Heat Meters Market Research, 2032

The global heat meters market size was valued at $1.6 billion in 2022, and is projected to reach $2.7 billion by 2032, growing at a CAGR of 5.4% from 2023 to 2032. The increase in adoption of district heating systems, driven by a global shift toward centralized, energy-efficient heating solutions, has significantly fueled the demand for heat meters. These systems enable the efficient distribution of thermal energy across large urban areas or industrial complexes, thus requiring accurate measurement and monitoring of energy consumption.

Report Key Highlighters:

- The global heat meters market has been analyzed in terms of value ($Million). The analysis in the report is provided on the basis of type, application, 4 major regions, and more than 15 countries.

- The global market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

- The heat meters market is fragmented in nature with few players such as Danfoss A/S, Diehl Stiftung & Co. KG, Honeywell International Inc., Ista Energy Solutions Limited, Kamstrup, Landis+Gyr Group AG, Qundis, Sensus, Siemens AG, and Sontex SA.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the heat meters industry.

- Countries such as China, U.S., India, Germany, and Brazil hold a significant share in the global heat meters market.

Introduction

A heat meter is a device used to measure the amount of thermal energy delivered by a heating or cooling system. It calculates energy consumption by measuring the flow rate of a heat transfer fluid, such as water or steam, and the temperature difference between the supply and return flow. It is commonly used in district heating and cooling systems, as well as in residential and commercial buildings, heat meters provide accurate data on energy usage. This allows for fair billing based on actual consumption and promotes energy efficiency by helping users monitor and optimize their energy use.

Market Dynamics

The growing adoption of district heating systems significantly boosts the demand for heat meters. These meters are crucial for accurately measuring and allocating heat consumption within expansive networks. According to the International Energy Agency (IEA), district energy network is a key factor that meets zero-carbon heating and cooling, with 350 million connections in cities globally targeted by 2030. The expansion of these systems is projected to provide about 20% of global space heating needs. As district heating becomes more prevalent, heat meters play a pivotal role in billing transparency, ensuring fair distribution of costs based on individual usage. They enable precise monitoring, encourage efficient energy use, and facilitate compliance with regulations mandating individual metering. Moreover, heat meters support optimization efforts, aiding in system efficiency enhancements and promoting sustainable practices in district heating systems, commercial buildings, industrial processes, and residential heating systems. All these factors are expected to drive the demand for the heat meters market during the forecast period.

However, the high initial cost of heat meters acts as a barrier to their widespread adoption. This cost deters potential users, especially where the investment might not immediately demonstrate a clear return. The expense of purchasing and installing heat meters, particularly in large-scale or retrofitting projects, presents a financial challenge. Budget constraints or competing priorities delay or prevent their adoption. However, the long-term benefits of energy savings, fair billing practices, and compliance with regulations justify the investment in heat meters.

The integration of heat meters with smart technologies represents a transformative growth in energy management. Real-time data on thermal energy consumption becomes readily accessible by combining heat meters with smart systems. This integration enables remote monitoring, predictive maintenance, and optimization of heating systems. It empowers users to analyze consumption patterns, make informed decisions, and adjust settings for improved efficiency. Moreover, connectivity with smart grids or IoT ecosystems allows for intelligent energy distribution and load management, shaping a more responsive, efficient, and sustainable energy landscape. All these factors are anticipated to offer new growth opportunities in the heat meters market forecast.

Segments Overview

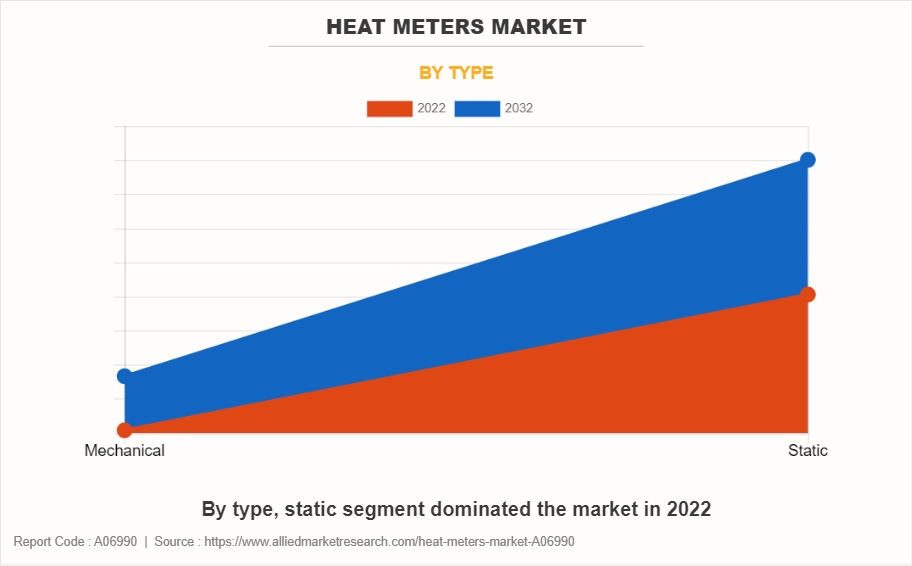

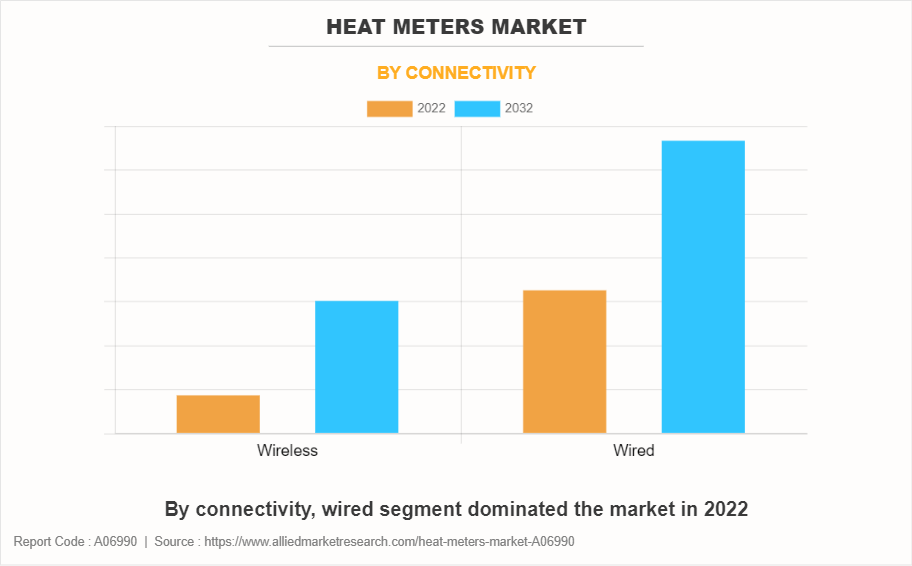

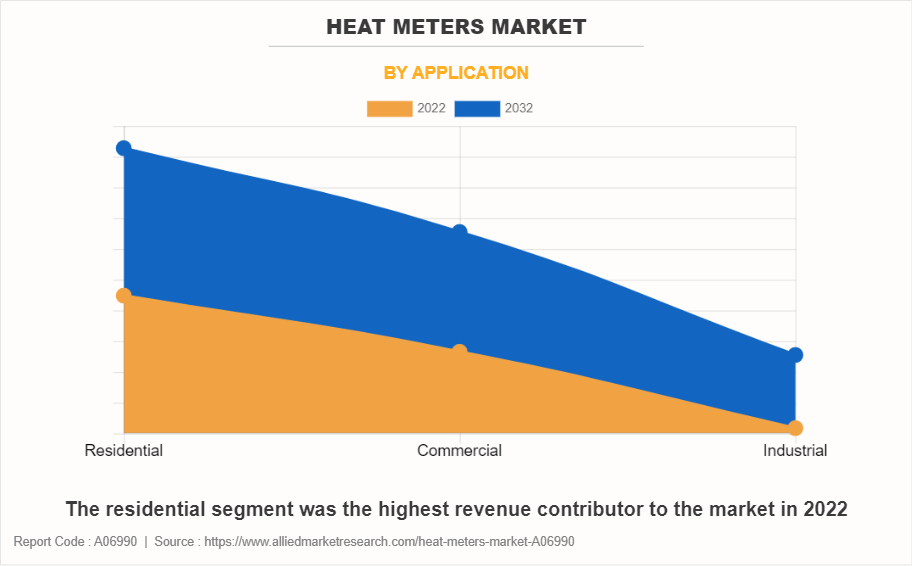

The heat meters market is segmented on the basis of type, connectivity, application, and region. On the basis of type, the market is bifurcated into mechanical and static. On the basis of connectivity, the market is divided into wireless and wired. On the basis of application, the market is segmented into residential, commercial, and industrial. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

Static heat meters are known for their accuracy and stability in measuring thermal energy, making them suitable for a wide range of applications such as district heating, individual apartment heating, and industrial processes. Moreover, static heat meters utilize advanced measurement technology, often employing ultrasonic or electromagnetic sensors. These sensors offer high precision in capturing heat consumption data, ensuring accurate measurements even in varying flow rates and temperatures.

By Connectivity

Wired heat meters play a vital role in smart city initiatives and urban planning. These meters, integrated into city-wide heating networks, provide accurate data on energy consumption in residential and commercial areas. This information empowers city planners to make informed decisions about infrastructure development, energy distribution, and sustainability measures, contributing to more efficient and environmentally friendly urban landscapes. All these factors are anticipated to offer new growth opportunities for the wired heat meter during the forecast period.

By Application

Heat meters offer residents valuable insights into their heating consumption patterns. Access to this data empowers homeowners or tenants to make informed decisions about energy usage and encourages the adoption of energy-efficient practices. All these factors are anticipated to offer new growth opportunities for heat meters in residential applications during the forecast period.

By Region

North America accounted for less than two-fifths of the global heat meters market share in 2022 and is expected to maintain its dominance during the forecast period. The integration of renewable energy sources such as solar and geothermal energy drives the demand for heat meters in North America. These meters play a crucial role in measuring and monitoring the efficiency of renewable heating systems.

Pricing and Cost Structure Analysis

The pricing and cost structure analysis of the heat meters market is influenced by various factors including the type of technology used, manufacturing costs, regional demand, and regulatory requirements. Heat meters vary in price depending on their complexity, accuracy, and features. Ultrasonic and electromagnetic heat meters, which offer higher precision and durability, tend to be priced higher compared to traditional mechanical meters. The integration of smart metering technology, which enables remote monitoring and data collection, also adds to the overall cost of the device.

In addition, manufacturing costs play a significant role in determining the final pricing. Components such as sensors, flow meters, and digital displays contribute to the overall production cost. Labor, raw materials, and R&D expenditures impact the cost structure. Regional variations in labor and material costs, along with import duties and taxes, lead to price differences across various markets. Moreover, as regulatory bodies increasingly mandate the installation of energy-efficient devices, manufacturers are compelled to meet specific standards, which drive the production costs but offer long-term benefits in energy savings and environmental compliance.

Competitive Analysis

Key players in the heat meter industry include Danfoss A/S, Diehl Stiftung & Co. KG, Honeywell International Inc., Ista Energy Solutions Limited, Kamstrup, Landis+Gyr Group AG, Qundis, Sensus, Siemens AG, and Sontex SA. Apart from these major players, there are other key players in the heat meters market growth. These include Apator Group, Krohne Messtechnik GmbH, Axioma Metering, Secure Meters, Zenner, Schlumberger Limited, Itron, Bmeters Srl, Micronics Ltd, and Diehl Stiftung & Co. KG.

In the heat meters market, companies have adopted acquisition and product launch to expand the market or develop new products. For instance, in November 2020, Sensus launched the next-generation PolluStat meter to enhance thermal energy management in Europe. This advanced meter is designed with energy efficiency in mind to help with conservation measures. Also in January 2022, Landis+Gyr Group AG acquired Luna, which is a provider of smart meters. Luna is a provider of smart metering devices for electricity, water, and heat and associated software solutions, with headquarters in Izmir, Turkey. These developments are expected to drive market growth during the forecast period.

Historical Trends of Heat Meters:

- The concept of heat meters traces back to the late 19th century when initial experiments and documentation emerged around measuring heat energy in various systems. This period saw the earliest attempts to quantify heat flow, mainly for industrial purposes and steam-based technologies. However, these early heat measurement devices were rudimentary and lacked accuracy.

- Advancements in thermodynamics and instrumentation during the early to mid-20th century significantly improved heat meter technology. Innovations in flow measurement, temperature sensors, and heat exchange theory bolstered the accuracy and applicability of heat meters. These improvements led to broader industrial use, especially in heating systems for buildings and industrial processes.

- By the late 20th century, heat meters began to see more widespread adoption, particularly in Europe for monitoring and billing purposes in district heating systems. Improved accuracy and reliability due to technological advancements in sensor technology and data processing supported their integration into energy-efficient practices.

- In the early 21st century, further refinements in heat meter technology such as enhanced sensor capabilities and more sophisticated data analysis methods, led to higher accuracy and efficiency. Additionally, regulatory bodies began to emphasize standardized requirements for heat meter installations, aiming to improve energy efficiency and accountability.

- During the mid-2010s, the heat meters market experienced growth, driven by increased awareness of energy conservation and sustainability. Advanced smart metering technologies, incorporating wireless connectivity and data analytics, emerged, offering more efficient and convenient heat measurement solutions for both residential and commercial applications.

- In the late 2010s and early 2020s, ongoing advancements in sensor technology, coupled with the integration of Internet of Things (IoT) capabilities, led to the development of more intelligent and interconnected heat metering systems. These systems measure heat consumption accurately and facilitate remote monitoring and control, optimizing energy usage and promoting sustainability.

Key Potential Factors That Drive The Heat Meters Market Demand:

In the global heat meters market, an increasing number of companies have adopted product launch and acquisition with other firms to expand the market or develop new products. For instance, November 2020 Sensus launched the next-generation PolluStat meter to enhance thermal energy management in Europe. This advanced meter is designed with energy efficiency in mind to help with conservation measures. Also in January 2022, Landis+Gyr Group AG acquired Luna, which is a provider of smart meters. Luna is a provider of smart metering devices for electricity, water and heat and associated software solutions, with headquarters in Izmir, Turkey. This development helps to drives the market expansion of the company and profitable growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the heat meters market analysis from 2022 to 2032 to identify the prevailing heat meters market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the heat meters market value, segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global heat meters market trends, key players, market segments, application areas, and market growth strategies.

Heat Meters Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.7 billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Connectivity |

|

| By Application |

|

| By Type |

|

| By Region |

|

| Key Market Players | Danfoss A/S, Honeywell International Inc., Landis+Gyr Group AG, Siemens AG, QUNDIS GmbH, Sontex SA, Sensus, Ista Energy Solutions Limited, Diehl Stiftung & Co. KG, Kamstrup |

Analyst Review

According to the opinions of various CXOs of leading companies, the heat meter market is expected to grow during the forecast period. Surge in the adoption of district heating systems and rise in demand for energy efficiency have increased the demand for heat meters.

Heat meters are instrumental devices utilized for measuring and monitoring the consumption of heat energy in residential, commercial, and industrial settings. These meters employ advanced technology to accurately gauge and record heat usage, facilitating efficient energy management and billing processes. They play a pivotal role in enhancing energy efficiency and sustainability by providing precise data for heating systems.

The growth trajectory of the heat meter market is propelled by a growing emphasis on energy conservation, stringent regulatory measures promoting energy efficiency, and rise in awareness of environmental impact. These factors collectively drive the demand for precise heat measurement and management systems, encouraging the adoption of heat meters across diverse industries. In addition, the market expansion is further bolstered by technological advancements in heat metering systems, leading to the development of more sophisticated and accurate devices. Continuous innovation in sensor technology, data analytics, and connectivity features has resulted in more reliable and efficient heat meters. These advancements enable better monitoring, analysis, and control of heat consumption, thereby empowering users to make informed decisions to optimize energy usage.

Integration with smart technologies is the upcoming trend in the heat meters market in the world.

Residential is the leading application of heat meters market.

North America is the largest regional market for heat meters.

Increase in adoption of district heating systems and rise in demand for energy efficiency are the leading drivers for the heat meters Market.

Asia-Pacific is the fastest growing region for the heat meters market.

The global heat meters market was valued at $1.6 billion in 2022, and is projected to reach $2.7 billion by 2032, registering a CAGR of 5.4% from 2023 to 2032.

Key players in the heat meter industry include Danfoss A/S, Diehl Stiftung & Co. KG, Honeywell International Inc., Ista Energy Solutions Limited, Kamstrup, Landis+Gyr Group AG, Qundis, Sensus, Siemens AG, and Sontex SA.

Loading Table Of Content...

Loading Research Methodology...