GPON Equipment Market Outlook: 2023

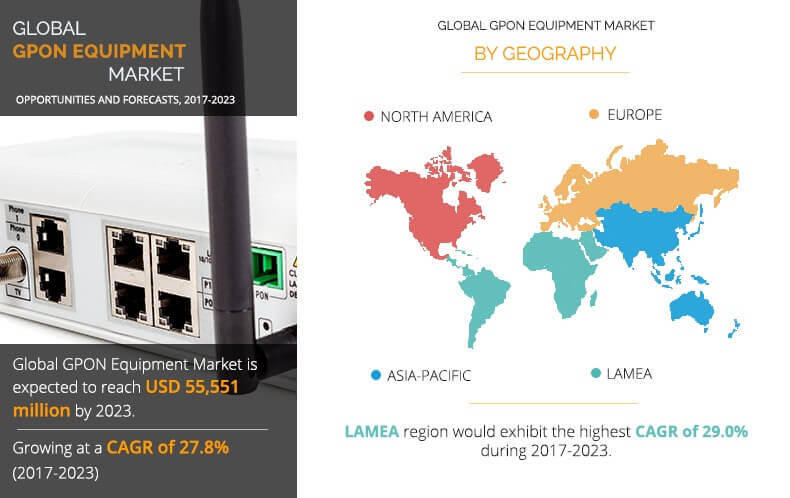

The global GPON equipment market was valued at $10,084 million in 2016, and is projected to reach $55,551 million by 2023, registering a CAGR of 27.8% from 2017 to 2023.The global GPON (gigabit passive optical network) equipment market is driven by technological advancements and increase in demand for better quality fiber in the network architecture of service providers. In addition, emergence of FTTH projects, specifically in China and the U.S., has fueled the GPON equipment market growth. Moreover, low cost of ownership, high ROI, advanced security, optimized bandwidth connectivity, and simplified network operations supplement the GPON equipment market growth.

Segment Review

The global GPON equipment market is segmented on the basis of equipment type, end-use industry, and region. On the basis of equipment type, it is divided into optical line terminals and optical network terminals. Based on end-use industry, it is categorized into hospitals, residential, IT & telecom, and other verticals. The geographical analysis of the industry includes regions such as North America, Europe, Asia-Pacific, and LAMEA.

The Global Gpon Equipment Market is dominated by key players such as, Huawei Technologies Co., Ltd., Hitachi, Ltd., Ericsson AB, Ubiquoss Inc., Motorola Solutions, Dasan Zhone Solutions, Calix, Mitsubishi Electric Corporation, Cisco Systems, Inc., and ZTE Corporation.

Top Impacting Factors

- Increased Growth in IP Traffic

Increase in penetration of internet across developing countries coupled with surge in IP traffic globally has fueled the market growth. Furthermore, technological and performance benefits offered by GPON over other legacy networks have helped GPON to emerge as the preferred fiber access technology.

- Growing FTTH Deployments

GPON infrastructure comprises a single optical fiber, which is accessed by multiple users via optical splitters. Thus, GPON is considered as the most cost-effective technology for FTTH (fiber to the home) deployments. Furthermore, increase in adoption of such services and growth in investments from both public & private sectors are expected to drive the global market.

- Demand for Higher Bandwidth

The introduction of high-speed services and streaming video have continued to drive the demand for higher bandwidth; thereby, boosting the demand for FTTP applications. Furthermore, the demand for higher bandwidth is expected to proliferate with the increase in the number of connected devices.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global GPON equipment market along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about the key drivers, restrains, and opportunities and their impact analyses on the market size is provided.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers operating in the industry.

- The quantitative analysis of the global market from 2017 to 2023 is provided to determine the market potential.

GPON Equipment Market Report Highlights

| Aspects | Details |

| By EQUIPMENT TYPE |

|

| By END USER |

|

| By Region |

|

| Key Market Players | ZTE CORPORATION, UBIQUOSS INC, CALIX, MITSUBISHI ELECTRIC CORPORATION, HITACHI, LTD, DASAN ZHONE SOLUTIONS, HUAWEI TECHNOLOGIES CO., LTD, CISCO SYSTEMS INC, MOTOROLA SOLUTIONS, ERICSSON AB |

Analyst Review

The sales of GPON equipment have grown significantly due to the increased adoption of fiber-to-the-business (FTTB) and fiber-to-the-home (FTTH). GPON offers increased bandwidth capabilities along with triple-play services, including internet, digital content, and voice over internet protocol (VoIP) over a single fiber optic line served to office premises or residential households. The strong optical network set-up in various countries and growth in demand for energy conservation have boosted the market growth globally.

The global GPON equipment market is driven by significant demand for higher bandwidth, and optical networking solutions. However, the cost of initial installations is higher than traditional technologies, which restricts the market growth.

Asia-Pacific accounted for the maximum share in the global market in 2016, owing to technological advancements and increase in internet penetration. Furthermore, LAMEA is anticipated to witness the highest growth rate during the forecast period due to the surge in the number of FTTH deployments in countries including Brazil.

The key players profiled in the GPON equipment report include Huawei Technologies Co., Ltd., Hitachi, Ltd., Ericsson AB, Ubiquoss Inc., Motorola Solutions, Dasan Zhone Solutions, Calix, Mitsubishi Electric Corporation, Cisco, and ZTE Corporation. The market players have adopted technological innovations and collaboration strategies to increase their product offerings, expand their customer base, and capitalize on the growing demand for this technology.

Loading Table Of Content...