Heavy-Duty Trailer Market Insights, 2032

The global heavy-duty trailer market size was valued at $12,933.9 million in 2022, and is projected to reach $21,113.2 million by 2032, registering a CAGR of 5.1% from 2023 to 2032.

Report Key Highlighters:

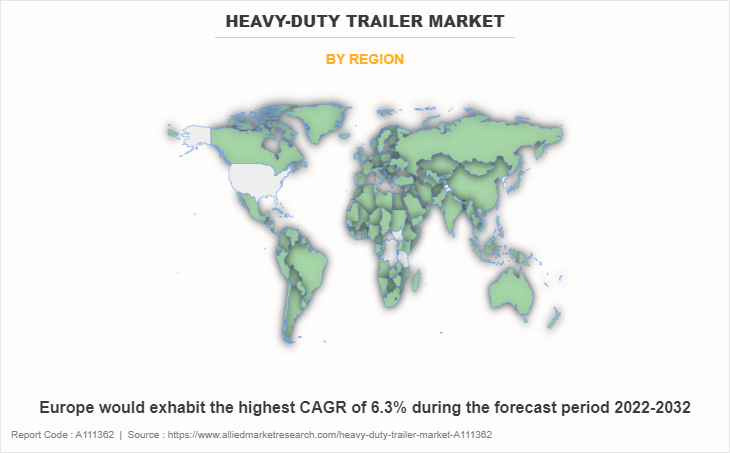

- The heavy-duty trailer market study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The heavy-duty trailer market share is highly fragmented, into several players including Fontaine Trailer, Great Dane, Lider Trailer, MAC Trailer Manufacturing, Polar Tank Trailer, Trail King Industries, Utility Trailer, Wabash National Corporation, Wilson Trailer and XL Specialized Trailers. The companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

A heavy-duty trailer is a kind of trailer that is made to carry big loads or equipment. These trailers are typically used in transportation, mining, construction, and agriculture—industries where moving big, bulky objects calls for a strong, long-lasting trailer. Heavy-duty trailers, built with reinforced frames and parts to withstand the stress of moving large loads, are available in different designs suitable for diverse transportation needs. They may come as flatbeds suited for transporting big machines or lowboy types perfect for carrying oversized cargo; there are also refrigerated trailers designed specifically to carry liquids.

Large construction equipment like excavators, bulldozers, and cranes typically require these specialized heavy-duty trailers due to their significant weight and dimensions. As a result, construction companies move their equipment to job sites more efficiently, minimizing downtime and project delays. This not only saves time but also reduces labor and fuel costs associated with multiple trips or disassembly and reassembly of equipment. Moreover, the transport of goods in the mining industry heavily relies on heavy-duty trailers. These trailers carry enormous quantities of ore, minerals, or coal from mining sites to processing facilities or ports for export. By accommodating these heavy loads, they help mining companies maximize their production output and optimize their supply chain logistics.

The growth of the global heavy-duty trailer industry is driven by expansion of logistics industry coupled with the increase in cold chain transportation, rise in industrialization, and increase in preference toward e-tailing and extra carriage capacity of the trailers. However, factors such as the high maintenance cost of the trailers and rise in environment concerns regarding refrigerated trailer restrain the market growth. On the contrary, increase in customized and specialized trailers and increase in attention to trailer platooning are expected to provide lucrative growth opportunities for the heavy-duty trailer market growth.

In addition, globalization and international trade have expanded the demand for heavy-duty trailers. To ship goods across borders and continents, the need for reliable and durable trailers to transport heavy cargo has grown. International trade relies heavily on shipping containers, and specialized heavy-duty trailers are often used to transport these containers from ports to distribution centers and beyond. Moreover, the need for sustainability and environmental considerations is influencing the demand for specialized heavy-duty trailers. Manufacturers are developing eco-friendly trailers that are more fuel-efficient and produce fewer emissions, aligning with the global push for greener transportation solutions.

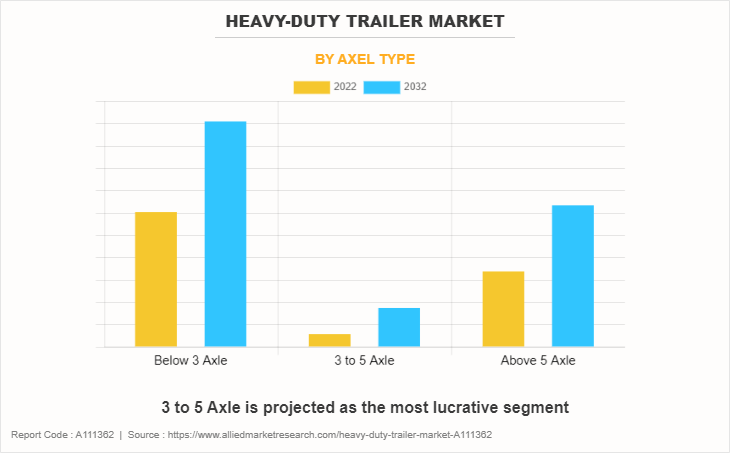

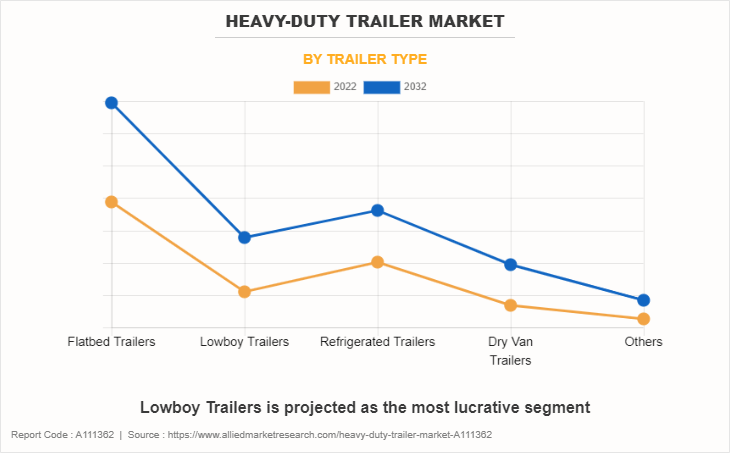

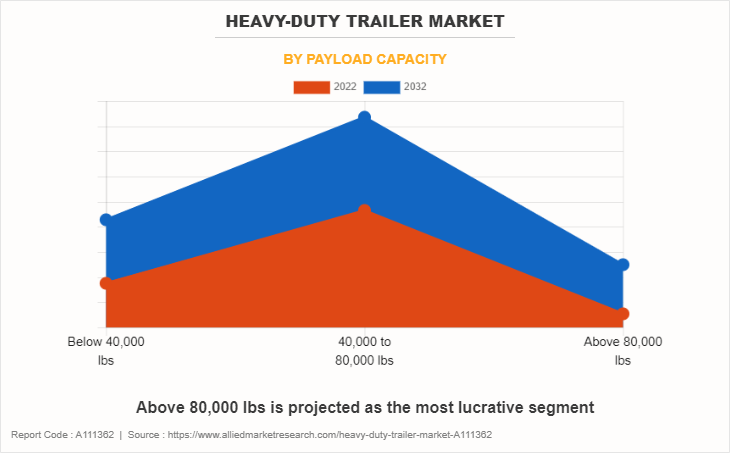

The global heavy-duty trailer market is segmented on the basis of trailer type, axle type, payload capacity, and region. Depending on the trailer type, the market is segregated into flatbed trailers, lowboy trailers, refrigerated trailers, dry van trailers, and others. By axle type, it is categorized into below 3 axle, 3 to 5 axle, and above 5 axle. Based on the payload capacity, it is fragmented into below 40,000 lbs., 40,000 to 80,000 lbs., and above 80,000 lbs. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The heavy duty trailer market in Asian countries has witnessed significant growth and is poised to offer compelling opportunities in the coming years. Rapid industrialization and a growing logistics industry in the Asia-Pacific region are driving up demand for heavy-duty trailers. Industrial growth has also led to an increase in freight transportation, necessitating more of these vehicle types. Forecasted is a 4% rise in medium- and heavy-duty vehicles production specifically from mainland China by July 2023; representing significant year-over-year growth since the previous corresponding period (26%). The necessity for reliable transport options like heavy duty-trailers has been amplified due to trade liberalisation such as through initiatives like Regional Comprehensive Economic Partnership which have enhanced cross-border trading activity across countries within this geographic zone. In addition, automakers in the region are collaborating to develop to transform cold-chain transportation in developed countries in Asia. For instance, in April 2023, The TB Business Group of CIMC Vehicles and Yutong Light Truck agreed to partner in the interests of meeting the growing demand for fresh food, e-commerce and express transportation in China. China, too, has seen new policies roll out including the need for logistics companies to invest in safer, higher-quality road transport equipment. The strategic cooperation between TB Business Group of CIMC Vehicles and Yutong Light Truck is reported to be not only in line with the development concept of both parties, adhering to science and technology as the core, but is also closely related to a number of exclusive technologies held by them.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In September 2023, Wabash National Corporation, the visionary leader of connected solutions, logistics and distribution industries, signed an agreement with Rockland Flooring for laminated wood trailer flooring. This agreement is important for better serve in the future in the transportation industry.

- In November 2022, Trail King Industries launched Trail King Sliding Axle trailer. TKSA features are low load angle, more corrosion protection and smoother, precise operation.

- In April 2022, MAC Trailer Manufacturing acquired the Bullet Trailer. This facility is formally MAC Bullet Manufacturing, Inc, and this expansion is a crucial move towards continued growth in the western region.

- In August 2020, Fontaine Trailer launched the Fontaine Magnitude 60LCC, that hauls 60-ton loads in 13 ft. with four axles close-coupled.

Expansion of logistics industry coupled with the increasing cold chain transportation

Road transportation is the most utilized mode of transportation in the logistics sector as it offers better cost advantages over other modes. Thus, logistics is one of the key end-use industries for heavy-duty trailers. In addition, rapid expansion of manufacturing, agriculture, electronics, and textile & apparel industries increases the demand for logistics & supply chain services. Moreover, most companies rely on third-party logistics companies to decrease investments in fleet, reduced workforce, and availability of various types of containers, tanks, and flatbeds as per the requirement of companies.

Furthermore, dependence of e-commerce companies on logistics service providers to ensure transportation of goods through warehouse and distribution hub has increased, owing to the significant expansion of e-commerce activities. Thus, logistics companies primarily less than truckload (LTL) and full truckload (FTL) freight shipping companies are increasingly adopting heavy-duty trailers due to the versatility being offered in terms of load-carrying capacity. Also, trailers offer the lowest cost of transportation per ton per km as compared to rigid trucks, which further enhances its adoption for logistics operations. Furthermore, the worldwide need for cold chain logistics is rising due to the escalating global demand for perishable goods like pharmaceuticals, poultry, fresh flowers, fish, dairy items and produce. This surge can be attributed to an increase in disposable income within developing nations that has enabled consumers to allocate more towards purchasing fresh organic and high-quality products.

Rise in industrialization and increase in preference toward e-tailing

As industrialization becomes more prevalent globally, there is a growing demand for efficient transportation and logistics solutions to cater to the movement of goods and materials. Heavy-duty trailers are vital in this context due to their capability of transporting large volumes over great distances efficiently. The rise in e-commerce has further increased the need for such services as it intensifies the flow of products from manufacturers through distribution centers right up till end consumers. E-retail is highly dependent on an effective supply chain, heavy-duty trailers form an indispensable part ensuring swift and secure product delivery. These trailers are designed to carry heavy loads, receive different types of cargo and meet the requirements of long-distance transport, making them indispensable in the modern logistics environment.

High maintenance cost of the heavy-duty trailers

One of the major factors hindering the growth of the global heavy-duty trailer market is the high maintenance cost that must be incurred. On average, the productive life of a new trailer is about 15 years, if maintained appropriately. However, a heavy-duty trailer comes with an air ride suspension, which costs more than the conventional trailers. The maintenance costs increase when the suspension is used for three years and after. Furthermore, the average lifespan of a trailer tire ranges between 25000 and 50000 miles, thus the replacement of tires further increases the maintenance cost of the vehicle. In addition, reefer trailers are equipped with a number of components including compressor, condenser, and an evaporator, which demands regular maintenance, thereby increasing the maintenance cost. Thus, such high maintenance costs act as a barrier for the growth of the heavy-duty trailer market.

Increase in customization and specialized trailers

As businesses across various sectors seek to optimize their logistics and transportation operations, there is a growing need for trailers tailored to their specific requirements. Customization in trailer design and manufacturing allows for the creation of solutions that precisely match the cargo and operational demands of businesses. This can include specialized features like temperature-controlled compartments for the pharmaceutical or food industry, low-bed trailers for heavy machinery transportation, or flatbed trailers with customized securing mechanisms for construction materials.

For instance, in March 2023, Talbert Manufacturing completed a customized version of its 60CC-RC fixed four-axle close-couple trailer, offering enhanced weight distribution options and a reinforced deck for greater versatility to meet load requirements in a variety of states. Furthermore, the rise of e-commerce and last-mile delivery services has generated a demand for trailers designed to optimize urban deliveries, featuring maneuverability and ease of access. These trends are spurring innovation and driving investments in the heavy-duty trailer market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the heavy-duty trailer market analysis from 2022 to 2032 to identify the prevailing heavy-duty trailer market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the heavy-duty trailer market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global heavy-duty trailer market trends, key players, market segments, application areas, and market growth strategies.

Heavy-Duty Trailer Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 21.1 billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 325 |

| By Axel Type |

|

| By Trailer Type |

|

| By Payload Capacity |

|

| By Region |

|

| Key Market Players | XL Specialized Trailers, Polar Tank Trailer, Trail King Industries, Fontaine Trailer, Wabash National Corporation, Great Dane LLC., Wilson Trailer, Utility Trailer, MAC Trailer Manufacturing, Lider Trailer |

The global heavy-duty trailer market was valued at $12,933.9 million in 2022, and is projected to reach $21,113.2 million by 2032, registering a CAGR of 5.1%.

Expansion of the logistics industry coupled with the increasing cold-chain transportation, rise in industrialization and increase in preference towards e-talling and extra carriage capacity of the trailers

The leading application of the heavy-duty trailer market is flat bed trailers.

The largest regional market for heavy-duty trailer market is Asia-Pacific.

The top companies are Fontaine Trailer, Great Dane, Lider Trailer, MAC Trailer Manufacturing, Polar Tank Trailer, Trail King Industries, Utility Trailer, Wabash National Corporation, Wilson Trailer and XL Specialized Trailers.

Loading Table Of Content...

Loading Research Methodology...