Green Mining Market Ovrview

The Global Green Mining Market size was valued at $11.4 billion in 2022, and is projected to reach $27.9 billion by 2032, growing at a CAGR of 9.5% from 2023 to 2032.

Green mining refers to the process of extracting valuable minerals and resources from the earth while minimizing the environmental impact and promoting sustainable practices. Its pursuits to minimize the carbon footprint, strength consumption, and water usage related with regular mining methods.

Market Dynamics

Green mining utilizes renewable strength sources such as solar, wind, or hydroelectric power to meet the strength necessities of mining operations. This reduces the reliance on fossil fuels and decreases greenhouse gasoline emissions. Mining businesses enforce energy-efficient applied sciences and procedures to optimize energy consumption. This involves using advanced equipment, improving ventilation systems, and utilizing automation and digitalization to reduce energy waste.

The increasing strictness of environmental regulations and the growing emphasis on sustainable practices are indeed important for the growth of the green mining market. Moreover, environmental regulations aim to decrease the terrible impacts of mining operations on ecosystems, land, and water resources. They require mining groups to implement measures to prevent or mitigate pollution, soil erosion, and habitat destruction. This encourages the adoption of technologies and practices that decrease the environmental footprint of mining activities. Furthermore, greenhouse gasoline emissions, especially carbon dioxide, contribute to local weather change.

Environmental policies often set targets for decreasing carbon emissions and promote the adoption of low-carbon technologies in mining operations. This consists of the use of renewable strength sources, energy-efficient equipment, and carbon seize and storage technologies. In addition, environmental regulations emphasize the proper management of mining waste, such as tailings and different byproducts. Mining companies are required to implement strategies for waste reduction, recycling, and responsible disposal. In addition, regulations encourage resource efficiency by promoting the use of advanced extraction and processing technologies that minimize the extraction of unnecessary materials.

Mining operations can have significant water requirements and can impact local water sources. Environmental regulations often address water conservation and management, requiring mining companies to implement measures for water efficiency, wastewater treatment, and responsible water use. This encourages the adoption of technologies that reduce water consumption and promote water recycling and reuse.

Implementing green mining practices often involves capital-intensive projects, such as installing renewable energy systems, improving waste management, or upgrading equipment to reduce emissions and improve energy efficiency. These projects require substantial upfront investments, which can strain the financial resources of mining companies, especially smaller or financially limited businesses. While green mining practices have long-term environmental benefits, the immediate financial returns may not be as evident.

Mining companies may face uncertainty regarding the payback period and return on investment for adopting green technologies. This uncertainty can make it difficult for companies to justify the high initial costs particularly if the financial benefits are not immediately apparent. Some mining companies particularly those operating in developing regions or smaller-scale operations may face challenges in accessing the necessary capital to fund the transition to green mining practices. Financial institutions and investors may be hesitant to provide funding due to the perceived risks and uncertainties associated with green mining projects, further exacerbating the initial cost restraints. The absence of supportive policies or regulations that incentivize or require green mining practices can act as a deterrent for companies to make significant investments in sustainability.

Green mining can benefit from the use of autonomous vehicles such as self-driving trucks and drilling rigs. These vehicles can operate with precision, reducing human error and enhancing safety in mining operations. In addition, autonomous vehicles can optimize routes, reduce fuel consumption, and minimize carbon emissions. Moreover, implementing remote monitoring and control systems allows mining operators to remotely monitor equipment, collect real-time data, and make informed decisions.

This technology enables proactive maintenance, reduces downtime, and improves overall operational efficiency. Remote monitoring and control systems also minimize the need for onsite personnel, reducing potential safety risks. Advanced analytics, including machine learning and artificial intelligence, can be applied to mining operations to analyze vast amounts of data and extract valuable insights. These technologies can optimize ore extraction, predict equipment failures, and optimize energy consumption. By leveraging advanced analytics, mining companies can improve productivity, reduce costs, and minimize environmental impacts.

The key players profiled in this report include BHP, Rio Tinto, Anglo American PLC, Glencore PLC, Liebherr, Tata Steel Mining Limited, Jiangxi Copper Corporation Limited, Exxaro, Dundee Precious Metals Inc., and Komatsu Ltd. Investment and agreement are common strategies followed by major market players. For instance, in February 2023, in order to ensure a sustainable and consistent supply of Rio Tinto's Responsible Aluminum products to Japanese downstream manufacturers, global miner Rio Tinto and Japanese trader and business giant Marubeni Corporation agreed to a first sale under a new strategic collaboration agreement.

Segment Overview

The green mining market is segmented on the basis of mining type, mineral or metal extracted, technology, and region. By mining type, the market is divided into surface mining, underground mining, placer mining, and in-situ mining. By mineral or metal extracted, the market is classified into mineral fuels, iron & ferro-alloys, non-ferrous metals, precious metals, and industrial minerals. By technology, the market is classified into mine filling, water preservation, simultaneous extraction of coal & gas, oxidizing utilization of ventilation air methane (VAM), gangue discharge reduction, mining from tailings, dust suppression techniques, liquid membrane emulsion technology, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The green mining market is segmented into Mining Type, Mineral or Metal Extracted and Technology.

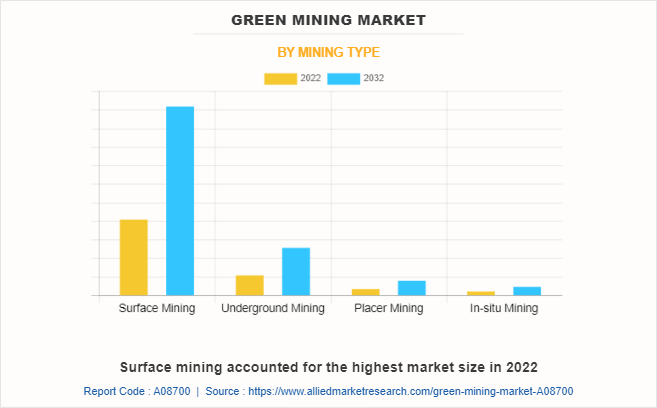

By Mining Type,

The surface mining sub-segment dominated the market in 2022. Surface mining is often more cost-effective than underground mining methods especially for large-scale operations. It allows for the extraction of a large volume of minerals or resources in a relatively shorter time frame. The lower costs associated with surface mining including lower labor and equipment expenses make it an attractive option for mining companies. Advancements in mining technologies and equipment have improved the efficiency and safety of surface mining operations. These technologies include advanced drilling and blasting techniques, autonomous mining equipment, real-time monitoring systems, and sophisticated mine planning software.

The integration of these technologies in surface mining operations enables better resource management or reduces waste and enhances overall productivity. Moreover, surface mining is particularly suitable for the extraction of resources located close to the earth's surface such as coal, iron ore and certain types of minerals. As accessible high-grade deposits become scarcer, mining companies turn to surface mining to tap into these resources. When implemented responsibly, surface mining projects can involve community engagement and consultation, ensuring that the concerns and interests of local stakeholders are addressed. This can lead to social acceptance and support for mining activities in the region.

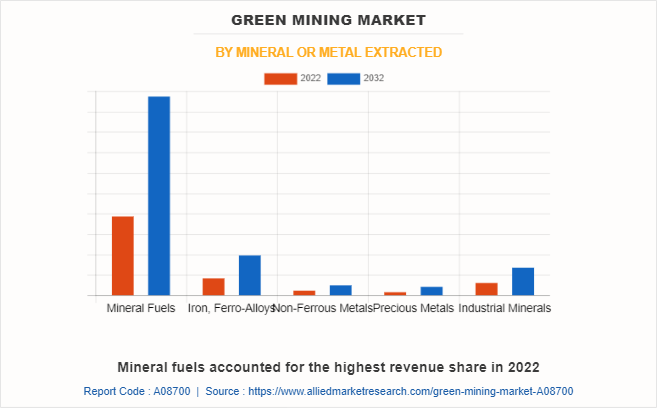

By mineral or metal extracted,

The mineral fuels sub-segment dominated the global market share in 2022. As non-renewable resources become scarcer, mining companies are incentivized to adopt green mining practices to extend the lifespan of their operations and make the most of available resources. Stringent environmental regulations imposed by governments play a significant role in driving the adoption of green mining practices.

Green mining in the mineral fuels segment helps companies comply with these regulations and improve their environmental performance. Moreover, green mining focuses on optimizing resource efficiency and minimizing waste generation. This approach aims to extract mineral fuels with minimal environmental impact, reduce water consumption, and optimize energy use throughout the mining process. By adopting sustainable practices, mining companies can conserve natural resources and reduce their ecological footprint. The development and adoption of advanced technologies play a crucial role in driving the green mining market.

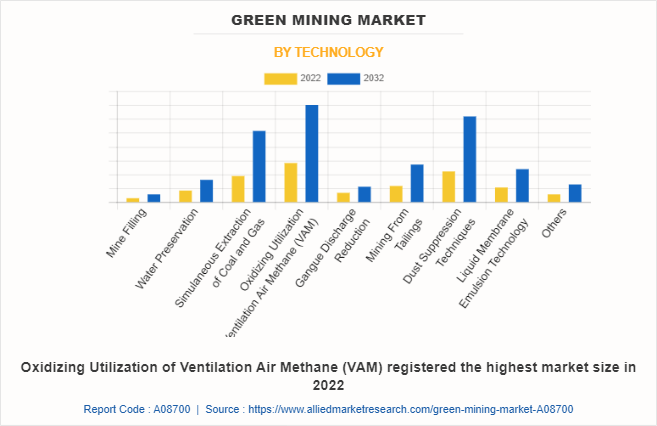

By technology,

The oxidizing utilization of ventilation air methane (VAM) sub-segment dominated the global green mining market share in 2022. Increasing environmental regulations and a growing focus on reducing greenhouse gas emissions have compelled the mining industry to adopt cleaner and more sustainable practices. VAM, which is a potent greenhouse gas can be captured and utilized as an energy source thereby reducing emissions and helping mining companies comply with regulations. Moreover, VAM contains methane, which is a valuable energy resource. By capturing and utilizing VAM, mining companies can generate additional revenue by converting it into electricity or heat. This reduces their dependence on traditional fossil fuels and lowers energy costs, resulting in cost savings over the long term. Utilizing VAM as an energy source enhances energy security for mining operations.

Furthermore, advancements in VAM capture and utilization technologies have made it more economically viable and efficient for mining companies to implement these solutions. Improved equipment and processes for VAM oxidation and energy conversion have reduced costs and increased the overall feasibility of utilizing VAM in mining operations. Governments around the world are implementing various incentives, subsidies, and grants to promote the adoption of cleaner technologies in the mining industry. These incentives can significantly reduce the upfront costs of implementing VAM capture and utilization projects, making them more attractive for mining companies.

By region,

Asia-Pacific dominated the global market in 2022. The rising awareness and concern about environmental degradation and the need for sustainable practices have led to a shift towards green mining in the region. Governments, communities, and industry stakeholders are demanding cleaner and more responsible mining practices, driving the adoption of green technologies and solutions. Moreover, governments in the region are implementing various initiatives and regulations to promote sustainable mining practices. They are encouraging the use of clean technologies, renewable energy sources, and reducing the environmental impact of mining operations through stricter regulations. These measures create a favorable environment for the growth of the regional green mining market.

Asia-Pacific has a high demand for energy and mining operations are typically energy-intensive. Green mining technologies such as energy-efficient equipment and renewable energy integration or help mining companies reduce their energy consumption and operational costs. Utilizing renewable energy helps reduce greenhouse gas emissions and environmental impact, making green mining an attractive option.

Impact of COVID-19 on the Global Green Mining Industry

- The COVID-19 pandemic has had a significant impact on various industries, including the green mining market outlook. The pandemic led to disruptions in global supply chains, affecting the availability and delivery of mining equipment, machinery, and raw materials. This disrupted the operations of green mining companies, causing delays in project timelines and production.

- The economic slowdown caused by the pandemic resulted in reduced demand for minerals and metals, including those obtained through green mining practices. Lower demand led to a decrease in prices, affecting the profitability and viability of green mining projects. Mining operations require a significant number of on-site workers, making it challenging to maintain social distancing and implement necessary health & safety protocols.

- The economic uncertainty caused by COVID-19 made it difficult for green mining projects to secure financing. Investors became more cautious, leading to a decrease in funding for new projects or expansion of existing ones. This limited the growth potential of the green mining market. Governments around the world diverted resources and attention towards managing the health crisis, resulting in delays or changes in environmental regulations and policies supporting the green mining sector. This uncertainty affected the long-term planning and investment decisions of green mining companies.

- The pandemic highlighted the importance of sustainability and resilience. There has been a growing recognition that green mining practices align with the goals of a sustainable and resilient future. This awareness is expected to lead to increase in support and investment in the green mining market in the post-pandemic period.

Key Benefits For Stakeholders

- The report provides exclusive and comprehensive analysis of the global green mining market trends along with the green mining market forecast.

- The report elucidates the green mining market opportunity along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

- The report entailing the green mining market analysis maps the qualitative sway of various industry factors on market segments as well as geographies.

- The data in this report aims on market dynamics, trends, and developments affecting the green mining market growth.

Green Mining Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 27.9 billion |

| Growth Rate | CAGR of 9.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 290 |

| By Mining Type |

|

| By Mineral or Metal Extracted |

|

| By Technology |

|

| By Region |

|

| Key Market Players | Exxaro Resources Ltd, Dundee Precious Metals Inc., Komatsu Ltd., Anglo American PLC., Liebherr, Tata Steel Mining Limited, Rio Tinto, BHP, Glencore PLC, Jiangxi Copper Corporation Limited |

The rising stringent environmental regulations and standards imposed by governments and regulatory bodies are driving the adoption of green mining practices. These regulations aim to reduce the environmental impact of mining activities, including the management of waste, emissions, and water usage, which is estimated to generate excellent opportunities in the green mining market.

The major growth strategies adopted by the green mining market players are investment and agreement.

Europe will provide more business opportunities for the global green mining market in the future.

Many mining companies and industry stakeholders are embracing sustainability as a core value and implementing initiatives to reduce their carbon footprint. Green mining practices, such as energy-efficient processes, recycling, and responsible water management, align with these sustainability goals and contribute to a positive brand image, which is estimated to drive the adoption of green mining.

BHP, Rio Tinto, Anglo American PLC, Glencore PLC, Liebherr, Tata Steel Mining Limited, Jiangxi Copper Corporation Limited, Exxaro, Dundee Precious Metals Inc., and Komatsu Ltd are the major players in the green mining market.

The mineral fuels sub-segment of the mineral or metal extracted acquired the maximum share of the global green mining market in 2022.

Government agencies & regulators and mining companies are the major customers in the global green mining market.

The demand for advancements in technology, such as the use of renewable energy sources, automation, artificial intelligence, and advanced data analytics, are enabling more sustainable mining operations. These innovations reduce energy consumption, optimize resource usage, and improve waste management, leading to greener and more efficient mining practices, which is anticipated to boost the green mining market in the upcoming years.

Loading Table Of Content...

Loading Research Methodology...