Guaranteed Auto Protection (GAP) Insurance Market Research, 2031

The global guaranteed auto protection (gap) insurance market was valued at $3.2 billion in 2021, and is projected to reach $8 billion by 2031, growing at a CAGR of 9.9% from 2022 to 2031.

Guaranteed Auto Protection (GAP) insurance shields the borrower in the event that the vehicle is written off by paying the gap between the true cash worth of the vehicle and the outstanding loan balance. Compact cars, lorries, and heavy trucks are the most common vehicles for which GAP coverage is employed.

An increasing need for protection against borrowers' unforeseen losses among self-financing companies and vehicle leasing companies is compelling owners and buyers to purchase GAP insurance add-on plans. In addition, a rise in the seriousness of theft claims for motor merchants and fleet owners supports the market for GAP insurance's expansion. However, lack of awareness of the advantages of guaranteed GAP insurance, a decline in new policy sales volumes, and fierce competition all restrain the expansion of guaranteed auto protection (gap) insurance market. Conversely, increasing focus on working with current vehicle insurance companies, providing advantages of guaranteed auto protection insurance awareness, and adopting comprehensive insurance with the addition of GAP insurance is anticipated to drive the guaranteed auto protection (gap) insurance market growth and also in upcoming years.

The report focuses on growth prospects, restraints, and trends of the data analytics in banking market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the data analytics in banking market outlook.

The guaranteed auto protection (gap) insurance market is segmented into Type, Application and Distribution Channel.

Segment Review

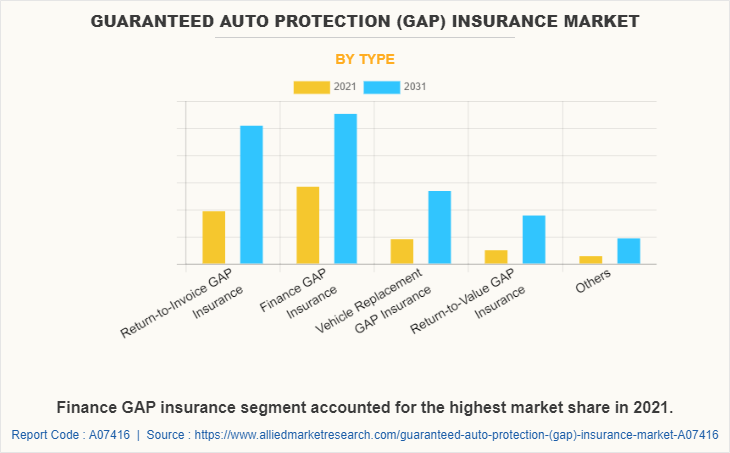

The Guaranteed Auto Protection (GAP) insurance market is segmented into type, application, distribution channel, and region. By type, the market is differentiated into return-to-invoice GAP insurance, finance GAP insurance, vehicle replacement GAP insurance, return-to-value GAP insurance and others. The application segment is segregated into passenger vehicle and commercial vehicle. The commercial vehicle is further segmented into light goods vehicle and heavy goods vehicle. The light goods vehicle is further segregated into new vehicle and used vehicle. Depending on distribution channel, it is fragmented into insurance agents/brokers, direct response and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, finance gap insurance attained the highest share in guaranteed auto protection (gap) insurance market size in 2021. This is attributed to the fact that finance GAP insurance is frequently purchased in advance, and if the car is sold or refinanced before the conclusion of the loan term, the buyer is typically entitled to a return of the unused portion of the cost.

By region, Asia-Pacific is expected to exhibit fastest growth in guaranteed auto protection (gap) insurance market forecast. This is attributed to the fact that the greatest number of vehicles used for commercial purpose strictly require a commercial auto insurance in the Asia-Pacific region, which also results in purchase of GAP insurance to avoid loss of value, therefore this is a major driving factor for the market.

The key players operating in the guaranteed auto protection (gap) insurance market include as Admiral Group Plc, Allianz, Allstate Insurance Company, American Family Insurance, Aviva, AXA, Berkshire Hathaway Inc., Chubb, Direct Gap, Kemper Corporation, Liberty Mutual Insurance Company, Majesco, Nationwide Mutual Insurance Company, Progressive Casualty Insurance Company, State Farm Mutual Automobile Insurance Company, The Travelers Idemnity Company, and Zurich. These players have adopted various strategies to increase their market penetration and strengthen their position in the data analytics in GAP insurance companies.

Top Impacting Factors

High Security and Reduced Risk on Motor Vehicles

Purchasing of a brand-new automobile is a convenient experience for people, however, once a car is driven off, it is no longer considered brand new and starts to depreciate. Occasionally, this depreciation can be as severe as 20 to 30% of the total worth. Depreciation has no effect on amount of loan. It remains unchanged and has to be paid regardless of conditions of the vehicles or drivers. For instance, if a vehicle is stolen, lost, or destroyed, the remaining balance of the loan remains due. Hence, this insurance bridges the gap between depreciated value of vehicles and the remaining sum. Moreover, in conjunction with repayments for replacement vehicles, GAP insurance has the ability to save money of people in case of a crisis. Thus, these factors propel growth of the guaranteed auto protection (gap) insurance market.

Quick Claim Settlements

The third-party protection is limitless in cases of accidents that result in bodily harm or fatalities, and the insurance provider is responsible for paying the full amount of damages. Typically, third parties file claims with the Motor Accident Claims Tribunal when there has been a death or injury (MACT). Additionally, the time it takes for a court to rule on a motor insurance claim is significantly greater. However, GAP insurance provides faster claim settlement following the receipt of required documents and full settlement of motor insurance claim. Moreover, gap insurance is intended to be used in addition to collision or comprehensive insurance. If the client files a claim that is covered, the collision coverage or comprehensive coverage will contribute to the cost of replacing the totaled or stolen car up to the depreciated worth of the vehicle. Thus, quick settlement of claim by GAP insurance is driving the growth of the market.

Increase in use of AI

Insurance business could find innovative methods to work and respond to customer needs while ensuring safety of both clients and employees. The pandemic has led to growth in transformation of the sector for a number of businesses, which have invested in IT infrastructure, improved data capabilities, preferred digital assessment, and complaints systems. New data sources and decision models can help to improve the underwriting process. Expansion of social networks, mobile technologies, and cloud services to facilitate smart functioning required by the pandemic spread, as well as legal limits, have all contributed to increase in cyber risk. Many firms are starting to see cyber security as an important business risk, demanding insurance coverage to ensure the continuity of financial operations in the event of a cyber-attack. As insurers expand to meet the demands of a digitized world, use of artificial intelligence, intelligent systems, telematics, and other advanced technologies to build tightly connected digital ecosystems has become usual. Thus, use of artificial intelligence, cloud services, innovative mobile technologies, and cyber securities are some opportunities for the GAP insurance industry.

Guaranteed Auto Protection (GAP) Insurance Market Trends

The demand for guaranteed auto protection (gap) insurance market is directly impacted by the trend of growing car prices. When cars get more expensive, people frequently need to take out loans or leases in to buy them. This practice raises the loan amount in comparison to the car's ACV. In the event of theft/complete loss, GAP insurance bridges the difference between the ACV covered by regular insurance and the remaining loan balance. This tendency is especially important in economies that are expanding or in areas where consumers are choosing more expensive cars with cutting-edge amenities. Insurers provide flexible GAP insurance products to adjust to the changing demands of customers looking for financial protection against significant depreciation and market volatility.

Guaranteed Auto Protection (GAP) Insurance Market Analysis

Based on application, the market is divided into passenger vehicles and commercial vehicles. The passenger vehicle segment dominates the market and is expected to reach over 4 billion by 2032.

A motor vehicle type intended primarily for the transportation of people rather than cargo is referred to as a passenger vehicle. These cars, which range from tiny cars to SUVs and vans, are usually smaller and provide seats for several people. Passenger cars are used for recreation, commuting, and personal mobility.

Their enclosed passenger cabins, which come equipped with airbags and seat belts for added safety and comfort, set them apart. Passenger cars are essential to daily mobility as they give people and families the freedom and accessibility to move quickly and easily from one place to another.

Based on type, the guaranteed auto protection (gap) insurance market is categorized into return-to-invoice GAP insurance, finance GAP insurance, vehicle replacement GAP insurance, return-to-value GAP insurance and others. The return-to-value GAP insurance segment is the fastest growing with a CAGR of over 10% between 2024 and 2032.

Return on Value A type of insurance known as guaranteed auto protection (gap) insurance market, or GAP insurance, pays the difference between the amount of the insurance settlement and the car's current market value in the event of a total loss or theft. Return-to-value GAP insurance focuses on compensating the depreciation loss up to the vehicle's market value, in contrast to regular GAP insurance, which covers the difference between the insurance payout and the remaining loan or lease amount.

This kind of coverage offers financial security against substantial losses in the event of an insurance claim, making it advantageous for car owners who might encounter quick depreciation or changes in market prices.

Guaranteed Auto Protection Insurance (GAP) Market Share

Allstate Insurance Company and Nationwide Mutual Insurance Company hold a significant share of over 10% in the GAP insurance industry. Allstate Insurance Company is one of the largest providers of insurance products in the United States. Through its vast network of agents and direct channels, it provides a wide range of insurance services, such as business, home, auto, and life insurance.

Allstate is renowned for its potent brand awareness, cutting-edge insurance options, and dedication to providing exceptional customer service. To improve client experiences, the business places a strong emphasis on individualized insurance solutions and makes use of cutting-edge technologies. To further demonstrate its commitment to being a good corporate citizen, Allstate also funds several neighborhood projects and disaster preparedness efforts by providing guaranteed auto protection (gap) insurance market platform.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the GAP insurance market analysis from 2021 to 2031 to identify the prevailing guaranteed auto protection (gap) insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities in guaranteed auto protection (gap) insurance market overview.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the guaranteed auto protection (gap) insurance market segmentation assists to determine the prevailing market opportunities and GAP insurance market share.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as guaranteed auto protection (gap) insurance market trends, key players, market segments, application areas, and market growth strategies.

Guaranteed Auto Protection (GAP) Insurance Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | State Farm Mutual Automobile Insurance Company, AXA, Progressive Casualty Insurance Company, Admiral Group PLC, Zurich, American Family Insurance, Direct Gap, Chubb, Allianz, Berkshire Hathaway Inc., Nationwide Mutual Insurance Company, Majesco, Aviva, Allstate Insurance Company, Liberty Mutual Insurance Company, Kemper Corporation, The Travelers Idemnity Company |

Analyst Review

The growth in the advantages of artificial intelligence (AI) technology across several industry verticals has made considerable advancement in the auto insurance market. With the use of technology, auto insurance providers can provide their clients with ongoing services such as personalized GAP insurance coverages and real-time speed limit tracking. Additionally, the GAP insurance sector is heavily dependent on AI for functions like automated underwriting, seamless streaming of customer details, and predictive analytics. Concerns about the guaranteed asset protection (GAP) insurance Market have been raised as a result of the sharp increase in the severity of theft claims for motor merchants and fleet owners.

The COVID-19 outbreak has a negative impact on the guaranteed auto protection (GAP) insurance market as automobile sales have drastically decreased. Moreover, during this global health crisis, the automobile insurance sales were also hampered owing to slump in the automobile industry. This, as a result hindered the demand for guaranteed auto protection (GAP) insurance, thereby restraining the market growth.

The Guaranteed Auto Protection (GAP) insurance market is fragmented with the presence of regional vendors such as Admiral Group Plc, Allianz, Allstate Insurance Company, American Family Insurance, Aviva, AXA, Berkshire Hathaway Inc., Chubb, Direct Gap, Kemper Corporation, Liberty Mutual Insurance Company, Majesco, Nationwide Mutual Insurance Company, Progressive Casualty Insurance Company, State Farm Mutual Automobile Insurance Company, The Travelers Idemnity Company, and Zurich. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for Guaranteed Auto Protection (GAP) insurance across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products

The GAP insurance market is estimated to grow at a CAGR of 9.9% from 2022 to 2031.

The GAP insurance market is projected to reach $7.98 billion by 2031.

The fact that it provides security and reduces risk on motor vehicle and aids in quick claim settlement majorly contribute toward the growth of the market.

The key players profiled in the report include Admiral Group Plc, Allianz, Allstate Insurance Company, American Family Insurance, Aviva, AXA, Berkshire Hathaway Inc., Chubb, Direct Gap, Kemper Corporation, Liberty Mutual Insurance Company, Majesco, Nationwide Mutual Insurance Company, Progressive Casualty Insurance Company, State Farm Mutual Automobile Insurance Company, The Travelers Idemnity Company, and Zurich.

The key growth strategies of GAP insurance market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...