High Performance Ceramic Coatings Market Outlook - 2026

The global high performance ceramic coatings market was valued at $7,844.0 million in 2018, and is projected to reach $12,633.3 million by 2026, growing at a CAGR of 6.2% from 2019 to 2026.

High-performance ceramic coatings (HPCC) are ceramic substrates coated with thin ceramic layers that provide enhanced resistance to high temperatures, wear, and corrosion than other conventional ceramics. They are an important part of the advanced coatings industry because of their physical and mechanical properties, which include corrosion and erosion resistance against a wide range of chemicals and across many applications. These coatings can withstand high temperatures upto 15,000°C. It is mainly used in the automotive industry, both in interior and exterior applications. It is mainly applied on automotive engine components, which help in increasing the fuel efficiency.

Rapid growth in automotive sector across developing economies such as India and China is the key factor that fuels the growth of the high performance ceramic coatings market. In addition, the commercial aviation and aerospace & defense markets are witnessing significant growth, which is expected to drive the market growth.

However, factors such as high cost of production is expected to restrain the growth of the high performance ceramic coatings market. On the other hand, technological advancements such as advancements in plasma sprayed coating practices are anticipated to provide lucrative opportunities for the growth of the market.

The high-performance ceramic coatings market is segmented based on product type, technology, end use industry, and region. Depending on product type, the market is classified into oxide coating, carbide coating and nitride coating. By technology, it is fragmented into thermal spray, physical vapor deposition, chemical vapor deposition, and other technologies. As per end use industry, it is segregated into automotive, aerospace & defense, general industrial tools & machinery, healthcare, and others. By region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, UK, Russia, and rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Thailand, rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Turkey, rest of LAMEA).

The major key players operating in the high performance ceramic coatings industry include Akzo Saint-Gobain, Aremco Products, Inc., Ceramic Polymer GmbH, Praxair Surface Technologies, Inc., DowDuPont, Cetek Ceramic Technologies Ltd., APS Materials Inc., Bodycote Plc, A&A Coatings, and Kurt J. Lesker Company Ltd. Other players operating in this market include Fosbel, Keronite Group, Oerlikon Metco, and Swain Tech Coatings. These major key players are adopting different strategies such as acquisition, business expansion, and collaboration to stay competitive in the global market.

Global High Performance Ceramic Coatings Market, By Region

Asia-Pacific accounted for the major share in 2018 in the global high performance ceramic coatings market, owing to increase in consumption of these coatings in the automotive, aerospace & defense, and healthcare industries. In addition, increase in investments by major market players for the R&D activities and expansion of their production capabilities and product portfolios are anticipated to increase the growth of the APAC high performance ceramic coatings market.

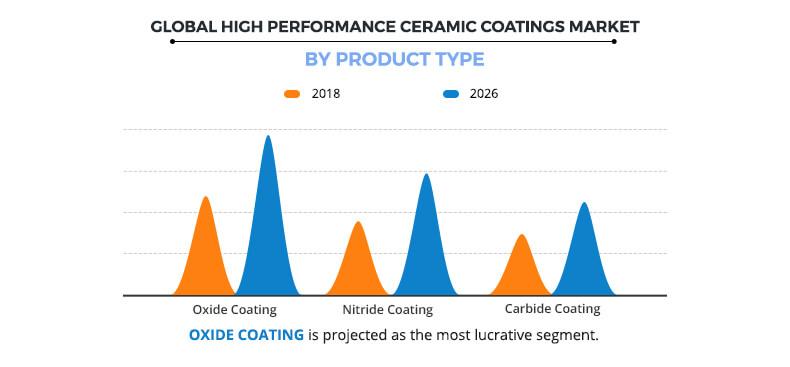

Global High Performance Ceramic Coatings Market Size, By Product Type

Based on product type, the oxide coating segment holds the major share in the market, as it is widely applied to steel and cast iron as well as to alloys of aluminum, copper, and zinc used in the automotive and aerospace & defense industries. In addition, it possesses properties such as resistance to corrosion and electrical insulation. These factors together are expected to increase the demand for oxide coatings and is anticipated to drive the growth of high performance ceramic coatings.

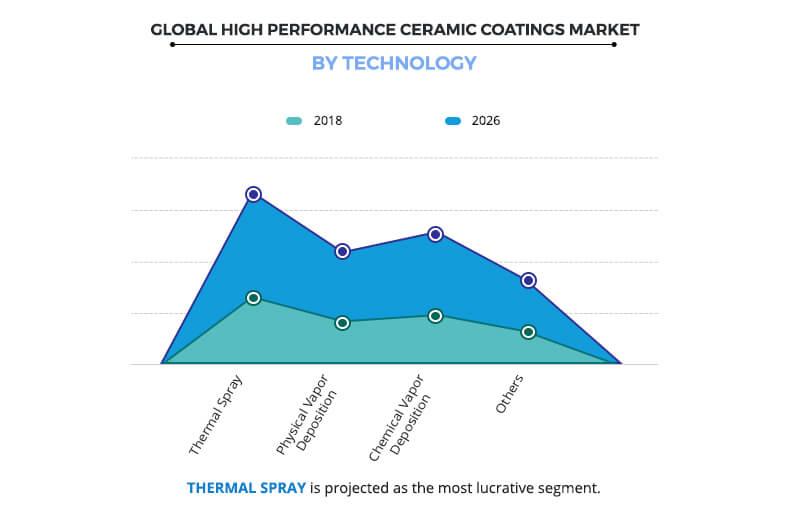

Global High Performance Ceramic Coatings Share, By Technology

Depending on technology, the thermal spray coating segment holds the major share in the market, owing to long self-life of the finished products and high precision. Furthermore, thermal spray coatings are applied on turbo-machinery such as high-pressure turbine seals, rotor-path linings, bearings, compressor seals, airframe, oil seals, and engine components of commercial and defense aircraft. Increase in production and export of military aircrafts and components across developed and developing countries such as the U.S., the UK, France, China, and Russia increases the demand for thermal spray coatings, which in turn is expected to fuel the growth of the high performance ceramic coatings market.

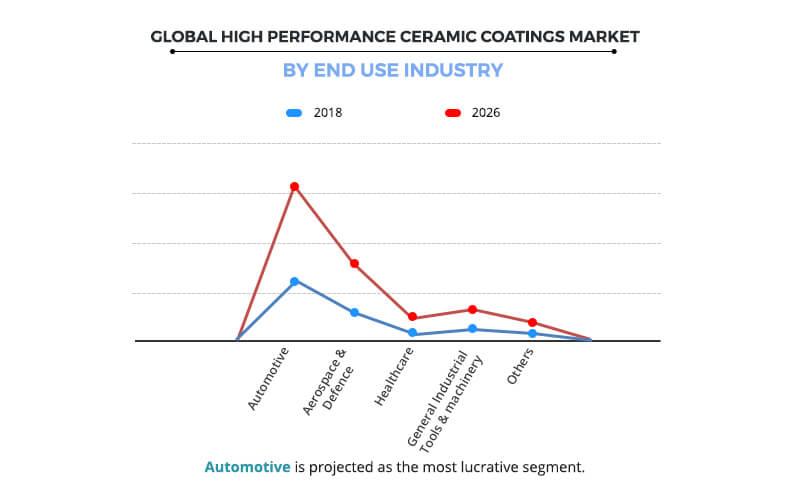

Global High Performance Ceramic Coatings Market, By End Use Industry

As per end use industry, the automotive segment holds the major share in the market. High performance ceramic coatings are applied on automotive engine components, which in turn increases the fuel efficiency. Its physical properties such as resistance to high temperature protects the components from oxidation. Due to increase in disposable income of consumers and rise standard of living across developing countries such as China and India has led to increase in demand for automobiles. This factor is anticipated to fuel the growth of the high performance ceramic coatings market.

Key Benefits for High Performance Ceramic Coatings Market:

- The high performance ceramic coatings market analysis covers in-depth information of major industry participants.

- The high performance ceramic coatings market share is analyzed across all the segments.

- High performance ceramic coatings market size has been analyzed across all regions.

- Porter’s five forces analysis helps to analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- The report outlines the current high performance ceramic coatings market trends and future scenario of the market from 2018 to 2026 to understand the prevailing opportunities and potential investment pockets. The market is forecasted for 2019-2026.

- The report provides an in depth analysis of the high performance ceramic coatings market forecast for the period 2019-2026.

- Major countries in the region have been mapped according to their individual revenue contribution to the regional market.

- The key drivers, restraints, and high performance ceramic coatings market opportunities and their detailed impact analyses are elucidated in the study.

High Performance Ceramic Coatings Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Technology |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | A&A Thermal Spray Coatings, Inc., Kurt J. Lesker Company, Saint Gobain S.A., Bodycote Plc., A.W. Chesterton Company, APS Material, Inc., DuPont de Nemours, Inc, Integrated Global Services, Inc., Linde plc, Aremco Products, Inc |

Analyst Review

The high performance ceramic coatings (HPCC) market is expected to witness substantial growth during the forecast period, owing to various factors such as development of the automotive and aerospace & defense industries. These coatings are witnessing outstanding acceptance due to their corrosion and erosion resistance properties. Unlike the usual wax-based coatings used in the automotive components, the HPCCs have high temperature resistance that protects the components from oxidation. Furthermore, development of coatings technology over the years has resulted in a significant increase in its usage in various end use industries, including automotive, aerospace & defense, general industrial tools & machinery, healthcare, and others.

Automotive and aerospace & defense industries serve as the most attractive end use industries in the U.S., France, Germany, China, and Russia, and are expected to be the first preference for new entrants, owing to increase in usage of these coatings for protection of metal and its alloys.

Loading Table Of Content...