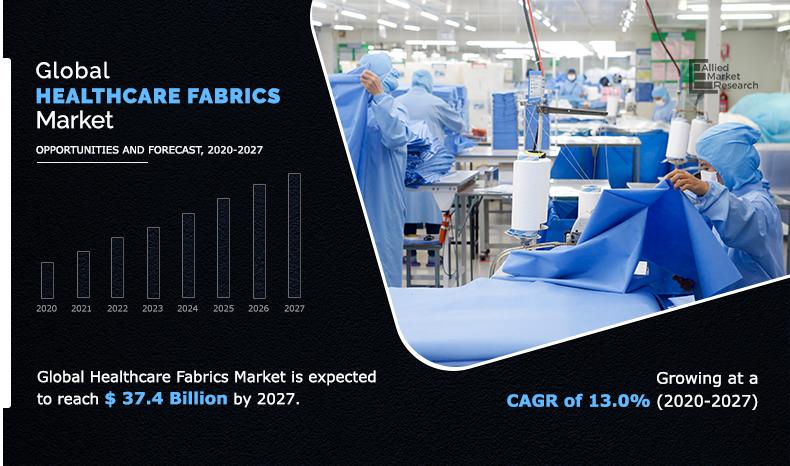

Healthcare Fabrics Market Research– 2027

The global healthcare fabrics market size was valued at $15.9 billion in 2019, and is projected to reach $37.4 billion by 2027, growing at a CAGR of 13.0% from 2020 to 2027. The rising demand for antimicrobial and infection-control fabrics is significantly driving the healthcare fabrics industry, as these materials are essential for minimizing the risk of hospital-acquired infections and promoting hygiene. In addition, the demand for comfortable, durable, and lightweight fabrics is increasing as healthcare providers and patients prioritize ease of use, flexibility, and comfort in medical settings. As a result, this factor drives the demand for the healthcare fabric market in the forecast period.

Introduction

Healthcare fabrics are specialized textiles designed and manufactured for use in medical and healthcare applications. Healthcare fabrics are engineered to meet the specific demands of the healthcare environment, offering features such as antimicrobial properties, durability, comfort, and ease of maintenance. They are widely used across various sectors, such as hospitals, surgical centers, home healthcare, rehabilitation, and personal protective equipment.

Market Dynamics

The primary goal of healthcare fabrics is to reduce the risk of contamination and the transmission of pathogens and diseases within the tissue. Health care fabrics are in high demand due to their waterproof, highly flexible, flame retardant, strain-resistance, and antimicrobial properties. Healthcare fabrics are made especially for various applications in the healthcare industry. These fabrics were created for use in medical and hygiene applications. Polypropylene, polyester, cotton, viscose, polyamide, and other fibers can be used to make healthcare fabrics. The fibers used in the healthcare industry should possess antimicrobial, fire-resistant, non-allergic, and non-carcinogenic properties.

One of the fastest growing segments of the medical textile industry is healthcare fabrics. The growth of the sector has been aided by the emergence of medical and healthcare facilities in developing countries.

Healthcare fabrics are mostly used in hospitals to avoid the spread and expansion of bacterial diseases, due to rising number of hospitalizations. Increased spending on personal hygiene items such as sanitary napkins, baby diapers, and adult diapers as well as continued technical advancements aimed at improving quality and performance parameters, are expected to drive the global healthcare fabric market. Moreover, the number of working women around the world as well as government campaigns to encourage use of sanitary napkins even in rural areas are expected to propel the healthcare fabrics market during the forecast period.

However, a marginal decrease in duty drawback rates could hamper market expansion. The availability of menstrual cups as a substitute for sanitary napkins is expected to limit the healthcare fabrics market growth. Product developments also contribute to the introduction of high-end goods to the market through increasing competition among market leaders.

The global healthcare fabrics market is segmented based on raw material, fabric type, application, and region. By raw material, the market is classified into polypropylene, cotton, polyester, viscose, polyamide, others. Based on fabric type, the healthcare fabricmarket is segmented into non-woven, woven and knitted. Based on application, the market is divided into hygiene products, dressing products, clothing, blanket & bedding, upholstery, privacy curtains, and others. Based on region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some of the key players operating in the global healthcare fabrics market are Ahlstrom Munksjo OYJ, Asahi Kasei Corporation, Avgol Ltd, Berry Global Group Inc., Carnegie Fabrics LLC, Eximius Incorporation, Freudenberg Group, Kimberly-Clark Corporation, Knoll Inc., and Paramount Tech Fab Industries.

Global Healthcare Fabrics Market, By Raw Materials

By raw material, because of the high demand for use in hygiene products, polypropylene had the largest share in the healthcare fabrics market in 2019. Since polypropylene is used in the top sheet of hygiene products, increased demand for sanitary napkins and baby wraps is driving the demand for the material.

By Raw Material

Polypropylene is projected as the most lucrative segment.

Global Healthcare Fabrics Market, By Fabric Type

By fabric type, because of their excellent absorption properties, softness, smoothness, strength, comfort and fit, stretch ability, and cost-effectiveness, nonwoven fabrics are used as a substitute for conventional textiles.

By Fabric Type

Non-woven is projected as the most lucrative segment.

Global Healthcare Fabrics Market, By Application

By application, in 2019, the hygiene application segment accounted for the largest share of the healthcare fabrics market, with an expected CAGR of 11.6% over the forecast period. This is primarily due to rising consumption of sanitary napkins and baby diapers globally.

By Applications

Hygiene Products is projected as the most lucrative segment.

Global Healthcare Fabrics Market, By Region

By region, Europe held the largest share in the healthcare fabrics market in 2019 up to 39.6%, due to the increasing adoption of female hygiene products in countries, such as India, and China.

By Region

Europe holds a dominant position in 2019 and would continue to maintain the lead over the forecast period.

Key Benefits For Stakeholders

- The report provides an in-depth analysis of the healthcare fabrics market forecast along with the current and future market trends.

- This report highlights the key drivers, opportunities, and restraints of the market along with the impact analyses during the forecast period.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the global healthcare fabrics industry for strategy building.

- A comprehensive healthcare fabrics market analysis covers factors that drive and restrain market growth.

- The qualitative data in this report aims on market dynamics, trends, and developments.

Key Market Segments

By Raw Material

- Polypropylene

- Cotton

- Polyester

- Viscose

- Polyamide

- Others

By Fabric Type

- Non-woven

- Woven

- Knitted

By Application

- Hygiene products

- Dressing products

- Clothing

- Blanket & bedding

- Upholstery

- Privacy curtains

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- Italy

- Spain

- UK

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Healthcare Fabrics Market Report Highlights

| Aspects | Details |

| By RAW MATERIAL |

|

| By FABRIC TYPE |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | ASAHI KASEI CORPORATION, Kimberly-Clark Corporation, Knoll Inc., Avgol Ltd, Paramount Tech Fab Industries, Berry Global Group Inc., .Carnegie Fabrics LLC, AHLSTROM-MUNKSJÖ, .Eximius Incorporation, Freudenberg Group |

Analyst Review

According to the CXO of the leading companies, in its business life cycle, the global demand for healthcare fabrics is heading toward a period of growth stabilization. Increased knowledge of hygiene products through promotions is primarily driving the healthcare fabrics market, and advertisement is primarily driving the healthcare fabrics market. Polypropylene is the most important raw material used in healthcare fabrics. Since polypropylene is used to make the top sheet of hygiene items, such as sanitary napkins and baby diapers, the polypropylene segment is expected to witness growth during the forecast period.

The non-woven fabric segment was the largest segment in 2019, and is expected to remain dominant during the forecast period. Because of their excellent absorption properties, softness, smoothness, strength, comfort and fit, stretch ability, and cost-effectiveness, nonwoven fabrics are used as a substitute for conventional textiles. Hygiene is the largest application of the healthcare fabrics market. The demand for hygiene products is being driven by the growing importance of healthcare fabrics in the manufacturing of baby diapers and sanitary napkins. Furthermore, increase in disposable income, and surge in birth rates are expected to drive the healthcare fabrics market in hygiene products. However, during the forecast period, Europe is expected to have the highest CAGR. Increasing health and hygiene awareness is driving the demand for feminine hygiene products, which is expected to boost the demand for healthcare fabrics in Europe.

The global healthcare fabric Market is projected to grow at CAGR of 13.0% during the forecast period

Hygiene products, dressing products and clothing application is projected to increase the demand for healthcare fabrics market

Non-woven fabric is the leading segment in the healthcare fabric market

The number of working women around the world as well as government campaigns to encourage use of sanitary napkins even in rural areas are expected to propel the healthcare fabrics market during the forecast period

Asahi Kasei Corporation, Avgol Ltd, Berry Global Group Inc., Carnegie Fabrics LLC, Eximius Incorporation, Freudenberg Group, and Kimberly-Clark Corporation are the leading players in healthcare fabric market

During the COVID-19 outbreak, the high consumption rate of medical garments and other fabrics-based items is expected to fuel the demand in the global healthcare fabrics market

Europe region hold the highest share in the healthcare fabric market

The market growth is primarily due to the growing awareness of hygiene products coupled with the availability of highly efficient and innovative products in the market.

Loading Table Of Content...