High Potency APIs Market Research, 2031

The global high potency apis market high potency APIs market size was valued at $19.7 billion in 2021, and is projected to reach $41.4 billion by 2031, growing at a CAGR of 7.7% from 2022 to 2031. High potency APIs are the active pharmaceutical ingredients which exhibit effect at a very low doses. They hold a significant share in the new drugs which are under development, which highlights their importance and application in the near future. In addition, high potency active pharmaceutical ingredients (HPAPI) are effective at much smaller dosage levels than traditional APIs, hence have a greater demand in the healthcare sector for treatment of serious ailments.

According to the Centers for Disease Control and Prevention, CDC, it is estimated that 12.1 million people in the U.S. will have atrial fibrillation in 2030. Many such cardiovascular disorders can be treated using these HPAPIs. Thus, the prevalence of the cardiovascular diseases in large number of population, will lead to the rise in the demand for the HPAPIs and will also propel the high potency APIs market growth. In addition, World Health Organization, WHO, states that an estimated 1.28 billion adults aged 30-79 years worldwide have hypertension, most of them belong to low- and middle-income countries, which will accelerate the growth of the market due to the rise in the demand of high potency drugs for cardiovascular disorders treatments and other diseases such as hormonal imbalance and glaucoma.

In addition, the government initiatives focusing on active pharmaceutical ingredient production are adding to the growth of the. For instance, the government scheme Production Linked Incentive (PLI) Scheme for Promotion of Domestic Manufacturing of critical Key Starting Materials (KSMs)/ Drug Intermediates and Active Pharmaceutical Ingredients (APIs) in the Country (India) which was announced in 2020, to boost domestic manufacturing of identified drug intermediates and APIs by attracting large investments in this sector, which will further boost the high potency APIs market during the forecast period.

The primary driving factors for the market includes the patent expiration of various drugs, launching of more cost effective generic substitutes, and increase in the demand for cancer treatment, along with the huge number of cancer treatment drugs in the pipeline for the future, increase in the number of contract manufacturing organizations, CMO, and is the contract development and manufacturing organizations, CDMOs. In the recent years, there is an increase in the partnerships between CMOs, CDMOs, and pharma companies, which lack the means and funds to take their product from its first phases to production and commercialization. Thus, CMOs and CDMOs collaborate with these organization for the further phases of production of the high potency APIs and leads to the growth of the market.

Furthermore, high risk of cross-contamination, huge capital investment and high technical skills required for the production are expected to provide hindrance to the market. However, patent expiry allows the generic companies to penetrate in the market and diversify product offerings, which provides a large opportunities for the market players during the forecast period.

Impact of COVID-19 on High Potency APIs Market

The COVID-19 pandemic have proved to be an incomparable global public health emergency that has affected almost every industry, and the effects are expected to impact every industry growth during the forecast period. Several changes in consumer demand and behavior, buying habits, supply chain redirection, and significant government initiatives have been seen around the globe. The COVID-19 witnessed a positive as well as negative impact on the high potency APIs market. The pandemic has provided opportunities for the key market players to invest and develop innovative HPAPIs for the treatment of the infectious diseases. On the other hand, the market has been severely impacted by the COVID 19 epidemic. This mostly refers to the worldwide market's supply chain. Additionally, India, which accounts for approximately 20% of the global market for the production of generic pharmaceutical drugs, manufactures the majority of APIs, particularly high strength active pharmaceutical ingredients was highly affected by the pandemic.

The high potency apis market is segmented into Application, Type of Synthesis and Product Type.

The high potency APIs market is segmented on the basis of product type, by application, by type of synthesis and region. On the basis of product type, the market is segmented into innovative high-potency API and generic high-potency API. On the basis of application, the market is segmented into oncology, hormonal imbalance, glaucoma and others. On the basis of type of synthesis, the market is segmented into synthetic and biotech. Further, the biotech is divided into merchant and captive.

Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

Segment Review

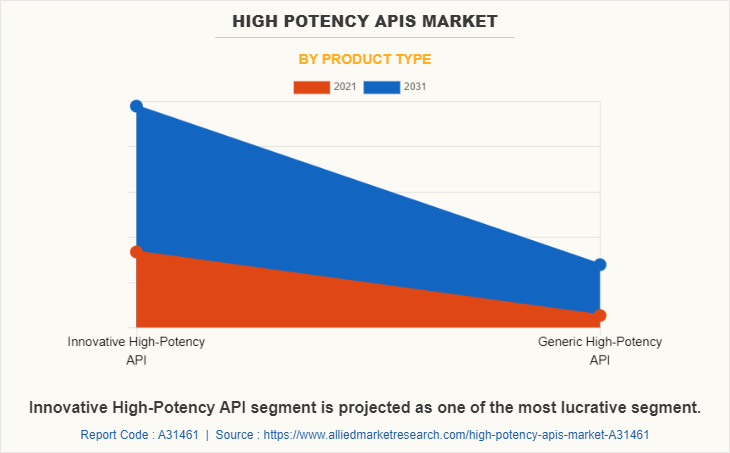

By product type, the market is segmented into innovative high-potency API and generic high-potency API. The innovative high-potency API segment generated maximum revenue in 2021, and is estimated to be the fastest growing segment, with a high CAGR owing to the increase in the R&D initiatives for novel drug development adopted by the pharmaceutical companies and favorable government policies, growing focus on personalized and precision medicines to treat specific disease conditions.

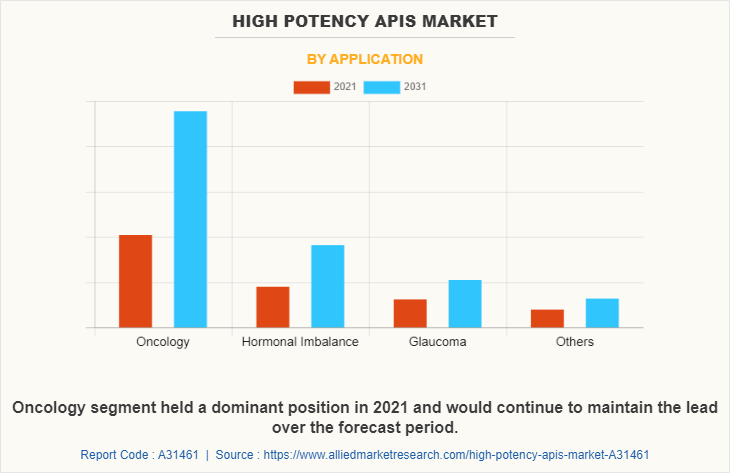

Depending on the application, the high potency APIs industry is divided into oncology, hormonal imbalance, glaucoma and others. The oncology segment dominated the market in 2021, and is estimated to grow with a high CAGR during the high potency APIs market forecast period due rise in the prevalence of cancer.

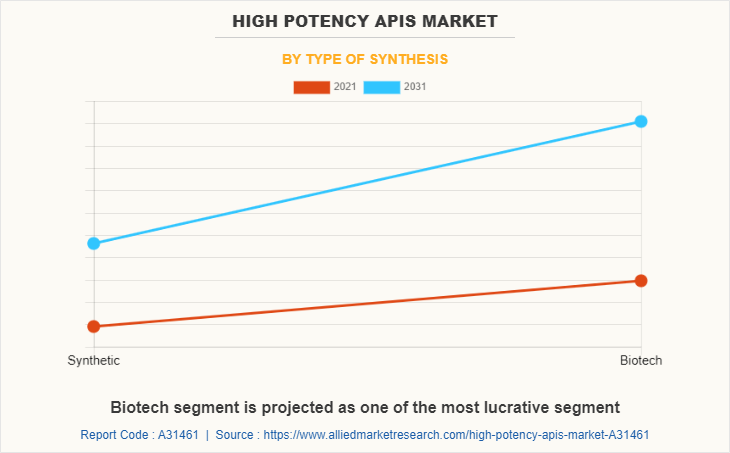

Depending on type of synthesis, the high potency APIs industry is divided into synthetic and biotech. The biotech segment owned the largest high potency APIs market share in 2021, because of the technological advancements and the high level of efficacy of these ingredients.

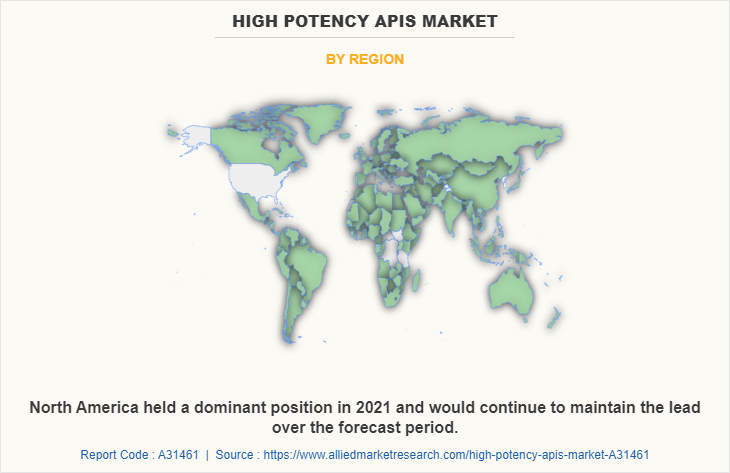

Region wise, North America acquired a major share in the year 2021, owing to the presence of key players, rising government initiatives, well-developed healthcare infrastructure, and rising awareness about the HPAPIs in the treatment of the serious ailments. The region registered the growth at a highest CAGR. However, Asia-Pacific is expected to witness the highest growth rate for the high potency APIs market throughout the forecast period. The major factors that drive the growth of the high potency APIs market share is the elevating healthcare demand for highly potent drug, unmet needs for the cancer treatment and availability of excessive raw material in this region. Also, the rise in market players investing in research and development are leveraging the high potency APIs market size.

The major companies profiled in this report include Abbvie Inc., Bayer AG, Boehringer Ingelheim International GmbH, Bristol-Myers Squibb, Eli Lilly and Company, F. Hoffmann-La Roche Ltd, Novartis AG, Pfizer Inc., Sanofi, Teva Pharmaceutical Industries Ltd. and others.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the high potency apis market analysis from 2021 to 2031 to identify the prevailing high potency apis market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the high potency apis market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global high potency apis market trends, key players, market segments, application areas, and market growth strategies.

High Potency APIs Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 41.4 billion |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 310 |

| By Application |

|

| By Type of Synthesis |

|

| By Product Type |

|

| By Region |

|

| Key Market Players | F. Hoffmann-La Roche, Boehringer Ingelheim International GmbH, Sanofi, Eli Lilly and Company, AbbVie Inc., Bristol-Myers Squibb Company, Bayer AG, Novartis International AG, Teva Pharmaceutical Industries Ltd., Pfizer, Inc. |

Analyst Review

This section provides various opinions of top-level CXOs in the high potency APIs market. The high potency APIs market has piqued the interest of healthcare providers, patients, and consumers, owing to several benefits offered by these products which helps the medical practitioner to treat the serious illness efficient rate. There have been remarkable advancements in development of high potency APIs market to provide advanced options for cancer and other diseases. As the market is saturated and is growing at a steady rate in developed nations, Asia-Pacific and LAMEA are expected to offer high growth opportunities to key players in this market.

According to the perspectives of CXOs of leading companies in the market, significant advancements in the manufacturing of the high potent APIs with increase in clinically backed research, rise in investments, funds, and grants, surge in incidence of target diseases, entry of new players, and growth in the diseased population are projected to increase the sale of high potency APIs market globally. In addition, COVID-19 has a negative as well as positive impact on the market, wherein the pandemic led to high demand for the potent APIs along as well as affected the export and import of APIs around the globe.

Advancements in HPAPI manufacturing technologies along with the rise in the number of contract manufacturing organization (CMOs) and contract development and manufacturing organization (CDMOs) are the upcoming trends of High Potency APIs Market.

Oncology is the leading application of High Potency APIs Market.

North America is the largest regional market for High Potency APIs.

High Potency APIs market is projected to reach $41,373.34 million by 2031, registering a CAGR of 7.7% from 2022 to 2031.

The major companies profiled in this report include Abbvie Inc., Bayer AG, Boehringer Ingelheim International GmbH, Bristol-Myers Squibb, Eli Lilly and Company, F. Hoffmann-La Roche Ltd, Novartis AG, Pfizer Inc., Sanofi, and Teva Pharmaceutical Industries Ltd.

The base year is 2021 in High Potency APIs market.

Yes, the High Potency APIs market report provides PORTER Analysis.

Loading Table Of Content...