.31 in 2023.

Rohe & Schwarz, Syntony GNSS, CAST Navigation, VIAVI Solutions, and u-blox are the top companies to hold the market share in GNSS simulators market

Loading Table Of Content...