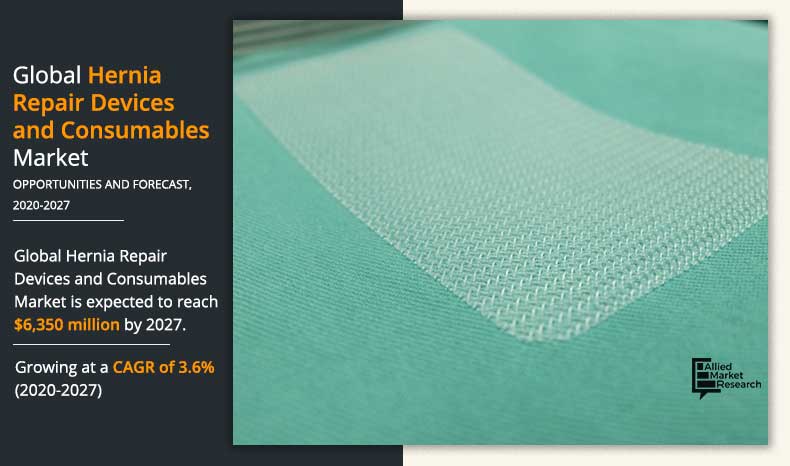

The global hernia repair devices and consumables market size was valued at $4,742 million in 2019, and is projected to reach $6,350 million by 2027, at a CAGR of 3.6% from 2020 to 2027.

Hernia is a type of disease in which the inner layers of abdominal muscles become weak, and the lining of abdomen bulges out into a small sac. It can affect multiple areas such as navel (umbilical hernia), groin (inguinal hernia), or incision site of surgery (post-surgery hernia). Watchful waiting and surgical procedures are the two measures by which hernia can be treated. The surgical procedures consist of two methodssuch as open tension-free repair surgery and laparoscopy. However, every year, about 20 million inguinal hernia repair surgeries are performed across the world. In the U.S., around 150 thousand incisional hernia repair surgeries are performed yearly. These surgeries are performed using mesh which are made up of synthetic material or biological material with the help of fixation devices.

The major factors that contribute toward the growth of the hernia repair devices and consumables market include high adoption rate of tension-free hernia repair surgical procedures, increase in demand for advanced mesh, rising adoption of robotic surgeries, and high prevalence rate of hernia across the world. However, high cost of hernia repair procedures and unfavorable reimbursement policies would hamper the market growth in the near future. On the contrary, the development of novel hernia products including biological mesh as well as high market potential in developing countries are expected to provide lucrative growth opportunities for the market.

Product Segment Review

On the basis of product, the market is bifurcated into fixation devices and consumables. Fixation devices are further segmented into tack and other fixation devices, where the tack segment is further sub-segmented into absorbable tack and non-absorbable tack. The consumables segment comprises mesh, which is further segmented into synthetic material mesh and biological material mesh. Synthetic material mesh is of two types, namely, absorbable mesh and non-absorbable mesh. The consumablessegment was the major revenue contributor in 2019,and is anticipated to continue this trend during the forecast period, owing tohigh usage, applicability, and growing number of hernia surgeries. Furthermore, the fixation devices segment is expected to grow at the highest CAGR of 4.6% from 2020 to 2027, owing to the high adoption rate of laparoscopic hernia surgeries leads to the increased usage of advanced fixation devices, thereby boosting the market growth. In addition, high recurrence rate of suture-based surgery, healthcare professionals prefer fixation device-based surgery, which further boosts the growth of the global hernia repair devices and consumables market.

By Product

Consumables holds the dominant position in 2019 and would continue to maintain the lead over the forecast period.

Hernia Type Segment Review

By hernia type, the global hernia repair devices and consumables market is classified into incisional hernia, umbilical hernia, inguinal hernia, femoral hernia, and other hernia. Theumbilical herniasegment is projected to exhibit the highest growth during the forecast period. This is attributed tothe rise in number of umbilical hernia worldwide, which is around three times more common in women than men, and approximately 20% of babies are born with umbilical hernia. Thus, increases the demand for umbilical hernia surgery. On the other hand, the inguinal hernia segmentheld the largest share in 2019, and id anticipated to continue its dominance during the forecast period, owing to large number of inguinal hernia repair surgeries performed every year globally.

By Hernia Type

Umbilical hernia segment is projected as one of the most lucrative segments.

Region segment review

Region wise, the hernia repair devices and consumable smarket is analyzed acrossNorth America, Europe, Asia-Pacific, and LAMEA. North America dominated the market in 2019, accounting forthe highest share, and is anticipated to maintain this trend throughout the forecast period.This is attributed to the early approval of hernia repair devices and increased number of hernia procedures.

By Region

Asia-Pacific region would exhibit the highest CAGR of 4.9% during 2020-2027.

The report provides a comprehensive analysis of key players operating in the global hernia repair devices and consumables market, namely, Allergan Plc., B. Braun Melsungen AG, Baxter International Inc., Becton, Dickinson and Company (C.R. Bard, Inc.), Cook Medical, Inc., HerniameshS.r.l., Johnson & Johnson (Ethicon Inc.), Medtronic Plc., The Cooper Companies, Inc., and W. L. Gore & Associates, Inc.The other players in the value chain (not profiled in the report) include Integra Life Sciences, and Insightra medical.

Key Benefits For Stakeholders

This report provides a detailed quantitative analysis of the current hernia repair devices and consumables market trends and forecast estimations from 2020 to 2027, which assists to identify the prevailing market opportunities.

An in-depth hernia repair devices and consumables market analysisof various regions is anticipated to provide a detailed understanding of the current trends to enable stakeholders formulate region-specific plans.

A comprehensive analysis of the factors that drive and restrain the growth of the market is provided.

Region-wise and country-wise hernia repair devices and consumables market conditions are comprehensively analyzed in this report.

The projections in this report are made by analyzing the current trends and future market potential from2020 to 2027, in terms of value.

An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves.

Key market players within the hernia repair devices and consumables market are profiled in this report and their strategies are analyzed thoroughly, which helps in understanding competitive outlook of global hernia repair devices and consumables market.

Key Market Segments

By Product

- Fixation Devices

- Tack

- Absorbable Tack

- Non-absorbable Tack

- Other Fixation Devices

- Consumables

- Mesh

- Synthetic Material Mesh

- Absorbable Mesh

- Non-absorbable Mesh

- Biological Material Mesh

By Surgery Type

- Open Tension-free Repair Surgery

- Laparoscopic Surgery

By Hernia Type

- Incisional Hernia

- Umbilical Hernia

- Inguinal Hernia

- Femoral Hernia

- Other Hernia

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Rest of Asia-Pacific

- LAMEA

- Brazil

- South Africa

- Saudi Arabia

- Rest of LAMEA

Hernia Repair Devices and Consumables Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By SURGERY TYPE |

|

| By HERNIA TYPE |

|

| By Region |

|

| Key Market Players | Cook Medical, Inc., W. L. Gore & Associates, Inc., B. Braun Melsungen AG, Becton, Dickinson and Company (C.R. Bard, Inc.), Herniamesh S.r.l., The Cooper Companies, Inc. (CooperSurgical, Inc.), Baxter International Inc., Allergan Plc. (LifeCell Corporation), Medtronic Plc., Johnson & Johnson (Ethicon Inc.) |

Analyst Review

The use of fixation devices and meshes has emerged as an effective solution for hernia repair procedures and is immensely contributing to the growth of this market. Hernia fixation devices are handheld devices used for mesh fixation. Meshes are prosthetics made using synthetic biological materials.

The rise innumber of hernia surgeries (open tension-free repair and laparoscopic repair) is the major factor that drivesthe growth of the market. Other factors such astechnological advancements, surge inacceptance of robotic surgeries, and rise ingovernment initiatives toward patient safety and efficacy are expected to have a significant impact on the market growth. However, factors such as expensive hernia repair surgeries and limited reimbursements are expected to impede the market growth.

Furthermore, use of hernia repair devices and consumables is the highest in North America, owing to large patient population and high adoption of hernia repair surgeries, followed by Europe and Asia-Pacific. In addition, hernia repair devices and consumables providers and distributors have focused on expanding their presence in emerging economies, which, in turn, is anticipated to drive the market growth.

The total market value of hernia repair devices and consumable market is $4,742 million in 2019.

The forcast period for hernia repair devices and consumable market is 2020 to 2027

The market value of influenza vaccine market in 2020 is $4,944 million

The base year is 2019 in hernia repair devices and consumable market

Medtronic Plc., Johnson & Johnson (Ethicon, Inc.), Baxter International Inc., Becton, Dickinson and Company (C.R. Bard, Inc.), and B. Braun Melsungen AG, held a high market position in 2019.

Fixation devices segment in hernia repair devices and consumable market is the most influencing segment growing with a CAGR of 4.6%.

The key trend in the herinia repair devices and consumable market is the higher acceptance of tension-free repair procedures, increase in demand for advanced meshes, and rise in adoption of robotic surgeries leads to increase int the demand of herinia repair devices and consumable in the near future.

Asia-Pacific has the highest growth rate in the market which is growing due to the contribution of the following emerging countries such as India and China with a CAGR of 5.9% and 5.5% respectively.

Loading Table Of Content...