Green SiC Market Research, 2031

The global green sic market was valued at $0.9 billion in 2021 and is projected to reach $2.8 billion by 2031, growing at a CAGR of 12.3% from 2022 to 2031.

Green silicon carbide is the finest powder that is crushed and sized by advanced fine powder technology using green silicon carbide abrasive as raw material. Along with maintaining a hardness that is near to diamond, it also has outstanding grinding and polishing qualities that are unaffected by chemicals. green silicon carbide is a good abrasive because it is sharp and friable. It is the most abrasive among conventional abrasives and is used to grind ceramics and carbides, which are less ductile and have lower tensile strengths. green SiC is utilized in the precise grinding of hard and brittle materials like glass or carbides, plastics, martensitic stainless steels, and nonferrous metals including titanium, aluminum, and tungsten. green SiC has a high purity of 97%-99% but is more expensive than black SiC. Cast iron roughing operations are mostly carried out at foundries using grinding tools made of impure black SiC.

Black SiC is formed from the recycled feed of earlier furnacing cycles, including amorphous SiC, while green SiC is made from a mixture of sand and coke. The black coloration is due to iron impurities. By the distance from the carbon rod in the furnace, green and black Sic’s are also sorted. The substance closest to the carbon electrode yields green SiC. The fragments are further divided, crushed, and screened into various sizes. In addition, the treatment modifies the grain's form. Coated abrasives use sharp, elongated grains, foundries use blocky grains, and the rest are used for general tasks.

SiC has a small thermal expansion coefficient, which gets smaller as the temperature rises. It qualifies as a suitable abrasive because of its high degree of hardness and sharp crystal edges. The Knoop hardness of SiC is 2500, and it is also exceedingly friable. The black grade's impurities somewhat increase toughness while decreasing hardness, but the resulting grains are still much more friable than corundum. SiC exhibits chemical reactivity toward metals like iron and nickel that have an affinity for carbon over 760°C. This inhibits its ability to grind nonferrous and hard metals. In addition, SiC reacts with sodium silicate and boron oxide, which are also typical components of vitrified wheel bonds.

Abrasives are materials used to grind away wood, concrete, ceramic, stone, or mineral. These materials offer a refined, completed appearance. Abrasives are frequently used to polish materials to obtain a smooth, shiny surface. Abrasives are used for roughing up materials with matte and satin. The market is expected to increase as a result of the use of these materials in tools, such as sandpapers, grinding wheels, polishes, honing stones, tumbling and vibratory mass-finishing media, pulp stones, sandblasting, ball mills, and other similar products.

Abrasives are in greater demand as a result of the unprecedented and significant changes the construction industry is experiencing, which are supported by economic expansion. The market is anticipated to grow as a result of the rising demand for the product in end-use sectors, including metal fabrication, automotive, electrical equipment (E&E) and machinery, and electronics for grinding and polishing applications. The product is essential in adjusting operating parameters during the production of automobile components, such as lowering noise levels, cutting carbon dioxide emissions from high-performance engines, and component machining.

Increased demand from the metal fabrication industry

Metal fabrication business includes manufacturing, hardware & hand tools, building & construction, aerospace, and hardware manufacturing. Rapid industrialization and infrastructure development are expected to boost the sheet metal fabrication services market. Increased demand for metal fabrication is expected to boost the demand for green silicon carbide. In addition, the rise in population, especially in developing economies like India and China is a significant investment in infrastructure development, owing to which the demand for metal fabrication has increased. These factors are expected to boost the demand for green silicon carbide in the metal fabrication industry.

Due to rising urbanization and improved lifestyles, there has been an upsurge in construction activities. Market development is further aided by high levels of renovation activity and economic growth in developing nations. These goods are employed in the construction sector for a variety of purposes, including metal fabrications, metal components, and woodworking & fabrication. The building business is expanding most dramatically in developing nations like China, India, Japan, and other Asian countries. Due to the increase in residential construction, the expanding population in these nations has had a favorable impact on green silicon carbide consumption. In addition, the rapid industrialization of smaller western nations is directly boosting the expansion of the construction sector, which in turn is fueling the expansion of the abrasives market. These factors are driving the demand for green silicon carbide.

The most widely used abrasive raw materials are silicon carbide and synthetic diamond. These raw materials are derived from resources that are regenerative, like petroleum. The supply of raw materials decreases as a result of the depletion of these resources, which is hindering the green SiC market expansion. Governments have also acted and imposed strict limits on the usage of this commodity as a response to growing concerns over environmental protection and halting the spread of pollution, which has hampered market expansion.

The growth in the metal fabrication and machining industries in North America is also expected to provide lucrative growth opportunities to manufacturers. For instance, Sargent Metal Fabricators Inc. invested $9.5 million in July 2020 into expanding operations in South Carolina, U.S. The expansion attempts to meet the rising demand from customers. These investments are anticipated to increase the product demand in the region during the forecast period.

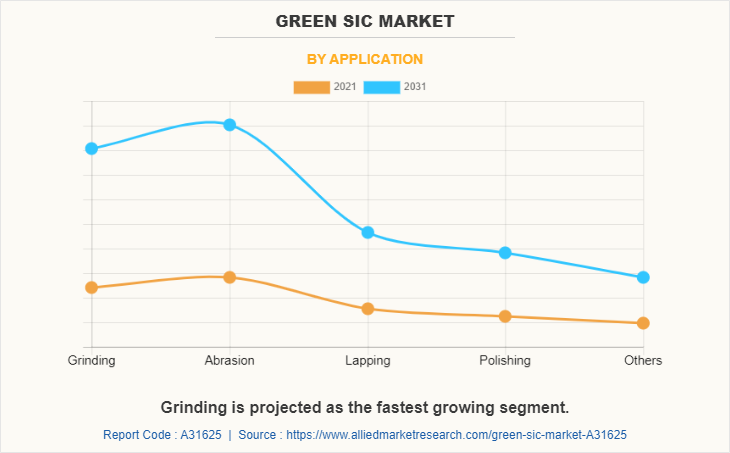

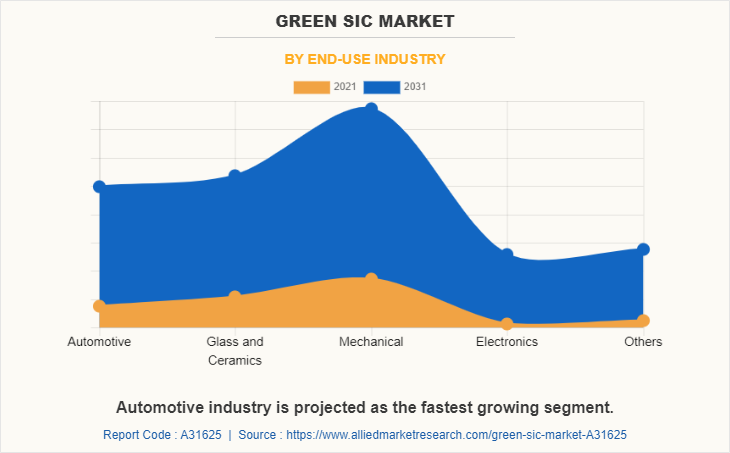

The green SiC market is segmented on the basis of application, end-use industry, and region. By application, the market is categorized into grinding, abrasion, lapping, polishing, and others. On the basis of the end-use industry, the market is fragmented into automotive, glass & ceramics, metal fabrication, electronics, and others. On the basis of region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Major players operating in the global green SiC market are Washington Mills, Futong Industry Co. Limited, General Abrasivi Srl, Shin-Etsu Chemical Co., Ltd, CHOKO CO., LTD., Fiven ASA, Zibo Jinjiyuan Abrasives Co. Ltd, Snam Abrasives Pvt. Ltd., Henan Qingjiang Industrial Co., Ltd., and U.S. Electrofused Minerals, Inc. Other players operating in the green SiC market are AGSCO Corp., Carborundum Universal Ltd., Gaddis Engineered Materials, Grindwell Norton Ltd., and SK Siltron Co., Ltd.

At The Architect Fair 2018 in May 2018, Saint-Gobain Group in Thailand unveiled a brand-new abrasive product called "Weber by Norton." The first of several upcoming new products was the "Weber by Norton" diamond blade line. A new assortment of goods, including 4" diamond blades, thin wheels, GC grinding wheels, flap discs, and fiber discs, are now being sold by the company in Thailand under the Weber brand. The company worked with the Weber Team in Thailand to launch this new product.

On the basis of application, the abrasion segment accounted for the largest market share in 2021 i.e. 31.5%, and is expected to maintain its dominance during the forecast period. This is owing to its wide range of end-use applications in electronics, construction, and automotive. The grinding segment is projected as the fastest growing segment at a CAGR of 12.9% during the forecast period owing to increasing demand for grinding materials in the construction industry.

On the basis of the end-use industry, the mechanical industry accounted for the largest share in 2021i.e. 30.3%, and is expected to maintain its dominance during the forecast period. The increased use of green silicon carbide in the metal fabrication industry is the primary factor driving the demand for green silicon carbide in the mechanical industries. The automotive industry is projected as the fastest-growing industry at a CAGR of 13.0% during the forecast period.

Region-wise, Asia-Pacific accounted for the largest market share i.e. 55.2% in 2021 and is projected to grow at a CAGR of 12.7% during the forecast period. An increase in construction and automotive markets in countries such as China and India has benefited the global green SiC market.

COVID-19 Impact Analysis on the Green SiC market

COVID-19 had a negative impact on the green SiC market owing to decreased demand from the automotive and mechanical industries. According to estimations, the metal fabrication industry could have a $200.0 billion loss in 2020 compared to 2019. In fact, the slowing demand and long wait times to resume operations force metal producers to improve forecasting and act quickly in response to market changes. Additionally, a quick price drop may be caused by an oversupply of goods. Manufacturers are under pressure to increase productivity while lowering prices, and some are even considering closing down operations to prevent excess output and inventory buildup.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the green sic market analysis from 2021 to 2031 to identify the prevailing green sic market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the green sic market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional, as well as global green, sic market trends, key players, market segments, application areas, and market growth strategies.

Green SiC Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2.8 billion |

| Growth Rate | CAGR of 12.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 320 |

| By Application |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Shin-Etsu Chemical Co., Ltd., Zibo Jinjiyuan Abrasives Co. Ltd., Fiven ASA, Henan Qingjiang Industrial Co., Ltd., Snam Abrasives Pvt. Ltd., CHOKO CO., LTD. , General Abrasivi Srl., Futong Industry Co. Limited, U.S. Electrofused Minerals, Inc., Washington Mills |

Analyst Review

According to the perspective of the CXOs of leading companies, green silicon carbide is a very distinguished material with valuable characteristics used in several applications. Due to its physical hardness, it can be used from coarse to very fine in several applications, being an essential material in the abrasive processes like grinding, honing, sandblasting, and water jet cutting. Moreover, high surface hardness allows it to be used in many engineering applications where a high degree of sliding, erosive, and corrosive wear resistance is required. The increasing demand for green silicon carbide for grinding and polishing applications in end-use industries, such as metal fabrication, automotive, electrical equipment (E&E) and machinery, and electronics, is expected to drive the market.

Increasing demand for abrasives from the automotive and metal fabrication industries are the upcoming trends of the Green SiC Market in the world.

Grinding is the leading application of the Green SiC Market.

Asia-pacific is the largest regional market for green SiC.

The green SiC market was valued at $0.9 billion in 2021 and is projected to reach $2.8 billion by 2031, growing at a CAGR of 12.3% from 2022 to 2031.

Washington mills, Futong Industry Co. Limited, General Abrasive Srl, and Shin-Etsu Chemical Co., Ltd are the top companies to hold the market share in Green SiC

The automotive industry is projected to increase the demand for the green SiC market.

COVID-19 had a negative impact on green SiC market owing to decreased demand from automotive and metal fabrication industry.

Loading Table Of Content...