Graphene Market Research, 2028

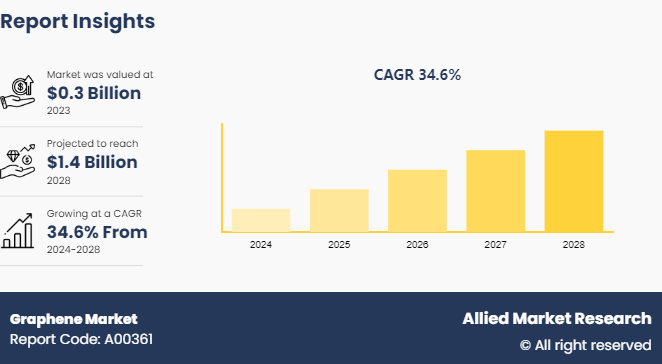

The global graphene market size was valued at $0.3 billion in 2023, and is projected to reach $1.4 billion by 2028, growing at a CAGR of 34.6% from 2024 to 2028.

Market Introduction and Definition

Graphene is a single layer of carbon atoms arranged in a two-dimensional honeycomb lattice. It is the basic structural element of other carbon-based materials, including graphite, carbon nanotubes, and fullerenes. Graphene exhibits remarkable physical properties, such as exceptional electrical conductivity, mechanical strength, and thermal conductivity. Its unique combination of properties makes it a highly promising material for a wide range of applications, such as electronics, materials science, and energy storage. It exhibits remarkable electrical conductivity due to the delocalized electrons in its structure, allowing them to move freely across the plane with minimal resistance. This makes graphene an excellent candidate for applications in electronics, potentially revolutionizing fields such as semiconductors, sensors, and transparent conductive electrodes.

Key Takeaways

- The graphene market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 2,400 product literatures, industry releases, annual reports, and other such documents of major graphene industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

In consumer electronics, graphene is being leveraged to develop faster and more efficient transistors, which are fundamental components of modern computing devices. Its ability to conduct electricity more effectively than traditional materials such as silicon means that devices operate at higher speeds while consuming less power. This improves the performance of smartphones, tablets, and laptops and contributes to longer battery life and reduced energy consumption. Furthermore, rise of flexible and wearable electronics has spurred interest in graphene. Its flexibility and strength make it suitable for use in flexible displays, sensors, and other wearable technology. All these factors are expected to drive the demand for the graphene market during the forecast period.

However, high material costs and scalability challenges significantly hinder widespread adoption of graphene and the market growth. The production of high-quality graphene involves complex and expensive processes, such as chemical vapor deposition (CVD) and exfoliation, which require advanced equipment and stringent control over conditions. These methods are effective in producing high purity graphene, which is not easily scalable for mass production, leading to high costs that limit its economic feasibility for many applications. All these factors hamper the growth of the graphene market.

Advancements in production techniques are creating new opportunities for graphene, innovative methods such as liquid-phase exfoliation, chemical reduction of graphene oxide, and electrochemical synthesis are emerging as more efficient and cost-effective ways to produce graphene. These techniques aim to simplify the production process, reduce the need for expensive equipment, and enable the generation of larger quantities of high-quality graphene. Furthermore, the development of electrochemical synthesis techniques, which utilize electric currents to exfoliate graphite into graphene, holds promise for large-scale production. This method is particularly attractive because it can be finely controlled to produce graphene with specific properties tailored to different applications. All these factors are anticipated to offer new growth opportunities for the global graphene market during the forecast period.

Market Segmentation

The graphene market is segmented into type, application, and region. By type, the market is classified into mono-layer & bi-layer graphene, few layer graphene (FLG) , graphene oxide (GO) , and graphene nano platelets (GNP) . By application, the market is divided into electronics, composites, energy storage, paint, coatings and inks, tires, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

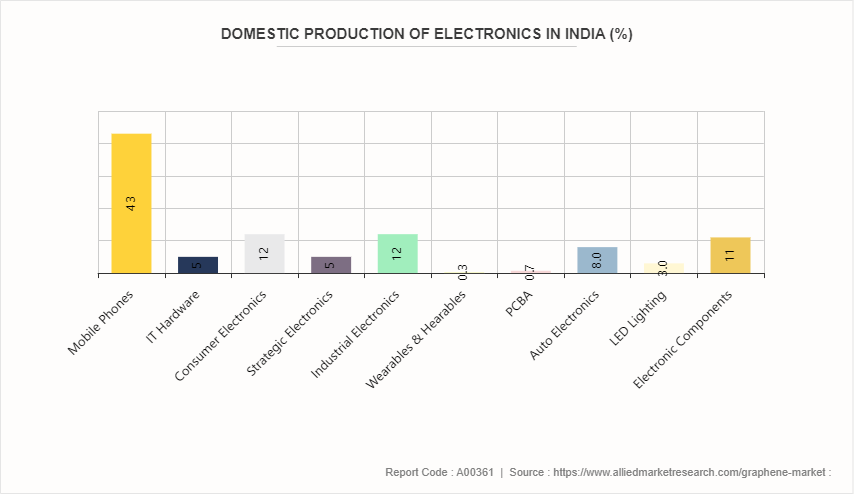

The Asia-Pacific region is witnessing a significant surge in demand for graphene, driven by factors such as industrial growth, technological innovation, and supportive government policies. There is surge in expansion of the electronics and semiconductor industries in countries such as China, Japan, South Korea, and Taiwan. These nations are leaders in electronics manufacturing, producing a wide range of consumer devices such as smartphones, tablets, and wearable technology. Graphene's exceptional electrical and thermal properties make it an attractive material for enhancing the performance and efficiency of these devices, prompting extensive research and development efforts within the region. Furthermore, the Asia-Pacific region benefits from substantial government support and investment in advanced materials and nanotechnology.

- Graphene's electrical conductivity and mechanical strength make it a preferable material for electronics and semiconductor applications. In the Asia-Pacific region, there is a growing focus on integrating graphene into devices such as flexible displays, high-speed transistors, and sensors.

- In September 2022, the Indian government revamped their $10 billion production linked incentive (PLI) scheme to provide up to 50% funding for project costs of building semiconductor fabs and display fabs.

- Graphene's lightweight and strong properties make it an ideal candidate for strengthening composite materials. In industries such as aerospace and automotive manufacturing in the Asia-Pacific region, there is increasing interest in incorporating graphene into composites to enhance structural integrity, reduce weight, and improve fuel efficiency.

Competitive Landscape

The major players operating in the graphene market include ACS Material, Applied Graphene Materials, CVD Equipment Corporation, Directa Plus S.p.A., G6 Materials Corp, Graphenea, Grolltex Inc, NANOTEK INSTRUMENTS INC, NanoXplore Inc., and Vorbeck Materials Corp.

- In April 2024, Schaffhausen 2HS AG launched the one-graphene platform, where the startup specializing in graphene nano electrics offers synthetic single-crystalline CVD graphene films.

- In November 2021, Neograf Solutions launched an advanced graphene product line. The launch of the Graf-X line is a transformational move for NeoGraf Solutions which has more than 140 years of product leadership and innovation in the carbon and graphite industry.

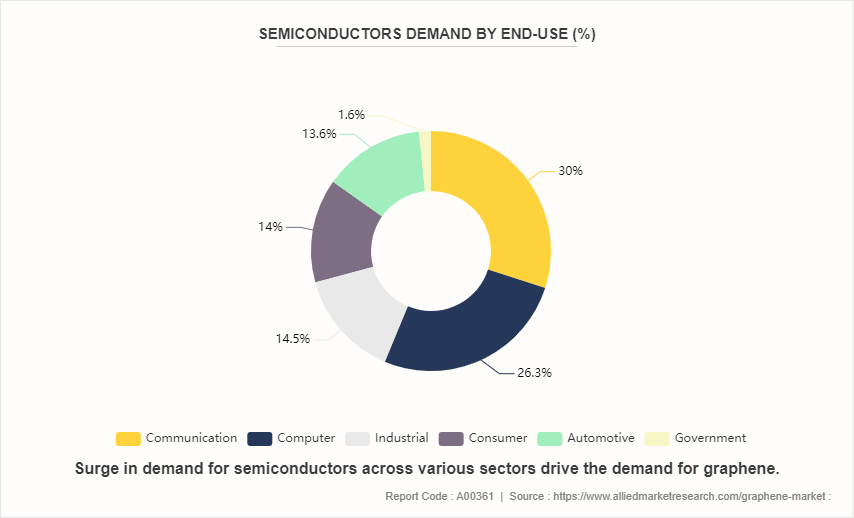

Graphene Impact on Semiconductor Demand Across Industries

The demand for semiconductors across various sectors provides valuable insight into the potential impact on graphene. Graphene's exceptional conductivity and flexibility enhance the performance of communication devices, enabling faster data transmission rates and more efficient communication systems. Its integration led to the development of thinner, lighter, and more durable communication devices, meeting the growing demands of the digital age. In the computer sector, graphene holds the promise of transforming computing technologies. Graphene's high electron mobility and thermal conductivity make it an ideal candidate for enhancing the speed and efficiency of computer processors and memory devices.

Industry Trends

- Graphene’s electrical conductivity and transparency make it a promising material for next-generation electronic devices. Trends include the integration of graphene into transistors, flexible displays, and touchscreens, leading to faster, more efficient, and flexible electronics.

- Graphene-based materials are being explored for advanced energy storage solutions, including supercapacitors and batteries. Graphene's high surface area and conductivity improve the performance and lifespan of energy storage devices. Trends in this sector involve enhancing energy density, reducing charging times, and improving cycling stability.

- According to the Internation Energy Agency (IEA) , global investment in battery energy storage exceeded $20?billion in 2022, predominantly in grid-scale deployment, which represented more than 65% of total spending in 2022. After solid growth in 2022, battery energy storage investment is expected to hit another record high and exceed $35?billion in 2023, based on the existing pipeline of projects and new capacity targets set by governments.

- Graphene production methods are evolving towards more sustainable and scalable processes, such as chemical vapor deposition (CVD) and liquid-phase exfoliation. Trends focus on reducing the environmental impact, lowering production costs, and increasing the scalability of graphene production for widespread commercial applications.

Key Sources Referred

- U.S. Department of Energy

- International Energy Agency

- Invest India

- The American Clean Power Association

- Semiconductor Industry Association

- The Graphene Council

- American Physical Society

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the graphene market analysis from 2024 to 2028 to identify the prevailing graphene market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the graphene market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global graphene market trends, key players, market segments, application areas, and market growth strategies.

Graphene Market Report Highlights

| Aspects | Details |

| Market Size By 2028 | USD 1.4 Billion |

| Growth Rate | CAGR of 34.6% |

| Forecast period | 2024 - 2028 |

| Report Pages | 410 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Directa Plus S.p.A., Applied Graphene Materials, G6 Materials Corp, Grolltex Inc, ACS Material, Vorbeck Materials Corp., Graphenea, NANOTEK INSTRUMENTS INC, NanoXplore Inc. , CVD Equipment Corporation |

Analyst Review

Presently, the global graphene market is in its nascent stage; however the market is expected to witness substantial growth in the future. The tremendous surge in patenting activities acts as evidence to support this fact. Global business leaders, such as Samsung, IBM, Nokia, and BASF are in a race to patent graphene-based applications in order to gain an early movers advantage in the graphene market. The material is endowed with excellent physical and chemical properties owing to its unique structure. This ensures its application in various industries, especially electronics and energy. Successful R&D would help to overcome the drawbacks of the compound and lead to it being widely adopted in electronics, potentially replacing conventional material, such as silicon. Moreover, graphene-based composites have the potential to replace the metals in the composite application. The monolayer & bi-layer graphene film could bring about a revolution in the higher applications of electronics, energy generation & storage, aerospace, automotive etc. The hurdles involved in mass production and the high cost of the material are restricting the market growth. However, ongoing R&D is expected to resolve these issues. Moreover, market players are trying to attract investors through issuing newsletters.

The global graphene market was valued at $0.3 billion in 2023, and is projected to reach $1.4 billion by 2028, growing at a CAGR of 34.6% from 2024 to 2028.

Asia-Pacific is the largest regional market for Graphene.

Energy storage is the leading application of Graphene Market.

Advancements in production techniques are the upcoming trends of Graphene Market in the globe.

The major players operating in the graphene market include ACS Material, Applied Graphene Materials, CVD Equipment Corporation, Directa Plus S.p.A., G6 Materials Corp, Graphenea, Grolltex Inc, NANOTEK INSTRUMENTS INC, NanoXplore Inc., and Vorbeck Materials Corp.

Loading Table Of Content...