Ground Support Equipment Market Oveview, 2032

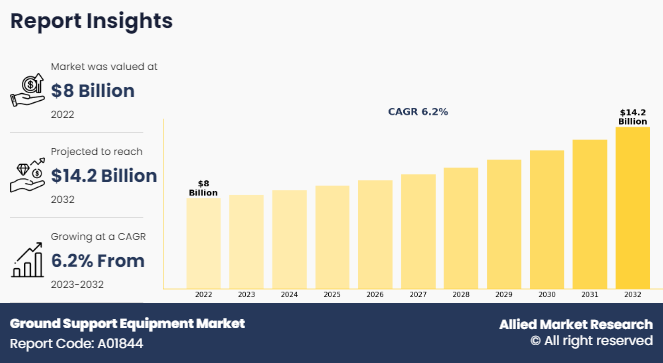

The global ground support equipment market was valued at $8 billion in 2022, and is projected to reach $14.2 billion by 2032, growing at a CAGR of 6.2% from 2023 to 2032.Ground support equipment (GSE) is a term used within the aviation industry to describe the array of equipment and tools stationed at airports to assist in the servicing of aircraft during the interval between flights. This equipment is typically stored on ramps near terminals for easy access when needed. The primary objective of GSE is to ensure the smooth and safe operation of aircraft, both after they have landed and before they take off again. This equipment is essential for various tasks involved in aircraft maintenance, servicing, loading, and other ground operations. Ground support equipment includes aircraft tugs/tow tractors, passenger boarding steps/stairs, ground power units (GPUs), aircraft deicing equipment, baggage handling systems, cargo loaders/unloaders, aircraft refueling trucks, ground cooling units, maintenance stands and equipment, and others.

Key Takeaways

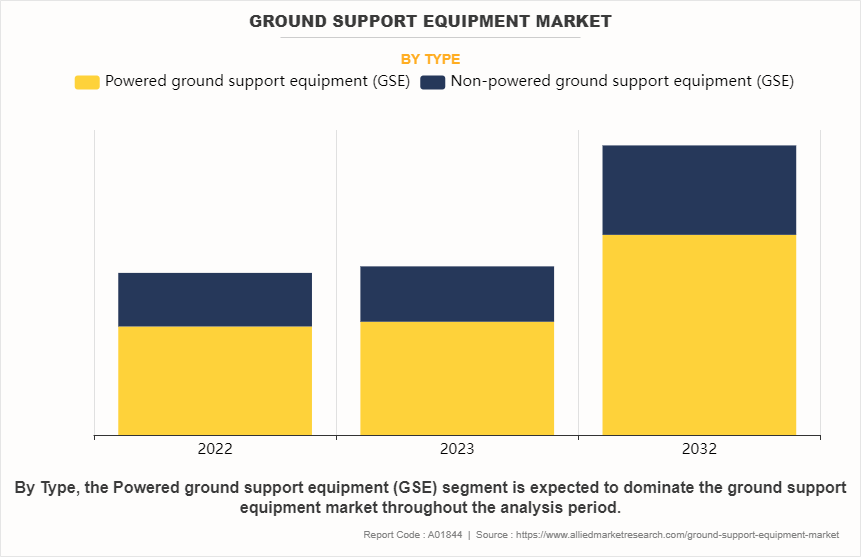

- On the basis of type, the powered ground support equipment (GSE) segment held the largest share in the ground support equipment market in 2022.

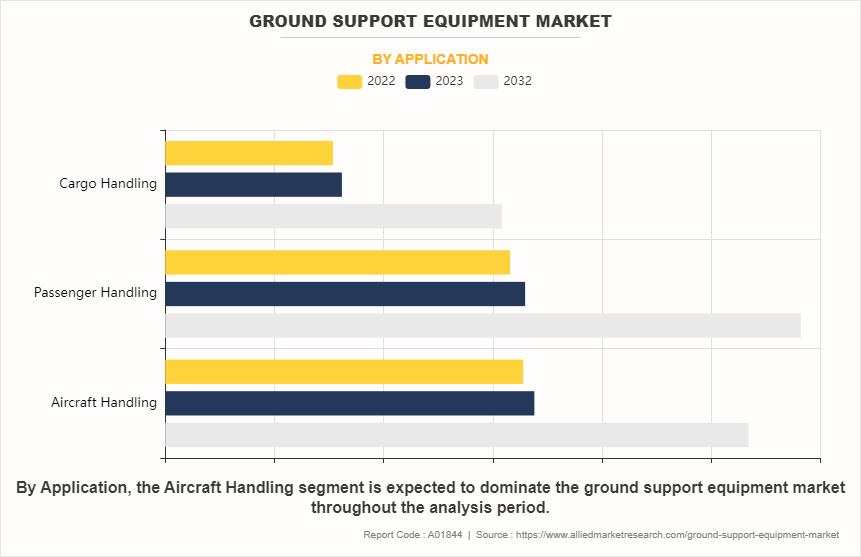

- By application, the aircraft handling segment held the largest share in the market in 2022.

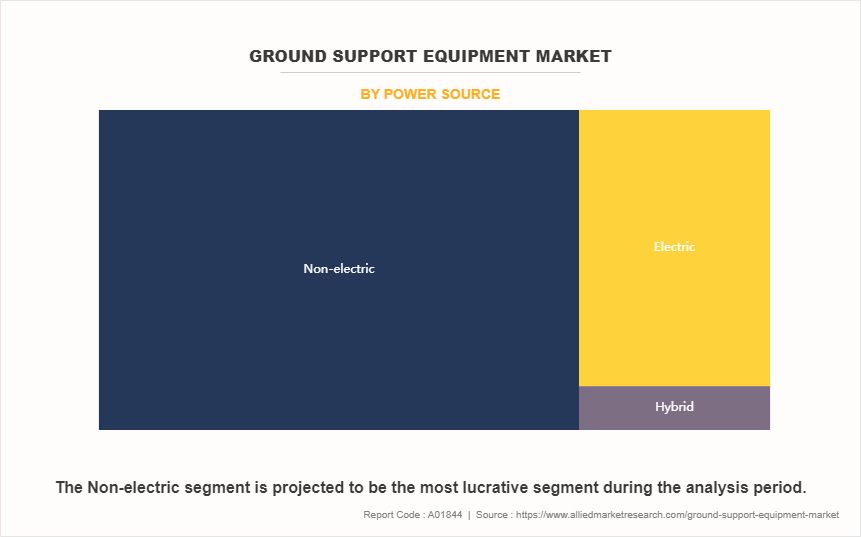

- On the basis of power source, the non-electric segment held the largest market share in 2022.

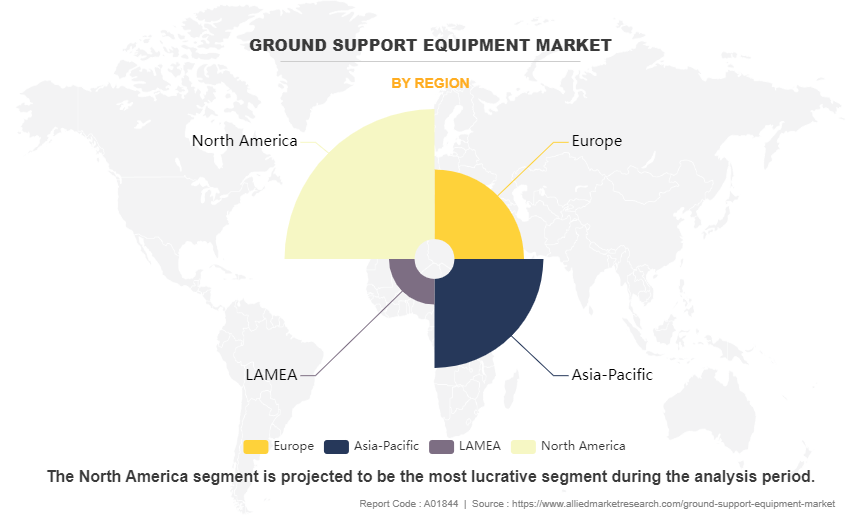

- On the basis of region, North America held the largest market share in 2022.

Furthermore, the global ground support equipment market is experiencing notable trends and factors that are influencing its growth trajectory. One significant trend in the ground support equipment (GSE) market is the increasing demand for electric and eco-friendly GSE solutions. As sustainability becomes a priority across various industries, including aviation, there is a growing emphasis on reducing emissions and carbon footprints associated with ground operations at airports. With continuous expansion in air travel globally, airlines are enlarging their fleets by procuring new aircraft, necessitating corresponding ground support equipment for precise airspeed measurement. As per the International Civil Aviation Organization (ICAO) annual global statistics, there was a substantial increase in the volume of air travelers in 2022, estimated to be 47% higher than in 2021. This upsurge is attributed to the rapid recovery of numerous international flight routes. Furthermore, in 2022, the number of passenger aircraft in operation reflected the broader revival in air traffic, with current forecasts indicating that it has reached 75% of pre-pandemic levels. These statistics indicate a continuous rise in international air passenger traffic over the years. This increase is anticipated to lead to a significant surge in demand for new airplanes globally, thereby supporting the growth of the ground support equipment market.

Moreover, companies adopt strategies to develop advanced GSE solutions for the aviation industry. For instance, in November 2023, Mercury GSE entered into a substantial agreement with JBT AeroTech, demonstrating its commitment to providing high-quality GSE solutions for the aviation industry. The partnership between Mercury GSE and JBT AeroTech aims to streamline ground operations, reduce costs, improve passenger experiences, and support green initiatives with energy-efficient equipment. The order includes various GSE products such as pushback tractors, cargo loaders, air conditioning units, heating systems, and more, contributing to smoother and more efficient airport operations. Therefore, such investments in advanced ground support equipment technology demonstrate a willingness to adapt and improve operations, leading to potential growth opportunities for GSE providers, which increases the ground support equipment market size.

Increase in air traffic and cargo, modernization and expansion of airports, rise in focus of airports on enhancing operational efficiency, and high service standards are factors driving the ground support equipment market. However, high initial investment hinders the growth of the market. Furthermore, increase in focus towards procurement of greener GSE and surge in demand for customized and specialized ground support equipment provide growth opportunities for the players operating in the market.

Segment Review

The GSE market is segmented on the basis of type, application, power source, and region. By type, it is divided into powered ground support equipment (GSE) and non-powered ground support equipment (GSE). By application, the market is classified into aircraft handling, passenger handling, and cargo handling. By power source, the market is classified into electric, non-electric, and hybrid. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

By Type

On the basis of type, the powered ground support equipment segment generated maximum revenue in 2022, owing to expansion and modernization projects of numerous airports globally to accommodate the growing number of passengers and aircraft. As airports expand, there is a need for more advanced and efficient ground support equipment, including powered vehicles such as tow tractors, baggage loaders, and aircraft tugs, to facilitate smooth operations on the ground.

By Application

On the basis of application, the aircraft handling segment generated maximum revenue in 2022, owing to rise in air and cargo traffic. As air travel continues to grow globally, airports are experiencing high volumes of aircraft movements, which necessitates efficient and reliable aircraft handling equipment to manage arrivals, departures, and turnarounds swiftly and safely. The growth in air traffic drives demand for a wide range of aircraft handling equipment, including ground power units (GPUs), passenger boarding stairs, aircraft towbars, and aircraft deicing equipment.

By Power Source

On the basis of power source, the non-electric segment was the highest revenue contributor to the market in 2022. Non-electric ground support equipment (GSE) demonstrates versatility across a broader spectrum of environments and conditions when compared to electric alternatives. Being independent of electrical power sources, they prove beneficial for operations in remote areas, adverse weather conditions, or regions with inconsistent power availability. In addition, non-electric GSE, such as conventional gasoline or diesel-powered equipment, is renowned for its sturdy construction and resilience. This inherent durability renders them suitable for demanding applications and environments characterized by substantial wear and tear on equipment.

By Region

Region-wise, North America dominated the GSE market in 2022. North America boasts a thriving aviation industry characterized by substantial demand for air travel, including both domestic and international routes. With a multitude of major airports and airline hubs, the region experiences extensive aircraft activity. As the demand for air travel persists in its growth, the need for ground support equipment (GSE) to facilitate essential ground operations such as aircraft handling, cargo management, and passenger services escalates, which drives the growth of the GSE industry.

Competitive Analysis

Some of the major companies that operate in the global ground support equipment market are AERO SPECIALTIES, INC., Illinois Tool Works Inc., Textron GSE, Flightline Support Ltd., GATE GSE, Imai Aero-Equipment Mfg. Co., Ltd., JBT Corporation, Mallaghan, TLD, and Guangtai.

Increase in Air and Cargo Traffic

There is surge in individuals seeking and utilizing air transportation services due to various factors such as economic growth, enhanced affordability of air travel, expansion of travel and tourism, and globalization. For instance, according to International Air Transport Association (IATA), total air traffic, measured in revenue passenger kilometers (RPKs), increased by 55.5% in February 2023 as compared to February 2022. Globally, the overall traffic level reached 84.9% of the levels recorded in February 2019. Moreover, according to Eurostat, in 2021, there was a substantial increase of 34.9% in the number of passengers traveling by air in the European Union (EU), totaling 373 million people. This increase in demand directly impacts on the aircraft industry, leading to a rise in the need for additional aircraft to accommodate the growing numbers of passengers. This increase in air traffic translates to a greater number of aircraft movements at airports, necessitating a proportional rise in ground support equipment (GSE) to facilitate efficient ground handling operations.

Moreover, as global trade continues to expand and e-commerce grows in popularity, there has been a rise in trend for cargo travel over the years. Overall, various factors can contribute to surge in cargo travel, including economic growth, changes in consumer behavior, and global events impacting supply chains. For instance, according to IATA, as air cargo demand recovered in 2023, airlines increased their use of freighter flights to transport goods, leading to higher utilization of cargo aircraft. This is expected to result in a greater need for ground support equipment (GSE) used in handling cargo aircraft on the ground. Essential equipment such as cargo loaders, pallet dollies, and forklifts are expected to be in demand to efficiently load and unload cargo, facilitating rise in air freight operations.

Modernization and expansion of airports

The ground support equipment market size is expected to witness substantial growth in the coming years, driven by increasing air passenger traffic and expanding aviation infrastructure worldwide. Ground support equipment market analysis indicates a rising demand for advanced equipment to streamline airport operations and enhance efficiency. Government and airport authorities aim to enhance the capacity and efficiency of airports with the expansion and modernization of airports. Various projects are being launched for the improvement of airport infrastructure across the country. For instance, in February 2023, the Airports Authority of India (AAI) and other airport operators in India announced a capital outlay of approximately $11.82 million by 2025. This investment is expected to be used for various projects such as the construction of Greenfield Airports, new terminals, expansion, and modernization of existing terminals, as well as strengthening of runways. Moreover, in June 2020, the airport in Serbia encountered a major expansion and modernization project led by a joint venture between Vinci Construction Grands Projects and GEK Terna Group. With an investment of $320.5 million , the project aims to upgrade the airport's capacity and operating conditions, support the addition of new routes, and increase passenger and cargo volumes. Moroever, within the GSE industry, companies compete to maintain their market share while adapting to changes in demand and technological advancements. Ground support equipment market growth is driven by various factors, including increased air traffic and infrastructure development, contributing to the expansion of the industry.

In addition, numerous counties conduct projects to expand and modernize airport infrastructure to support the tourism industry. For instance, in January 2024, Pedro Sanchez, the President of Spain, announced the beginining of the expansion of Barajas airport in Madrid with an investment of $2.6 billion. The expansion of Barajas airport is anticipated to result in heightened airport operations, involving rise in flights, passenger traffic, and cargo movements. This surge in activity is expected to drive a greater need for ground support equipment, including aircraft tugs, baggage handling systems, and ground power units, to ensure efficient ground handling operations.The ground support equipment market forecasts represents growth in the industry due to rising demand for air travel, technological advancements in GSE equipment, and expansion of airports and aviation infrastructure worldwide.

High initial investment

High initial investment requirements can act as a significant barrier to entry for new companies wishing to enter the market. The substantial capital needed to establish operations or develop new products may deter potential competitors from entering the market, limiting competition and innovation. Companies may be reluctant to make high initial investments due to the perceived risks involved.

Uncertainty about market demand, regulatory changes, or technological advancements can make companies hesitant to commit significant resources upfront, leading to a conservative approach to investment and market expansion. Moreover, the upfront cost of electric GSE is approximately 30% to 35% more expensive than its gas-powered counterparts. This indicates a significant initial investment required for purchasing electric ground support equipment, which is expected to hinder the growth of the GSE market.

Increased focus towards procurement of greener GSE

There is a growing emphasis on reducing carbon emissions and environmental impact across various industries, including aviation. Regulatory bodies and industry stakeholders are implementing stricter environmental regulations and sustainability initiatives to mitigate the environmental footprint of airports and airlines. As a result, there is a heightened demand for greener GSE, such as electric or hybrid-powered equipment. For instance, in February 2024, the New Terminal One at New York John F. Kennedy International Airport issued a request for proposals (RFP) to procure an all-electric fleet of ground service equipment (GSE) for its operations. This RFP marks the first step in establishing the operations of the new terminal, which is scheduled to open in 2026 as part of a $19 billion transformation project undertaken in partnership with the Port Authority of New York & New Jersey.Ground support equipment market share is dominated by key players offering innovative solutions and technological advancements, catering to the evolving needs of the aviation industry. As the industry evolves, ground support equipment market trends reveal a shift towards eco-friendly and sustainable equipment options, reflecting the growing emphasis on environmental stewardship within the aviation sector. The GSE market share reflects the distribution of market influence among competitors, indicating the relative strength of each player within the industry.

Moreover, airports across the globe are increasingly aiming to achieve emission-free ground operations. For instance, Schiphol Airport in the Netherlands has set a target to have completely emission-free ground operations by 2030. In March 2022, Schiphol Airport and KLM Equipment Services tested new electric ground equipment designed for handling widebody planes at Amsterdam Airport Schiphol. The trial involves replacing diesel-powered models with electric ground equipment to supply power to parked planes. The objective of the trial is to assess the technical quality and feasibility of deploying the new electric ground equipment at the airport. Such developments act as significant driver for the growth of the GSE market by stimulating demand for electric GSE.

Impact of Russia-Ukraine War on Ground Support Equipment Industry

The conflict is expected to disrupt the global supply chain for components and equipment used in ground support equipment (GSE) manufacturing. Both, Russia and Ukraine serve as significant manufacturing centers for various industries, including aerospace and automotive sectors, which supply components essential for GSE production. Disruptions to manufacturing facilities, transportation networks, and logistics routes in these countries may cause delays in the production and delivery of GSE equipment.

Furthermore, instability in the region may cause fluctuations in prices of raw materials and commodities utilized in GSE manufacturing. Heightened geopolitical tensions can lead to market uncertainties, driving up material costs and impacting the production expenses of GSE manufacturers. Thus, leading to higher prices for GSE equipment, thereby affecting both profitability and affordability for buyers.

Recent Developments in the Ground Support Equipment Industry

- In March 2022, Textron Ground Support Equipment Inc., a subsidiary of Textron Inc., announced a collaboration with General Motors (GM) and Powertrain Control Solutions (PCS) to electrify its diverse range of ground support equipment (GSE) for the aviation industry. In this collaboration, GM and PCS have developed integrated driveline, specifically tailored for Textron GSE products, utilizing GM's lithium-ion battery systems.

- In December 2021, Textron Ground Support Equipment Inc., a subsidiary of Textron Inc., unveiled its latest innovation, the TUG 660 Li belt loader, designed to revolutionize ground support operations in the aviation industry. This new belt loader is powered by a high-performance lithium-ion electric drivetrain, offering quiet, energy-efficient, and cost-effective operation.

- In October 2023, JBT AeroTech announced a joint development agreement with Universal Hydrogen Co. for the design and development of an H2AmpCartTM, which is expected to be a hydrogen fuel cell-powered mobile battery charger for existing electrified airport ground support equipment (GSE).

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ground support equipment market analysis from 2022 to 2032 to identify the prevailing ground support equipment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ground support equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ground support equipment market trends, key players, market segments, application areas, and market growth strategies.

Ground Support Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 14.2 billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 210 |

| By Type |

|

| By Application |

|

| By Power Source |

|

| By Region |

|

| Key Market Players | Mallaghan, AERO SPECIALTIES, INC., Illinois Tool Works Inc., Guangtai, Imai Aero-Equipment Mfg. Co., Ltd, TLD, Flightline Support Ltd, Textron GSE, GATE GSE, JBT Corporation |

Analyst Review

Ground support equipment comprise equipment installed on the airports for the purpose of aircraft handling, passenger handling, and cargo handling. The demand for GSE has witnessed an increase, especially in the Middle East and Asia-Pacific, owing to rise in number of passengers, airports, and freight. However, most of the manufacturers in the GSE market are based in North America generating a significant 43.3% market share in 2016.

The ground support equipment market has witnessed immense growth, owing to rise in air traffic & cargo, increased focus of airports on enhancing operational efficiency, and high service standards. In addition, the leasing of GSE has further propelled the ground support equipment market growth.

Ground support equipment are expected to witness surge in growth rate in LAMEA, followed by Asia-Pacific, Europe, and North America. Asia-Pacific witnesses increase in requirement for aircraft in the industry and is anticipated to have the highest number of aircraft deliveries during the forecast period.

Tug Technologies Corporation, GATE GSE, Weihai Guangtai Airports Equipment Co., Ltd., Imai Aero-Equipment Mfg. Co. Ltd., Mallaghan Engineering, Ltd., AERO Specialties, Inc., Cavotec SA, Flightline Support Ltd., JBT Corporation, and Douglas Equipment Ltd. are some of the key market players that occupy a significant revenue share in the ground support equipment industry.

The global ground support equipment market was valued at $7,972.2 million in 2022, and is projected to reach $14,242.0 million by 2032, registering a CAGR of 6.2% from 2023 to 2032.

The top companies to hold the market share in ground support equipment are AERO SPECIALTIES, INC., Illinois Tool Works Inc., Textron GSE, Flightline Support Ltd., GATE GSE, Imai Aero-Equipment Mfg. Co., Ltd., JBT Corporation, Mallaghan, TLD, and Guangtai.

The largest regional market for ground support equipment is Asia-Pacific.

The leading application of ground support equipment market is aircraft handling.

The upcoming trends of ground support equipment market in the world are increase in focus towards procurement of greener GSE and surge in demand for customized and specialized ground support equipment.

Loading Table Of Content...

Loading Research Methodology...