Golf Shoes Market Research, 2034

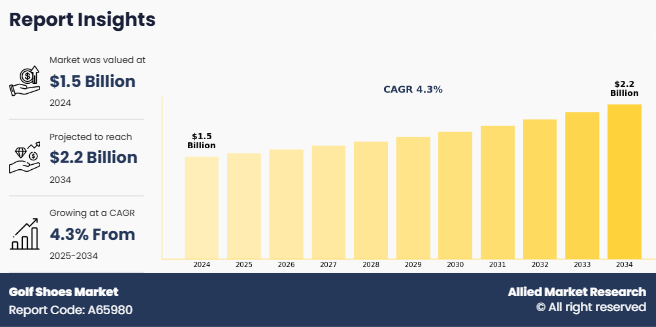

The global golf shoes market was valued at $1.5 billion in 2024, and is projected to reach $2.2 billion by 2034, growing at a CAGR of 4.3% from 2025 to 2034. Golf shoes are athletic footwear designed specifically for playing golf. They offer grip, support, and comfort during swings and long walks on the course. Manufacturers use materials such as synthetic fabrics, leather, and rubber. Uppers, the part of the shoe that covers the foot, provide durability and weather resistance, while midsoles include EVA or foam for cushioning. Outsoles feature spikes and textured patterns for traction. Benefits of golf shoes include better balance, reduced risk of slipping, and increased comfort over long periods, which improve performance and stability while playing the game.

Market Dynamics

Surge in golf participation has led to the rapid expansion of the golf shoes market size. According to the National Golf Foundation, on-course golfer numbers increased by 3.1 million in 2023 compared to 2022, growing faster than the 2020 to 2022 period, which averaged 2.5 million new golfers each year. The on-course player base has increased by 44% since 2016, reaching over 42 million. Such steady increase in participation has led to increased demand for golf shoes, as both new and existing players seek footwear designed for stability, grip, and comfort. The consistent rise in number of global golfers boosts the golf shoes market share.

Moreover, alternative golf formats have also expanded the base of participants, further strengthening the demand for golf shoes. National federations across the affiliated markets of R&A in Asia, Africa, Canada, the Caribbean, Central & South America, Europe, the Middle East, and Oceania reported that 62.3 million adults outside the U.S. and Mexico engaged with golf in 2023, increasing by 1.1 million from 2022. Many of these players are involved in par-3 golf, indoor simulator golf and driving range use, which has led to increased demand for golf shoes suited to diverse formats, thus driving the golf shoes market growth globally.

However, competition from counterfeit products has become a significant restraint to the growth of the global golf shoes market. Counterfeit products replicate the design and appearance of premium golf shoes at a much lower cost, attracting price-sensitive consumers. Although fake products lack the quality, durability, and performance features of authentic golf shoes, the price advantage draws interest from buyers with limited budgets. Consumers, particularly those who are new to the sport or from lower-income regions, often choose counterfeit alternatives over genuine and higher-priced golf shoes, which hampers the growth of golf shoes Market Demand.

In addition, availability of counterfeit golf shoes damages brand reputation and weakens demand for genuine products from companies such as Nike, FootJoy, and Puma. Direct competition from fake alternatives makes it difficult for manufacturers of authentic golf shoes to communicate the long-term value and performance benefits of original products. Brands are often forced to lower prices or invest in anti-counterfeit measures, which reduces profit margins. Simultaneously, the presence of fake golf shoes leads to customer dissatisfaction, increased product returns, and challenges related to compliance & regulation. Consumer hesitation to invest in authentic golf shoes owing to concerns regarding authenticity is expected to restrict the growth of the global golf shoes market.

Furthermore, rise in demand for golf shoes made from eco-friendly and recyclable materials offers opportunities for the growth of the global golf shoes market. Consumers increasingly prioritize sustainability and seek golf shoes produced using recycled plastics, bio-based materials, and manufacturing methods that reduce environmental impact. In key markets such as North America and Europe, many golfers prefer shoes that support eco-conscious practices while maintaining comfort and performance. Increased focus on reducing environmental footprint has encouraged companies to shift away from conventional leather and synthetic fabrics toward more sustainable alternatives in golf shoe production.

Simultaneously, brands such as Puma and ECCO explore eco-friendly materials such as recycled plastics and sustainable leather to meet rise in demand for environmentally responsible golf shoes. In May 2023, Allbirds launched the Golf Dasher, a shoe that is manufactured using sustainable Dasher silhouette with added traction and water-repellent materials for golf performance. Introduction of models made with recycled content, plant-based fabrics, and water-efficient manufacturing processes reflect growing industry alignment with environmental values. Thus, golf shoe manufacturers that introduce sustainable product lines and reduce use of traditional high-impact materials are positioned to capture demand from environmentally conscious consumers and expand their presence in the global golf shoes market.

Segmental Overview

The golf shoes market is segmented into type, end user, distribution channel, and region. By type, the market is divided into spiked shoes and spikeless shoes. By end user, the market is bifurcated into men and women. By distribution channel, the market is categorized into specialty sports stores, departmental stores, online sales channel, and others. By region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Singapore, and rest of Asia Pacific), and LAMEA (Brazil, Argentina, South Africa, Saudi Arabia, UAE, and rest of LAMEA).

By Type

By type, the spiked shoes segment dominated the global golf shoes market in 2024 and is anticipated to maintain its dominance during the forecast period. Demand for spiked golf shoes in the global golf market has increased owing to the need for reliable grip, stability, and swing control on varied golf course conditions. Spiked golf shoes reduce the risk of slipping during swings, especially on wet, hilly, and grassy surfaces, which improves performance and accuracy. Golfers prefer spiked shoes to maintain balance and footing in unpredictable weather and terrain, which has contributed to higher demand for this segment.

In addition, growth in the spiked golf shoes segment is supported by advancements in spike configuration and shoe construction. Manufacturers have developed shoes with soft, removable spikes that offer strong traction while minimizing damage to golf courses. Use of breathable and lightweight materials has also improved comfort, encouraging more frequent use during long periods. Thus, the spiked segment has gained traction among players who prioritize performance consistency across diverse playing environments.

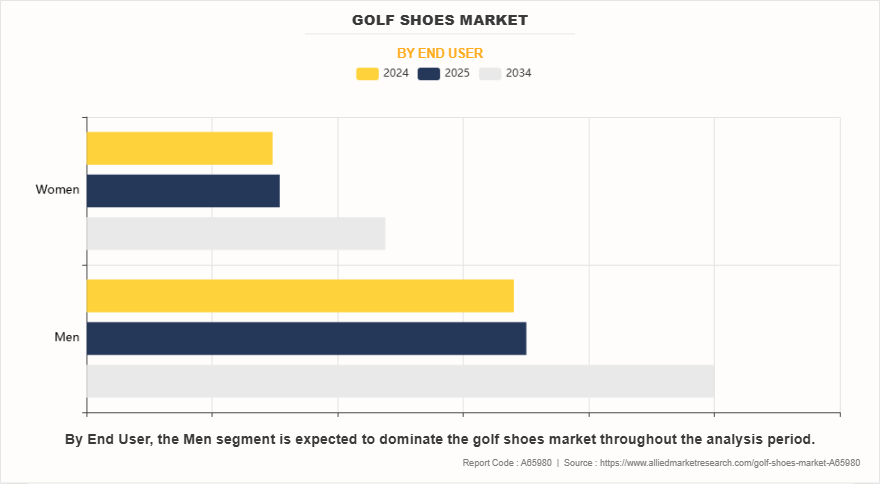

By End User

By end user, the men segment dominated the global golf shoes market in 2024 and is anticipated to maintain its dominance during the forecast period. Surge in proliferation of golf shoes among men has been supported by rise in interest in the sport and change in preferences regarding performance, comfort, and style. A 14% increase in rounds played in the U.S. in 2020, as reported by the National Golf Foundation, reflects renewed engagement, especially in the post-pandemic period. Younger male players using simulators and digital golf platforms have driven demand for golf shoes that offer balance and traction even in indoor settings. Older male golfers, with more disposable income and leisure time, continue to invest in supportive, cushioned footwear suited for outdoor courses.

Moreover, technological improvements such as lightweight construction, GORE-TEX waterproofing, enhanced traction, and spikeless designs have strengthened product value. In addition, fashion collaborations, such as Justin Thomas’s line with FootJoy, have helped introduce golf shoes into lifestyle and casual wear. Sustainability trends, reflected in offerings from Adidas and ECCO using recycled and biom-based materials, have further encouraged adoption among environmentally conscious male consumers.

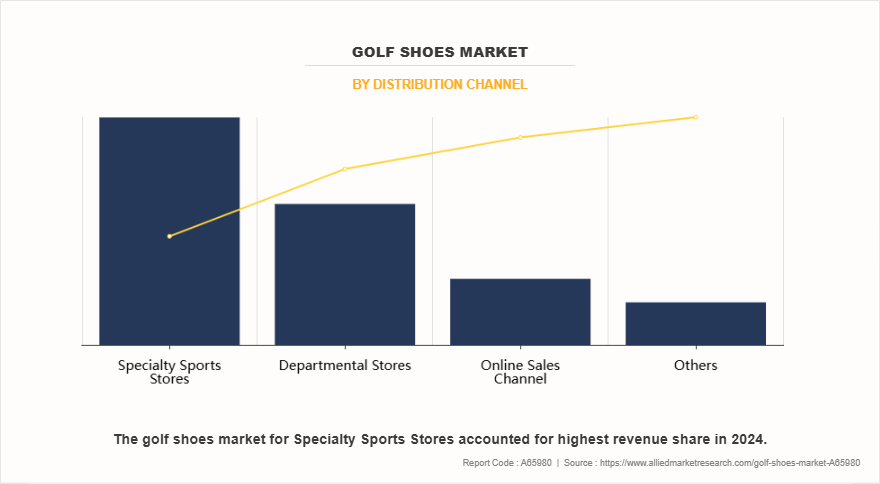

By Distribution Channel

By distribution channel, the specialty sports stores segment dominated the global golf shoes market in 2024 and is anticipated to maintain its dominance during the forecast period. Sales of golf shoes through specialty sports stores have increased owing to the personalized service and product expertise available at sports or golf-focused retail outlets. Golf players often prefer in-person shopping experiences that allow them to try on shoes, test comfort and fit, and seek advice from knowledgeable staff. Specialty sports stores concentrate on high-performance footwear, showcasing models designed for grip, stability, and all-weather use. Golf brands often prefer specialty sports stores to introduce premium ranges that benefit from technical explanation and hands-on interaction.

In addition, product authenticity and access to the latest golf shoe launches also contribute to strong sales and growth of this segment. Specialty sports retailers usually partner with leading brands such as FootJoy, Adidas, and Ecco to stock current collections and exclusive designs. Services such as shoe fitting, customization, and maintenance support offer added value. Golf players seeking trusted quality, expert input, and specific product solutions are more likely to prefer specialty sports stores over mass-market retail outlets.

By Region

By region, North America is anticipated to dominate the global golf shoes market with the largest share during the forecast period. In North America, the growth of golf shoe sales has been strongly influenced by the increase in popularity of golf as a recreational and social activity. As more individuals from diverse age groups take up golf, demand for specialized footwear that enhances comfort, performance, and durability has surged. In Canada, the growing interest in outdoor activities and sports has also led to a higher participation rate in golf, further driving the need for golf shoes designed for both recreational and professional players.

Moreover, golfers in North America have shifted toward multi-functional footwear, seeking shoes that are worn both on and off the course. Preference for adaptable footwear aligns with the active lifestyle adopted by many people in the region, particularly in urban areas where individuals prioritize fitness and convenience. Established players in the region, such as Nike, Adidas, FootJoy, and Puma, have responded by offering a broader variety of golf shoe options, ranging from athletic-inspired designs to traditional styles, which ensures compatibility with the diverse preferences of consumers in the North America region.

Competitive Analysis

The key players operating in the global golf shoes industry include ASICS Corporation, Acushnet Holdings Corp., ECCO Sko A/S, G/FORE, Topgolf Callaway Brands Corp., New Balance Athletics, Inc., Nike, Inc., Puma SE, Skechers USA, Inc., and Under Armour, Inc. Several well-known and upcoming brands are vying for market dominance in the expanding golf shoes market. Smaller, niche firms are more well known for catering to consumer demands and preferences in the global market. Large conglomerates, however, control most of the market and often buy innovative start-ups to broaden their product lines.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the golf shoes market analysis from 2024 to 2034 to identify the prevailing golf shoes market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the golf shoes market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global golf shoes market trends, key players, market segments, application areas, and market growth strategies.

Golf Shoes Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 2.2 billion |

| Growth Rate | CAGR of 4.3% |

| Forecast period | 2024 - 2034 |

| Report Pages | 420 |

| By Type |

|

| By End User |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Acushnet Holdings Corp., ASICS Corporation, Puma SE, Ecco Sko A/S, Topgolf Callaway Brands Corp., G/Fore, New Balance Athletics, Inc., Under Armour, Inc., Skechers USA, Inc., Nike Inc. |

Analyst Review

This section consists of the opinion of the top CXO in the golf shoes market. CXOs in the golf shoe market recognize that consumer expectations are evolving, with a significant focus on high-performance and technologically advanced products. Golfers are increasingly inclined toward shoes that combine comfort with innovative features such as enhanced grip, waterproofing, and customizable fit. Advances in materials and design have become essential for staying competitive. As per top executives, understanding the intersection of performance and comfort is critical, as it directly influences purchasing decisions and brand loyalty.

Sustainability is another major consideration stated by industry leaders. As eco-consciousness grows, consumers demand golf shoes made from environmentally friendly materials such as recycled plastics or plant-based components. CXOs are adopting sustainable practices not just to cater to consumer preferences but also as a means of differentiating their brands in a competitive market. Emphasizing durability and longer-lasting shoes is key to addressing concerns regarding waste and promoting responsible consumption. Executives consider sustainability as a significant factor in aligning with consumer values and contributing to long-term market growth.

The direct-to-consumer (DTC) model has become a transformative force in the golf shoe market. CXOs understand that online sales channels and digital engagement are essential for reaching a wider consumer base. Offering personalized products, whether in design or performance attributes, has proven effective in attracting and retaining customers. By utilizing DTC channels, companies can gather invaluable consumer insights, improving product offerings and strengthening brand connections. This shift to a more direct approach allows for a deeper understanding of consumer preferences, which in turn is expected to promote greater customer loyalty in the competitive golf shoe market.

The golf shoes market was valued at $1,465.8 million in 2024.

By type, the spiked shoes segment dominated the global golf shoes market in 2024.

Sustainable materials, smart shoes, spikeless designs, customization options, and rising e-commerce adoption are driving upcoming global golf shoes market trends.

North America is the largest regional market for golf shoes.

The key players operating in the global golf shoes industry include ASICS Corporation, Acushnet Holdings Corp., ECCO Sko A/S, G/FORE, Topgolf Callaway Brands Corp., New Balance Athletics, Inc., Nike, Inc., Puma SE, Skechers USA, Inc., and Under Armour, Inc.

Loading Table Of Content...

Loading Research Methodology...