The global high power microwave directed energy weapons market size was valued at $1.3 billion in 2022, and is projected to reach $5 billion by 2032, growing at a CAGR of 15.1% from 2023 to 2032.

Report Key Highlighters:

- The high power microwave directed energy weapons market studies more than 15 countries. The research includes a segment analysis of each country in terms of value ($ million) for the projected period 2022-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The high power microwave directed energy weapons market share is moderately fragmented, with several players including Lockheed Martin Corporation, Raytheon Technologies Corporation, BAE systems, Boeing, Epirus, Inc., Thales Group, Leidos, Inc., L3Harris Technologies, Inc., Rheinmetall AG, and Rafael Advanced Defense Systems Ltd. Key strategies such as contract, product launch, product development, and other strategies of the players operating in the market are tracked and monitored.

A high-power microwave refers to radio electromagnetic waves generated by a microwave source with a peak power ranging from 100 MW to 100 GW and an operating frequency within the range of 1 to 300 GHz. High-power microwave (HPM) weapons produce beams of electromagnetic energy across a wide spectrum of radio and microwave frequencies. The primary purpose of the weapons is to engage with electronics within specific systems, either inflicting damage or inducing temporary disruption.

Factors such as increase in demand for directed energy weapons to achieve precise targeting and reduced collateral damage, rise in security threats posed by terrorist organizations, and surge in the defense budget drive the growth of the high-power microwave directed energy weapons market. However, technological limitations, and ethical and health concerns hinder the growth of the market. Furthermore, the technological advancements and continuous research, and integration of directed energy weapons with conventional weapons offer remarkable growth opportunities for the players operating in the market.

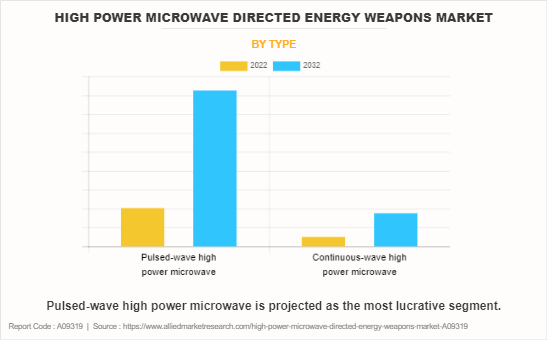

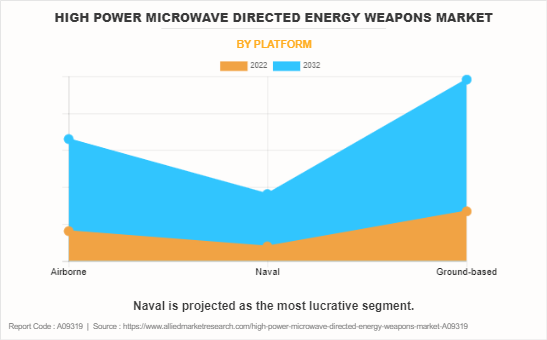

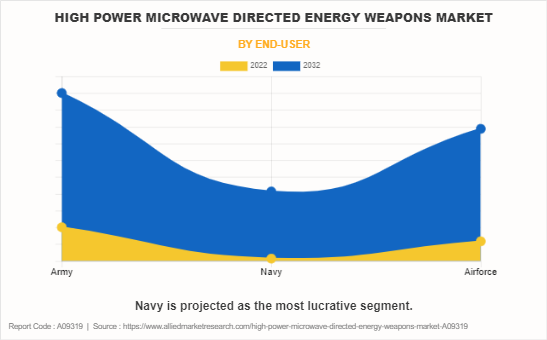

The high power microwave directed energy weapons market is segmented on the type, platform, end-user, and region. By type, it is divided into pulsed-wave high power microwave, and continuous-wave high power microwave. By platform, it is fragmented into airborne, naval, ground-based. By end-user, it is categorized into army, navy, and Airforce. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading companies profiled in the high power microwave directed energy weapons market report include Lockheed Martin Corporation, Raytheon Technologies Corporation, BAE systems, Boeing, Epirus, Inc., Thales Group, Leidos, Inc., L3Harris Technologies, Inc., Rheinmetall AG, and Rafael Advanced Defense Systems Ltd. The companies have adopted strategies such as contract, product launch, product development, and others to improve their market positioning.

North America includes the U.S., and Canada. Military entities in the counties of the region are consistently developing technological innovations to achieve a competitive advantage in combat situations. Moreover, the rise in collaborations between the defense sector and manufacturers to develop advanced, high-efficiency high power microwave weapons is expected to drive the growth of the market. Countries in the region aim to promote technological advancements in defense and military domains.

The advancement of cutting-edge technologies, such as directed energy weapons, has been propelled by substantial financial investments in research and development. Notably, the U.S. Department of Defence allocates approximately $1 billion each year for the development of weapons employing "directed energy" technologies, as highlighted by the U.S. Government Accountability Office. This heightened focus on the research and development of directed energy weapons signifies significant opportunities for market expansion in this domain.

In addition, manufacturers collaborate with the defense sector to test and deploy advanced high power microwave weapons. For instance, in January 2023, a $66 million contract for prototypes of the Leonidas high-power microwave system was awarded to Epirus, a developer of software-defined high-power microwave technology. The system's goal is to mitigate the growing threat posed by enemies' use of unmanned aerial vehicles (drones).

Europe includes the United Kingdom, Germany, France, Russia, and the rest of the continent. The market for directed energy weapons is expected to grow in the area due to the increased research, development, and testing of high power microwave weapons to strengthen security. The defence forces of numerous regional nations are also studying and creating directed energy weapons (DEWs), which is promoting the high power microwave directed energy weapons industry.

Numerous European nations have been allocating resources to research and develop directed energy weapons technology. These countries are investigating the potential of directed energy weaponry for military purposes. Moreover, collaborative efforts among European nations in defense projects are expected to increase the advancement and exchange of directed energy weapons technology. In addition, there is a surge in the number of collaborations between manufacturers and defense sectors of various countries in Europe to develop advanced directed energy weapons that can defend against various threats, including drones.

Moreover, various countries in Europe such as Russia have been investing in the research and development of high power microwave weapon systems. For instance, in September 2021, The Ministry of Defense (MOD) in the United Kingdom granted three contracts for directed-energy weapons demonstrators, amounting to a total of $100 million, to Thales UK and Raytheon Technologies Corporation. Two of the demonstrators will utilize high-energy laser weapons, while the third program will focus on an electromagnetic warfare RF and microwave directed-energy weapon. Such developments encourage the government to allocate resources toward the development and acquisition of directed energy weapons which is expected to propel the growth of the high-power microwave directed energy weapons market.

Increase in demand for directed energy weapons for precise targeting and reduced collateral damage

The surge in demand for directed energy weapons stems from the compelling need to achieve precision in targeting capabilities while concurrently mitigating collateral damage. Conventional kinetic armaments, including missiles and explosives, frequently result in inadvertent harm and civilian casualties, thereby triggering ethical and strategic apprehensions. In contrast, directed energy weapons hold the promise of engaging and incapacitating specific objectives with exceptional accuracy, thereby minimizing the likelihood of unintentional harm to non-combatants and vital infrastructure.

Directed Energy Weapons (DEWs) such as high power microwave weapons exhibit precision when engaging swiftly moving targets, setting them apart from conventional weaponry which makes them a suitable choice. Furthermore, high power microwave directed energy weapons possess advantages such as the ability to cover multiple target zones, and silent operation. These systems find extensive utilization across various platforms including ground vehicles, naval vessels, aircraft, and unmanned vehicles. This versatile array of applications highlights the potential for high power microwave weapons to revolutionize modern warfare and security strategies. Therefore, such advantages provided by directed energy weapons are expected to drive the growth of the market.

Rise in security threats posed by terrorist organizations

The rise in the number of security threats presented by terrorist organizations has emerged as a significant driver for the growth of the high power microwave directed energy weapons market. According to the Office for the Coordination of Humanitarian Affairs, in 2022, terrorist attacks exhibited a higher level of lethality, resulting in an average of 1.7 fatalities per attack, as opposed to the previous year, 2021, when the average stood at 1.3 deaths per attack. Attacks have become more deadly with the lethality rising by 26%. Moreover, according to the National Institute of Health, U.S., The mean number of UAVs employed in an attack was 1.28 (range: 1-5) and multiple UAVs were used in 22% of attacks. Therefore, the use of UAVs to carry out terrorist attacks has increased significantly.

Terrorist groups are progressively employing unmanned aerial vehicles (UAVs) and drones for activities such as reconnaissance, surveillance, and other operations. Directed energy weapons offer a valuable solution to counter these activities by incapacitating or eliminating unauthorized UAVs. This enhances the protection of vital infrastructure, public gatherings, and military sites. In addition, utilizing directed energy weapons is expected to strengthen border security by deterring and incapacitating potential infiltrators. The extended range and precision of the weapons make them highly suitable for surveilling and safeguarding vast borders from unauthorized incursions. Therefore, the rise in security threats from terrorist organizations is expected to increase the demand for high power microwave directed energy weapons.

Technological limitations

Technological limitations exert a significant restraint on the growth of the market. These constraints originate from the present capabilities and confines of prevailing technologies, thereby impeding the broad acceptance and efficacy of specific advancements. Certain technologies may not currently meet the performance benchmarks essential for particular applications. Power consumption poses a significant hurdle for high power microwave weapon systems. These systems demand a substantial energy supply to generate the intense energy beam. Supplying such vast amounts of power is challenging, and ensuring a consistent power source on the battlefield when needed adds an even greater level of complexity.

These weapons demand substantial power resources for optimal operation, and technological restrictions in power creation, storage, and transmission can compromise their functionality and endurance, impacting their viability in practical situations. The generation of intense heat during directed energy weapon operation requires efficient cooling mechanisms. Technological limitations in thermal management can affect the weapon's performance and longevity. Technologically complex systems can be prone to malfunctions and require sophisticated maintenance. Ensuring the reliability of directed energy weapons under various operational conditions is a technological hurdle. Therefore, all such technological limitations during the development and maintenance of directed energy weapons are expected to hamper the growth of the market.

Ethical and health concerns

Ethical and health-related worries serve as significant factors constraining the progress of the market, especially in domains such as directed energy weapons. These concerns revolve around the ethical consequences and possible health hazards linked to the application and utilization of these technologies. The introduction of directed energy weapons brings about the possibility of unintentional harm to individuals who are not directly targeted. This scenario prompts ethical considerations about the appropriateness of using force and the potential for unintended civilian casualties or damage to non-targeted assets. Additionally, the effects on health due to exposure to directed energy emissions, like powerful microwaves, are not entirely comprehended. The potential health risks related to the use of microwave energy are expected to hamper the growth of the high power microwave directed energy weapons market.

Technological advancements and continuous research

Technological progress and persistent research offer significant opportunities for market expansion and advancement. There is a rise in ongoing enhancements and innovations across different areas of the high-power microwave weapon industry, which is expected to promote the evolution of directed energy weapons and their uses.

Technological advancements are anticipated to significantly increase the overall proficiency of directed energy weapons, their range, power output, and targeting precision. Moreover, technological advancements provide more energy-efficient configurations for directed energy weapons, extending their operational endurance. This advantage is expected to be beneficial for longer missions where sustained functionality is crucial.

Additionally, research on directed energy weapons (DEWs) is expanding across numerous nations and organisations. For instance, in February 2019, Tau Technologies in Albuquerque secured an $8.9 million contract from the U.S. Air Force for directed energy modeling aimed at cross-domain analysis within the Air Force Research Laboratory, as disclosed by U.S. Senator Martin Heinrich. Directed energy modeling involves employing computer simulations and mathematical models to anticipate the performance of directed energy weapons in diverse scenarios across land, air, sea, space, and cyber domains of conflict. This research facilitates an enhanced comprehension of these weapons' capabilities and constraints, fostering innovation and technological advancements, anticipated to drive market growth.

Recent Developments in the High Power Microwave Directed Energy Weapons Industry

- In January 2023, Epirus, a technology company received a contract worth $66.1 million by the U.S. Army's Rapid Capabilities and Critical Technologies Office (RCCTO) for its Leonidas Directed Energy System. This contract is part of the Indirect Fire Protection Capability-High-Power Microwave Program, and it underscores the increasing recognition of high-power microwave (HPM) systems as effective solutions for short-range air defense against swarming unmanned aerial systems (UAS).

- In February 2022, Leidos [LDOS] received a $26 million contract from the Air Force Research Laboratory's (AFRL) directed energy directorate at Kirtland AFB, New Mexico, to develop the company's Mjölnir high power microwave (HPM) weapon against hostile drones.

- In February 2022, Epirus, a developer of directed energy systems announced the launch of the Leonidas Pod, a solid-state, multiple-shot high-power microwave (HPM) system. This portable system is the latest addition to Epirus' advanced electronic warfare (EW) solutions and complements the existing product portfolio of the company. The Leonidas Pod is designed to provide a versatile and portable solution for countering electronic threats.

- In April 2022, Epirus unveiled an upgraded version of its Counter-Electronics Leonidas system, featuring increased power and enhanced operational capabilities. The Counter-Electronics Leonidas system by Epirus is a high-power microwave (HPM) technology designed for countering electronic threats. The latest system features both hardware and software upgrades that directly align with the mission sets.

- In October 2020, Raytheon received an exclusive 18-month contract from U.S. Air Force Research Laboratory for the purpose of conducting experiments with the company's directed-energy weapon prototype, known as the Counter-Electronic High Power Microwave Extended Range Air Base Air Defense (CHIMERA).

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the high power microwave directed energy weapons market analysis from 2022 to 2032 to identify the prevailing high power microwave directed energy weapons market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the high power microwave directed energy weapons market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global high power microwave directed energy weapons market trends, key players, market segments, application areas, and market growth strategies.

High Power Microwave Directed Energy Weapons Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5 billion |

| Growth Rate | CAGR of 15.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 245 |

| By Type |

|

| By Platform |

|

| By End-user |

|

| By Region |

|

| Key Market Players | Lockheed Martin Corporation, L3Harris Technologies, Inc., Thales Group, Boeing, Rheinmetall AG, BAE Systems, Epirus, Inc., Rafael Advanced Defense Systems Ltd., Leidos, Inc., Raytheon Technologies Corporation |

The estimated industry size of high power microwave directed energy weapons market is $1.26 billion in 2022.

The leading companies profiled in the report include Lockheed Martin Corporation, Raytheon Technologies Corporation, BAE systems, Boeing, Epirus, Inc., Thales Group, Leidos, Inc., L3Harris Technologies, Inc., Rheinmetall AG, and Rafael Advanced Defense Systems Ltd.

The largest regional market of high power microwave directed energy weapons market is North America.

The leading platform of high power microwave directed energy weapons market is ground-based.

The upcoming trends of high power microwave directed energy weapons market in the world are technological advancements and continuous research, and integration of directed energy weapons with conventional weapons.

Loading Table Of Content...

Loading Research Methodology...