Handheld X-ray Imaging Device Market Research, 2033

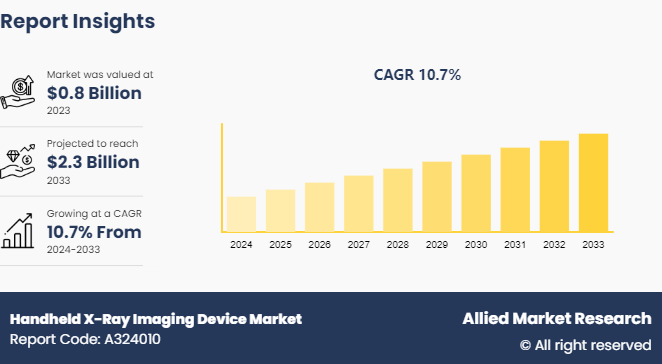

The global handheld X-ray imaging device market size was valued at $0.8 billion in 2023, and is projected to reach $2.3 billion by 2033, growing at a CAGR of 10.7% from 2024 to 2033. The handheld X-ray imaging device market is driven by the increasing demand for portable and easy-to-use diagnostic tools in various medical settings, including emergency care and remote areas. Additionally, advancements in technology that improve image quality and reduce radiation exposure are fueling handheld x-ray imaging device market growth.

Market Introduction and Definition

A handheld X-ray imaging device is a compact, portable tool used for capturing X-ray images in a variety of clinical and field settings. Unlike traditional X-ray machines, which are often bulky and stationary, handheld X-ray devices are designed to be lightweight and easily maneuverable. These devices use X-ray technology to produce diagnostic images of internal structures, such as bones and teeth, making them valuable in settings where quick and flexible imaging is required.

Handheld X-ray devices typically feature integrated sensors and digital imaging systems that allow for immediate image capture and analysis, improving diagnostic efficiency. They are particularly useful in emergency situations, remote locations, and for point-of-care applications, where traditional imaging equipment may be impractical. The convenience and mobility of handheld X-ray imaging devices represent significant advancements in medical imaging, enhancing accessibility and response times in diverse healthcare scenarios.

Key Takeaways

- The handheld X-ray imaging device market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major handheld X-ray imaging device industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The handheld X-ray imaging device market size is driven by several factors, including technological advancements, the need for portability in diverse healthcare settings, and increasing adoption in emergency and remote locations. For example, the development of high-resolution digital sensors and battery-efficient designs has significantly improved the performance and usability of handheld X-ray devices, making them more attractive to healthcare providers. Additionally, their ability to provide immediate imaging in emergency situations and remote areas where traditional X-ray machines are impractical further fuels their demand.

However, the market faces some restraints during handheld X-ray imaging device market forecast. One major concern is the high cost of advanced handheld X-ray devices, which can be a barrier for smaller healthcare facilities or those in developing regions. Furthermore, despite advancements, concerns about radiation exposure and safety remain, which can affect adoption rates and require ongoing improvements and assurances from manufacturers.

The handheld X-ray imaging device market opportunity are substantial. There is a growing potential for integration with digital health systems and electronic health records, which can streamline workflows and enhance diagnostic accuracy. For instance, integrating handheld X-ray devices with telemedicine platforms could enable remote consultations and diagnostics, expanding their utility in underserved areas.

Additionally, increasing applications in specialized fields such as dental and orthopedic care present further growth opportunities. The market also stands to benefit from ongoing innovations aimed at reducing costs and improving device accessibility, making these technologies more widely available. As manufacturers address these opportunities, they are likely to enhance market growth and broaden the adoption of handheld X-ray devices in various healthcare settings.

Market Segmentation

The handheld X-ray imaging device industry is segmented into application, end-user, and region. On the basis of application, the market is classified into dental, orthopedic, and others. Based on end user, the market is divided into hospitals & clinics, outpatient facilities, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The North American has largest handheld X-ray imaging device market share is driven by several key factors. Firstly, the increasing demand for portable and easy-to-use imaging solutions in emergency medical situations and remote locations significantly fuels market growth. Handheld X-ray devices offer the advantage of mobility and rapid imaging capabilities, making them ideal for use in various settings where traditional, stationary X-ray machines may be impractical.

Additionally, advancements in technology have led to improvements in the image quality and functionality of handheld devices, making them more appealing to healthcare professionals. The growing focus on reducing diagnostic errors and enhancing patient care further propels the adoption of these devices. Moreover, the rising prevalence of chronic diseases and the need for regular monitoring contribute to the market's expansion. Supportive government regulations and increased healthcare expenditure in North America also play a crucial role in driving the growth of the handheld X-ray imaging device market.

Industry Trends

- Innovations in sensor technology, digital imaging, and battery efficiency are enhancing the performance and capabilities of handheld X-ray devices. Advances such as high-resolution imaging and real-time data processing are making these devices more effective and reliable.

- Handheld X-ray devices are increasingly being integrated with digital health platforms and electronic health records (EHRs) . This integration facilitates seamless data sharing and improves diagnostic workflows, enhancing patient care and operational efficiency.

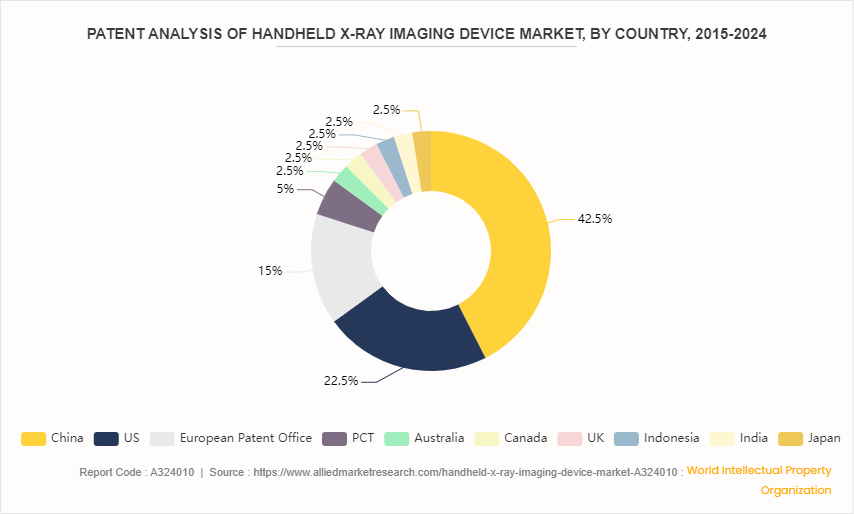

Patent Analysis, By Country, 2015-2024

China witnessed the highest number of patent approvals and applications, due to favorable government policies, new technological advancement and new product launches in the country. U.S. has 22.5% of the total number of patents, followed by European Patent Office at 15.0%.

Competitive Landscape

The major handheld X-ray imaging device market share players operating in the handheld X-ray imaging device market include Carestream Health, Inc., GE Healthcare, Philips Healthcare, Siemens Healthineers, Hologic, Inc., Fujifilm Holdings Corporation, Konica Minolta, Inc., Shimadzu Corporation, Digital X-Ray Solutions, and Canon Medical Systems Corporation. Other players in handheld X-ray imaging device market include ZKX-Ray, Mobius Imaging, LLC., Medtronic, OrthoScan, Inc., Dürr Dental SE and so on.

Recent Key Strategies and Developments

- In September 2023, Remedi, a company renowned for its radiological solutions know-how, announced REMEX KA-6, a revolutionary advancement in the medical industry. This advanced handheld X-ray gadget is low-dose and lightweight, making it the ideal instrument for precise and rapid diagnosis.

- In October 2022, Videray Technologies, Inc. announced the launch of PX Ultra. PX Ultra is the industry’s first hand-held X-ray machine with a 160 keV.

- In July 2022, Fujifilm Europe launched new hybrid C-arm and portable X-ray device. FDR CROSS is a flexible, hybrid C-arm and portable X-ray machine designed to offer high-quality fluoroscopic and static X-ray images during surgery and other medical procedures. The system can capture both fluoroscopic and radiographic images on a single platform, providing a more efficient and streamlined workflow.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the handheld X-ray imaging device market segments, current trends, estimations, and dynamics of the handheld X-ray imaging device market analysis from 2023 to 2033 to identify the prevailing handheld X-ray imaging device market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the handheld X-ray imaging device market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global handheld X-ray imaging device market Statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global handheld X-ray imaging device market trends, key players, market segments, application areas, and market growth strategies.

Key Sources Referred

- Centers for Disease Control and Prevention

- World Health Organization

- National Center for Biotechnology Information

- The Lancet

- Australian Bureau of Statistics

- Science Direct

- Health Resources and Services Administration (HRSA)

- Department of Health and Human Services (HHS)

- National Institutes of Health (NIH)

- GOV.UK

Handheld X-Ray Imaging Device Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.3 Billion |

| Growth Rate | CAGR of 10.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 260 |

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Philips Healthcare, Canon Medical Systems Corporation, Shimadzu Corporation, Hologic, Inc., Digital X-Ray Solutions, Inc, Konica Minolta, Inc., Siemens Healthineers AG, GE Healthcare, Carestream Health, Inc., Fujifilm Holdings Corporation |

The Carestream Health, Inc., GE Healthcare, Philips Healthcare, Siemens Healthineers, Hologic, Inc. held a high market position in 2023.

The base year is 2023 in handheld X-ray imaging device market.

The forecast period for handheld X-ray imaging device market is 2024 to 2033.

The market value of handheld X-ray imaging device market is projected to reach $2.3 billion by 2033.

The total market value of handheld X-ray imaging device market was $0.82 billion in 2023.

Loading Table Of Content...