Growlers Market Research, 2031

The Growlers Market Size was valued at $456.8 million in 2021, and is projected to reach $791.1 million by 2031, growing at a CAGR of 5.4% from 2022 to 2031. A growler is a draught beer container made of glass, ceramic, or stainless steel that is mostly used in the United States, Canada, Australia, Brazil, and other nations. Breweries and brewpubs frequently sell them to customers who want to purchase craft beer to go. Growler bottles of beer are rarely used for retail sales.

The growlers market is segmented into Material, Application, Capacity, End User and Sales Channel.

The demand for growlers is positively impacted by the increase in demand for alcohol consumption especially in the developing economies. With the growing trend of dining out, the demand for beer, red wine, whiskey, and other spirits is rising. Moreover, compared to past 10 years, the consumption of beer, wine, whiskey, and other spirits among the consumers while dining out have increased at a huge pace. With busy lifestyle, consumers prefer to relax out with a drink at the end of the day. Additionally, the major on-premise consumption of r beer, red wine, whiskey, and other spirits is high among the consumers in between the age of 18 to 34. Furthermore, the hotel, restaurant, and café (HoReCa) industry has massively expanded especially in the developing economies of Asia-Pacific, Latin America, and Africa. Therefore, the growing trend of on-premise consumption of red wine, whiskey, and other spirits is propelling the demand for growlers in the market.

Attributed to high negative impact of alcohol consumption on human health, dark spirits are heavily taxed. Furthermore, taxes on whiskey are higher than their counterparts in the U.S. In India, which is the largest consumer of whiskey in the world, the raw materials for whiskey are heavily taxed to discourage consumption. Molasses, which is one the prominent ingredients for manufacturing whiskey, is taxed at 28%. Similarly, other inputs, such as chemicals and coloring agents, are taxed below 18%. High taxation exerts negative pressure on consumers and has profound impacts on their purchasing decisions. With high taxation on whiskey, the dark spirits market continues to flounder across several regions. Therefore, with the drop in demand for whiskey and other alcoholic beverages due to tax, the demand for growlers is also dropping down in the Growlers Industry. Which shows a direct relation between the dark spirits and other alcoholic beverages and growlers.

The rise in environmental concerns related to single-use plastic pollution is likely to affect the beverage packaging industry negatively. However, major players in this industry have already started the utilization of alternatives for packaging of beverages. Bio-plastics is one of these alternatives, which is manufactured using renewable biomass sources such as corn starch, sugarcane bagasse, wood chips, saw dust, and other materials. Another advantage of bio-plastics is that it can also be utilized for engineering grade applications such as in electronics or automotive parts. According to a report published by European Bioplastics, an association researching the bioplastics industry in Europe, the global bio-plastics production capacity in 2018 was 2.11 million tons, with almost 65% volume of this production utilized for the packaging industry. Therefore, directly impacting the growlers market in the process.

The utilization of bio-plastics as an alternative to traditional petroleum-based plastics is likely to create lucrative opportunities for the growlers industry during the Growlers Market Forecast period. The implementation of bio-plastic is expected to assist in overcoming the problems faced by the industry, owing to the eradication of single-use plastic.

According to a data published by FoodDrinkEurope Association in 2018, the European food and beverage industry witnessed a growth of 0.4% in production from 2017 to 2018, and is the highest exporter of food & drink products globally. Moreover, European beverage producers are constantly upgrading their beverage packaging portfolios to provide sustainable packaging products to curb the growing environmental problems. Packaging providers are switching toward paper-based packaging to restrict plastic consumption in the European region. For instance, SIG Combibloc, Switzerland, launched combidome carton bottle with a signature packaging material. This product is used by Drink Cubed based in Germany, for their premium bottled water product named Water Cubed, which is generally packaged in single use plastic bottles. The combidome carton bottle features 100% recyclability and lower CO2 emissions than other packaging alternatives. Such alternatives are likely to create lucrative opportunities for the growth of beverage packaging industry.

Segment review

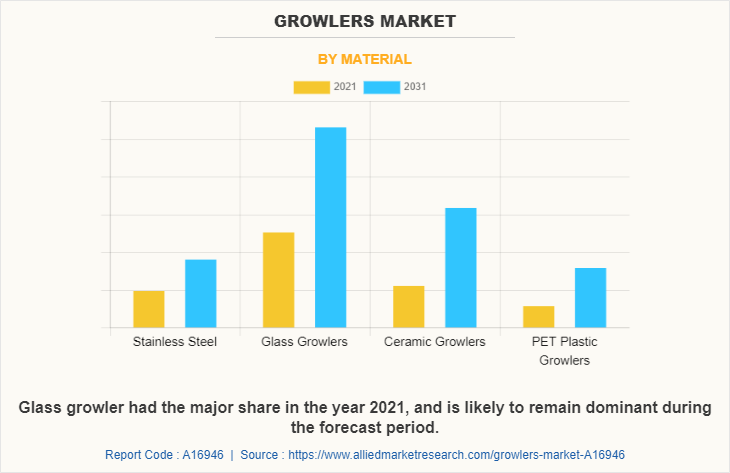

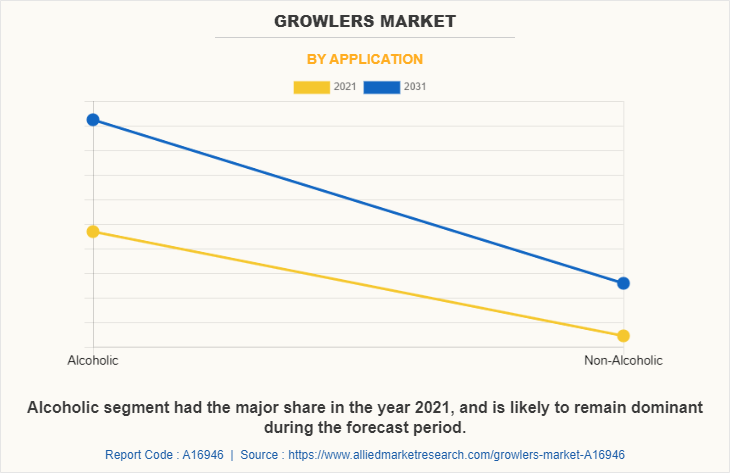

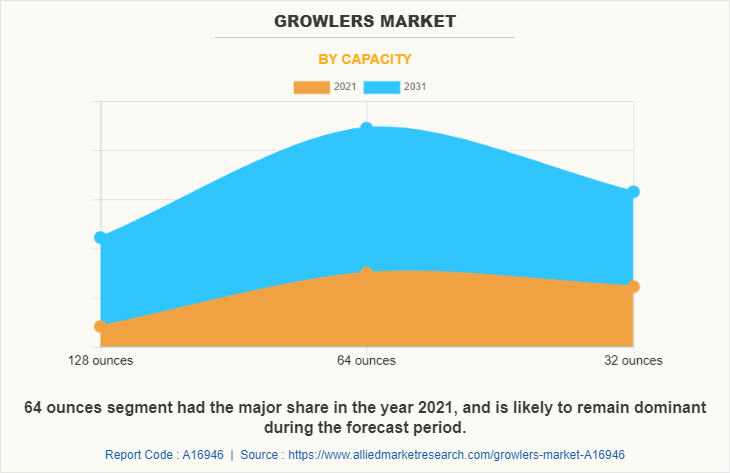

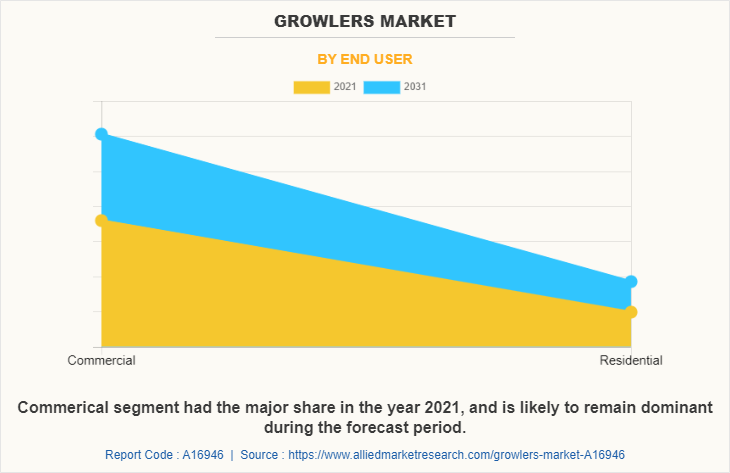

The growlers market is segmented into material, application, capacity, end user, sales channel and region. On the basis of material, the market is categorized into stainless steel, glass, ceramic and PET plastic growler. On the basis of application, the market is categorized into alcoholic and non-alcoholic. On the basis of capacity, it is fragmented into 128 ounces, 64 ounces, 32 ounces. On the basis of end user the market is bifurcated into commercial and residential. Based on sales channel the market is further divided into online and offline. Region-wise, it is analysed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, Russia, Portugal and rest of Europe), Asia-Pacific (China, India, Japan, Australia and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, South Africa, and rest of LAMEA).

Based on material, the glass growlers segment has the highest Growlers Market Size in the year 2021, and is estimated to reach $314.8 million by 2031, with a CAGR of 5.8%. This is attributed to high usage of glass material for the packaging and storage of alcohol beverages such as beers, wines, and spirits, which contain different concentrations of alcohol. Furthermore, glass provides a transparent medium, which can promote beverage sales by showing off attractive colours. In addition, a tinted glass medium doesn’t fade with time and hence, is more sustainable than plastic alternatives. In the current scenario, with consumers being more environmental conscious, the advantages of glass bottles are being recognized. Considering this, many bottle manufacturers are producing organic, multi-functional, and recyclable glass bottles to overcome pollution problems caused by single use plastic bottles. However, the ceramic growlers segment is estimated to be the fastest growing segment with the CAGR of 6.9% during the forecast period.

Based on application, alcoholic beverages dominated the global market, and is estimated to reach $561.9 million by 2031, with a CAGR of 5.1%. Alcohol consumption is considerably high in Europe and Oceania. The consumption is considerably on rise in India and Latin American countries such as Brazil and Columbia. However, alcohol consumption has become stagnant in the U.S. as consumers are switching toward healthy beverages. This created opportunities for the premium and craft beer sector. However, non-alcoholic segment is the fastest growing segment during the forecast period.

Based on capacity, The 64 ounces segment was the highest revenue contributor to the market, and is estimated to reach $322.2 million by 2031, with a CAGR of 6.1%. The 64 oz Craft Growler is the typical size for filling up at your neighbourhood brewery and also works well for sharing any alcoholic beverage, including cocktails, wine, and your beloved homebrewed cold brew.

Based on end user, the commercial segment was the highest revenue contributor to the market, with $358.3 million in 2021, and is estimated to reach $606.4 million by 2031, with a CAGR of 5.2%. Growing out door consumption of alcoholic beverages, is the main cause of growing market demand for growlers in commercial segment. Moreover, the demand for growlers is rising which is highly attributed to the rise in number of consumers who consider higher-end brands and their consumption after using a growler as a prestigious symbol of wealth and status. However, residential segment is likely to be the fastest growing segment during the forecast period.

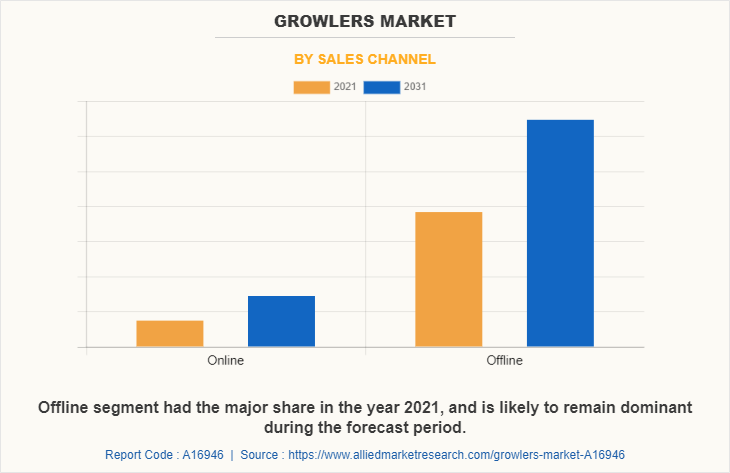

Based on sales channel, the offline segment has the highest Growlers Market Share in the year 2021, with $383.3 million in 2021, and is estimated to reach $646.5 million by 2031, with a CAGR of 5.1%. Offline growlers sales channel haves multiple advantages, including the facility of quick delivery and quick return. Furthermore, customers can visit the growlers stores and check on the shape, size and quality of the growler by touching and can also compare the product with other options available. In addition, the satisfaction rate of customers is comparatively higher, as they get personalized attention and recommendation from the sales staff, which helps them to purchase the suitable growlers. Thus, owing to numerous benefits the Growlers Market Demand for offline sales channels remains high. However, onlines sales channel have the highest Growlers Market Growth during the forecast period.

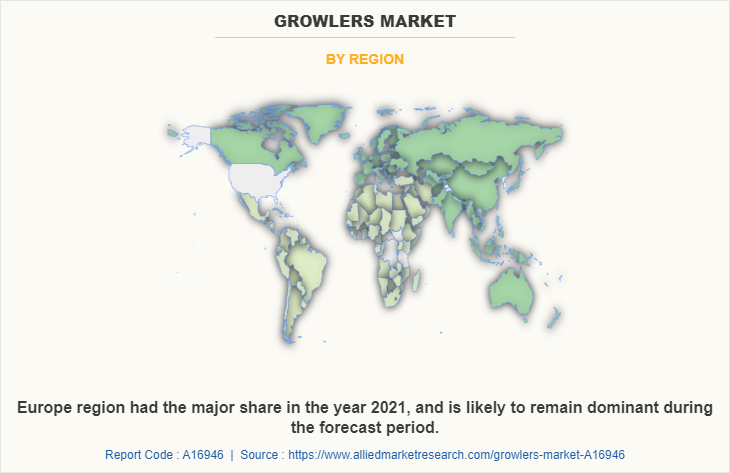

Based on region, Europe has the highest Growlers Market Share in 2021, accounting for $152.6 million in 2021, and is estimated to reach $228.6 million by 2031, with a CAGR of 3.9%. This is attributed to changing lifestyle due to considerable rise in disposable income further boosts the demand for high quality and variety of growlers in European market. To cater to the increasing demand from customers, companies are acquiring big and local players to increase their product portfolio of growlers in Europe.

The report focuses on the growth prospects, restraints, and opportunities of the global growlers market. The study provides Porter’s five forces analysis to understand the impact of various factors such as competitive intensity of competitors, bargaining power of suppliers, threat of substitutes, threat of new entrants, and bargaining power of buyers of the growlers market. Some of the major players profiled in the market analysis include Ardagh Group S.A., Alpha Packaging, William Croxsons & Sons Limited, GrowlerWerks, Inc., Global Glass Solutions, Orange Vessel Co, Berlin Packaging LLC, Boelter Companies, Inc, Drink Tanks Corporation, Zenan Glass, Novio Packaging B.V., MJS Packaging Inc, Saxco International, LLC, Hydro Flask, and Portland Growlers Company.

COVID-19 Impact Analysis

- The growlers market was negatively impacted by the COVID-19 pandemic.

- The COVID-19 pandemic had disrupted the sales of growlers via brick-and-mortar stores resulting in transition of consumers toward online sales channels to purchase alcohol products including growlers.

- However, with increase in disposable income and expansion of hospitality industry, the demand for premium growlers is likely to increase.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the growlers market analysis from 2021 to 2031 to identify the prevailing growlers market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the growlers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global growlers market trends, key players, market segments, application areas, and Growlers Market Growth strategies.

Growlers Market Report Highlights

| Aspects | Details |

| By Material |

|

| By Application |

|

| By Capacity |

|

| By End User |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | alpha packaging, MJS Packaging Inc, Portland Growlers Company, Berlin Packaging LLC, Orange Vessel Co, hydro flask, Saxco International, LLC, Novio Packaging B.V., zenan glass, Global Glass Solutions, GrowlerWerks, Inc., Ardagh Group S.A., Drink Tanks Corporation, Boelter Companies, Inc, William Croxsons & Sons Limited |

Analyst Review

The past few years have witnessed an increase in number of alcohol consumers, especially in the millennial population residing in developing countries. This increase in alcohol consumption, such as wine and whiskey, which is becoming a symbol of status drives demand for growlers. It leads to increase in use of growlers for storing and displaying drinks, which fuels demand for growlers substantially.

Growlers nowadays are being used very frequently in households and commercial establishments such as bars, pubs, and restaurants to create an impressive display of alcohol. Consumers of drinks are willing to spend exorbitant amount of money on growler that are uniquely designed, which increases aesthetics of their displays; thus, resulting in engaged stakeholders to create new, innovative designs that are completely different from traditional growlers and add a sense of novelty to the decanter. Designs such as globes, diamonds, animals, and growler with taps are likely to witness surge in both residential and commercial segments.

With alcoholic drinks being associated with wealth and status, there has been a shift in the consumer behavior, which has led to change in strategies adopted by the engaged stakeholders. Plastic is being used to make growlers, which makes them cheaper than a lot of glass growlers to facilitate the adoption with lower strata of the society. Furthermore, plastic is easy to mold, has good surface finish, and is unbreakable, as a result, growler made up of plastic are witnessing significant demand from consumers.

The global growlers market was valued at $456.8 million in 2021, and is projected to reach $791.1 million by 2031, registering a CAGR of 5.4% from 2022 to 2031.

From 2022-2031 would be forecast period in the growlers market report

$456.8 million is the market value of growlers market in 2021

2021 is base year calculated in the growlers market report

Ardagh Group S.A., Alpha Packaging, William Croxsons & Sons Limited, GrowlerWerks, Inc., Global Glass Solutions, Orange Vessel Co, Berlin Packaging LLC are the top companies hold the market share in growlers market.

Loading Table Of Content...