Healthcare Cyber Security Market Size & Insights:

The global healthcare cyber security market was valued at USD 12.85 billion in 2020, and is projected to reach USD 57.25 billion by 2030, growing at a CAGR of 16.3% from 2021 to 2030.

Increased number of cyber-attacks and rise in demand for cloud services propel the growth of the global healthcare cyber security industry. Moreover, regulatory and government policies encouraging improvement in the security standards of the healthcare industry positively impact the growth of the healthcare cyber security market growth. However, high implementation cost of healthcare cyber security solutions hampers the market. On the contrary, increased digital dependence and industry 4.0 trends are expected to offer remunerative opportunities for expansion of the market during the forecast period.

Healthcare cybersecurity has become increasingly important. Cyber threats have been gradually increasing in recent years and many healthcare organizations have struggled to secure their network infrastructure and perimeter to keep intruders at bay. For instance, in November 2021, the CyberPeace Institute reported that the healthcare industry witnessed more than 11 million data breaches globally during the period of pandemic. Such instances fuel the need for global healthcare cyber security market in the coming years.

Segment Review:

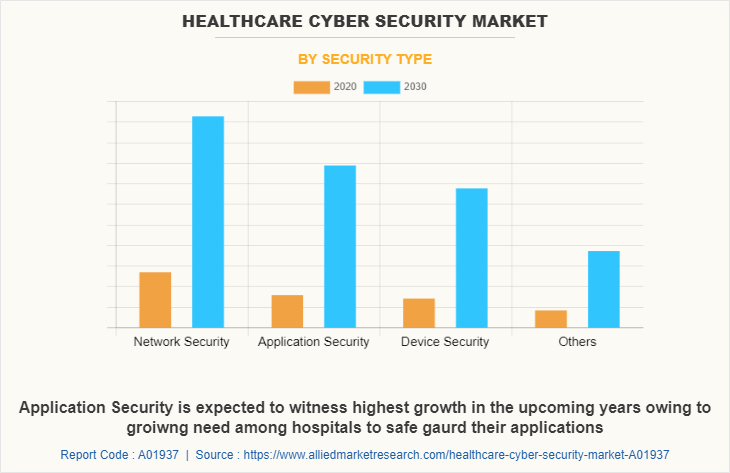

The healthcare cyber security size is segmented on the basis of component, security type, and region. On the basis of component, the industry is bifurcated into solutions and services. Depending on security type, the market is classified into network security, application security, device security, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global healthcare cyber security industry is dominated by key players such as AO Kaspersky Lab, Cisco Systems, Inc., FireEye, IBM Corporation, Lockheed Martin Corporation, McAfee Corporation, Northrop Grumman, Palo Alto Networks, SENSATO CYBERSECURITY SOLUTIONS, and Symantec Corporation. These players have adopted various strategies to increase their market penetration and strengthen their position in the healthcare cyber security forecast.

Depending on security type, the network security segment dominated the healthcare cyber security market share in 2020 and is expected to continue this trend during the forecast period as the demand for healthcare network and infrastructure security solutions are on the rise in the healthcare sector. However, the application security segment is expected to witness highest growth in the upcoming years, as healthcare and medicine sector businesses have inclined toward application security solutions to safeguard their data from cyber-criminals and fraudsters.

Region wise, the healthcare cyber security market was dominated by North America in 2020, and is expected to retain its position during the forecast period, owing to its strict healthcare privacy policies. Moreover, the increased number of cyber-attacks in the region is expected to drive the market for healthcare cyber security technology during the forecast period. However, Asia-Pacific is expected to witness significant growth during the forecast period owing to some rapid technological and economical advancements in the region, which is anticipated to fuel the growth of healthcare cyber security solutions in the region in the coming few years.

The report focuses on growth prospects, restraints, and analysis of the global healthcare cyber security market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global healthcare cyber security market share.

Top Impacting Factors:

Increased Number of Cyber-attacks and Regulatory Policies

The rise in the volume of cyber-threat vectors and attacks due to inadequate security measures is a major concern for the healthcare industry, which is projected to drive the use of security solutions. This has empowered the implementation of supporting government policies and measures to protect patient information from data breaches that is incentivizing healthcare providers to use advanced cyber security solutions to safeguard their healthcare data. For instance, the U.S. government established "the Health Insurance Portability and Accountability Act (HIPAA)" in order to encourage healthcare institutions to keep healthcare data private and secret. Such factors contribute toward the growth of healthcare cyber security market size in the coming years.

Need for Improving Authentication and Management of Healthcare Services

Strong authentication functionality is needed by healthcare organizations to guarantee that only authorized personnel have access to internal networks or specialized apps. To prevent the risks associated with common password-based authentication such as credential theft, healthcare organizations have gradually shifted to multi-factor authentication. For most cases, multi-factor authentication is accomplished by adding another element to the usual username and password. This might be a hardware and software token, a biometric verification, or a device authentication step. The usage of authentication procedures to lower the risk of cyber-attacks encourages consumers to employ effective cyber security solutions and safeguard the overall healthcare infrastructure.

Key Benefits for Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the healthcare cyber security market analysis from 2020 to 2030 to identify the prevailing healthcare cyber security market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the healthcare cyber security market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global healthcare cyber security market trends, key players, market segments, application areas, and market growth strategies.

Healthcare Cyber Security Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Security Type |

|

| By Region |

|

| Key Market Players | MACAFEE, INC., Kaspersky Lab, sensato investors, NORTHROP GRUMMA CORPORATION, Cisco Systems, Inc., FireEye, Inc., Lockheed Martin Corporation, SYMANTEC CORPORATION, ibm corporation, Palo Alto Networks, Inc. |

Analyst Review

Demand for healthcare cyber security systems has increased in the past few years and is expected to continue this trend in the coming years as well, owing to surge in cloud and digital penetration in the global healthcare sector, which enable the development of the healthcare cyber security sector. Moreover, stringent regulatory and compliance policies such as health insurance portability and accountability act of 1996 (HIPAA) in the medicine and healthcare sectors that ensure the security and privacy of patient data further establish the need for effective healthcare cyber security solutions. In addition, growth in number of data breaches and cyber-attacks on the healthcare sector promise new opportunities for the growth of the cyber security solutions in the healthcare and medicine sector.

Key providers of the healthcare cyber security market such as Cisco Systems, Inc., McAfee, LLC, and IBM Corporation account for a significant share in the market. With the growth in requirement for healthcare cyber security solutions, various companies have established partnerships to increase their healthcare cyber security capabilities. For instance, in June 2021, IBM Corporation announced partnership with U.S. Federal government to improve security policies in highly regulated industries, such as financial services, telecommunications, and healthcare. IBM has leveraged its hybrid cloud environment to provide more efficient management solutions, working with a group of internal IBM experts and external advisors, including former government officials with decades of cybersecurity experience, the center is expected to leverage IBM technology and host workshops focused on priorities such as zero trust frameworks and cloud security, complemented by access to IBM Research labs to collaborate around the future of encryption.

In addition, with rise in demand for healthcare cyber security, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in November 2021, Cisco system Inc., announced the launch of their Country Digital Acceleration (CDA) program to accelerate digitization across the country of Thailand and support an inclusive recovery from the COVID-19 pandemic.

Moreover, market players have expanded their business operations and customer reach by increasing their acquisition. For instance, in February 2020, McAfee, LLC announced the acquisition of Light Point Security, LLC, an award-winning pioneer of browser isolation. This acquisition aims to extend McAfee’s MVISION Unified Cloud Edge (UCE) capabilities for Secure Access Service Edge (SASE).

Increase in in digital and internet penetration around the world and rise in in awareness regarding data privacy and security signals drives the growth of the market.

North America is the largest regional market for healthcare cyber security due to various companies having their headquarter in the U.S. region and growing penetration of cyber security solution among various hospitals, healthcare providers and others.

The healthcare cyber security market size was valued at $12.85 billion in 2020, and is projected to reach $57.25 billion by 2030, growing at a CAGR of 16.3% from 2021 to 2030.

The top companies to hold the market share in the healthcare cyber security market are Cisco Systems, Inc., IBM Corporation, Lockheed Martin Corporation, McAfee Corporation, and Symantec Corporation.

Loading Table Of Content...