Hemp-Based Foods Market Summary

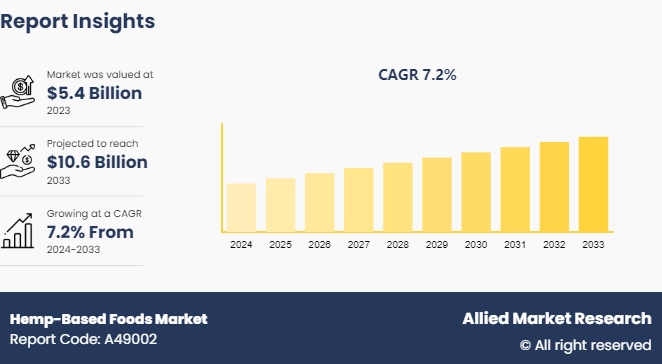

The global hemp-based foods market size was valued at $5.4 billion in 2023, and is projected to reach $10.6 billion by 2033, growing at a CAGR of 7.2% from 2024 to 2033.

Key Market Trends and Insights

Region wise, North America generated the highest revenue in 2023.

The global hemp-based foods market share was dominated by the specialty segment in 2023 and is expected to maintain its dominance in the upcoming years

The food and beverage industry segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2023 Market Size: USD 5.4 Billion

- 2033 Projected Market Size: USD 10.6 Billion

- Compound Annual Growth Rate (CAGR) (2024-2033): 7.2%

- North America: Generated the highest revenue in 2023

Market Introduction and Definition

The hemp-based foods market consists of a variety of edible products derived from the hemp plant Cannabis sativa. These food include seeds, oil, protein powder, milk, and derived products such as snacks, beverages, and baked goods. Hemp-based food are rich in nutrients such as protein, healthy fats, fiber, vitamins, and minerals, which offer numerous health benefits, including supporting heart health, digestion, and overall wellness. In addition, hemp is a sustainable crop that requires minimal water and pesticides, making it environmentally friendly compared to many conventional crops. Growth in consumer interest in plant-based diets, coupled with increase in awareness of the nutritional benefits of hemp drive the hemp-based foods market growth. Moreover, regulatory changes favoring the legalization of hemp cultivation and the relaxation of restrictions on hemp-derived products in several regions further drive hemp based foods industry expansion. The hemp-based food market represents a growing segment within the broader health food industry, catering to health-conscious consumers seeking nutritious, sustainable, and plant-based dietary options.

Key Takeaways

The hemp-based foods market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The increase in demand for plant-based foods has driven the hemp-based foods market size owing to the unique nutritional profile and sustainability of hemp. As consumers increasingly adopt plant-based diets for health, environmental, and ethical reasons, they seek alternative sources of protein, healthy fats, and nutrients. Hemp-based food, such as hemp seeds, hemp oil, and hemp protein powder, offer a rich source of protein, omega-3 fatty acids, vitamins, and minerals, which thus makes them attractive options for plant-based consumers. Moreover, hemp cultivation is environment-friendly, requiring minimal water and pesticides compared to many conventional crops, aligning with the sustainability concerns of environmentally conscious consumers. With growing awareness of hemp's nutritional benefits and sustainability, along with the broader trend toward plant-based eating, the hemp-based foods market share has experienced significant growth as it caters to the evolving preferences of health-conscious consumers.

However, the potential for cross-contamination with tetrahydrocannabinol (THC) in hemp-derived products poses a significant restraint on hemp-based foods market demand. Hemp and marijuana are both varieties of the cannabis plant, and while hemp contains minimal levels of THC, there is a risk of cross-contamination during cultivation, harvesting, processing, and packaging. Regulatory agencies impose strict limits on THC levels in hemp-derived products to ensure compliance with legal standards and avoid psychoactive effects. In addition, the presence of even trace amounts of THC can raise concerns among consumers, particularly in regions where marijuana remains illegal or heavily regulated. The uncertainty surrounding THC contamination weakens consumer confidence in hemp-based food and may deter some individuals from purchasing these products, limiting market demand during the hemp-based foods market forecast.

Partnerships with food and beverage companies are creating significant opportunities in the market for the hemp-based foods market by leveraging established distribution networks, expertise in product development, and brand recognition. Collaborations between hemp-based food manufacturers and larger food and beverage companies allow for the introduction of hemp-infused products to a broader consumer base through mainstream retail channels. For instance, in January 2020, partnerships between hemp-based food producers such as Manitoba Harvest and major food corporations Nestle have resulted in the development of hemp-based snack bars and beverages, thereby expanding market reach, and driving consumer acceptance. Thus, partnerships with food and beverage companies are anticipated to create new growth opportunities for the key players in the market.

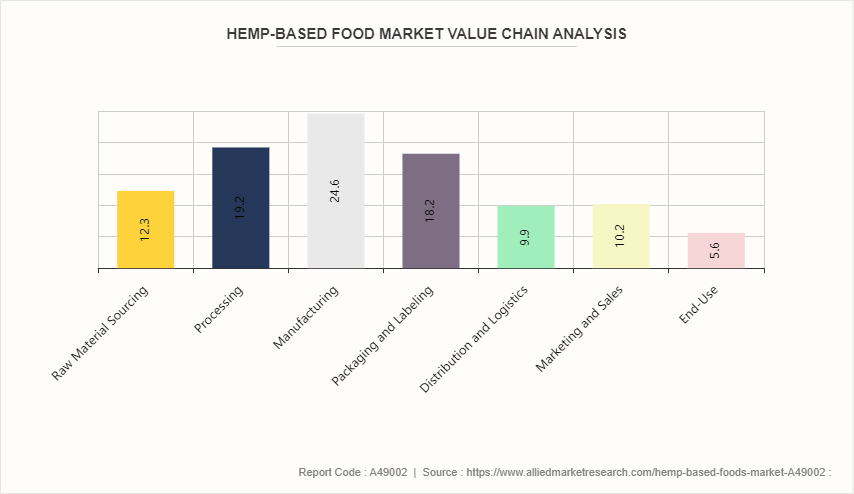

Value Chain of Market

The value chain of the hemp-based foods market involves several key stages. First, there is the cultivation of hemp plants, which requires specialized knowledge and adherence to regulations. Then, the harvested hemp undergoes processing, which includes dehulling, cleaning, and extracting the edible components. The processed hemp is then used as an ingredient in various food products, such as hemp seeds, hemp protein powder, hemp milk, and hemp-based snacks. These products are manufactured by food companies, who must comply with food safety and labeling regulations. The hemp-based foods are then distributed through various channels, including retail stores, online platforms, and specialty health food stores. Finally, consumers purchase and consume these products, driven by the perceived health benefits and versatility of hemp-based ingredients.

Market Segmentation

The hemp-based foods market share is segmented into type, end user, distribution channel, and region. On the basis of type, the market is divided into hemp seeds, hemp oil, hemp protein powder, hemp milk, hemp snacks, hemp beverages, and others. As per end user, the market is categorized into household consumers, food and beverage industry, nutraceutical industry, cosmetics and personal care industry, and others. On the basis of distribution channel, the hemp-based foods market is segregated into supermarkets/hypermarkets, convenience stores, specialty stores, online sales channel, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

In October 2022, Germany announced to legalize cannabis, potentially marking a significant shift in the European hemp-based foods market dynamics. The regulatory change is anticipated to catalyze the hemp-based food sector in Europe, offering new opportunities for key players to serve the increase in consumption of hemp-derived products. The legalization initiative is projected to increase job creation, with approximately 27, 000 positions forecasted, while also delivering substantial economic savings estimated at around $4.7 billion. Furthermore, the rise in demand for hemp in nutritional supplements, CBD personal care products, and its utilization across industries such as automotive and textiles is anticipated to create hemp-based foods market opportunities across Europe until 2033.

In November 2021, Food Safety and Standards Authority of India (FSSAI) issued a notification stating that hemp seed, hemp seed oil, and hemp seed flour can be sold as food or used in food products, provided they meet the specified standards. With hemp being recognized for its nutritional benefits and sustainability, the market can now capitalize on the growing demand for plant-based and healthy food options among health-conscious consumers. Moreover, the regulatory approval fosters innovation in product development, encouraging manufacturers to introduce a wider range of hemp-based food products, thereby driving market expansion, and leading to a thriving hemp-based foods market in India.

Industry Trends:

An annual campaign by a UK-based non-profit organization Veganuary, which encourages participants to adopt a vegan lifestyle has experienced significant growth, with signups rising from 4 million in 2020 to over 5 million in 2021, and further to 6.29 million in 2022. The surge in participants indicates a growing vegan population, which is expected to boost the hemp-based foods market demand globally.

Regulatory changes and the legalization of hemp cultivation in various countries have led to significant growth in the hemp-based foods industry. With legal barriers lifted, companies can now explore the full potential of hemp as a food ingredient. The ease in regulations related to hemp-based items has prompted increased research and development efforts to create new hemp-based products and improve existing ones. Established companies such as Hemp Foods Australia have expanded their product lines to include a diverse range of hemp-based food, such as hemp seed oil, hemp protein powder, and hemp snacks. Moreover, startups such as Manitoba Harvest have emerged, specializing in innovative hemp-based products such as hemp milk and hemp granola bars. These developments cater rapidly to the growing demand for nutritious and sustainable plant-based food and drives innovation in the hemp-based food industry.

The increase in consumer demand for plant-based and sustainable food products has driven interest in hemp-based alternatives owing to the nutritional benefits and versatility. Hemp seeds, rich in protein, healthy fats, and essential nutrients, are used in various culinary applications, such as salads, smoothies, and baked goods, providing a plant-based source of protein and omega-3 fatty acids. Hemp milk, a dairy-free alternative made from hemp seeds, is gaining popularity among consumers seeking lactose-free and environmentally friendly options. Hemp protein powder, extracted from hemp seeds, is known for its high protein content, and is incorporated into shakes, smoothies, and protein bars as a plant-based protein source. These hemp-based products offer nutritious and sustainable alternatives to conventional ingredients, catering to the growing demand for plant-based food.

Competitive Landscape

The major players operating in the hemp-based foods market include Agropro, Nutiva Inc., Compass Diversified, Canopy Growth Corporation, Hempco Inc., Canada Hempfoods Ltd., Elixinol, Cool Hemp, and Hemp Foods Australia Pty Ltd.

Other players in hemp-based foods industry includes Hemp House, Living Harvest, Pacific Seeds, Canah International, Hempup, Hemptons, and others.

Recent Key Strategies and Developments

In August 2022, BioLife Sciences Inc., a prominent innovator in healthcare, beauty, and food & beverage technologies, introduced a product line of consumer products infused with cannabinoids to increase strengthen its product portfolio in hemp-based food products.

In August 2022, TagZ Foods, an Indian snack food company, launched hemp-infused cookies to increase the product line of hemp-based food products.

In July 2022, Victory Hemp Foods, a hemp-based food manufacturer headquartered in the U.S., announced partnership with Applied Food Sciences (AFS) to enhance the sales and marketing strategies for Victory Hemp's exclusive ingredients, namely V-70TM Hemp Heart Protein and V-ONETM Hemp Heart Oil, along with its broader range of food and beverage components.

In June 2020, Healthy Food Ingredients (HFI) , a specialty ingredient supplier headquartered in the U.S., announced partnership with KND Labs to offer clean label extraction, transparent third-party testing, and direct supply assurance from growers to businesses in the food, beverage, pet, nutraceutical, and cosmeceutical sectors.

In August 2019, Aurora Cannabis, a Canadian cannabis producer, purchased Hempco Food and Fiber Inc. to have access to abundant, cost-effective raw hemp material for extracting cannabidiol ("CBD") and other sought-after cannabinoids known for various health advantages.

Key Sources Referred

Food Safety and Standards Authority of India (FSSAI)

U.S. Food and Drug Administration (FDA)

Organic Trade Association (OTA)

Euromonitor International

USDA Economic Research Service (ERS)

Food and Agriculture Organization of the United Nations (FAO)

National Restaurant Association (NRA)

Agricultural & Processed Food Products Export Development Authority (APEDA)

U.S. Department of Agriculture (USDA)

Bureau of Labor Statistics (BLS)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hemp-based foods market analysis to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hemp-based foods market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hemp-based foods market trends, key players, market segments, application areas, and hemp-based foods market growth strategies.

Hemp-Based Foods Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 10.6 Billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 389 |

| By Type |

|

| By End User |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Compass Diversified Holdings, Canopy Growth Corporation, Agropro, Nutiva Inc., Canada Hempfoods Ltd., Hemp Foods Australia Pty Ltd., elixinol, Hempco Inc., Cool Hemp |

The global hemp-based food market size was valued at USD 5.4 billion in 2023, and is projected to reach USD 10.6 billion by 2033

The global hemp-based food market is projected to grow at a compound annual growth rate of 7.2% from 2024-2033 to reach USD 10.6 billion by 2033

The major players operating in the hemp-based food market include Agropro, Nutiva Inc., Compass Diversified, Canopy Growth Corporation, Hempco Inc., Canada Hempfoods Ltd., Elixinol, Cool Hemp, and Hemp Foods Australia Pty Ltd.

North America held the highest market share in terms of revenue in 2023.

Increased demand for plant-based proteins, growing consumer awareness of hemp's nutritional benefits, expansion of product offerings such as hemp milk and hemp snacks, sustainable farming practices, and increased interest in organic and non-GMO products.

Loading Table Of Content...