Green Diesel Market Research, 2032

The global green diesel market size was valued at $30.7 billion in 2022, and is projected to reach $92.3 billion by 2032, growing at a CAGR of 11.7% from 2023 to 2032.

Report Key Highlighters:

The green diesel market is highly fragmented, with several players including Neste Corporation, Chevron Corporation, Valero Energy Corporation, Phillips 66, Eni S.p.A., Honeywell International Inc., Marathon Petroleum Corporation, TotalEnergies SE, Cargill Incorporated, and Exxon Mobil Corporation.

More than 6,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study covers nearly 20 countries. The segment analysis of each country in terms of value during the forecast period 2022-2032 is covered in the green diesel market report.

Green diesel is a fuel made from fats and oils, such as soybean oil or canola oil, and is processed to be chemically the same as petroleum diesel. Green diesel can be used as a replacement fuel or blended with any amount of petroleum diesel. It is produced by several different technology pathways. Currently, commercial production facilities are using fats, oils, and greases as common feedstocks.

Green diesel meets the same fuel quality specification as petroleum diesel (ASTM D975) and is used in existing diesel engines and refueling infrastructure. For domestic production of green diesel, the construction of its plants has significantly in North America. It is primarily made from used cooking oil and inedible animal fats left over from processing meat. Researchers found that green diesel reduced both carbon dioxide and nitrogen oxide emissions when compared with petroleum diesel. For instance, Low Carbon Fuel Standard is a trading mechanism designed to reduce CO2 intensity, which shows that green diesel reduces carbon intensity on average by 65% when compared with petroleum diesel.

Production technology serves as a fundamental driver in shaping and advancing the green diesel market expansion through its influence on efficiency, scalability, and the diversification of feedstock sources. Advanced refining techniques such as hydrotreating, thermochemical conversion, and biochemical processes continually ensure higher conversion rates, greater energy efficiency, and reduced environmental impact. These advancements enable the utilization of a wider range of feedstocks, which include various biomass sources such as agricultural residues, algae, waste oils, and even municipal solid waste. Moreover, technological advancements drive economies of scale, make green diesel production more cost-effective, thus enhancing the competitiveness of renewable fuels in the market. Investments in R&D foster innovations in production technology, promoting scalability and commercial viability, driving the expansion off green diesel as an environmentally friendly fuel alternative.

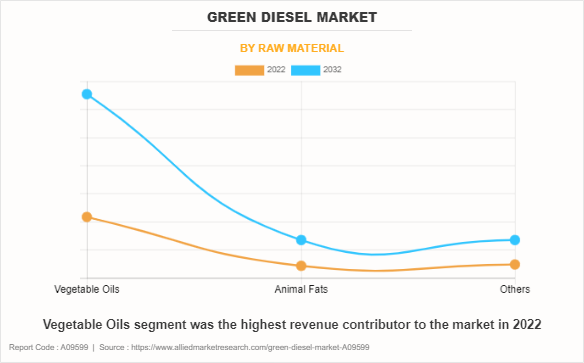

Vegetable oils stand as a cornerstone in driving the green diesel market, serving as a primary feedstock for biodiesel production and influencing the shift toward renewable fuels. In addition, the widespread availability and diversity of vegetable oil sources globally contribute to the scalability of biodiesel production, allow for large-scale manufacturing to meet increasing market demands. Moreover, the renewable nature of vegetable oils aligns with sustainability goals, reduce greenhouse gas emissions and dependency on finite fossil fuels, thereby driving the momentum toward a more environmentally friendly and sustainable green diesel market.

The Europe region stands as a significant driver in propelling the green diesel market forward through various key factors. Firstly, stringent environmental regulations and ambitious sustainability goals set by the European Union (EU) have spurred substantial demand for renewable fuels. The Renewable Energy Directive (RED) and the revised Renewable Energy Directive (RED II) outline targets for increasing the share of renewable energy in transport fuels, incentivizing the adoption of green diesel and biodiesel blends. These regulations create a favorable environment for the growth of green diesel by promoting blending mandates, tax incentives, and carbon intensity reduction goals, effectively driving market demand and encouraging investments in renewable fuel technologies.

Europe strong focus on reducing greenhouse gas emissions and combating climate change reinforces the push toward cleaner energy alternatives, including green diesel. Countries within the region are increasingly emphasizing the decarbonization of transportation, with green diesel emerging as a viable solution due to its lower carbon footprint compared to conventional diesel. This emphasis on sustainability aligns with consumer preferences for environmentally friendly products, further driving the adoption of green diesel blends and pure biodiesel.

Moreover, Europe's extensive infrastructure and advancements in renewable energy technologies support the growth of the green diesel market. The continent's robust refining capabilities, distribution networks, and investments in research and development facilitate the production, blending, and widespread availability of green diesel. In addition, technological innovations in biofuel production processes, such as hydrotreating and advanced feedstock sourcing, contribute to the market's expansion by improving efficiency, quality, and scalability of green diesel production.

The major companies profiled in this report include Neste Corporation, Chevron Corporation, Valero Energy Corporation, Phillips 66, Eni S.p.A., Honeywell International Inc., Marathon Petroleum Corporation, TotalEnergies SE, Cargill Incorporated, and Exxon Mobil Corporation.

Segments Overview

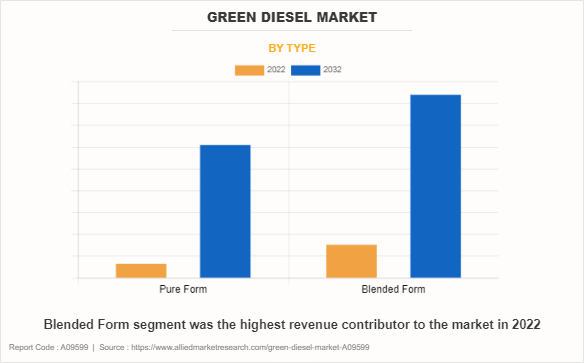

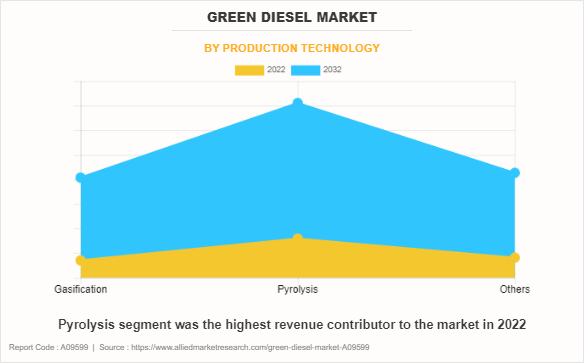

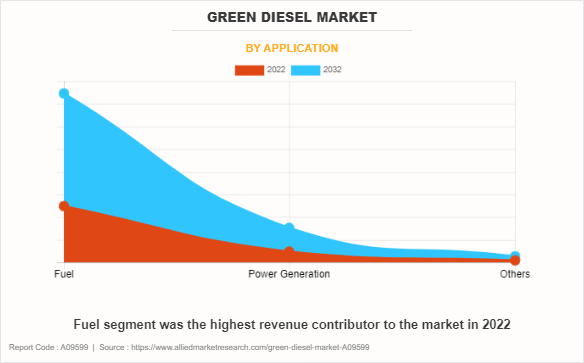

The green diesel industry is segmented on the basis of type, production technology, raw material, application, and region. On the basis of type, it is bifurcated into pure form and blended form. On the basis of production technology, it is divided into gasification, pyrolysis, and others. On the basis of raw material, it is classified into vegetable oils, animal fats, and others. On the basis of application, it is categorized into fuel, power generation, and others. Region wise, the green diesel market share is studied across North America, Europe, Asia-Pacific, and LAMEA.

Based on type, blended form was the highest revenue contributor to the market in 2022. The green diesel market, particularly in its blended forms such as B20, B10, and B5, is experiencing several pivotal trends shaping its trajectory. Blended biodiesel, offering a balance between renewable content and compatibility with existing infrastructure, is gaining prominence as an intermediate step toward achieving cleaner energy goals. This trend drives the adoption of biodiesel blends, especially in regions implementing renewable fuel standards and incentivizing lower-carbon alternatives. Manufacturers are designing engines that accommodate higher blends of biodiesel, ensuring better performance and efficiency while minimizing the need for modifications.

Based on production technology, pyrolysis was the highest revenue contributor to the market in 2022. Pyrolysis, a thermal decomposition process converting biomass or waste materials into bio-oils, gases, and biochar, stands as a promising avenue driving the green diesel market through several key trends. Technological advancements in pyrolysis processes led to more efficient and scalable systems. Improved reactor designs, innovative catalysts, and optimized operating conditions enhance the yield and quality of bio-oils, a vital component in the production of green diesel. These advancements facilitate higher conversion rates and enable the utilization of a broader range of feedstocks, which include agricultural residues, forestry waste, and even municipal solid waste, expanding the availability of sustainable sources for green diesel production.

By raw material, vegetable oils was the highest revenue contributor to the green diesel market value in 2022. Vegetable oils as raw materials for green diesel production are witnessing significant trends that drive the market's growth and evolution. Notable shift toward diversification in feedstock sources within the vegetable oils category. While conventional sources such as soybean, palm, and canola oils remain prominent, to explore non-traditional feedstocks such as algae, camelina, jatropha, and used cooking oils. This trend stems from the need to reduce reliance on food-based oils, minimize competition with food production, and enhance the sustainability profile of green diesel, aligning with sustainability goals and mitigating concerns regarding deforestation and land use changes associated with traditional oil crops.

Based on application, fuel was the highest revenue contributor to the market in 2022. Fuels are utilized across numerous industries and applications, which include transportation, electricity generation, heating, and manufacturing.

Notable shift toward renewable and low-carbon fuels driven by stringent environmental regulations and sustainability goals, drive green diesel market growth. Green diesel, being a renewable and cleaner alternative to conventional diesel, benefits from this trend, especially as governments and industries seek to reduce carbon footprints and combat climate change. This regulatory push incentivizes the use of green diesel blends, such as B20 or B10, in transportation and industrial sectors, encouraging a transition toward more sustainable fuel options.

On the basis of region, North America was the highest revenue contributor to the market in 2022. In North America, several impactful trends are steering the green diesel market toward significant growth. Stringent environmental regulations and ambitious carbon reduction goals set by governments at federal and state levels are steering the region toward renewable energy sources. Federal and state-level regulations promoting renewable fuels, such as the Renewable Fuel Standard (RFS) in the U.S. and similar mandates in Canada, are pivotal to stimulate the demand for green diesel. These regulations create a robust framework that encourages the blending and adoption of biodiesel blends such as B20 or B5, providing incentives for industries to invest in renewable fuel production.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the green diesel market analysis and green diesel market forecast from 2022 to 2032 to identify the prevailing green diesel market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the green diesel market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global green diesel market trends, key players, market segments, application areas, and market growth strategies.

Green Diesel Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 92.3 billion |

| Growth Rate | CAGR of 11.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 150 |

| By Raw Material |

|

| By Application |

|

| By Type |

|

| By Production Technology |

|

| By Region |

|

| Key Market Players | Phillips 66 Company, Eni S.p.A., Neste Corporation (Finland), Chevron Corporation, Cargill Incorporated, Exxon Mobil Corporation, TotalEnergies, Valero Energy Corporation., Honeywell International Inc., Marathon Petroleum Corporation |

Analyst Review

According to CXO perspective, the global green diesel market is expected to witness increased demand during the forecast period due to a rise in power demand from various industries such as marine, aviation, and agricultural sectors.

Biofuel is classified into categories based upon the raw material: first, second, third, and fourth generation. The first generation is the conventional biofuel produced from food crops, which include biodiesel through the esterification or transesterification of natural oil and animal fats. This generation also comprises bioethanol via fermentation process.6 Second generation biofuel is synthesized from non-edible feedstock and organic waste. This second generation involves the production of biofuel with the same structure as fossil fuel such as green diesel.

Green diesel increases the greenhouse gas (GHG) saving up to 60% higher compared to the renewable energy use directive (RED) reduction target. This value has not been achieved by the first generation of biofuel. It fulfils the standard of ASTM D-975 regarding the density, viscosity, and cetane number. Moreover, the study of emission and fuel consumption of green diesel and biodiesel tested by heavy duty diesel inferred that green diesel has better performance in the reduction of NOx and lower fuel consumption.

Green diesel is not extensively available across the Asia-Pacific and LAMEA. The industry is working to meet the demand for cleaner diesel across the U.S., but currently, there is a limited supply for high demand. However, there is a stronger focus in the western states such as California, Washington, and Oregon.

Each year, the U.S. emits nearly 7 billion metric tons of greenhouse gases, with 29% coming from the transportation market. Emissions have decreased slightly over the past few years, but the government continues to impose regulations to tighten emission standards and improve heavy-duty truck fuel economy. Companies around the world are investing in renewable diesel advancements, and the ecological solution of renewable diesel is expected to surpass the demand for standard diesel.

Environmental concerns serve as a potent force propelling the green diesel market's expansion. In the face of escalating climate change threats and heightened awareness of carbon emissions' impact, the quest for sustainable energy alternatives intensifies. Green diesel emerges as a promising solution, derived from renewable sources such as biomass, animal fats, or used cooking oils.

North America was the highest revenue contributor to the market in 2022.

Fuel is the leading application of Green Diesel Market.

The global green diesel market size was valued at $30.7 billion in 2022, and is projected to reach $92.3 billion by 2032, registering a CAGR of 11.7% from 2023 to 2032.

Neste Corporation, Chevron Corporation, Valero Energy Corporation, Phillips 66, Eni S.p.A., Honeywell International Inc., Marathon Petroleum Corporation, TotalEnergies SE, Cargill Incorporated, and Exxon Mobil Corporation are some of the major players discussed in the report.

Loading Table Of Content...

Loading Research Methodology...