Green Hydrogen Market Research, 2032

The global green hydrogen market was valued at $2.5 billion in 2022, and is projected to reach $143.8 billion by 2032, growing at a CAGR of 50.3% from 2023 to 2032.

Green hydrogen refers to hydrogen gas production through a process called electrolysis using renewable energy sources, such as wind, solar, or hydroelectric power. The electrolysis process separates hydrogen molecules from water molecules, creating a clean and sustainable form of hydrogen fuel without emitting greenhouse gases or pollutants.

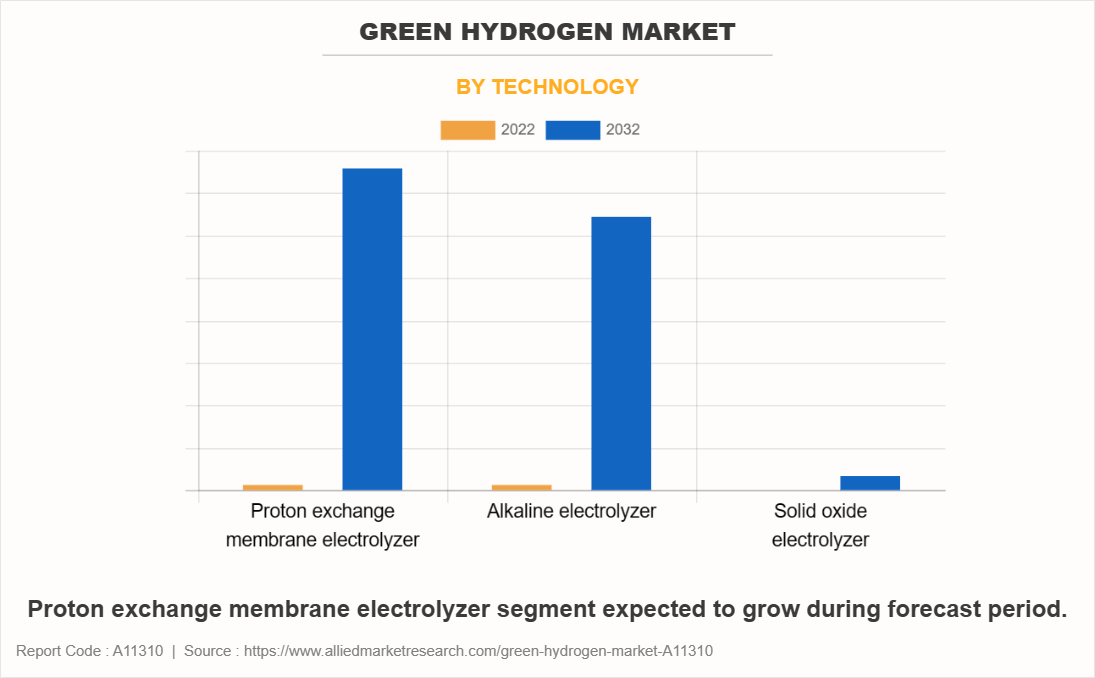

Proton exchange membrane (PEM) electrolyzer plays a pivotal role in driving the green hydrogen market due to its efficiency, scalability, and suitability for renewable energy integration. Moreover, PEM electrolyzer is a compact, modular, and capable of decentralized deployment, facilitating its integration into various settings, from small-scale applications to larger industrial setups. PEM electrolyzer stands as a critical technology as demand grows for clean, sustainable hydrogen, driving the green hydrogen market by enabling efficient and flexible production of hydrogen from renewable sources, thereby supporting the transition to a low-carbon economy.

The future of the green hydrogen industry appears promising, with several key trends poised to shape its trajectory. Furthermore, advancements in technology and declining costs are anticipated to drive widespread adoption of green hydrogen. Ongoing R&D efforts focus on enhancing electrolyzer efficiency, durability, and scaling up production, leading to cost reductions and improved performance. This trend aligns with ambitious governmental targets and corporate commitments aimed at fostering the green hydrogen economy, spurring innovation and green hydrogen market growth.

Moreover, the integration of green hydrogen across various sectors expands significantly. Industries such as transportation, manufacturing, and energy production increasingly recognize the potential of green hydrogen market size as a versatile, clean energy carrier. Rise in applications in heavy transport, such as trucks, trains, and maritime vessels, as well as the potential to blend hydrogen into existing natural gas infrastructure, underlines its versatility and potential to decarbonize multiple sectors simultaneously.

Recent collaborative efforts and partnerships among governments, industries, and research institutions are expected to accelerate green hydrogen market growth. International collaborations seek to establish supply chains, infrastructure, and regulatory frameworks conducive to large-scale green hydrogen production and distribution. Moreover, public-private partnerships and investment initiatives are crucial in supporting the deployment of green hydrogen projects, fostering a conducive environment for innovation, and enabling green hydrogen market growth.

Furthermore, the emergence of regional hubs and pilot projects is expected to catalyze market expansion. Growth in emphasis on sustainability and climate goals has driven policy support and green hydrogen market demand. Increasingly stringent regulations and carbon pricing mechanisms incentivize to transition of industries into low-carbon alternatives, propelling its market penetration. These converging trends collectively position green hydrogen as a pivotal player in the sustainable energy landscape, driving a fundamental shift toward cleaner, more resilient energy systems across the globe.

The European Commission unveiled a comprehensive decarbonization strategy, outlining hydrogen as a key element for achieving carbon neutrality. This strategy involved revising the directive to promote renewable energy use, allowing green hydrogen produced from renewable sources with certified origins to contribute toward meeting the 2030 renewable energy targets.

In addition, the commission established a "Hydrogen Energy Network" as a platform for EU member states. Concurrently, a significant milestone was reached as 28 European countries endorsed the Linz declaration "Hydrogen Initiative," emphasizing collaborative efforts on sustainable hydrogen technology. This initiative garnered support from approximately 100 businesses, organizations, and institutions, signifying a collective commitment to advance green hydrogen advancements and cooperation across Europe.

Furthermore, declining renewables energy costs are one of the forces driving green potential of hydrogen upwards. At high proportions of solar and wind power, the variability of their output poses a challenge. A number of countries and region now have ambitious targets for the share of electricity coming from low-carbon sources, with South Australia aiming for 100% by 2025, Fukushima by 2040, Sweden by 2040, California by 2045 and Denmark by 2050.

Surge in transportation demands, particularly for sustainable and low-carbon options, plays a pivotal role in propelling the green hydrogen market. The need for efficient, clean, and versatile transportation solutions escalates as global populations grow, urban centers expand, and economic activities intensify. Green hydrogen emerges as a promising candidate to meet these demands, especially in heavy-duty and long-haul transportation sectors.

Hydrogen fuel cell technology offers a solution by providing quicker refueling times compared to battery electric vehicles, making it a viable alternative for heavy-duty transport such as trucks, buses, trains, and maritime vessels. Moreover, the push toward decarbonization and the reduction of greenhouse gas emissions in the transportation sector amplifies the appeal of green hydrogen market opportunities.

Rise in transportation needs, coupled with environmental concerns, fosters innovation and investment in green hydrogen technologies. Companies and industries have increasingly explored hydrogen fuel cell vehicles as a sustainable option to meet transportation demands while significantly reducing carbon footprints. Growth in hydrogen refueling infrastructure is gradually addressing the infrastructure gap, further promoting the adoption of hydrogen-powered vehicles.

The demand for petrochemicals is on the rise due to various factors, such as population growth, urbanization, and the expanding middle class in emerging economies. Petrochemicals are fundamental components in numerous everyday products, which include plastics, fertilizers, pharmaceuticals, and construction materials. The demand for these goods surges, subsequently boost the demand for petrochemicals as the global population increases and living standards improve. This escalating demand for petrochemicals presents an opportunity for the green hydrogen market.

Green hydrogen is a crucial feedstock in the production of several petrochemicals, traditionally sourced from fossil fuels through steam methane reforming. However, the shift toward sustainability and reduced carbon footprints has prompted industries to explore green alternatives such as green hydrogen. Industries are projected to significantly reduce their carbon emissions and environmental impact by utilizing green hydrogen as a clean feedstock for petrochemical production.

Europe witnessed significant growth in the green hydrogen market driven by various factors. Firstly, the European Union strong commitment to climate change mitigation and achieving carbon neutrality by 2050 propel a series of ambitious policies and strategies supporting the development of green hydrogen. The EUHydrogen Strategy have set clear targets and allocated substantial funding for the scaling up of renewable hydrogen production.

Moreover, collaborations and alliances among European countries, industries, and research institutions foster innovation and technological advancements in green hydrogen. Initiatives such as the European Clean Hydrogen Alliance facilitate cross-sectoral cooperation and knowledge sharing to accelerate the development of a hydrogen value chain across industries. Furthermore, the region strong emphasis on transitioning top sectors such as transportation, manufacturing, and heating & cooling toward cleaner energy sources drive the demand for green hydrogen market.

The European market growth is also bolstered by a conducive regulatory framework, which include standards for hydrogen infrastructure, certification schemes, and financial incentives supporting investments in hydrogen technologies. Overall, Europe commitment to decarbonization, robust renewable energy infrastructure, collaborative initiatives, and a growing demand for clean energy alternatives collectively drive the expansion of the green hydrogen market in the Europe, positioning Europe as a global leader in the transition towards a sustainable hydrogen economy.

For instance, in November 23, 2023, the European Commission launched a European Hydrogen Bank auction to support the production of renewable hydrogen for European consumers. The auction is projected to provide up to $1 billion funding for projects to produce renewable hydrogen at a cost of less than $3 per kilogram. This is a significant step toward achieving goal of producing 10 million tonnes of renewable hydrogen per year by 2030 of the EU. In October 2023, Germany announced green hydrogen project partnership with France, Spain, and Portugal. The partnership aims to develop a pipeline network to transport renewable hydrogen from Southern Europe to Northern Europe.

The landscape for green hydrogen market trends production has evolved rapidly, gaining traction across various sectors due to its diverse applications, from power generation to manufacturing and transportation. Technological advancements, coupled with decrease in renewable energy costs and improving electrolyzer efficiency, have enhanced the commercial feasibility of green hydrogen. The anticipated decline in costs potentially drives the production of green hydrogen to a range of $0.70 to $1.60 per kg by 2050, positioning it as a price-competitive alternative to natural gas across most global regions as per Bloomberg New Energy Finance.

NEL, recognized as the leading electrolyzer producer globally, foresees the possibility of achieving cost parity or even surpassing fossil fuel production expenses as early as 2025 is a key driver for green hydrogen market. However, the majority of ongoing and planned green hydrogen projects are presently in a pre-commercial phase, with electrolyzer capacities, below 50 MW. These green hydrogen endeavors bring unique challenges to traditional project finance due to several factors especially in project financing, as most initiatives are at a pre-commercial phase and face risks tied to technology, energy input, production, storage, and distribution.

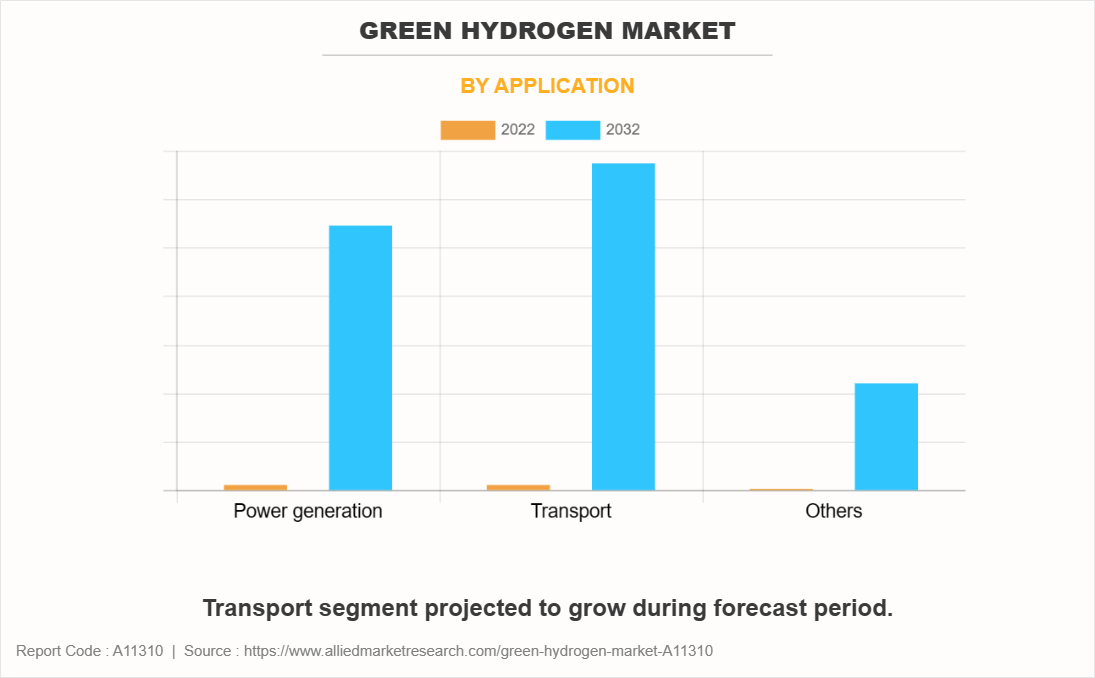

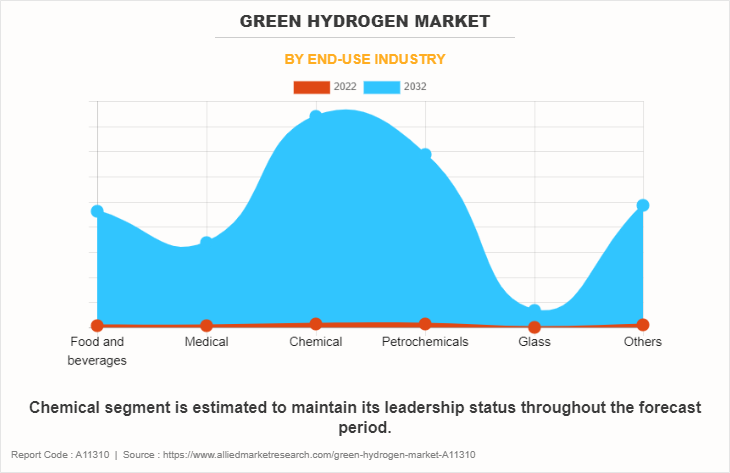

The green hydrogen market is segmented on the basis of technology, application, end-use industry, and region. On the basis of technology, it is classified into proton exchange membrane electrolyzer, alkaline electrolyzer, and solid oxide electrolyzer. On the basis of application, it is divided into power generation, transport, and others. On the basis of end-use industry, it is fragmented into food and beverages, medical, chemical, petrochemicals, glass, others.

On the basis of region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. Currently, Europe accounts for the largest share of the market, followed by Asia-Pacific and North America. The major companies profiled in this report include Green Hydrogen Systems, Air Liquide, Shell plc, Enapter S.r.l., Plug Power Inc., Ballard Power Systems, Linde plc, Reliance Industries, GAIL (India) Limited and Adani Green Energy Ltd.

The report provides a detailed green hydrogen market analysis of these key players. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their green hydrogen market share and maintain dominant shares in different regions. Further, key strategies adopted by potential market leaders to facilitate effective planning have been discussed under green hydrogen market scope in this report.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the green hydrogen market forecast from 2022 to 2032 to identify the prevailing green hydrogen market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the green hydrogen market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global green hydrogen market trends, key players, market segments, application areas, and market growth strategies.

Green Hydrogen Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 143.8 billion |

| Growth Rate | CAGR of 50.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 605 |

| By Technology |

|

| By Application |

|

| By End-use industry |

|

| By Region |

|

| Key Market Players | Plug Power Inc., Enapter, Air Liquide, Green Hydrogen Systems, GAIL (India) Limited, Ballard Power Systems, Linde Plc, Adani Green Energy Ltd, Reliance Industries, Royal Dutch Shell |

Analyst Review

According to CXO perspective, the global green hydrogen market is expected to witness increased demand during the forecast period due to a rise in end -use industries such as food and beverages, medical, chemical, and petrochemicals.?

Panelists agreed that blending public and private capital made hydrogen projects commercially viable, at the recent Global Infrastructure Facility (GIF) Advisory Council Meeting, but certain factors need to be considered such as co-location of renewable energy production and hydrogen facilities to enhance its integration. For instance, in Puertollano, Spain, a 100 MW solar farm built alongside Europe’s largest green hydrogen facility. Governments also need to create policy and regulatory frameworks that incentivize investments.

The World Bank Group plays a pivotal role in fostering green hydrogen projects in developing countries, aiming to propel green hydrogen production from pilot stages to industrial-scale implementation. This involves providing technical assistance to shape conducive policy frameworks, innovating financing mechanisms to catalyze climate finance resources and integrating risk mitigation tools to attract private capital. For instance, isuch as Chile, Colombia, Costa Rica, Panama, and Brazil, the World Bank Group is actively involved in initiatives to establish green hydrogen as a viable fuel and advocate for its use in energy storage. This involves designing financing structures, creating certification mechanisms along with the value chain, and implementing carbon pricing strategies through partnerships.

Transport is the leading application of green hydrogen market.

Key trends include scaling up production capacities, falling electrolyzer costs, advancements in renewable energy integration, and rising demand across industries such as transportation and energy storage, fostering global adoption and investment.

Asia-Pacific is the largest regional market for green hydrogen.

The global green hydrogen market was valued at $2.5 billion in 2022, and is projected to reach $143.8 billion by 2032, growing at a CAGR of 50.3% from 2023 to 2032.

The major companies profiled in this report include Green Hydrogen Systems, Air Liquide, Shell plc, Enapter S.r.l., Plug Power Inc., Ballard Power Systems, Linde plc, Reliance Industries, GAIL (India) Limited and Adani Green Energy Ltd.

Loading Table Of Content...

Loading Research Methodology...