The global helicopter simulation market size was valued at $1 billion in 2021, and is projected to reach $1.8 billion by 2031, growing at a CAGR of 6.1% from 2022 to 2031.

Helicopter simulation is a technology that artificially reproduces the flight and flight environment of an airplane for the purpose of pilot training and design. Helicopter simulation is employed during flight training to provide pilots with a unique opportunity to develop their navigational abilities while operating under both visual and instrumental flight regulations.

Helicopter simulation can be programmed to practice a specific route before a prepared flight. Training with helicopter simulation reduces the actual training required in a helicopter and provides a cost-effective way for pilots to practice both routine and rarely used skills. It also offers cost-effective tools to enable pilots to build flight time, practice techniques, and prepare for emergencies that would be impossible to train for in a real helicopter.

The growth of the global helicopter simulation market is driven by rise in air passenger traffic, surge in defense expenditure, increase in concern regarding passenger safety, and rise in number of pilot training institutes. However, high purchase cost, operating cost, and frequent maintenance cost hampers the growth of the market. Furthermore, rise in adoption of virtual reality and AI in helicopter simulation and greater demand for simulators from civil and commercial aviation are factors expected to offer growth opportunities during the forecast period.

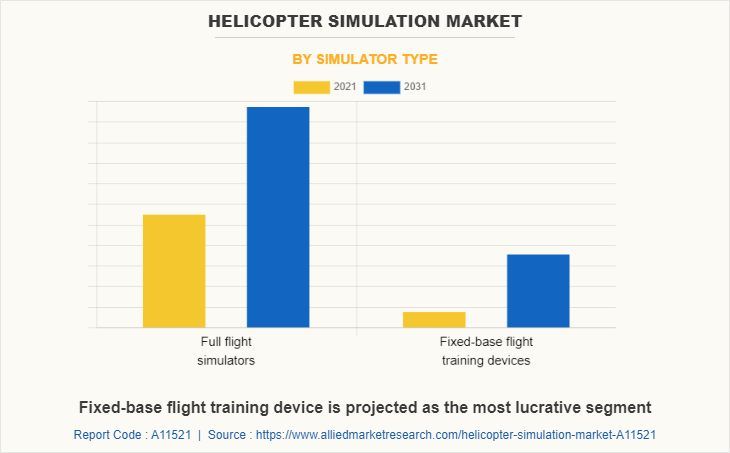

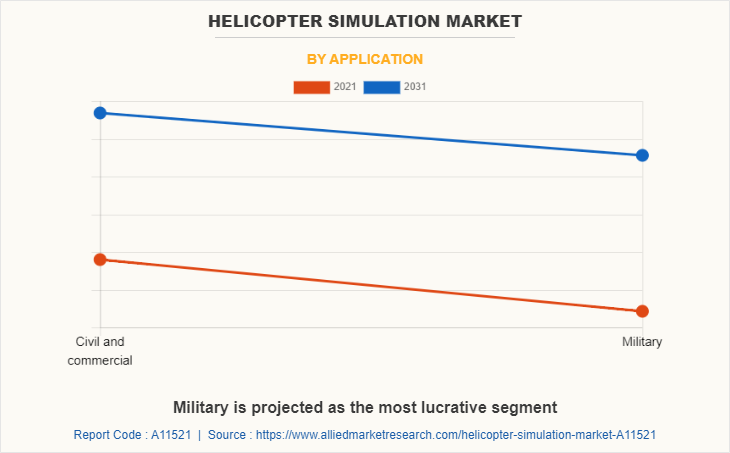

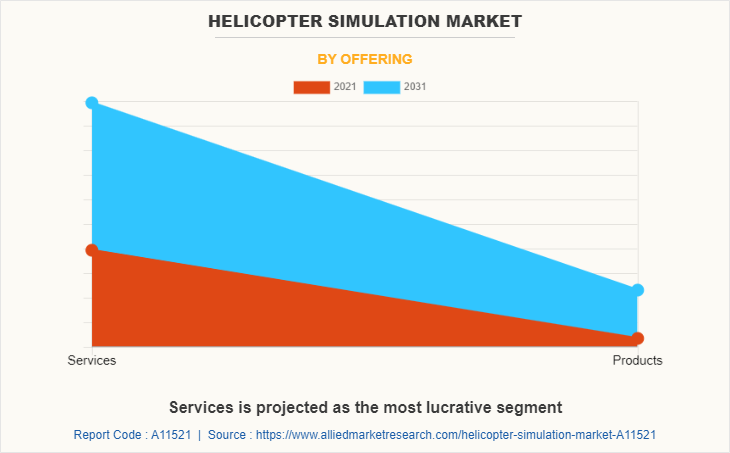

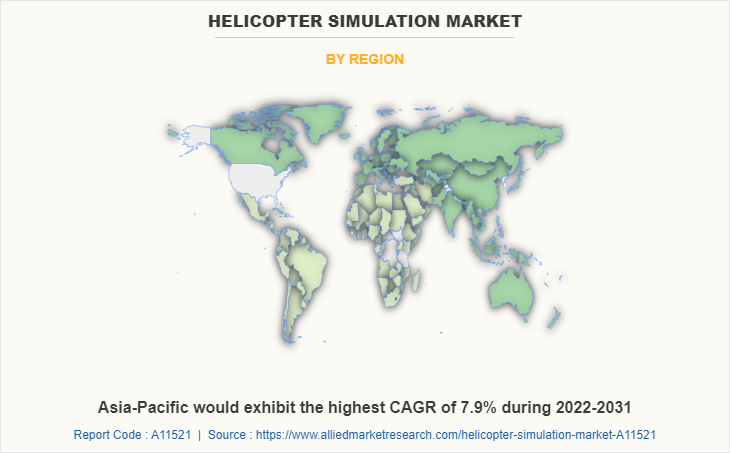

The helicopter simulation market is segmented on the basis of offering, simulator type, application, and region. By offering, it is fragmented into services and products. By simulator type, it is categorized into full flight simulators and fixed-base flight training devices. By application, it is classified into civil and commercial, and military. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

North America includes countries such as the U.S., Canada, and Mexico. Development of the state-of-the-art components that enhance the efficiency of helicopter simulators is being carried out by several companies such as CAE Inc., Collins Aerospace, and others, which is expected to fuel the expansion of the helicopter simulator market in North America. For instance, Collins Aerospace provide transportable-black hawk operations simulator, a flight training device (FTD) capability for UH-60L and UH-60M helicopters.

Factors such as increasing concerns regarding strengthening the air defense skills and the demand for helicopter simulators by the U.S. Air Force coupled with upgrades to the existing equipment contributes to the growth of market in the region. In addition, the development of new helicopter simulator to deal with unfavorable occurrences and the procurement of military helicopters simulator further supplement the market growth in the region. For instance, in November 2021, RYAN AEROSPACE (Australia) has been awarded a series of contracts to supply nearly 300 jet fighter and helicopter training simulators to the U.S. Air Force as part of the Pilot Training Transformation (PTT) program.

Furthermore, strict Federal Aviation Administration regulations and Federal Aviation Regulations, including Section 61.64 regarding the use of flight simulators for training purposes further fuel market growth in this region. Also, the availability of advanced military and commercial infrastructure is expected to boost the helicopter simulator market in the region.

The development of helicopter simulator for emergencies that would be impossible to train for in a real helicopter, and also cost-effective tools to help pilots build flight time, & practice techniques are anticipated to create significant demand for advanced helicopters simulator market in the U.S. For instance, in April 2022, the U.S. Marine expanded CH-53K heavy lift helicopter training with addition simulators, and Containerized Flight Training Device (CFTD) provided by Lockheed Martin under a contract between the U.S. Navy and Lockheed Martin.

In addition, in December 2020, CAE USA was awarded a contract by the U.S. Army to provide classroom, simulator, and live flying instructor support services for Army aviators training to fly the CH-47 Chinook, UH-60 Black Hawk, and AH-64 Apache helicopters at the U.S. Army’s Aviation Center of Excellence (USAACE) at Fort Rucker, Alabama. Similarly, in February 2022, The U.S. Naval Air Systems Command has awarded Sikorsky a $99 million VH-92A aircraft simulators and trainers’ contract in support of the Presidential Helicopter Program. Such developments are envisioned to drive the growth prospects of the market in the U.S. during the forecast period.

Some leading companies profiled in the report include Elbit Systems Ltd., Airbus, Lockheed Martin Corporation, Thales, Indra Sistemas, S.A., Textron Inc., ATC Flight Simulator, FLYIT Simulators, Inc., Berkshire Hathaway, and CAE Inc. These leading companies are adopting various strategies such as product launch, partnerships, and contracts to strengthen their market position. In April 2022, CAE Inc. received an order from NATO Support and Procurement Agency (NSPA) to deliver a second full-mission simulator (FMS) to support German NH90 Sea Lion naval helicopter training, expanding an existing contract which was signed in 2019.

In July 2022, Airbus partnered with VRM Switzerland for development of virtual reality-based simulator for H125 helicopter. In July 2022, Thales and Atlantic Airways signed a contract for one AW139 Reality H Level D Full Flight Simulator. The Faroe Islands, located in the North Atlantic between Iceland and Norway, will serve as a hub for advanced AW 139 training, promoting safer helicopter operations worldwide.

Increase in air passenger traffic

The growth in passenger air traffic has translated into an increase in demand for professional pilots worldwide. As air travel resumes and air passenger traffic increases post covid, the airline industry is expected to drive the demand for new pilots. U.S. aircraft and helicopter manufacturers currently need 602,000 pilots, 610,000 maintenance technicians, and 899,000 flight attendants to safely support the recovery of commercial aircraft and staff aircraft over the next 20 years. Therefore, the surge in air passenger traffic drives the demand for highly qualified and trained pilots, which is expected to boost the growth of the market.

Helicopters provide a safe, fast way to avoid time-consuming travel between destinations. Global aircraft operator Air Charter Service experienced an over 150% increase in helicopter flights during summer 2021 compared with the same period in the previous year. Castle Air, a helicopter charter business based at London Biggin Hill Airport also experienced a similar uptick in demand, with 2021 marking its busiest since the company launched.

Rise in defense expenditure

Governments of countries such as Russia, the U.S., China, India, and others are increasing investment in armed forces to establish dominance on the battlefield. In April 2022, according to Stockholm International Peace Research Institute (SIPRI), total global military expenditure increased by 0.7% in 2021, to reach $2,113 billion. The five largest spenders in 2021 were the U. S., China, India, the U.K., and Russia, together accounting for 62% of expenditure. Also, total global military expenditure rose to $1,981 billion in 2020, an increase of 2.6 percent from 2019.

Moreover, governments of countries such as the U.K., India, China, Russia, the U.S., and others are significantly spending on military modernization programs to improve their firepower and upgrade their weapons & surveillance capabilities. For instance, in August 2022, the Ministry of Defense in Tokyo planned for a $40.4 billion budget request for the fiscal year 2023. The Japan Maritime Self-Defense Force (JMSDF) requested $24.6 million to convert two Izumo-class helicopter carriers (JS Izumoto and JS Kaga) into carriers capable of operating Lockheed Martin F-35B fighter jets. Therefore, the rise in defense expenditure is expected to drive the growth of the market during the forecast period.

Rise in number of pilot training institutes

The aviation industry has witnessed a growing global demand for pilots, resulting in high demand for pilot training institutes. For instance, in July 2022, India's Ministry of Aviation announced plans to establish flight schools in the country to train large number of civilian pilots. The Airports Authority of India approved the establishment of nine more flight schools in the country. The pilot training institutes develop long-term partnerships with airlines and aircraft operators to provide training programs to pilots to generate sustainable revenue over the long term.

Greater use in civil and commercial aviation

A flight simulator artificially reproduces the flight environment of an airplane and is useful for training pilots and designing helicopters in the aviation sector. It's a system that combines software and hardware to allow users to simulate flying helicopters. The increase in commercial air travel has created a demand for active and efficient pilots, leading to a rise in demand for flight simulators.

Globalization has led to a surge in air travel for business and leisure, increasing the demand for training for commercial helicopter pilots. Widespread adoption of virtual flight environments for training purposes in commercial and civil aviation and the rise in need for cost-effective pilot training programs are expected to accelerate the growth of the market during the forecast period. Commercial and civil airlines continue to gravitate toward flight simulation technology to take advantage of the benefits these platforms offer, including reduced operational costs.

High purchase cost, operating cost, and frequent maintenance cost

A helicopter simulator system consists of various components that handle different functionalities. These systems provide real-world environments for flight control. Helicopter systems influence and respond to external factors such as clouds, precipitation, air density, and turbulence. These factors must be integrated into the helicopter simulation systems to create a replica of real flight maneuvers. These factors increase the cost of helicopter simulation systems. The high cost of manufacturing and acquiring these systems and cockpit procedure training is expected to hinder the growth of the market. Therefore, high purchase, operating, and frequent maintenance cost is expected to hamper the growth of the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the helicopter simulation market analysis from 2021 to 2031 to identify the prevailing helicopter simulation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the helicopter simulation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global helicopter simulation market trends, key players, market segments, application areas, and market growth strategies.

Helicopter Simulation Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.8 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 233 |

| By Simulator Type |

|

| By Application |

|

| By Offering |

|

| By Region |

|

| Key Market Players | Airbus, CAE Inc., Berkshire Hathaway, Lockheed Martin Corporation, Elbit Systems Ltd., Indra Sistemas, S.A., Textron Inc., Thales, FLYIT Simulators, Inc., ATC Flight Simulator |

Analyst Review

The global helicopter simulation market is expected to witness growth globally due to rise in air travel and increase in number of pilot training institutes.

Numerous training centers and institutes use helicopter simulators to cater to the need of airlines and professional pilots. Helicopter simulation provides a secure environment and enhances aviation safety during the training of pilots. There is expected to be growth in the integration of the simulators in training to address factors such as sustainability, reduced emission of CO2, lower costs, and higher safety in the aviation industry.

Virtual reality is being widely used in the aviation industry as a training tool for pilots and cabin crew. For instance, in April 2021, EASA (European Union Aviation Safety Agency) approved virtual-reality simulation for R22 training. The rotorcraft pilots obtained the first European certification for a virtual-reality system. VR provides significant advantages to flight simulation such as immersive representation and interconnectivity. Therefore, virtual reality used in helicopter simulation is expected to provide opportunities for the growth of the market.

The global helicopter simulation market was valued at $1.0 billion in 2021 and is projected to reach $1.8 billion in 2031, registering a CAGR of 6.1%.

The top companies in the global helicopter simulation market include Elbit Systems Ltd., Airbus, Lockheed Martin Corporation, Thales, Indra Sistemas, S.A., Textron Inc., ATC Flight Simulator, FLYIT Simulators, Inc., Berkshire Hathaway, and CAE Inc.

The largest regional market for helicopter simulation is North America.

The leading application of the helicopter simulation market is civil and commercial.

The upcoming trends in the helicopter simulation market include the establishment of a greater number of pilot training institutes and rise in demand for helicopter simulators from civil and commercial sector.

Loading Table Of Content...