Helium Market Research, 2032

The global helium market size was valued at $3.3 billion in 2022, and is projected to reach $4.9 billion by 2032, growing at a CAGR of 4.2% from 2023 to 2032.

Introduction

Helium is characterized by its low boiling point, which is the lowest among all elements. One of the most significant applications of helium is in the field of cryogenics. It is used as a coolant in superconducting magnets, which are essential for magnetic resonance imaging (MRI) machines and particle accelerators. Its low boiling point allows it to maintain superconducting materials at temperatures close to absolute zero. This property is critical for the operation of high-energy physics experiments, such as those conducted at the Large Hadron Collider (LHC). Helium's role in these technologies supports advancements in medical imaging, scientific research, and various other high-tech fields.

In aerospace applications, Helium is used to pressurize and purge rocket fuel tanks, as it is a non-reactive and lighter alternative to other gases. Its low density and inert nature make it suitable for this purpose, as it prevents reactions that could compromise the integrity of fuel systems. In addition, it is used in the testing of spacecraft and other aerospace equipment. Its use in these domains ensures the safe and efficient operation of space exploration technologies and contributes to the advancement of aerospace engineering.

Key Takeaways

The helium market study covers 20 countries. The research includes a segment analysis of each country in terms of both value ($million) and volume (million cubic feet) for the projected period 2023-2032.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Over 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the helium market.

The helium market is highly fragmented, with several players including Air Liquide S.A., Air Products & Chemicals Inc., ExxonMobil Corporation, Gazprom PJSC, Gulf Cryo S.A.L., IACX Energy, Linde plc, Matheson Tri-Gas, Inc., Praxair, Inc., and Taiyo Nippon Sanso Corporation. Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in the helium market.

Market Dynamics

Rising semiconductors & electronics production is expected to drive the growth of the helium market. Helium plays a vital role in the semiconductor manufacturing process due to its inert properties, high thermal conductivity, and low boiling point. It is used in various stages of chip production, including cooling, plasma etching, and as a carrier gas during deposition processes. With the rapid advancement of technologies such as Artificial Intelligence (AI), 5G communication, and the Internet of Things (IoT), the demand for high-performance semiconductors has surged significantly. These technologies require advanced microchips with greater processing power and efficiency, fueling the expansion of semiconductor fabrication facilities worldwide. In May 2024, China launched the third phase of its Big Fund in 2024, raising approximately $47.5 billion to invest in semiconductor manufacturing, equipment, materials, and AI-related technologies. This move aims to strengthen China's self-reliance amid ongoing U.S. export controls.

However, high extraction and storage costs are expected to restrain the growth of the helium market. Helium is primarily extracted as a by-product of natural gas processing, but the concentrations are typically very low—often between 0.04% and 0.35% which makes extraction both technically challenging and expensive. The high costs have contributed to persistent supply constraints and price volatility. For example, helium prices surged by 50–100% from early 2022, driven by ongoing shortages, supply chain disruptions, and geopolitical factors. In the first quarter of 2025, helium prices in India reached $92,710 per metric ton, with similar high prices observed in Qatar at $91,780 per metric ton. This sharp increase reflects not only demand growth in sectors like healthcare and electronics but also the impact of extraction and storage challenges on market stability.

Moreover, an increase in data centers & supercomputing is expected to provide lucrative opportunities in the helium industry. Helium plays a vital role in the data storage industry, particularly through its use in helium-filled hard disk drives (HDDs). Helium-filled drives benefit from helium’s lower density, which significantly reduces internal friction. This leads to cooler operation, quieter performance, and improved energy efficiency, enabling higher storage capacities and longer device lifespans. As data centers continue to grow rapidly worldwide to meet the soaring demand for cloud computing, artificial intelligence (AI), and big data analytics, the need for efficient, high-capacity, and reliable storage solutions becomes critical. In May 2025, the European Union introduced the EHDS regulation in March 2025, aiming to enhance the use and exchange of electronic health data across member states. The regulation focuses on providing citizens better control over their health data and ensuring interoperability among various stakeholders, including researchers and policymakers.

Segment Overview:

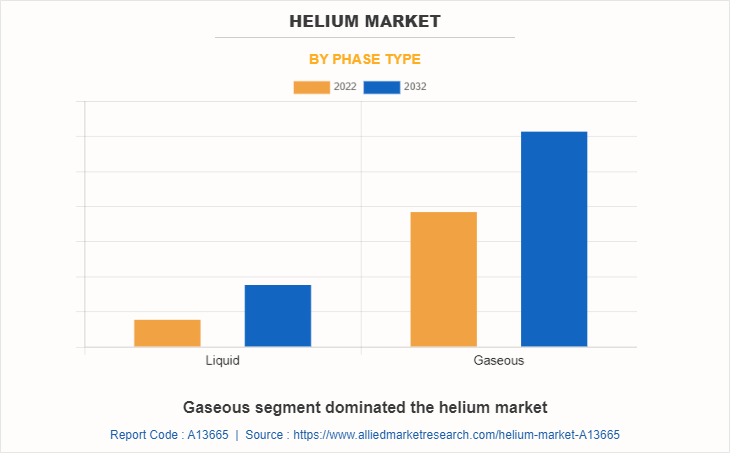

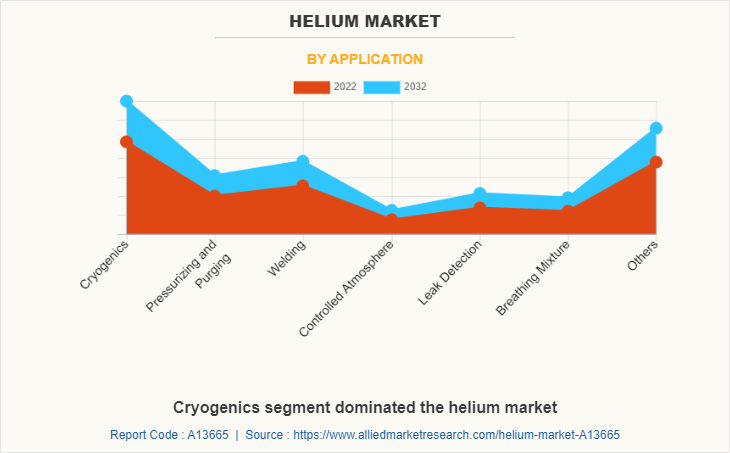

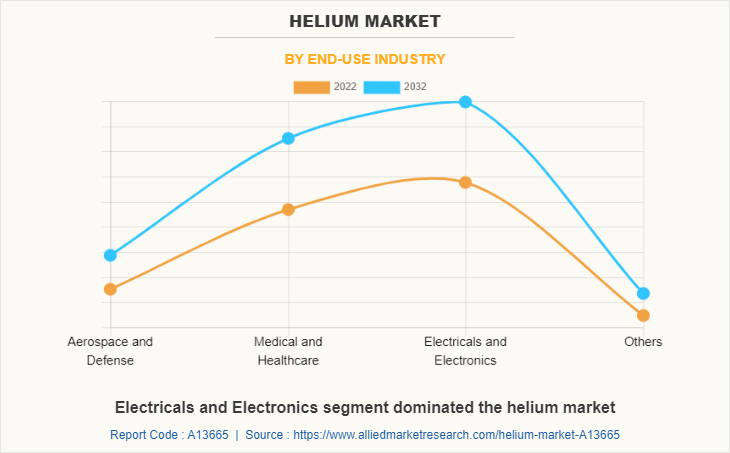

The helium market is segmented into type, application, end-use industry, and regions. On the basis of phase type, the helium market is bifurcated into liquid and gaseous. On the basis of application, the helium market is categorized into cryogenics, pressurizing and purging, welding, controlled atmosphere, leak detection, breathing mixture, others. On the basis of the end-use industry, the helium market is divided into aerospace and defense, medical and healthcare, electricals and electronics, and others. Region-wise, the helium market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Helium gas serves important roles in different industries, including technology, science, medicine, and manufacturing. In welding processes like TIG and MIG welding, helium acts as a shielding gas, safeguarding the weld area from oxidation and contamination. This ensures high-quality welds. In diving applications, helium-oxygen mixtures like heliox and trimix are used for deep-sea and saturation diving. The low density of helium minimizes the narcotic effects of breathing gases at high pressures, preventing conditions like nitrogen narcosis. In December 2024, New Era Helium went public through a $90 million merger. The company operates in New Mexico's Pecos Slope, with over 1.5 billion cubic feet of helium reserves.

On the basis of application, the cryogenics segment dominated the helium market representing the CAGR of 3.7% during the forecast period. Helium plays a crucial role in various scientific applications that require extremely low temperatures. One important use of helium is in the long-term storage of biological samples like eggs, embryos, and tissue. By creating and maintaining cryogenic temperatures, helium enables the preservation of these samples for medical research, assisted reproduction, and the conservation of genetic diversity.

Additionally, helium finds extensive usage in scientific research fields such as low-temperature physics, materials science, and condensed matter physics. In December 2024, the UK government launched a £44 million initiative to develop cryogenic hydrogen-electric propulsion systems. The University of Nottingham leads this project, collaborating with GKN Aerospace and Parker Meggitt, aiming to advance net-zero aviation technologies.

Based on end-use industry, the electricals and electronics segment held the highest revenue and is expected to experience a substantial growth of 3.2% CAGR during the forecast period. Helium is commonly used as a coolant in various electronic and electrical systems. Superconducting magnets in devices such as magnetic resonance imaging (MRI) machines, particle accelerators, and some scientific research equipment require extremely low temperatures. Helium is employed as a cryogenic coolant to achieve these low temperatures. Helium is used as a tracer gas to detect leaks in electronic and electrical systems. It is an inert gas that can be easily detected using sensitive helium leak detectors. This method is particularly useful in identifying leaks in systems such as air conditioning, refrigeration, and vacuum systems. In October 2024, the U.S. allocated $39 billion to bolster domestic semiconductor manufacturing, directly increasing helium demand due to the gas's role in chip production.

The Asia-Pacific region stands at the forefront of research and development in the fields of cryogenics and superconductivity. Helium serves as a crucial cryogenic coolant in a wide range of applications, including superconducting magnets, MRI machines, particle accelerators, and nuclear magnetic resonance (NMR) spectrometers. These advanced technologies have widespread applications in scientific research, healthcare, and materials science. Furthermore, the Asia-Pacific region has emerged as a leader in the electronics and semiconductor manufacturing industries, where the presence of helium plays a vital role in ensuring stability and reliability across various processes. Helium is particularly significant in cooling superconducting magnets in MRI machines, manufacturing fiber optics, and purging contaminants from electronic components during assembly. In July 2022, Iwatani Corporation and Helios Specialty Gases entered into an agreement whereby Iwatani would supply liquid helium to Helios’s distribution facilities in Gujarat, Telangana, and Rajasthan.

Competitive Analysis:

The major players operating in the global helium market include Air Liquide S.A., Air Products & Chemicals Inc., ExxonMobil Corporation, Gazprom PJSC, Gulf Cryo S.A.L., IACX Energy, Linde plc, Matheson Tri-Gas, Inc., Praxair, Inc., and Taiyo Nippon Sanso Corporation.

In July 2024, European Organization for Nuclear Research (CERN) completed the installation of four large helium tanks for the High-Luminosity LHC (HL-LHC). Two tanks were installed at Point 1 in June, and two more were positioned at Point 5 in July. These tanks are essential for storing helium to power the refrigerators that will cool the HL-LHC’s new focusing magnets adjacent to the ATLAS and CMS experiments. Each tank, manufactured in Portugal, is 28 meters long, 3.5 meters in diameter, and weighs over 62 tons. They have a storage capacity of 250 cubic meters of gaseous helium at 20 bars pressure, which equates to approximately 800 kg of helium. The transport of these tanks to CERN was a significant logistical operation, taking over eight days due to their size.

Recent Key Developments in Helium Market

- In May 2025, Ukrainian startup Aerobavovna has been deploying helium-filled balloons equipped with radio repeaters to extend the range of attack drones, enhancing communication and operational capabilities.

- In January 2024, the U.S. privatized its Federal Helium Reserve, leading to a restructuring of helium supply dynamics and increased market uncertainty.

- In March 2024, the Canadian government provided approximately $2.2 million(CAD$3 million )to Royal Helium to support helium exploration and production in Saskatchewan.

- In November 2024, Reliance Industries' U.S. unit acquired a 21% stake in Wavetech Helium for $12 million, aiming to expand its low-carbon energy portfolio.

- In April 2024, Royal Helium partnered with Sparrow Hawk Developments in a $25 million joint venture to develop the Val Marie helium project in Saskatchewan.

- In April 2022, Linde signed a long-term helium purchase contract with Freeport LNG to recover helium from its Texas production site, with operations expected to commence in 2024.

Trump’s Tariff Impact on Helium Market

- Helium, a critical resource for industries including healthcare, electronics, and aerospace, has seen price volatility due to these tariffs. The increased cost of importing helium and related equipment has led to higher prices for end-users. For instance, in India, helium gas cylinders are now priced at approximately $28.92 (₹2,400) for a 47-litre capacity, with smaller, refillable tanks ranging from $18.52 to $251.74 (₹1,543 to ₹20,978), depending on the brand and size.

- The tariffs have also prompted retaliatory measures from trade partners, further exacerbating supply constraints. China's response, including a 125% tariff on U.S. goods and restrictions on rare earth exports, has heightened tensions and contributed to global supply chain disruptions. These developments have led to increased operational costs for companies reliant on helium, particularly in high-tech and medical sectors.

- Increase in tariffs on Canadian and Qatari imports, some U.S. buyers have turned to alternative sources such as Algeria and Russia, albeit at higher logistical costs and with geopolitical risks. As of Q1 2025, average global helium prices have surged by approximately 18% year-on-year, according to industry estimates, reaching over $450 per thousand cubic feet in some regions. These price hikes disproportionately affect emerging economies, where healthcare and manufacturing sectors struggle to absorb the increased costs.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the helium market analysis from 2022 to 2032 to identify the prevailing helium market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the helium market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global helium market trends, key players, market segments, application areas, and helium market growth strategies.

Helium Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.9 billion |

| Growth Rate | CAGR of 4.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Application |

|

| By End-Use Industry |

|

| By Phase Type |

|

| By Region |

|

| Key Market Players | Gazprom PJSC, Matheson Tri-Gas, Inc., Praxair, Inc., Gulf Cryo S.A.L., Taiyo Nippon Sanso Corporation, Air Products & Chemicals Inc., IACX Energy, ExxonMobil Corporation, Linde plc, Air Liquide S.A. |

| | Exxon Mobil Corporation, Air Liquide SA, Messer Group GmbH, PGNiG. |

Analyst Review

According to the opinions of various CXOs of leading companies, the global helium market was dominated by the gaseous segment. Helium gas plays a crucial role in welding procedures, especially for non-ferrous metals like aluminum, where it serves as a shielding gas. Its primary purpose is to safeguard the welding region from impurities, combat oxidation, and improve the overall welding quality. Helium is frequently combined with other gases, and specialized equipment can readily identify its presence, enabling the detection of leaks in systems or containers.

The helium market is driven by rise in demand for helium in the healthcare sector. Helium is a crucial component in the healthcare industry, driven by its various medical applications. One important use is in heliox, a mixture of helium and oxygen, which is utilized in respiratory treatments for conditions such as asthma, Chronic obstructive pulmonary disease (COPD), and upper airway obstruction. The demand for helium in healthcare is further fueled by the rise in prevalence of respiratory diseases and the need for respiratory therapies in developing countries.

However, limited helium reserves are expected to restrain industry expansion. The limited availability of helium, combined with increasing demand from industries such as electronics, aerospace, and healthcare, results in a supply-demand imbalance and higher prices. These rising prices can negatively impact businesses that depend on helium, making it expensive to acquire and potentially affecting their profitability.

The Asia-Pacific region is projected to register robust growth during the forecast period. Helium plays a crucial role in the aerospace and defense sectors across the Asia-Pacific region. Its unique properties, including low density and non-reactivity, make it highly desirable for various applications. One of its primary uses is as a lifting gas in airships and balloons, which are employed for surveillance, research, and communication purposes. Additionally, helium finds extensive utilization in purging and pressurizing fuel tanks and rocket engines. It is also employed as a cooling medium in nuclear reactors.

The leading application of helium market includes cryogenics, pressurizing, and purging, welding, controlled atmosphere, leak detection, breathing mixture, and others.

Air Liquide S.A., Air Products & Chemicals Inc., ExxonMobil Corporation, Gazprom PJSC, Gulf Cryo S.A.L., IACX Energy, Linde plc, Matheson Tri-Gas, Inc., Praxair, Inc., and Taiyo Nippon Sanso Corporation are the top companies to hold the market share in helium.

Advancements in technology with respect to helium and rise in demand for helium in the healthcare sector are the driving factors of the helium market.

Helium recycling and conservation are the upcoming trends of Helium Market in the world

Asia-Pacific is the largest regional market for helium.

The price volatility of helium is the challenge faced by the helium market.

The global helium market was valued at $3.3 billion in 2022, and is projected to reach $4.9 billion by 2032, growing at a CAGR of 4.2% from 2023 to 2032.

Loading Table Of Content...

Loading Research Methodology...