Green Logistics and Transportation Market Insights, 2032

The global green logistics market size was valued at $1.3 trillion in 2022, and is projected to reach $2.9 trillion by 2032, growing at a CAGR of 8.3% from 2023 to 2032.

Green logistics, also known as sustainable logistics or eco-logistics, refers to the practice of integrating environmental considerations into logistics operations and supply chain management processes to minimize their impact on the environment and promote sustainability. It involves the application of innovative strategies, technologies, and policies to reduce carbon emissions, energy consumption, waste generation, and other negative environmental effects associated with the transportation and logistics industry. It focusses on various factors such as efficient transportation, supply chain optimization, sustainable packaging, and energy efficiency.

Report Key Highlighters:

- The green logistics market study covers 15 countries. The research includes a segment analysis of each country in terms of both value ($billion) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key companies profiled in the green logistics market report include FedEx Corporation, DSV, Agility Public Warehousing Company K.S.C.P. and Subsidiaries, GEODIS, Deutsche Post DHL Group., YUSEN LOGISTICS CO., LTD., Bollor SE, CEVA Logistics, XPO Logistics, Inc., and United Parcel Service of America, Inc. The leading companies adopt strategies such as partnership, agreement, acquisition, expansion, and collaboration to strengthen their market position.

The green logistics market is segmented into End Use, Business Type and Mode of Operation.

Factor such as increase in corporate social responsibility (CSR) activities by logistic companies and rise in adoption of EVs in the logistics industry drive the growth of the green logistics market share. In addition, surge in adoption of EVs in the logistics industry propels the market growth. However, rise in dependency on fossil fuels for transportation hinders the growth of the market. On the contrary, increase in environmental consciousness among end-use industries is anticipated to offer remunerative opportunities for the players operating in the green logistics industry.

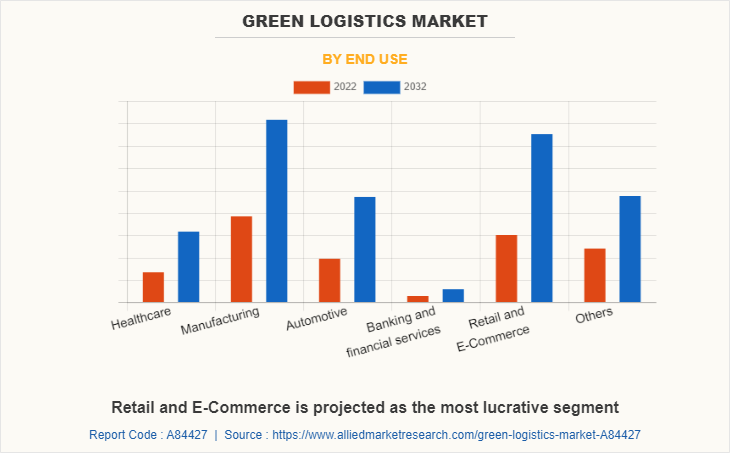

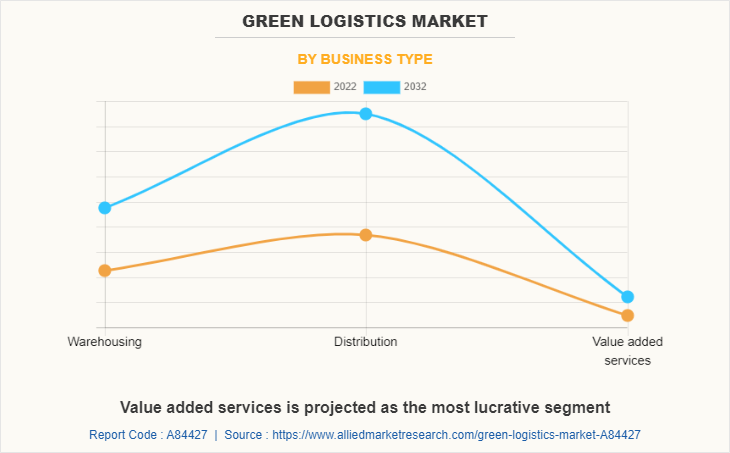

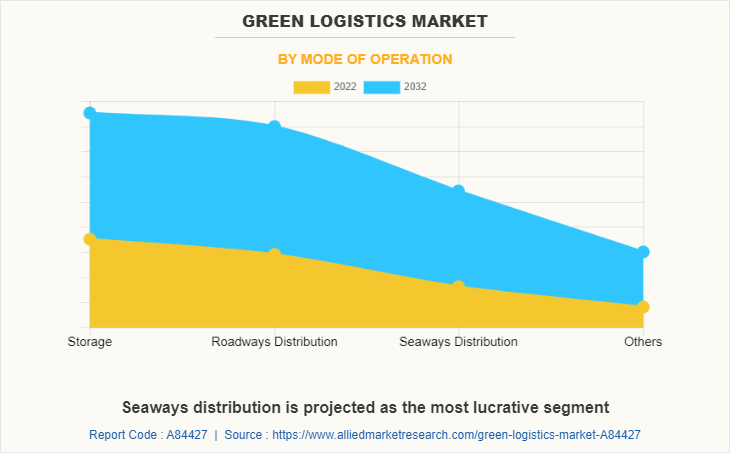

The global green logistics market is segmented into end use, business type, mode of operation, and region. On the basis of end use, it is bifurcated into military commercial and UAV. By business type, it is categorized into warehouse, distribution, and value-added services. On the basis of mode of operation, it is segregated into storage, roadways distribution, seaways distribution, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The green logistics industry in Asia-Pacific is studied across China, Japan, India, South Korea, and others. China, as the major economy in the region, has actively promoted green logistics practices to address environmental challenges. The country has made investments in electric vehicles (EVs), clean energy sources, and smart transportation systems. Japan, known for its adoption of green technology, particularly in hybrid and EVs, has seen logistic companies adopting sustainable fuel options for transportation. For instance, in April 2023, Yusen Logistics Co., Ltd. launched the Yusen Book-and-Claim service, which utilizes sustainable aviation fuel (SAF) for air freight forwarding, enabling customers to grow sustainably.

Moreover, India is focused on improving logistics infrastructure and promoting EVs in the sector. For instance, in January 2023, FedEx Express expanded its fleet by installing 30 TATA Ace EVs in India as part of its global transition to carbon-neutral operations by 2040. South Korea has also made progress in green logistics, implementing initiatives to reduce emissions and enhance logistics efficiency. Other countries in Asia-Pacific, including Australia, Singapore, and New Zealand, are gradually embracing sustainable practices in their logistics operations. Logistic companies in Singapore have adopted EVs and other sustainable solutions to reduce their carbon footprint. For instance, Ninja Van Singapore introduced initiatives such as a pilot program for testing EVs and the relaunch of an eco-friendly version of Ninja Packs, aiming to minimize environmental impact and contribute to a sustainable logistics industry.

The key players profiled in the green logistics market report include FedEx Corporation, DSV, Agility Public Warehousing Company K.S.C.P. and Subsidiaries, GEODIS, Deutsche Post DHL Group., YUSEN LOGISTICS CO., LTD., Bollor SE, CEVA Logistics, XPO Logistics, Inc., and United Parcel Service of America, Inc. The leading companies adopt strategies such as partnership, agreement, acquisition, expansion, and collaboration to strengthen their market position.

Increased CSR activities by logistic companies

As businesses prioritize sustainable practices, logistic companies have taken proactive measures to minimize their environmental footprint. Historically reliant on oil and fossil fuels, freight transportation has significantly increased the operational costs for shippers and logistics companies. Moreover, it contributes to hazardous emissions such as carbon dioxide, black carbon, nitrogen oxides, and particulate matter. These emissions are major contributors to climate change and pose health risks in communities near ports and freight hubs.

Moreover, companies are actively seeking ways to minimize diesel fuel usage in freight transportation to save costs and reduce emissions, carriers, and logistics. Strategies such as load consolidation, intermodal switching, adoption of cleaner fuels, and improved visibility potentially enhance shipping efficiencies and reduce emissions. Companies are taking efforts to improve the efficiency of freight transportation to enhance air quality and mitigate climate change. This way companies are demonstrating commitment to the principles of "people, profit, and planet" that support corporate social responsibility (CSR) and sustainability plans. In addition, logistic companies are entering into partnerships with eco-conscious suppliers. These efforts have gained recognition at international conferences. For instance, in January 2023, Hitachi Transport System, Ltd. (HTS) collaborated with Ezaki Glico Co., Ltd., Glico Channel Create, Inc., and other suppliers who received the Green Logistics Partnership Conference Special Award at the Excellent Logistics Partnership Commendation Program in 2022. This award aims to promote and disseminate cooperative efforts between shipping and logistics companies, focusing on reducing environmental impact and improving logistics operation productivity to establish a sustainable logistics operating system.

Similarly, GEODIS, a major logistic company, places a strong emphasis on environmental initiatives and overall CSR activities. The company is committed to its sustainability objective of achieving a 30% reduction in carbon footprint below the 2017 baseline by 2030. Thus, rise of CSR initiatives by logistic companies is expected to drive the growth of the green logistics market, as businesses strive to align their operations with sustainability objectives.

Surge in adoption of EVs in the logistics industry

The adoption of electric vehicles (EVs) in city logistics has gained momentum in recent years due to their potential to reduce motor noise and emissions compared to traditional internal combustion vehicles (ICVs). This shift toward EVs aligns with the increased focus on environmentally friendly practices in logistics. For instance, in March 2021, DHL Group announced a significant investment of approximately $7.5 billion (7 billion euros) toward environmentally neutral logistics by 2030. DHL aims to have 80,000 EVs for last-mile deliveries, achieving 60% fleet electrification by 2030.

Prominent companies in the U.S., such as Wal-Mart, Amazon, UPS, and DHL, have endorsed the Sustainable Fuel Buyers' Principles established by Business for Social Responsibility. This act signifies its dedication to expediting the shift toward sustainable vehicle technologies. In 2020, EVs accounted for 18% of DHL's last-mile delivery fleet, and it announced Mission 2050 to commit to a zero-emissions target by 2050. FedEx has set forth a commitment to incorporate EVs into its pickup and delivery vehicle fleet. The company aims to achieve 25% of its vehicle purchases as EVs by 2025, with a subsequent target of 100% EV adoption by 2030. Large fleet operators globally, such as La Poste in France, British Gas in the UK, SF Express, and online retailer JD.com in China, have similarly prioritized electric options when renewing their fleets, highlighting the widespread adoption of EVs in the green logistics industry.

Automakers have recognized the demand for EVs and have introduced customized models to cater to the specific needs of logistics. For instance, in January 2021, General Motors (GM) established a dedicated business unit to provide purpose-built EVs for delivery. These developments in the deployment of EVs in logistics, along with the support of major companies and automakers, indicate a strong driver for the green logistics market, that promotes sustainable logistics market and reduces emissions in the transportation sector.

Implementation of stringent environmental regulations

The implementation of stringent environmental standards and policies by governments and regulatory bodies worldwide has become a key driver of the green logistics market. These regulations cover various aspects of logistics operations, such as emissions control, waste management, energy efficiency, and sustainable sourcing. To comply with these regulations, logistic companies are adopting green practices and technologies in their operations. Improving logistics performance has become a crucial factor in effectively integrating into global value chains, sustaining economic growth, and boosting national competitiveness.

With growing global environmental concerns, companies and policymakers are facing high pressure to reduce the negative ecological impact of logistics activities and make them more environmentally sustainable. Recent instances highlight these efforts, for instance, in April 2023, the U.S. Environmental Protection Agency announced new exhaust emissions rules, which require 67% of new vehicles registered in the U.S. to be all-electric by 2032. In line with the European Union regulations, specific carbon emission guidelines have been implemented for different vehicle categories. These guidelines require a 15% reduction in carbon emissions for new cars and vans by 2025, relative to the levels recorded in 2021. Furthermore, a target of 55% reduction for cars and 50% reduction for vans by 2030 has been set, with the ultimate aim of achieving a 100% reduction in emissions by 2035.

Asia-Pacific is further investing in green supply market projects. For instance, India is committed to reduce emission intensity by 45% by 2030 and achieve net-zero emissions by 2070. This commitment is supported by $4,200 million (Rs 35,000 crore) capital investment for energy transition, thus supporting the green logistics industry to reduce its environmental impact and embrace green mobility. Moreover, logistic companies are bound to adopt green practices and technologies to comply with these regulations and contribute to global sustainability efforts. Thus, these efforts from various governments significantly contribute toward the growth of the global green logistics market.

Increase in adoption of artificial intelligence in the global logistics industry

Increase in the adoption of artificial intelligence (AI) in the global logistics industry has emerged as a key driver of the green logistics market. AI technologies, such as machine learning, data analytics, and automation, offer significant benefits in terms of optimizing logistics operations, reducing resource consumption, and improving efficiency. Furthermore, AI-powered algorithms analyze massive volume of data and identify patterns, enabling logistics companies to optimize route planning, load consolidation, and inventory management. This optimization leads to reduced fuel consumption, lower carbon emissions, and improved overall efficiency in the transportation of goods.

Logistic solution supplier developed AI-powered carbon sensing device for green logistics. For instance, in October 2022, DispatchTrack, a last mile delivery solution provider, announced AI-powered carbon emission tracker for green supply chain market to assist businesses in meeting their supply chain sustainability targets. Carbon tracking, which is available as a function in the DispatchTrack routing dashboard, allows businesses to better understand their current carbon footprint. These developments further propel the growth of the green logistics market share.

Recent Developments

- In June 2023, DHL Global Forwarding, the division of Deutsche Post AG specializing in air and ocean freight, formed a strategic partnership with IAG Cargo in the field of Sustainable Aviation Fuel (SAF). As part of this collaboration, DHL has entered into a contract to acquire 11.5 million liters of SAF, which will contribute to the reduction of transport emissions categorized under Scope 3 in 2023.

- In May 2023, Bolloré Logistics, a subsidiary of Bollore SE, extended its fleet in India with a commercial electric vehicle. It is ideal for last-mile deliveries due to its high mobility and low carbon impact.

- In April 2023, DHL, a subsidiary of the Deutsche Post DHL Group, launched a new tool to assist clients in reducing their carbon impact. The DHL GoGreen Dashboard is an emission tracking solution for large wide customers, providing transparency in in line with established industry standards such as the Global Logistics Emissions Council (GLEC) Framework.

- March 2023, GEODIS and PRD Group signed a 10-year lease agreement for a 20,000 square meter collaborative facility in Shanghai. Additionally, the delivery fleet will include electric vans for delivery in metropolitan areas within the district.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the green logistics market analysis from 2022 to 2032 to identify the prevailing green logistics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the green logistics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global green logistics market trends, key players, market segments, application areas, and market growth strategies.

Green Logistics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.9 trillion |

| Growth Rate | CAGR of 8.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 279 |

| By End Use |

|

| By Business Type |

|

| By Mode of Operation |

|

| By Region |

|

| Key Market Players | Deutsche Post DHL Group., Bollor SE, United Parcel Service of America, Inc., GEODIS, DSV, Agility Public Warehousing Company K.S.C.P. and Subsidiaries, YUSEN LOGISTICS CO., LTD., XPO Logistics, Inc., FedEx Corporation, CEVA Logistics |

The key players profiled in the report include FedEx Corporation, DSV, Agility Public Warehousing Company K.S.C.P. and Subsidiaries, GEODIS, Deutsche Post DHL Group., YUSEN LOGISTICS CO., LTD., Bollor SE, CEVA Logistics, XPO Logistics, Inc., and United Parcel Service of America, Inc.

The global green logistics market was valued at $1.3 trillion in 2022, and is projected to reach $2.9 trillion by 2032, growing at a CAGR of 8.3% from 2023 to 2032.

Asia-Pacific is the largest regional market for Green Logistics

Manufacturing is the leading application of Green Logistics Market

Increase in corporate social responsibility (CSR) activities by logistic companies and rise in adoption of EVs in the logistics industry are the upcoming trends of Green Logistics Market

Loading Table Of Content...

Loading Research Methodology...