High-Speed Rail/Bullet Train Market Statistics, 2033

The global high-speed rail/bullet train market was valued at $54.3 billion in 2023, and is projected to reach $98.9 billion by 2033, growing at a CAGR of 6.2% from 2024 to 2033.

The high-speed rail (HSR) market encompasses the development, production, and operation of railway systems designed for speeds exceeding 250 km/h (155 mph). It includes trains, infrastructure, signaling systems, and associated services aimed at providing efficient, fast, and sustainable transportation solutions for passengers and freight. The market is driven by urbanization, environmental concerns, and the need for reduced travel times over medium to long distances. Key players include train manufacturers, infrastructure developers, and government bodies investing in expanding rail networks.

Key Takeaways

- The market studies more than 16 countries. The analysis includes a breakdown analysis in terms of value ($million) available from 2022 to 2032.

- The research combined high-quality data, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the servo motors market growth.

Market Dynamics

Surge in demand for secure, safer, and efficient transport system

According to the fact sheet of the World Health Organization (WHO), road traffic injuries are the leading cause of fatality among people aged between 15 and 29 years, thus accounting for 1.25 million deaths every year due to road accidents. In addition, 90% of the world's fatalities on roads occur in low and middle-income countries, though such countries have approximately 54% of the world's vehicles. Moreover, for most countries, road accidents cost 3% of their GDP. Furthermore, road accidents cause considerable economic losses to individuals, their families, and to nations. Therefore, rise in need for safe, secure, and efficient transportation systems significantly contributes toward the growth of the global high-speed rail/bullet train market.

Railway transportation is considered the safest and economical mode of transportation, which has further boosted the demand for high speed rails. High speed rails are equipped with onboard cameras, sensors, and communication devices. Moreover, such trains in most locations run underground or at the ground level and are highly secured by fences or walls to prevent trespassing, which propels the growth of the market. In addition, high speed rails consume less energy due to their advanced acceleration, traction, and braking system, resulting in reduction of energy consumption by around 30% based on the degree of automation. Moreover, train control management system provides integrated diagnostics & prognostic capability to the train, enables visualization of systems issues & performance, and suggests a corrective action to the driver. Furthermore, such trains can provide a flexible way to coordinate in terms of frequency, which results in the improvement of the system performance in all aspects, which is boosting the growth of the railway industry. Thus, demand and preference of consumers for safe, secure, and efficient transportation is augmenting the growth of high speed rail market.

Increase in demand for passenger and freight capacity

The railway industry has witnessed significant growth in passenger ridership as compared to other public transit, owing to its fare frequency and overall commute time. According to the Organization for Economic Cooperation and Development (OECD), passenger transport by rail for million passenger-kilometers has witnessed steady growth in the past decade. Moreover, countries such as China, India, and Japan are gaining momentum for million passenger-kilometers.

According to the World Bank, China registered 0.37 million rail passenger–kilometers in 1998, which increased significantly to 2.5 billion rail passenger–kilometers by 2023. Similarly, the U.S. has witnessed a resurgence in rail ridership, recording over a 70% increase since 1997. As of 2022, rail transit in the U.S. accounted for approximately 50% of total public transit usage, showcasing its growing prominence. This rising ridership trend is expected to continue during the forecast period, driven by urbanization and sustainable transportation initiatives. The increase in ridership is anticipated to create substantial demand for cost-effective, operationally efficient rail solutions. High-speed rails are projected to play a pivotal role by offering advanced services such as passenger and freight operations management, safety, and security monitoring. These developments are poised to meet evolving passenger demands, reduce commute times, and enhance overall travel experiences.

Lack of skilled staff and lack of reimbursement in developing countries

Education in the developing countries such as Africa and Chile are not advancing at the same pace as them economies. Hence, lack of manpower and skilled labor in major organizations in developing countries is a factor that hampers the growth of the high-speed/bullet train market. For instance, according to UNESCO, in 2020, 17 countries in Africa still had literacy rates of 50% and below. In addition, in 2021, around 313 million illiterate people were registered in India.

The railway industry in developing countries manually handles maintenance applications and technological innovation in machines. This high speed rail requires some technical skills for its proper operation. These activities require skilled staff and labors to operate effectively. Hence, lack of skilled staff and lack of reimbursement in developing countries is anticipated to restrain the growth of the high speed rail market.

Improvement in railway infrastructure in developing countries

Railway infrastructure within a country significantly enhances the speed and efficiency of railway systems for both freight and passenger transportation. The adoption of autonomous trains requires substantial investments to support the necessary technological advancements. Governments of developing countries continue to invest heavily in upgrading their infrastructure to meet the demands of automation. For instance, India has made consistent efforts to modernize its railway system, allocating $30 billion in 2022 for infrastructure development and automation projects, which include advancements in railway infrastructure. The government also announced plans to invest $100 billion by 2026 to further expand and modernize its railway network, including the integration of high-speed rail corridors.

Similarly, France is undergoing massive railway upgrades, with Paris allocating over $35 billion in recent years to automate its existing high-speed rail network and construct additional metro lines to improve connectivity across the region. These advancements in high-speed rail infrastructure in developing and developed countries alike are driving the growth of the high-speed rail market. Such developments present significant opportunities for high-speed rail manufacturers globally, allowing them to capitalize on the increasing demand for efficient, modern railway systems.

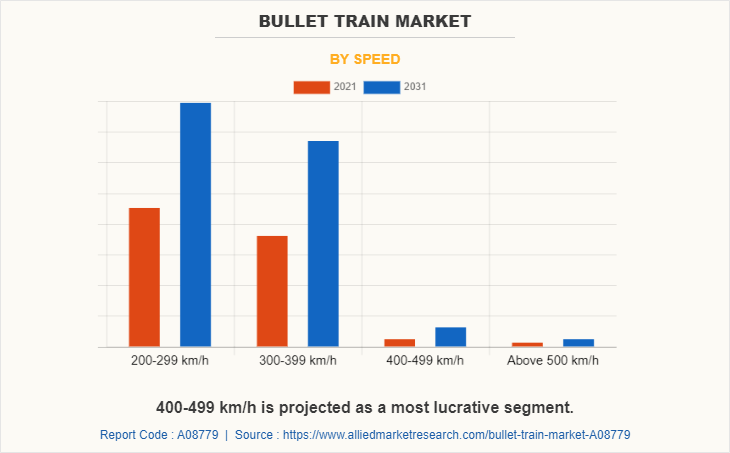

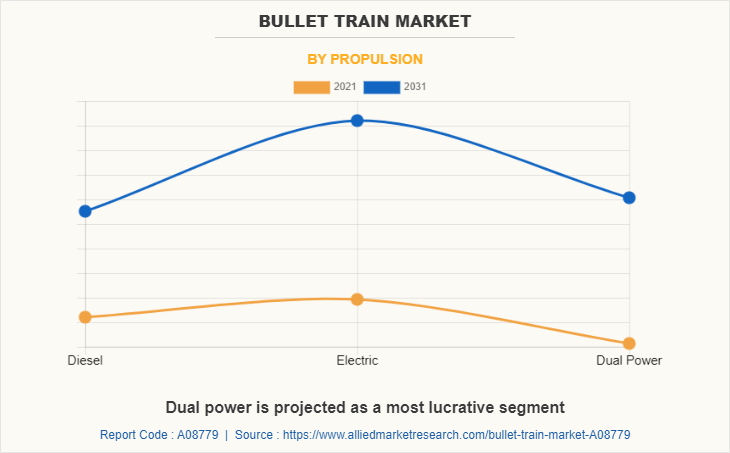

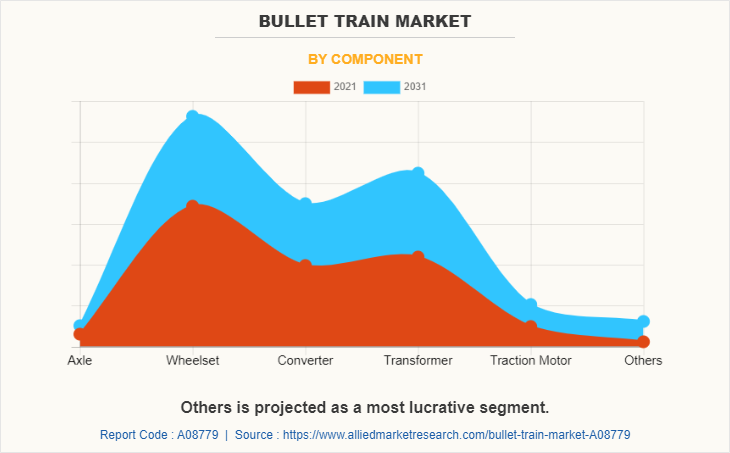

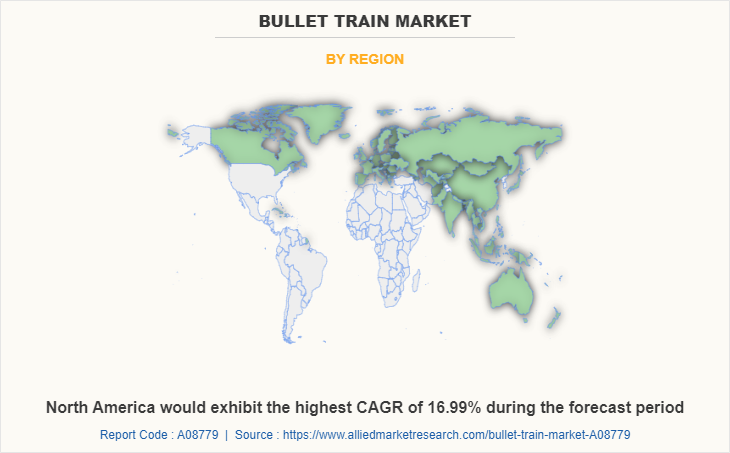

The high speed rail market is segmented on the basis of speed, propulsion, component, and region. By speed, it is divided into 200-299 km/h, 300-399 km/h, 400-499 km/h, and above 500 km/h. By propulsion, it is classified into diesel, electric, and dual power. By component, it is categorized into axle, wheelset, converter, transformer, traction motor, and others. By region, it is analysed across North America, Europe, Asia-Pacific, and MEA.

By Speed

Based on speed, the 200-299 km/h segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period.

The dominance of the 200-299 km/h segment is attributed to its cost efficiency, optimal speed for passenger comfort, and extensive adoption in intercity and regional travel. This speed range balances construction costs, energy consumption, and ticket affordability, making it ideal for densely populated areas. Countries like China, Japan, and European nations have heavily invested in this segment for their high-speed rail networks, further driving its dominance. Additionally, ongoing advancements in rail infrastructure and technology ensure the continued prominence of this speed range globally.

By Propulsion

Based on propulsion, the Electric segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period.

Electric propulsion's dominance stems from its efficiency, sustainability, and ability to support high-speed travel. Electric trains produce significantly lower greenhouse gas emissions compared to diesel alternatives, aligning with global efforts to reduce carbon footprints. Furthermore, advancements in electrification infrastructure and renewable energy integration have enhanced the feasibility and cost-effectiveness of electric propulsion. Countries like China and Germany have prioritized electric-powered high-speed rail to meet environmental goals and improve energy efficiency. With increasing investments in clean energy initiatives, the electric segment is poised to retain its dominance.

By Component

Based on components, the Wheelset segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period.

The wheelset segment’s dominance is driven by its critical role in ensuring the safety, stability, and performance of high-speed trains. Advanced wheelset materials and designs have enhanced durability and reduced maintenance costs, making them a key focus area for manufacturers. The growing adoption of lightweight alloys and innovative designs has further improved train efficiency and speed. With high-speed rail networks expanding globally, demand for reliable and high-quality wheelsets remains robust, cementing their market leadership. Additionally, manufacturers are increasingly emphasizing noise reduction and passenger comfort, further fueling demand for advanced wheelset systems.

By Region

Based on region, the Asia-Pacific region dominated the global market in the year 2023 and is likely to remain dominant during the forecast period.

The Asia-Pacific region’s dominance is driven by significant investments in high-speed rail infrastructure, particularly in countries like China, Japan, and South Korea. China alone operates over 40,000 kilometers of high-speed rail, the largest network globally, driven by strong government initiatives and urbanization. Additionally, the region benefits from high population density, increasing demand for efficient intercity transportation. Technological advancements, lower manufacturing costs, and a growing focus on sustainable mobility further strengthen the region's position. With ongoing projects, such as India’s high-speed rail corridor, the Asia-Pacific is set to lead the market through continued expansion and innovation.

Key Players included in the high speed rail market analysis are Siemens, Hitachi Ltd., Construcciones y Auxiliar de Ferrocarriles, S.A., CRRC Corporation Limited, Alstom SA, ABB, Fuji Electric Co., Ltd., Stadler Rail AG, Kawasaki Rail Car, Inc., and Mitsubishi Heavy Industries Ltd.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the High Speed Rail market analysis from 2023 to 2033 to identify the prevailing High Speed Rail market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the High Speed Rail market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the High Speed Rails market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as High Speed Rail market trends, key players, market segments, application areas, and market growth strategies.

Analyst Review

In accordance with the insights by the CXOs of leading companies, the high speed rail market is projected to witness a low-to-moderate growth rate, owing to growth in population along with increase in globalization and rise in purchasing power. Companies in this industry are adopting various innovative techniques to provide customers with advanced and innovative feature offerings.

The high-speed rail market is driven by increase in allocation of the budget for the development of railways, rise in demand for secure, safer, & efficient transport, and surge in use of public transport services as a solution to minimize traffic congestions. For instance, Indian Railways (IR) announced the target to manufacture 8000 locomotives, coaches and wagons in 2022, up from 5,000 in 2021 at a cost of around $5.47 billion (INR 40,000 crore).

However, high capital requirement, and lack of high-speed rail infrastructure are anticipated to restrict the market growth. Moreover, improvement in railway infrastructure, particularly in developing countries, and increase in industrial & mining activity are expected to create lucrative opportunities in the near future for the high-speed rail market.

Among the analyzed regions, Asia-Pacific accounted for the highest revenue in the global market in 2021. However, North America is expected to grow at a higher rate, predicting lucrative opportunities for the key players operating in the high speed rail market.t.

The estimated industry size of High Speed Rail market was valuedat $47,474.8 million in 2023, and is projected to reach $86,470.6 million by 2033.

The growth rate of High Speed Rail is 6.3% from 2024 to 2033.

200-299 km/h is the leading vehicle type in High Speed Rail Market.

Dual Power is the fastest growing propulsion segment in High Speed Rail Market.

Siemens, Hitachi Ltd., Construcciones y Auxiliar de Ferrocarriles, S.A., CRRC Corporation Limited are some of the leading players in High Speed Rail in 2023.

Loading Table Of Content...