High Performance Plastics Market Research, 2032

The global high performance plastics market was valued at $23.6 billion in 2022, and is projected to reach $58.0 billion by 2032, growing at a CAGR of 9.5% from 2023 to 2032.

Report Key Highlighters:

- The high performance plastics market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) and volume (Kilotons) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The high performance plastics market is highly fragmented, with several players including Daikin Industries, Ltd., Evonik Industries AG, SABIC, Kuraray Co., Ltd., 3M Company, Mitsui Chemical Inc., LANXESS, Solvay, BASF SE, Dow Inc.

High performance plastic is a specialized polymer engineered to exhibit exceptional mechanical, thermal, chemical, and electrical properties. This material surpasses conventional plastics with remarkable strength, durability, and resistance to extreme conditions. High-performance plastics offer high thermal stability, chemical resistance, and excellent electrical insulation. Their diverse properties make them crucial in industries such as aerospace, automotive, electronics, and medical devices. High performance plastics contribute to lightweight, corrosion resistance, and enhanced performance, driving innovation in advanced applications while maintaining structural integrity and reliability.

The surge in demand for high-performance plastics from the electronics industry is poised to be a significant driver that propels the growth of the high-performance plastics market.

As the electronics sector continues to rapidly evolve and innovate, there is an upsurge in the need for materials that meet the rigorous demands of modern electronic devices and components. High-performance plastics offer a compelling solution due to their exceptional electrical insulation properties, thermal stability, and resistance to various environmental factors. These plastics enable the development of compact, lightweight, and efficient electronic products while ensuring the safety and reliability of sensitive electronic components. From intricate circuitry and connectors to advanced semiconductor packaging, high-performance plastics play a pivotal role in enhancing the performance and longevity of electronics. As the electronics industry further embraces miniaturization, energy efficiency, and high-speed data processing, the demand for high-performance plastics is expected to surge, fostering growth and innovation in the high-performance plastics market.

The surge in demand for high-performance plastics from the healthcare and medical industry is poised to significantly drive the high-performance plastic market's expansion.

In recent years, high-performance plastics have emerged as essential materials in medical and healthcare applications due to their exceptional properties that align with stringent requirements in these sectors. These plastics offer a unique combination of biocompatibility, chemical resistance, and durability, making them integral to the manufacturing of medical devices, implants, surgical instruments, and diagnostic equipment. High-performance plastics play a crucial role in ensuring patient safety and enhancing medical procedures. They are employed in a range of applications, such as prosthetics, orthopedic implants, dental devices, and diagnostic components, where their biocompatibility minimizes adverse reactions within the body. Furthermore, these plastics endure the rigorous sterilization processes necessary in medical settings, contributing to infection control and maintaining the highest hygiene standards.

The trend toward minimally invasive surgical techniques and the increase in the use of advanced medical equipment further propel the demand for high-performance plastics. These materials offer the precision, reliability, and dimensional stability required for intricate medical devices, including catheters, endoscopes, and imaging components. In addition, high-performance plastics' ability to withstand exposure to various chemicals and bodily fluids ensures their longevity and consistent performance in critical medical applications. As the healthcare and medical industry continues to evolve, with an emphasis on improved patient care and technological innovation, the demand for high-performance plastics is set to rise.

The high performance plastics market growth is hindered by factors such as high commodity prices, the transfer of the end-use sector from developed to emerging countries, and rise in production costs. Changes in the demand and supply of primary materials have a negative impact on market expansion. Moreover, the absence of suitable testing standards within the industry is a challenge for this industry. As a result of the lack of standardized test methods, industries struggle with quality assurance and quality inspection, with many switching to internal testing procedures. Thus, fluctuations in the prices of raw materials hamper market expansion.

The surge in emphasis on renewable energy solutions offers lucrative opportunities for the high-performance plastics market. As the world shifts toward cleaner and more sustainable energy sources, high-performance plastics offer a crucial avenue for innovation and advancement. These plastics are employed in critical components of renewable energy technologies such as solar panels, wind turbine blades, and energy storage systems. Their exceptional durability, corrosion resistance, and thermal stability make them well-suited to endure the demanding conditions of these applications. By enabling the development of more efficient, reliable, and long-lasting renewable energy systems, high-performance plastics contribute to the success of green energy initiatives as well as open up lucrative opportunities for market growth. As the renewable energy sector continues to expand, the demand for high-performance plastics is poised to rise, solidifying their role as essential materials in driving the transition to a sustainable energy future.

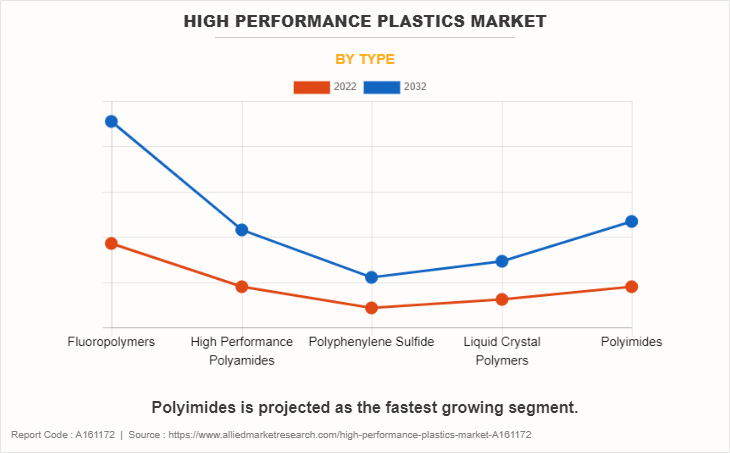

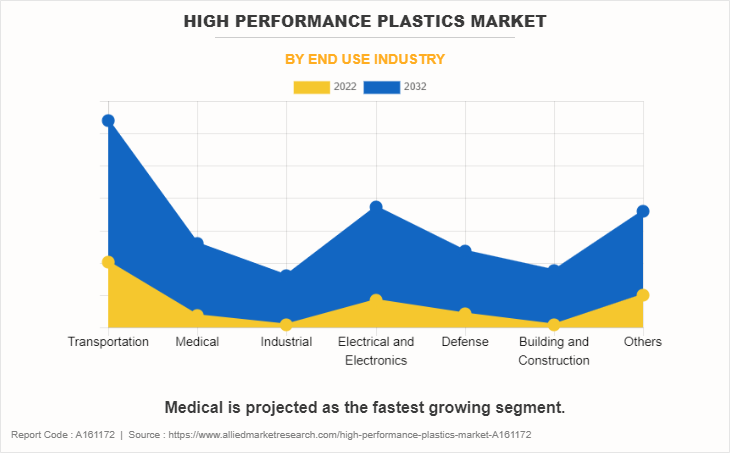

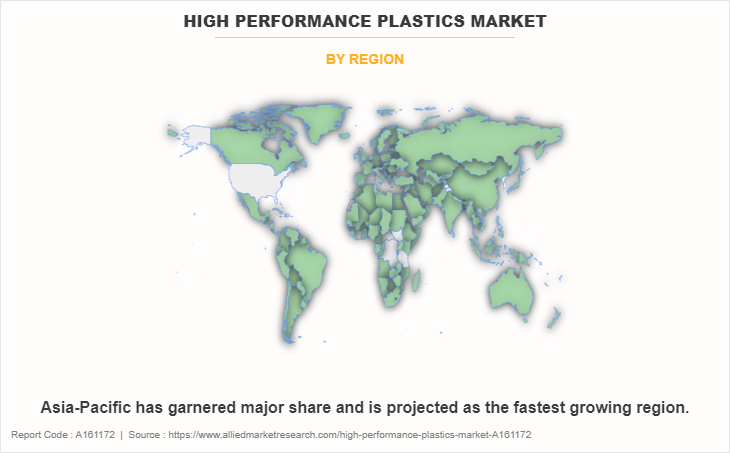

The high performance plastics market is segmented into type, end-use industry, and region. Depending on the type, the market is divided into fluoropolymers, high-performance polyamides, polyphenylene sulfide, liquid crystal polymers and polyimides. On the basis of end-use industry, it is categorized into transportation, medical, industrial, electrical & electronics, defense, building and construction, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The major players operating in the global high-performance plastics market are Daikin Industries, Ltd., Evonik Industries AG, SABIC, Kuraray Co., Ltd., 3M Company, Mitsui Chemical Inc., LANXESS, Solvay, BASF SE, Dow Inc.

Other players include DuPont, Victrex, Celanese, Arkema, Mitsubishi Engineering-Plastics Corporation, Ensinger, Quadrant Engineering Plastics, RTP Company, Covestro, Toray Industries, Teijin Limited, Zhejiang NHU Special Materials Co., Ltd and UBE Industries.

The fluoropolymers segment held the highest market share in 2022, accounting for nearly two-fifths of the global high performance plastics market revenue. This is due to their exceptional chemical resistance, high-temperature stability, and low friction properties. Increasing demand across industries like automotive, electronics, and aerospace, driven by stringent regulatory requirements and technological advancements, is propelling the growth of fluoropolymers. These materials offer unique solutions for applications requiring extreme performance and reliability, such as in corrosive environments, making them a preferred choice for various critical components.

Polyimides is expected to register the highest CAGR of 10.1%. This is due to their exceptional thermal stability, chemical resistance, and mechanical strength. Their versatility makes them ideal for aerospace, electronics, and automotive applications, where demanding conditions require robust materials. Additionally, innovations in polymer processing techniques and increased demand for lightweight, durable materials have further fueled the adoption of polyimides in various industries.

The transportation segment held the highest market share in 2022, accounting for around one-fourth of the global high performance plastics market revenue . This is due to the lightweight efforts to improve fuel efficiency, increased demand for electric vehicles, and the need for durable, corrosion-resistant materials in harsh environments.

Medical is expected to register the highest CAGR of 10.3%. This is due to increased demand for durable and lightweight materials for medical devices, equipment, and packaging. These plastics offer exceptional chemical resistance, biocompatibility, and sterilizability, making them ideal for various medical applications. Additionally, advancements in plastic manufacturing technologies have led to the development of innovative materials with enhanced properties, further driving their adoption in the medical sector.

Asia-Pacific held the highest market share in terms of revenue in 2022, accounting for nearly two-fifths of the global high performance plastics market revenue. The high-performance plastics market in Asia-Pacific is thriving due to several factors. Rapid industrialization, increasing automotive production, and a growing electronics sector drive demand. Additionally, the region's focus on sustainability and innovation in materials contributes to market growth.

Strategic developments undertaken by key players

On February 14, 2022, Mitsui Chemicals and Covestro were involved in an agreement for the supply of the raw materials phenol and acetone from ISCC Plus-certified mass-balanced sources. Both components were utilized in the production of polycarbonate at Covestro's Shanghai, China, and Map Ta Phut, Thailand facilities. Such applications include automobile headlights, LED lighting, electronic and medical devices, and automotive glazing. Mitsui Chemicals and Mitsui & Co., Ltd. of Japan have been Covestro suppliers for decades.

On May 31, 2022, Advent International and LANXESS established an engineering and high-performance plastics joint venture. The two companies entered into an agreement to acquire the DSM Engineering Materials (DEM) division from Dutch conglomerate Royal DSM, which then became a part of the new joint venture. The Enterprise Value is approximately EUR 3.7 billion and is financed via Advent equity and external debt. The business generates approximately EUR 1.5 billion in revenue, with an EBITDA margin of roughly 20%.

On June 27, 2023, Solvay and Zotefoams signed a long-term agreement for the supply of Solef polyvinylidene fluoride (PVDF). Solef will be utilized in the manufacturing of Zotefoams' ZOTEK F high-performance, closed-cell, cross-linked aerospace foam product line. The collaboration will target a vast array of interior aerospace applications, including ducting, carpet underlay, environmental control systems, and insulation, where low weight, high flame retardancy, and cost-effective processability are of paramount importance.

On April 1, 2021, Solvay expanded the distribution of its Solef PVDF and Halar ECTFE speciality polymers in the EMEA region (excluding Italy) through Biesterfeld Plastic and Albis, respectively.

On May 29, 2019, Solvay SA, specialty chemicals company, and Stratasys formed a partnership to develop high-performance filaments for the FDM F900 3D Printers manufactured by Stratasys.

Impact Of Russia Ukraine War On the High Performance Plastics Market

The potential impact of the Russia-Ukraine war on the high-performance plastics market is complex and multifaceted. Both Russia and Ukraine are home to chemical and petrochemical industries that produce raw materials used in the production of plastics. The war has disrupted supply chains, which affected the availability of key raw materials, and causes shortages in the high-performance plastics market.

Supply disruptions and increased geopolitical risks have led to price volatility in the high-performance plastics market. Shortages and uncertainty drive up prices, impacting manufacturers and consumers.

Trade disruptions due to the war have led to export and import restrictions, affecting the movement of high-performance plastics and related products across borders. This further contributes to supply chain challenges.

During the conflict, industries that heavily rely on high-performance plastics, such as aerospace, automotive, electronics, and medical devices, experience disruptions. Reduced economic activity and uncertainty have led to fluctuations in demand for these products.

Geopolitical instability has influenced investment decisions and R&D activities. Companies delay or re-evaluate their plans to invest in new technologies and innovations related to high-performance plastics.

The significant conflict creates global market uncertainty, impacting investor confidence and spending across various industries, including the high-performance plastics sector. In times of geopolitical uncertainty, governments enact new regulations or trade policies that impact the high-performance plastics market, either directly or indirectly.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the high performance plastics market analysis from 2022 to 2032 to identify the prevailing high performance plastics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the high performance plastics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global high performance plastics market trends, key players, market segments, application areas, and market growth strategies.

High Performance Plastics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 58 billion |

| Growth Rate | CAGR of 9.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 693 |

| By Type |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | SABIC, LANXESS, Daikin Industries, Ltd., Evonik Industries AG, 3M Company, BASF SE, Dow Inc., Solvay, Mitsui Chemical Inc, Kuraray Co., Ltd. |

Analyst Review

According to the insights of the CXOs of leading companies, the market is driven by the superior anticorrosion and thermal conductivity properties of high performance plastics, which have witnessed a surge in its usage in a variety of industries. The surge in demand for high performance plastics is due to their superior performance at high temperatures and as highly reactive compounds. These plastics feature high mechanical strength, chemical resistance, and thermal stability. However, the market represents only a minor portion of the global plastics market, and the demand for these plastics is expected to increase substantially during the forecast period. The growth rate of the market is primarily attributable to the increase in government initiatives, policies, and regulations. Rise in industrialization and demand for applications, such as automotive and aerospace, are expected to have a direct and positive effect on the market's growth rate, particularly in developing nations. The growth and expansion of various end-user industries, as well as a greater awareness of the benefits, is anticipated to fuel the growth of the high performance plastics market. In addition, the increase in use of advanced plastics for a variety of end-use applications, such as transportation and automotive applications, industrial, electrical & electronics, medical, construction, and defense applications, and the rise in industrialization, particularly in developing countries, are the primary factors driving the market's expansion.

The CXO further added that the surge in costs and environmental concerns are expected to pose the greatest challenge to the market's expansion. The presence of substitutes in the market is anticipated to hinder market expansion. In addition, fluctuations in the cost of basic materials are anticipated to have an effect on the market.

The high performance plastics market attained $23.6 billion in 2022 and is projected to reach $58.0 billion by 2032, growing at a CAGR of 9.5% from 2023 to 2032.

The High Performance Plastics Market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Asia-Pacific is the largest regional market for High Performance Plastics.

Medical is the leading end-use industry of High Performance Plastics Market.

Special characteristics of high performance plastics and surge in demand for high performance plastic from healthcare and medical industry are the driving factor of High Performance Plastics Market.

Increasing focus on industrial equipment enhancement is the upcoming trend of High Performance Plastics Market in the world.

Daikin Industries, Ltd., Evonik Industries AG, SABIC, Kuraray Co., Ltd., 3M Company, Mitsui Chemical Inc., LANXESS, Solvay, BASF SE, Dow Inc. are the top companies to hold the market share in High Performance Plastics.

Loading Table Of Content...

Loading Research Methodology...