Hemodynamic Monitoring Devices Market Research, 2033

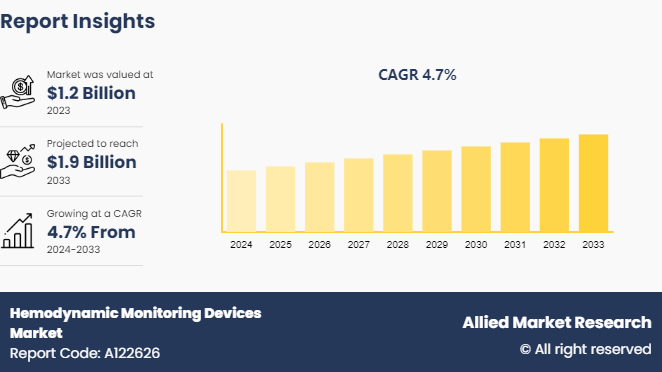

The global hemodynamic monitoring devices market size was valued at $1.2 billion in 2023, and is projected to reach $1.9 billion by 2033, growing at a CAGR of 4.7% from 2024 to 2033. The global hemodynamic monitoring market is experiencing growth due to several factors such as the increase in prevalence of chronic diseases such as heart failure and hypertension and technological advancements in hemodynamic monitoring devices.

Market Introduction and Definition

Hemodynamic monitoring is a vital aspect of patient care, particularly in critical care settings such as intensive care units (ICUs) and operating rooms. It involves the continuous assessment and measurement of various parameters related to the cardiovascular system's function, including blood pressure, heart rate, cardiac output, and fluid status. These measurements provide clinicians with crucial insights into a patient's cardiovascular stability, allowing for early detection of hemodynamic instability and prompt intervention. With advances in technology, hemodynamic monitoring has become increasingly sophisticated, offering clinicians a wide array of tools and techniques to optimize patient care and improve outcomes.

Key Takeaways

- The hemodynamic monitoring market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major hemodynamic monitoring devices industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The hemodynamic monitoring devices market size is propelled by several drivers such as technological advancements. Innovations such as minimally invasive monitoring devices and wireless connectivity have revolutionized patient care, allowing for real-time monitoring of hemodynamic parameters such as blood pressure, cardiac output, and oxygen saturation. These advancements enable healthcare providers to make informed decisions promptly, enhancing patient outcomes and driving market growth. Additionally, the increasing prevalence of chronic diseases such as heart failure and hypertension contribute to the expanding demand for hemodynamic monitoring systems. Furthermore, the increase in geriatric population in developed regions like North America and Europe presents a significant driver for market growth, as elderly individuals are more susceptible to cardiovascular disorders, necessitating continuous monitoring to manage their conditions effectively.

However, the high cost of hemodynamic monitoring devices acts as a restraint factor for the hemodynamic monitoring devices market growth. The initial investment required for purchasing monitoring systems and the ongoing expenses associated with maintenance and consumables pose challenges, particularly in resource-constrained healthcare settings. Furthermore, reimbursement limitations in certain regions dampen the adoption of advanced monitoring technologies, constraining growth during hemodynamic monitoring devices market forecast.

The market presents various hemodynamic monitoring devices market opportunity for growth, primarily driven by the increasing focus on patient-centric care and the integration of digital health solutions. The growing trend towards remote patient monitoring and telemedicine opens avenues for hemodynamic monitoring players to develop innovative solutions that facilitate remote data transmission and teleconsultation, thereby improving accessibility to healthcare services. Moreover, the emergence of artificial intelligence and data analytics offers exciting prospects for enhancing hemodynamic monitoring capabilities. By leveraging AI algorithms to analyze hemodynamic data and predict patient deterioration, healthcare providers can intervene proactively, leading to better outcomes and reduced healthcare costs.

Market Segmentation

The hemodynamic monitoring devices industry is segmented into product, type, end-user and region. On the basis of product, the market is bifurcated into disposables and monitors. On the basis of type, the market is bifurcated into, non-invasive, minimally invasive, and invasive. On the basis of end user, the market is divided into hospitals, home care settings, laboratory settings, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America has largest hemodynamic monitoring devices market share driven by factors such as the increase in prevalence of cardiovascular diseases, technological advancements, emphasis on preventive healthcare, and rise in geriatric population. These drivers collectively contribute to the growth and expansion of the market, creating opportunities for innovation and improved patient care.

In addition, factors such as the increase in burden of cardiovascular diseases, healthcare infrastructure development, medical technology advancements, healthcare professional awareness, aging populations, and supportive government initiatives are driving the growth of the hemodynamic monitoring devices market share in developing countries like China and India.

- In 2020, health expenditure as a share of GDP for China was 5.6%. Health expenditure as a share of GDP of China increased from 4.3% in 2001 to 5.6% in 2020 growing at an average annual rate of 1.54%.

Industry Trends

In December 2022, Dr. Hans Henri P. Kluge, the Regional Director of WHO for Europe, will introduce a new Signature Initiative that will be especially relevant to the nations in the Region with the highest rates of CVDs, the highest prevalence of hypertension, inadequate control of hypertension, and high salt consumption.

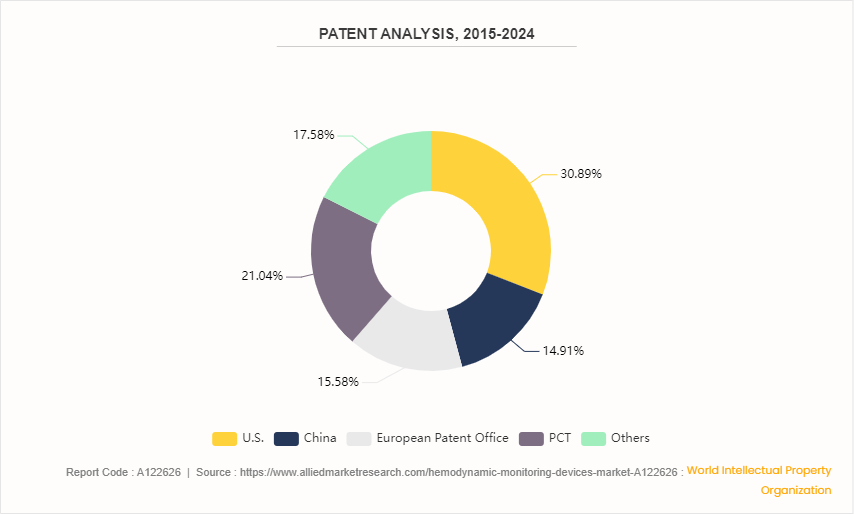

Patent Analysis, By Country, 2015-2024

U.S. witnessed the highest number of patent approvals and applications, due to favorable government policies, new technological advancement ad new product launches in the country. PCT has 18.8% of the total number of patents, followed by European Patent Office at 13.9% and China at 13.3%.

Competitive Landscape

The major players operating in the hemodynamic monitoring market include Edwards Lifesciences Corporation, GE HealthCare, Baxter International, ICU Medical, Koninklijke Philips N.V., Sramek BioDynamics, Inc., OsypkaCardiotek GmbH, Deltex Medical Group, Masimo, and Medtronic, PLC. Other players in the hemodynamic monitoring market includes Mindray Medical, Edward Lifesciences, Inspira Technologies OXY B.H.N, Getinge AB, and so on.

Recent Key Strategies and Developments

- In June 2023, Mindray Medical and Edward Lifesciences Corporation collaborated to integrate the Edwards FloTrac sensor in Mindray’s hemodynamic monitor- BeneVision N. The product is expected to be launched in the European market, post-market acceptance in China.

- In May 2023, Inspira Technologies OXY B.H.N. Ltd. announced to develop VORTX, a respiration technology expected to improve hemodynamic performance and reduce oxygenator failures.

- In January 2022, Medtronic received approval from the National Medical Products Association (NMPA) for Evolut PRO TAVR System. The system aids in treating severe aortic stenosis while providing full hemodynamic performance.

- In March 2021, Koninklijke Philips N.V. launched the IntelliVue X3 system. The system provides advanced hemodynamic measurements and improves the clinical focus during different procedures.

- In October 2020, Getinge launched NICCI, an advanced non-invasive monitoring solution to reduce the complications associated with low blood pressure.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hemodynamic monitoring devices market analysis to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hemodynamic monitoring devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hemodynamic monitoring devices market trends, key players, market segments, application areas, and market growth strategies.

Key Sources Referred

- World Health Organization

- Center for Disease Control and Prevention

- National Center for Biotechnology Information

- British Heart Foundation

- Australian Institute of Health and Welfare

- Pan American Health Organization

- European Society of Cardiology

- Australian Bureau of Statistics

- National Health Service

- American Heart Association

- British Heart Foundation

- The Heart Foundation

- Cardiovascular Research Foundation

Hemodynamic Monitoring Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.9 Billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 260 |

| By Product |

|

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | GE Healthcare, ICU Medical Inc., Deltex Medical Group, Medtronic, PLC, Baxter International Inc., Edwards Lifesciences Corporation, Koninklijke Philips N.V., Sramek BioDynamics, Inc., Masimo Corporation, OsypkaCardiotek GmbH |

Loading Table Of Content...