Hazmat Packaging Market Research: 2031

The Global Hazmat Packaging Market Size was valued at $10.2 billion in 2021, and is projected to reach $17.2 billion by 2031, growing at a CAGR of 5.4% from 2022 to 2031. Packaging is a very important factor for any industry as proper packaging ensures safety and protects the product during transportation. Hazmat packaging is used for products that are hazardous for health and their transportation is not very easy. Hazmat packaging is a very effective way of packaging these products so that any harm to humans or the environment can be avoided. it is a safe and efficient way to transport hazardous materials such as chemicals and waste. it includes common containers for hazardous materials packaging such as drums, IBCs, pails, and bottles.

Market Dynamics

The surge in the usage of plastic containers will propel the expansion of hazmat packaging industry over the forecast period. Hazmat packaging is considered to be an important factor in the transportation of hazardous materials or products. These materials or products are capable of affecting human health or the environment in a negative manner. Hazmat packaging is an effective solution to avoid these problems. It can be done in many ways by using industrial bulk containers, flexi tanks, pails and drums. Packaging by using these products is considered as the primary packaging.

For secondary packaging of hazardous materials, corrugated boxes are commonly used. The main purpose of using hazmat packaging is the transportation of hazardous products or materials across state borders and national borders. In addition, it is also used to store hazardous materials. For shipping of hazardous materials, there are regulations and guidelines to be followed by the company. These regulations have been set by organizations such as ICAO, IATA, IMO, and U.S.DOT. In addition, during the forecast period, the market expansion will be aided by the rising oil and gas sector. As the United States' population has grown, which creates the demand for oil. Large-scale petrochemical initiatives have decreased the demand for gasoline.

The US's expanding petrochemical industry has inevitably increased demand for transportation services to move hazardous oil and gas. Furthermore, safety concerns are allayed by a number of innovative packaging, which also leaves a less environmental legacy. Pails and drums have traditionally been used extensively in the transportation of chemical materials by various industries. Although these products offer a number of advantages over similar materials, new products are filling a huge sustainability gap in the market. In addition, classes defined under hazmat packaging include infectious substances, toxics, corrosives, oxidizing substances, flammable solids, flammable liquids, gases, and explosives.

The design of hazmat packaging solution is made such that it is capable of protecting the cargo from leakage or explosion. Various details should be provided on hazmat packaging such as packing group, identification number, hazardous material classification, and shipping name marketing and labeling are considered as the primary factors for the hazmat packaging market. Hazmat packaging must be of good quality to avoid serious injuries to human life and the environment. All such factors are anticipated to boost the hazmat packaging market growth.

Segmental Overview

The hazmat packaging market is segmented into Product Type, Material Type and End-User Industry and Region. By product type, it is divided into drums, intermediate bulk containers (IBCs), pails, bottles, and Others. By material, market is classified into plastic, metal, corrugated. By end-user, it is divided into chemical, pharmaceutical, oil & gas, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

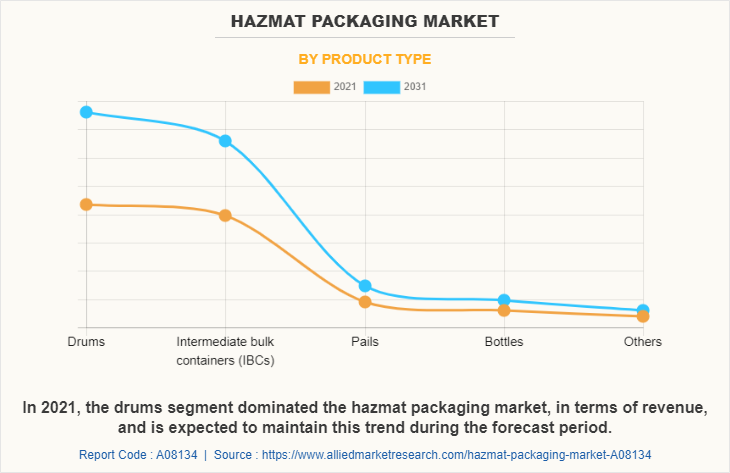

By Product Type:

On the basis of product type, it is divided into drums, intermediate bulk containers (IBCs), pails, bottles, and Others. In 2021, the drums segment dominated the hazmat packaging market, in terms of revenue, and is expected to maintain this trend during the forecast period. Drums are commonly used for the storage and transportation of hazardous as well as non-hazardous goods. In addition, rising various end-user industries such as chemicals, pharmaceuticals, and others are creating the demand for the drums for transportation of hazardous goods.

Drums have a capacity of approximately 200 litres used to store almost all classes of chemicals including pharmaceutical liquids. It is also used as a shape of returnable shipping packaging for the past few years wherein the manufacturers and logistics companies reuse the drums after taking important precautions. All such factors are expected to boost the demand for the hazmat packaging market during the forecast period.

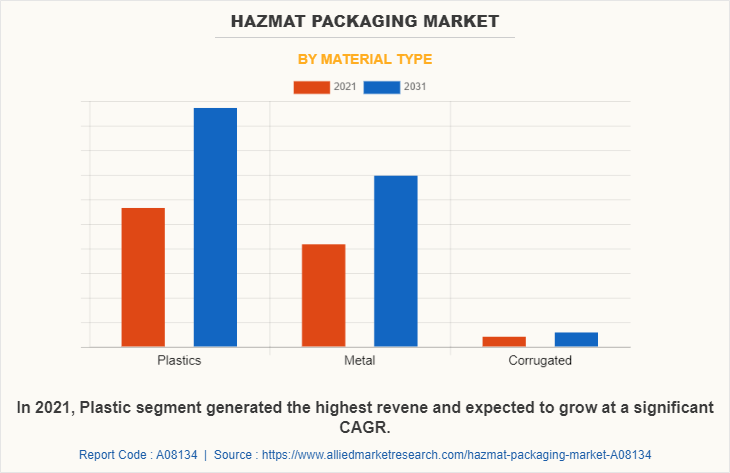

By Material Type:

The hazmat packaging market is classified into plastic, metal, and corrugated. According to the Global Plastics Outlook in February 2022, plastic production is on rise significantly. However, growth in plastic waste pollution and related problems are catching attention of various governmental organizations and hence, manufacturers are switching toward use of recycled plastic in small amounts to curb use of virgin plastic production. Thus, the plastic hazmat packaging industry is expected to grow, if environment friendly alternatives are implemented and majority of plastic waste is recycled during the forecast period.

Further, the market for plastics hazmat packaging is expected to grow in accordance with growth in healthcare and pharmaceuticals industries. This is attributed to features of plastics such as stiffness, impact resistance, and strength. The rise in the use of product such as drums, pails, IBCs and bottles are expected to boost the demand for plastic hazmat packaging. In addition, plastics are low in weight as compared to other materials such as metal and glass. All such trends are expected to lead to growth of the market.

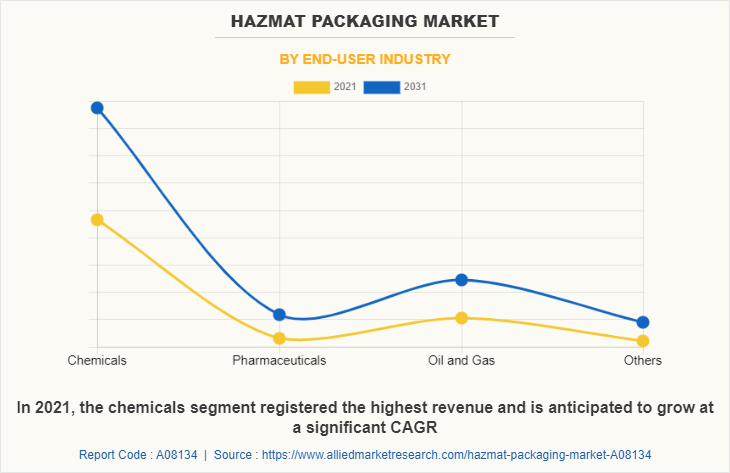

By End-User Industry:

The hazmat packaging market is categorized into chemical, pharmaceutical, oil & gas, and others. Chemical packaging is a way of enclosing chemical items in order to store, distribute, sell, and use them. Packaging safeguards, maintains, and identifies the chemical being stored and transported. The rise in demand from the chemicals and petroleum industries is a major growth driver of the hazmat packaging market. Major players are adopting various strategies such as product launch and acquisition to sustain the intense competition.

For instance, on 15 December 2022, Greif, Inc. acquired Lee container corporation Inc which is a leading producer of conventional and high-performance barrier blow molded containers, specialized in serving growth-oriented customers in the agricultural, other specialty chemical, oil & lubricant, and pet care sectors in North America. This acquisition will immediately add to the worldwide portfolio's diversification, and Lee's market mix will facilitate the company's transition to less cyclical end market exposures. Hence increase in production of chemical consumables will boost the growth of the hazmat packaging.

Rise in health awareness and the need for convenience in the highly competitive pharmaceutical packaging market necessitate brand enhancement through the production of unique packaging material. In addition, the pharmaceutical packaging business benefits from rising environmental concerns and the adoption of new regulatory criteria for packaging recycling. Adoption and compliance with regulatory norms in pharmaceutical packaging, as well as standards for packaging recycling, are further propelling the market growth.

By Region:

The hazmat packaging market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, The Asia-Pacific region has accounted for the highest share in the global hazmat packaging market share, owing to the large-scale manufacturing in the countries such as China, India, and Vietnam. Moreover, the region’s rapidly growing population and urbanization are contributing significantly to the expansion of the chemical, pharmaceutical and automotive sectors.

In addition, strong economic growth, rapid urbanization, and presence of large population base significantly contribute toward the growth of the hazmat packaging market in Asia-Pacific. Moreover, non-compliance of shipping regulations for hazardous materials results in heavy penalties, therefore, end-users prefer hazmat packaging that complies with the shipping regulations. Asia-pacific is expected to grow at the highest rate during the forecast period, owing to the increasing industrialization and urbanization, which has led to the growth of various end-user industries. Furthermore, the increasing population and rising household income in the region are expected to further drive the demand from various end-user sector such as chemical, pharmaceutical and oil and gas; thereby providing lucrative growth opportunities for the growth of the HAZMAT packaging market.

Competition Analysis

The major players profiled in the HAZMAT Packaging market include Balmer Lawrie & Co. Ltd, Fibrestar Drums Limited, Great Western Containers Inc., Grief Inc., Mauser Group, Meyer Steel Drum, Inc, Peninsula Drums Cc, Schutz Container Systems, Inc, Sicagen India Ltd, Thielmann US LLC. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the hazmat packaging market.

Some Examples of Recent Development in the Market

In May 2020 Greif Inc. developed GCube Connect IBCs, which are used for the storage and transport of liquids and free-flowing materials, in collaboration with Sigfox 0G network connectivity.

Acquisitions in the Market

In April 2020, a minority stake in Centurion Container LLC has acquired by Greif, Inc. to expand its Intermediate Bulk Container (IBC) readjustment network in North America. This investment is expected to strengthen the company's IBC and IBC reconditioning business.

In September 2020, Mauser acquired EuroVeneta Fusti. by means of this acquisition. Company expands its presence in Italy and expand its current plastic industrial packaging, steel drum packaging, and readjustment offerings of IBC services in the Italian market.

In April 2021, Mauser Packaging Solutions has acquired Global Tank Srl through Joint Venture NCG-Maider in Italy. Via this acquisition, Mauser Packaging Solutions will further extend the offering of industrial packaging products and services in the Italian market while strengthening the company’s position as the global market player in reconditioning.

In December 2022, Greif, Inc. acquired Lee container corporation Inc which is a leading producer of conventional and high-performance barrier blow molded containers, specialized in serving growth-oriented customers in the agricultural, other specialty chemical, oil & lubricant, and pet care sectors in North America. This acquisition will immediately add to the worldwide portfolio's diversification, and Lee's market mix will facilitate the company's transition to less cyclical end market exposures.

Expansion in the Market

In september 2021, Mauser Group is investing a significant amount on cutting-edge machinery to expand the production capacity of IBCs and plastic drums at its factory in Gebze, Turkey. The site expansion will also support the customer growth strategies and provide additional support for the expanding export markets in the Middle East and Eastern Europe.

Key Benefits For Stakeholders

The report provides an extensive analysis of the current and emerging global hazmat packaging market trends and dynamics.

In-depth market global hazmat packaging market analysis is conducted by constructing market estimations for key market segments between 2022 and 2031.

Extensive analysis of hazmat packaging market is conducted by following key product positioning and monitoring of top competitors within the market framework.

A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

Hazmat packaging market forecast analysis from 2022 to 2031 is included in the report.

The key players within hazmat packaging market outlook are profiled in this report and their strategies are analysed thoroughly, which help understand the competitive outlook of hazmat packaging industry.

Hazmat Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 17.2 billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 212 |

| By Product Type |

|

| By Material Type |

|

| By End-User Industry |

|

| By Region |

|

| Key Market Players | Schtz GmbH & Co. KGaA, Sicagen India Limited, Balmer Lawrie & Co. Ltd., Peninsula Drums, Mauser Group, Great Western Containers Inc., Myers Container, THIELMANN US LLC, Greif, Inc., Fibrestar Drums Limited |

Analyst Review

The hazmat packaging market has observed huge demand in North America, Asia-Pacific, and Europe. Asia-pacific is expected to grow at the highest rate during the forecast period, owing to the increasing industrialization and urbanization, which has led to the growth of various end-user industries. Furthermore, the increasing population and rising household income in the region are expected to further drive the demand from various end-user sector such as chemical, pharmaceutical and oil and gas; thereby providing lucrative growth opportunities for the growth of the HAZMAT packaging market. The drums segment generated the highest revenue in 2021, due to it is commonly used for the storage and transportation of hazardous as well as non-hazardous goods.

Various market players have adopted strategies such as business expansion and acquisition to expand their business and strengthen their market position. For instance, in December 2022, Greif, Inc. acquired Lee container corporation Inc which is a leading producer of conventional and high-performance barrier blow moulded containers, specialized in serving growth-oriented customers in the agricultural, other specialty chemical, oil & lubricant, and pet care sectors in North America. This acquisition will immediately add to the worldwide portfolio's diversification, and Lee's market mix will facilitate the company's transition to less cyclical end market exposures. As a result, such strategic moves are expected to provide lucrative growth opportunities in the global hazmat packaging market

The global hazmat packaging market size was valued at $10,187.7 million in 2021, and is projected to reach $17,237.9 million by 2031, registering a CAGR of 5.4% from 2022 to 2031.

The base year considered in the global Hazmat Packaging market report is 2021.

Drums is the leading product type of Hazmat Packaging Market.

Asia-Pacific is is the largest regional market for Hazmat Packaging.

The rise in the various end-user industries such as chemicals and pharmaceuticals are the upcoming trends of Hazmat Packaging Market in the world.

Balmer Lawrie & Co. Ltd, Fibrestar Drums Limited, Great Western Containers Inc., Grief Inc., Mauser Group, Meyer Steel Drum, Inc, Peninsula Drums Cc, Schutz Container Systems, Inc, Sicagen India Ltd, Thielmann US LLC.are the top companies to hold the market share in Hazmat Packaging.

The top 10 market players are selected based on two key attributes- competitive strength and market positioning.

The report contains an exclusive company profile section, where leading 10 companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...