Hereditary Cancer Testing Market Research, 2031

The global hereditary cancer testing market was valued at $3.5 billion in 2021, and is projected to reach $10.1 billion by 2031, growing at a CAGR of 11.6% from 2022 to 2031. Cancer arises from the uncontrolled growth of cells. Cancer is caused by harmful changes (mutations) in the genetic messages (genes) which control the growth and division of cells which prevent them from being able to do their jobs effectively. The patient receives one complete copy of the genes from the mother and another from the father. It is the accumulation of multiple mutations over many years that disrupts the growth control of the cell and allows a normal cell to grow without control, and eventually become cancer. Most cases of cancer occur in the absence of a significant family history, and are not inherited. In these families the mutations causing the cancer occur only in the tumor itself and are all acquired after birth. Although the cause is seldom as these acquired mutations may be the result of environmental, hormonal exposures, or mistakes which can occasionally occur when a cell divides.

The key drivers of the hereditary cancer testing market size are the rise in geriatric population, surge in incidence of cancer across the globe and increase in the government expenditure on healthcare.

Moreover, the increase in the awareness regarding the cancer testing and favorable reimbursement policies contribute toward the hereditary cancer testing market growth. However, lack of skilled professionals and high cost of the tests are expected to hinder the market growth. Conversely, the high growth potential in untapped emerging economies offers lucrative growth opportunities for the market.

Impact of COVID-19 Pandemic on Hereditary Cancer Testing Market Size

The COVID-19 pandemic affected the hereditary cancer testing industry in a negative way, like various other diagnostics and biotechnology industries were affected. The COVID-19 pandemic has disrupted virtually each aspect of healthcare provision including cancer care. The impact of this pandemic on the hereditary cancer testing market is anticipated to provide learnings to diagnostic companies across other therapy areas both in the short and the long term. Oncology is most valuable sector in diagnostics market and will continue to be most valuable market of the world, driven by more innovation throughout the next decade and beyond. Moreover, outbreak of COVID-19 has acted as a significant restraint on the hereditary cancer testing market as supply chains were disrupted due to restrictions on trade of diagnostics products across countries. In addition, COVID-19 is an infectious disease with flu-like symptoms including fever, cough, and difficulty in breathing. In its disruption to clinical trials and drug supply to patients, the COVID-19 pandemic has impacted the most crucial areas of the hereditary cancer testing industry. Pandemic has directly affected the supply of hereditary cancer diagnostic products to cancer testing firms. Moreover, the spread of COVID-19 has reduced the willingness of cancer testing organizations and ability to access the cancer testing technologies. Furthermore, a Cancer Research Institute and IQVIA survey published in Nature Reviews Drug Discovery found that patient enrolment in oncology clinical trials during the early stages of the pandemic was significantly impacted in the U.S. and Europe, where 60% and 86% of institutions respectively were enrolling new patients at a lower rate in 2020.

Hereditary Cancer Testing Market Segmentation

The hereditary cancer testing market is segmented into Cancer Type, Test Type and End User. On the basis of cancer type, the market is categorized into breast cancer, gastric cancer, ovarian cancer, prostate cancer, colorectal cancer, other cancers. On the basis of test type, the market is classified into predictive testing and diagnostic testing. On the basis of end user, the market is divided into diagnostic centers, hospitals and clinics. Furthermore, the hospitals segment is sub-classified by type as private and public. On the basis of region, the market is studied across North America (U.S., Canada, Mexico), Europe (Germany, France, the UK, Italy, Spain, Rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, Rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, Rest of LAMEA).

Market By Cancer Type Segment Review

On the basis of cancer type, the market is classified into breast cancer, gastric cancer, ovarian cancer, prostate cancer, colorectal cancer, other cancers. The breast cancer segment is anticipated to grow with the largest hereditary cancer testing market share during the forecast period. This is attributed to increase in the prevalence of breast cancer and increase in the geriatric population as they are more prone to chronic diseases.

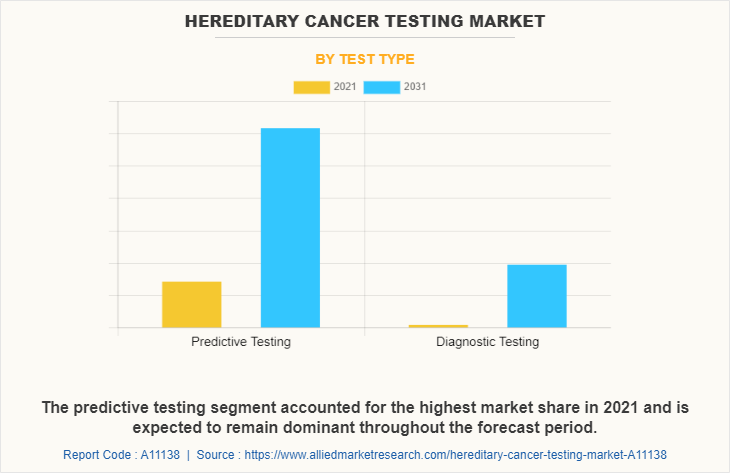

Market By Test Type Segment Review

On the basis of test type, the market is classified into predictive testing and diagnostic testing. The predictive testing segment is anticipated to grow with the largest share during the forecast period. This is attributed to upsurge in adoption of predictive testing in the diagnostic centers and rise in the prevalence of various cancer types. Moreover, the rise in the awareness regarding the predictive testing helps foster the growth of the market.

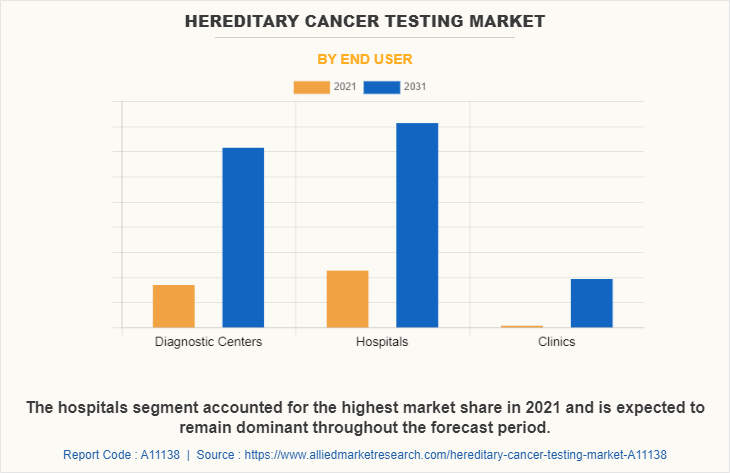

Market By End User Segment Review

On the basis of end user, the market is classified into the market is classified into diagnostic centers, hospitals and clinics. Furthermore, the hospitals segment is sub-classified by type as private and public. The hospitals segment is anticipated to grow with the largest hereditary cancer testing market share during the forecast period. This is attributed to increase in the number of hospitals, surge in the healthcare expenditure and rise in the hospital visits of cancer patients for early diagnosis of cancers.

Market By Region Review

North America was the dominant region and is expected to remain dominant during the hereditary cancer testing market forecast period, owing to high prevalence rate of cancer, increase in geriatric population, and surge in number of diagnostic procedures in the region. However, Asia-Pacific is expected to witness the highest CAGR of 13.8% during the analysis period, owing to the presence of high populace countries such as India and China, which in turn increases the prevalence rate of cancer types, and the increasing number of product launch and product approvals.

The major companies profiled in the report include Abbott Laboratories, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, Eurofins Scientific SE, F. Hoffmann-La Roche AG, Illumina, Inc., Myriad Genetics, Inc., Qiagen N.V., Thermo Fisher Scientific, Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hereditary cancer testing market analysis from 2021 to 2031 to identify the prevailing hereditary cancer testing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hereditary cancer testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hereditary cancer testing market trends, key players, market segments, application areas, and market growth strategies.

Hereditary Cancer Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 10.1 billion |

| Growth Rate | CAGR of 11.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 303 |

| By Cancer Type |

|

| By Test Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Danaher Corporation, Illumina, Inc., CSL Ltd., Thermo Fisher Scientific, Inc., Abbott Laboratories, Bio-Rad Laboratories, Inc., Qiagen NV, EUROFINS SCIENTIFIC, Myriad Genetics, Inc., F. HOFFMANN-LA ROCHE LTD |

| Other Players | Twist Bioscience. |

Analyst Review

The detection of cancer early helps the patient to have access to preventative measures and proactive treatment leading to an overall better prognosis. The growth of the hereditary cancer testing market is driven by rise in geriatric population, surge in incidence of cancer across the globe, and increase in the government expenditure on healthcare.

North America accounted for the highest market share in 2021, due to availability of advance cancer testing products, cancer testing awareness among the population, and heavy expenditure by the government on healthcare. Asia-Pacific is expected to exhibit fastest market growth due to increase in incidence of various types of cancer.

The leading application of hereditary cancer testing is that it determine whether family members who have not (yet) developed a cancer have inherited the same variant as a family member who is known to carry a harmful (cancer susceptibility predisposing) variant.

The upcoming trends of hereditary cancer testing market in the world include the rise in geriatric population, surge in incidence of cancer across the globe, and increase in the government expenditure on healthcare.

North America is the largest regional market for hereditary cancer testing.

The estimated industry size of hereditary cancer testing is $10,087.49 million in 2031.

The top companies to hold the market share in hereditary cancer testing include Abbott Laboratories., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, Eurofins Scientific SE, F. Hoffmann-La Roche AG, Illumina, Inc., Myriad Genetics, Inc., Qiagen N.V., Thermo Fisher Scientific, Inc.

The forecast period in the market report is from 2022 to 2031

The base year calculated in the hereditary cancer testing market report is 2021.

Yes, the hereditary cancer testing market report provides PORTER Analysis.

Loading Table Of Content...