Graphite Market Research, 2033

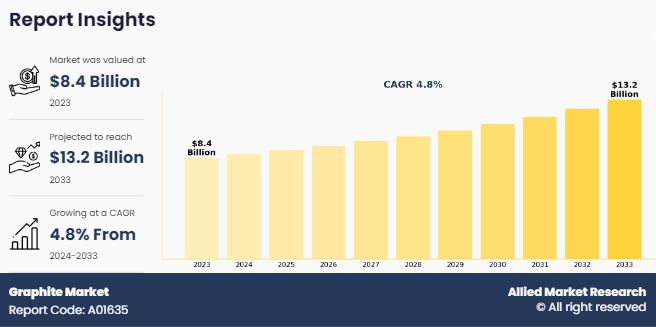

The global graphite market was valued at $8.4 billion in 2023, and is projected to reach $13.2 billion by 2033, growing at a CAGR of 4.8% from 2024 to 2033.

Market Introduction and Definition

Graphite is an allotrope of carbon, a naturally occurring form of crystalline carbon that exhibits unique properties, such as high electrical conductivity, thermal conductivity, lubricity, and stability at high temperatures. Its atomic structure, composed of layers of carbon atoms arranged in a hexagonal lattice, gives it both metallic and non-metallic properties, making it a material of high significance across various industries. These layered planes of carbon atoms in graphite are held together by weak van der Waals forces, allowing the layers to easily slide over each other, which explains its lubricating qualities

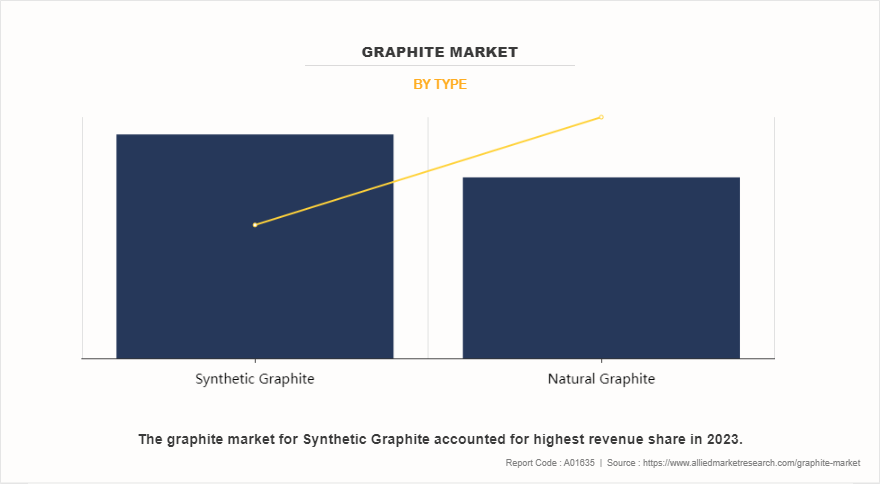

Graphite exists in natural and synthetic forms. Naturally, it is mined from metamorphic rocks and is found in regions where high-temperature and high-pressure conditions prevail. Synthetic graphite, on the other hand, is manufactured using petroleum coke or coal tar pitch through a process called graphitization. Both natural and synthetic graphite find widespread applications, though synthetic graphite tends to be used in more controlled environments or for highly specific industrial applications.

Graphite's excellent electrical conductivity makes it an essential material in the electronics and electrical industries. It is widely used in batteries, especially in lithium-ion batteries, where graphite is the predominant material used for the anode. As the demand for energy storage and electric vehicles (EVs) rises, the need for graphite in the production of battery anodes continues to grow. Its ability to intercalate lithium ions without breaking down makes it ideal for this application.

Additionally, graphite plays a role in electrodes for electric arc furnaces in the steelmaking industry. Synthetic graphite electrodes are used for conducting electricity into the furnace, where temperatures can exceed 3000°C. Graphite electrodes are preferred for their durability and ability to withstand high temperatures, making them vital for smelting and refining processes.

Key Takeaways

- The graphite market industry covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period (2024-2032).

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global graphite market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the graphite market size.

- The graphite market share is highly fragmented, with several players including GrafTech International, Mason Resources Inc, Focus Graphite, Westwater Resources, Nippon Kokuen Group, Tokai Carbon Co., Ltd, NEXTSource Materials Inc., Triton Minerals Ltd, Asbury Carbons, and Qingdao Tennry Carbon Co.,Ltd. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the graphite market growth.

Segment Overview

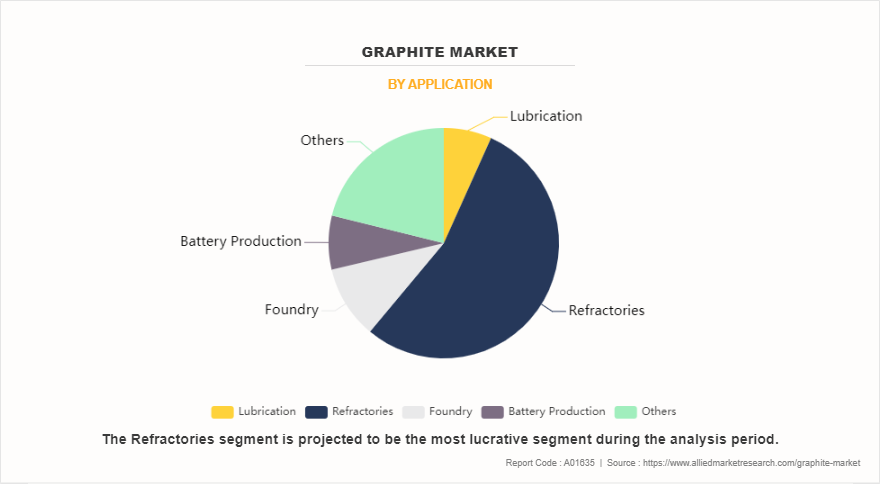

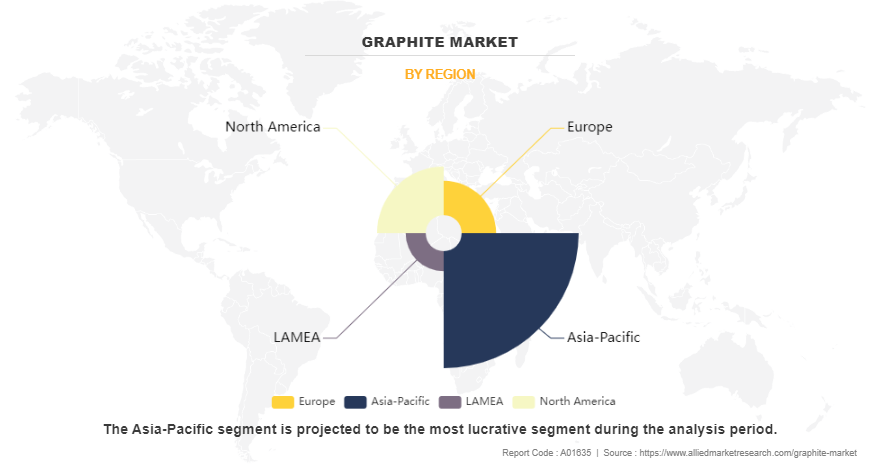

The graphite market is segmented into type, application, and region. On the basis of type, the market is divided into natural graphite and synthetic graphite. On the basis of application, the market is segmented into lubrication, refractories, foundry, battery production, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Increase in demand for lithium-ion batteries is expected to drive the growth of graphite market during the forecast period. The increasing adoption of electric vehicles (EVs) and renewable energy solutions is propelling a surge in the demand for graphite, primarily due to its essential role in lithium-ion batteries. Graphite serves as a key component in the anode of lithium-ion batteries, playing a critical role in the storage and release of energy. As the automotive industry undergoes a significant transformation towards electrification, with governments worldwide implementing policies to reduce carbon emissions and combat climate change, the demand for EVs continues to escalate. In March 2024, the U.S. General Services Administration (GSA) announced $25 million to enhance the electrical vehicle infrastructure worldwide. The allocation includes over $20 million initially, facilitated by the Inflation Reduction Act (IRA), to fuel 32 projects spanning 21 states. These projects will be implemented at 33 federal buildings and will comprise 782 electrical vehicle charging ports. The primary aim is to establish a robust and accessible EV charging network to support the federal government’s electric vehicle fleet.

The expansion of renewable energy sources, such as wind and solar power, necessitates efficient energy storage solutions to address intermittency issues. Lithium-ion batteries emerge as a leading option for energy storage systems, further boosting the demand for graphite. These batteries not only power electric vehicles but also serve as storage solutions for renewable energy generated from solar panels and wind turbines.

However, environmental regulations and sustainability concerns is expected to hamper the graphite market during the forecast period. Graphite mining often involves open-pit or underground extraction methods, which can lead to habitat destruction, soil erosion, and disruption of ecosystems. Clearing land for mining activities can fragment wildlife habitats and contribute to biodiversity loss. Reclamation and rehabilitation of mined areas are essential to mitigate land degradation and restore ecosystems, but these efforts require careful planning and investment. Graphite mining and processing can contaminate water sources through the discharge of wastewater containing heavy metals, chemicals, and sedimentation. Surface runoff from mining sites may carry pollutants into nearby water bodies, affecting aquatic ecosystems and drinking water quality. Implementing effective water management practices, such as sedimentation ponds, treatment facilities, and recycling systems, is crucial to minimize water pollution and comply with regulatory standards.

Furthermore, growing use of graphite-filled filaments and powders in 3D printing is expected to provide lucrative opportunities in the graphite market. Graphite-filled filaments and powders have emerged as essential materials in the realm of additive manufacturing, or 3D printing. This innovative application capitalizes on graphite's unique properties to produce components with enhanced mechanical strength, electrical conductivity, and thermal management capabilities. By incorporating graphite into the printing process, manufacturers can create parts and products that surpass traditional materials in performance and functionality. In November 2022, Axial3D, a med-tech start-up, secured a $15 million investment round, with Stratasys leading with a $10 million strategic investment. This collaboration aims to enhance accessibility to patient-specific 3D printing solutions for hospitals and medical device manufacturers, potentially making 3D printing a mainstream healthcare solution. Consequently, the increasing demand for 3D printing is anticipated to boost the graphite market.

By Region the graphite market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In North America, graphite plays a pivotal role in industries such as automotive, aerospace, and electronics. The automotive sector, in particular, relies on graphite for manufacturing components such as gaskets, seals, and brake linings due to its heat resistance and lubricating properties.

In the Asia-Pacific region, graphite usage is heavily influenced by the region's robust manufacturing sector and burgeoning technological advancements. Countries such as China, Japan, and South Korea are significant consumers of graphite, primarily in steel production, automotive manufacturing, and electronics. As of October 2023, China holds the position of the world's leading producer and exporter of graphite, as reported by Reuters. Impressively, over 90% of the global graphite undergoes refinement within China, transforming it into a crucial component for electric vehicle (EV) batteries. Graphite serves as the essential material for the anodes of these batteries, providing the necessary negative charge for their operation.

Industry Trends of Graphite Market

- In April 2023, the World Steel Association released its short-range outlook (SRO) steel demand forecast for 2023 and 2024. According to the forecast, steel demand is expected to rebound by 2.3% in 2023, reaching 1,822.3 million tons (Mt), and to grow by 1.7% in 2024, reaching 1,854.0 Mt. Additionally, the total global crude steel production in 2022 was 1,878.5 Mt, marking a 4.2% decrease compared to 2021.

- As per the U.S. Geological Survey, in 2023, China was the world’s leading graphite producer, producing an estimated 77% of total world production. Approximately 15% of graphite produced in China was amorphous and about 85% was flake. In October, China announced export restrictions to take effect on December 1 on certain goods, including flake graphite, spherical graphite (natural and synthetic), expandable graphite, and some synthetic graphite products.

- As per U.S. Geological Survey, in 2022, the U.S. around 95 companies, mainly located in the Great Lakes and Northeast regions, utilized 72,000 tons of the graphite material, worth an estimated $140 million. The primary applications for natural graphite included batteries, brake linings, lubricants, powdered metals, refractory uses, and steelmaking. During the same year, the U.S. imported approximately 82,000 tons of natural graphite, comprising about 77% flake and high-purity graphite, 22% amorphous graphite, and 1% lump and chip graphite.

- In October 2022, Imerys Graphite & Carbon unveiled a significant lithium exploitation initiative known as "the EMILI Project" at their Beauvoir site in the Allier département of France. This project aims to bolster Imerys' leadership and expertise in the Li-ion battery components market, complementing their existing product portfolio. The company's current offerings, which include synthetic graphite and carbon black, are produced at their facilities in Willebroek, Belgium, and Bodio, Switzerland.

Patent Analysis of Graphite Market (Application)

- 3M Innovative Properties Company leads the pack with a notable 21.4% share of patents filed in graphite market. Their substantial involvement underscores a strategic focus on graphite-related innovations, possibly spanning applications in various industries, including electronics, automotive, and energy storage.

- BASF SE and E I Du Pont De Nemours and Company stand out, with respective shares of 13.1% and 12.7%. Their extensive patent filings indicate a strong commitment to pushing the boundaries of graphite technology, with a focus on improving performance, sustainability, and exploring innovative applications for this highly adaptable material.

- Dexcom Inc, RAI Strategic Holdings Inc, Nike Inc, and Philip Morris Products SA are prominent players shaping the patent landscape within the graphite market. Their significant contributions reflect a diverse range of expertise and perspectives, fostering innovation and advancing research and development in graphite-related endeavors.

- Additionally, the combined number of patents filed by these companies, amounting to 4,151 highlights the substantial investment and activity within the graphite market. This high level of involvement indicates a vibrant and competitive environment, offering numerous prospects for technological progress and expansion in the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the graphite market analysis from 2023 to 2033 to identify the prevailing graphite market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the graphite market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global graphite market trends, key players, market segments, application areas, and market growth strategies.

Graphite Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 13.2 billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | NEXTSource Materials Inc., Nippon Kokuen Group, Qingdao Tennry Carbon Co.,Ltd, Asbury Carbons, Tokai Carbon Co., Ltd, Westwater Resources, Triton Minerals Ltd, Focus Graphite, GrafTech International, Mason Resources Inc |

Analyst Review

The growing demand for graphite in battery production is primarily driven by the rapid rise of electric vehicles (EVs) and the expansion of renewable energy storage solutions. As global efforts to combat climate change intensify, governments and consumers alike are increasingly turning to EVs as a sustainable alternative to traditional gasoline-powered vehicles. This shift is not just a passing trend; it reflects a broader commitment to reducing carbon emissions and fostering a greener future. Furthermore, the push for renewable energy sources, such as solar and wind, has created a parallel demand for efficient energy storage systems. These systems are essential for balancing energy supply and demand, especially given the intermittent nature of renewable sources. Graphite's unique properties make it an ideal candidate for enhancing battery performance, allowing for faster charging times and greater longevity. As battery technologies continue to evolve, innovations in graphite processing and formulation are likely to further enhance its applications in both electric vehicles and stationary energy storage solutions.

High production costs represent a significant restraint in the graphite market, impacting both profitability and pricing. The extraction and processing of natural graphite involve several complex and resource-intensive steps, including mining, purification, and milling. These processes require substantial investments in technology and equipment, as well as compliance with environmental regulations, which can further escalate operational costs. As a result, manufacturers may face challenges in maintaining competitive pricing, particularly in a market where price fluctuations can be influenced by supply-demand dynamics and geopolitical factors.

Key market players in the graphite market include GrafTech International, Mason Resources Inc, Focus Graphite, Westwater Resources, Nippon Kokuen Group, Tokai Carbon Co., Ltd, NEXTSource Materials Inc., Triton Minerals Ltd, Asbury Carbons, and Qingdao Tennry Carbon Co.,Ltd.

The global graphite market was valued at $8.4 billion in 2023, and is projected to reach $13.2 billion by 2033, growing at a CAGR of 4.8% from 2024 to 2033.

Asia-Pacific is the largest regional market for graphite.

Refractories is the leading application of graphite market.

Growing use of graphite-filled filaments and powders in 3D printing are the upcoming trends of graphite market.

Loading Table Of Content...

Loading Research Methodology...