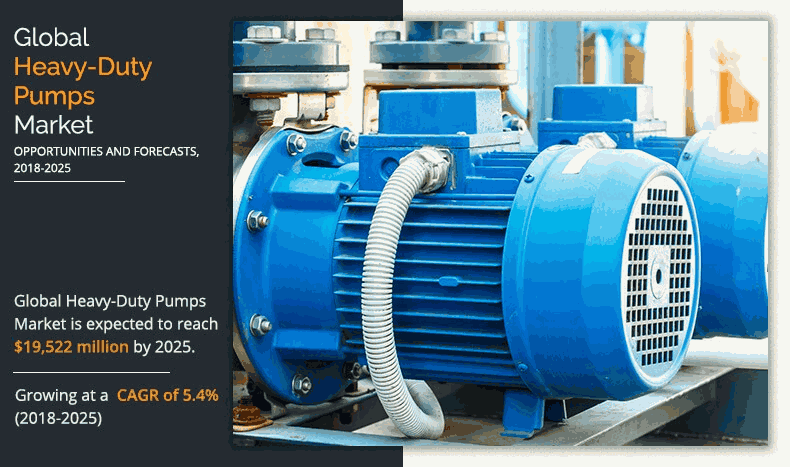

Heavy-duty Pumps Market Outlook - 2025

Heavy-duty pump is an industrial pump which is used to transfer highly viscous, corrosive, or abrasive products such as chemicals, sewage, crude oil, and others proficiently from one location to another. The global heavy-duty pumps market size was $12,823 million in 2017, and is projected to reach $19,522 million in 2025, growing at a CAGR of 5.4%

An increase in demand for electricity and power consumption is observed globally, that further fuels, the power industry, and thereby boosts the need of heavy-duty pumps. In addition, the surge in oil consumption worldwide fuels the oil & gas sector, which in turn generates opportunities for the heavy-duty pumps market. In addition, market players are adopting new strategies such as acquisitions, business expansions, and others to boost the growth of the heavy-duty pumps industry.

Market Dynamics

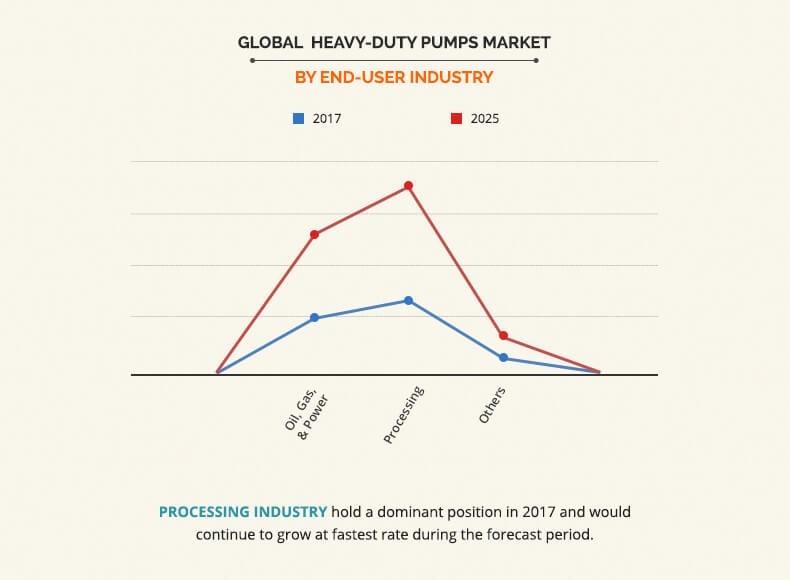

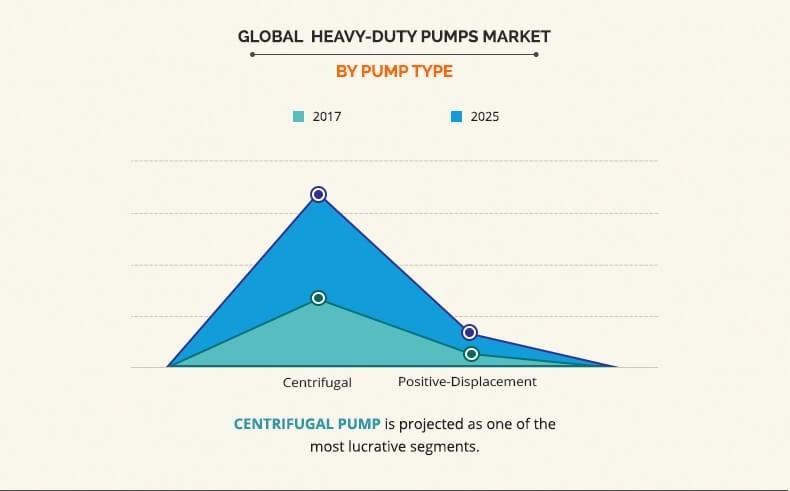

The global heavy-duty pumps market share is segmented based on pump type, product type, end-user industry, and region. Based on pump type, the market is bifurcated into centrifugal pump and positive-displacement pump. The centrifugal pump segment is anticipated to dominate the global market throughout the study period. Based on product type, the market is categorized into crude oil, fuel oil, asphalt, and others. The crude oil segment is projected to dominate the global heavy-duty pumps market throughout the study period. Based on end-user industry, the market is categorized into oil, gas, & power, processing, and others. The processing industry segment accounts for the maximum market share.

Pump Type

Region

The following graph exhibits the growth potential of various regions in the market. The heavy-duty pumps market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Among these, Asia-Pacific holds a significant share in the global market, owing to rise in demand for food & beverage and portable water in the region. The Asia-Pacific market is projected to register the highest CAGR of 6.2% followed by LAMEA. North America and Europe possess high growth potential, due to increase in demand for oil & gas as well as fresh drinking water. Rapid urbanization, growth in population, and increase in awareness regarding water & wastewater management have facilitated widespread adoption of heavy-duty pumps.

Key Benefits for Heavy-duty Pumps Market:

- The study provides an in-depth analysis of the global heavy-duty pumps market along with the current trends and estimations to elucidate the imminent investment pockets.

- Information about the key drivers, restraints, and opportunities and their impact analyses on the market size is included in the study.

- Porter’s five forces analysis illustrates the potency of the buyers and the suppliers operating in the industry.

- The quantitative analysis of the global heavy-duty pumps market forecast from 2017 to 2025 is provided to determine the market potential.

Heavy-duty Pumps Market Report Highlights

| Aspects | Details |

| By PUMP TYPE |

|

| By PRODUCT TYPE |

|

| By END-USER INDUSTRY |

|

| By Region |

|

| Key Market Players | GARDNER DENVER, INC., THE WEIR GROUP PLC, ALFA LAVAL, SULZER LTD., GRUNDFOS, GENERAL ELECTRIC COMPANY, KSB SE & CO., ITT INC., EBARA CORPORATION, FLOWSERVE CORPORATION |

Analyst Review

Heavy-duty pumps are widely used in the past few years in many industries such as oil & gas, food & beverage, petrochemicals, pulp & paper, and others, thereby stimulating the growth of the market. In addition, rise in infrastructural improvement and urbanization is also estimated to fuel the heavy-duty pumps market.

The market players have developed new ways to improve efficiency, and productivity of heavy-duty pumps. Heavy-duty pumps can efficiently perform heavy-duty applications such as slurry transfer, fuel oil transfer, asphalt transfer, and others. Moreover, manufacturers have implemented new technologies such as smart pipes, and others to boost the demand for heavy-duty pumps. For instance, ITT Inc. has developed technological devices such as PumpSmart Controllers and i-ALERT2 equipment health monitoring devices to control pumps, and thus, such new innovations generate revenue for the market.

Growth in demand for portable and clean water in regions such as Europe, and others drive the market growth. In addition, the features of heavy-duty pumps such as easy maintenance and high reliability are expected to propel the growth of the heavy-duty pumps market.

The factors that drive heavy-duty pumps market growth are an increase in the installation of food processing plants, oil, gas, & power processing plants, and the growth of the oil & gas industry.

Acquisitions & business expansion are the key growth strategies of heavy-duty pumps market players.

To get latest version of heavy-duty pumps market report.

The key trends in the heavy-duty pumps market are upsurge in demand for wastewater management and rise in awareness about energy saving and government regulations.

Asia-Pacific will provide more business opportunities for heavy-duty pumps in the future.

On the basis of top growing big corporation, we select top 10 players.

The leading players in the heavy-duty pump market are Alfa Laval, EBARA Corporation, Flowserve Corporation, Gardner Denver, Inc., General Electric Company, Grundfos, ITT INC.

By pump type, the centrifugal pump segment holds the maximum share of the heavy-duty pump market throughout the study period.

The expected market value of heavy-duty pumps by 2025 would be $19,522 million.

The potential customers of the heavy-duty industry are the oil & gas industry and power generation industry.

Loading Table Of Content...