High Voltage Direct Current (HVDC) Capacitor Market Outlook -2030

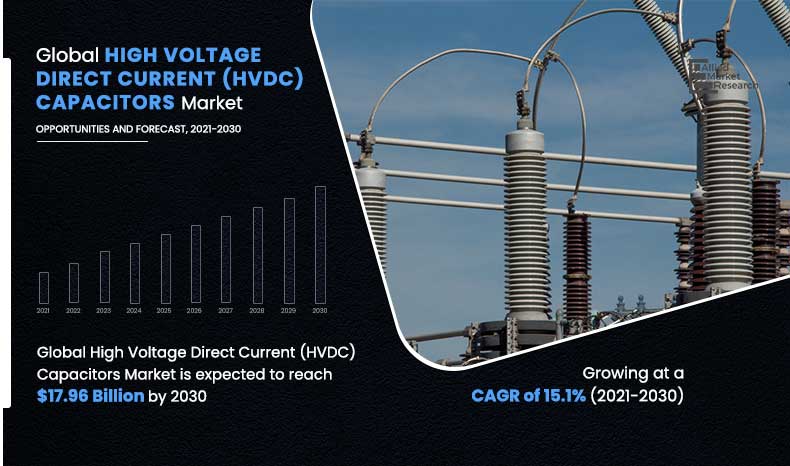

The global high voltage direct current (HVDC) capacitor market size was valued at $4.73 billion in 2020, and is projected to reach $17.96 billion by 2030, growing at a CAGR of 15.1% from 2021 to 2030.

High voltage direct current (HVDC) capacitor are designed for DC supplies and other general applications of electronic equipment. HVDC capacitor optimizes safety, reliability, and cost-effectiveness of transmission system. It assures safety and reliability by identifying flaws and defects in products without disrupting operations or delaying processes.

The rising demand to enhance grid infrastructure for increasing the electricity accessibility is the prime reason that drives the growth of the high voltage direct current (HVDC) capacitor industry during the forecast period. Further, increasing adoption of high voltage capacitors in extra high voltage (EHV) and ultra-high voltage (UVH) transmission accelerates the growth of the high voltage direct current (HVDC) capacitor market. Moreover, increasing industrialization is opportunistic for the market growth. Considering these factors, the high voltage direct current (HVDC) capacitor market is estimated to witness substantial growth in the future.

Innovation in energy & power sector is expected to offer lucrative growth opportunities for the market during the forecast period. However, high voltage hazards related to the HVDC capacitors hampers the market growth during the forecast period. Besides, some of the other factors attributing to the market growth are need for improved stability, supportive government regulations, and niche end-user segments.

COVID-19 Impact Analysis

The global high voltage direct current (HVDC) capacitors market has been significantly impacted by the COVID-19 outbreak. Production facilities of electronics and semiconductors have been halted, owing to slowdown and unavailability of workforce across the globe. COVID-19 outbreak has caused a significant and protracted drop in manufacturing utilization, and travel bans & facility closures kept workers out of their factories, which led to slowdown in growth of the high voltage direct current (HVDC) capacitors market in 2020. However, the high voltage direct current (HVDC) capacitor market growth is estimated to recover by the end of 2022 with technological advancements. Market players are deploying strategies to boost the market growth during the forecast period.

Segment Review

The high voltage direct current (HVDC) capacitor market is segmented on the basis of type, technology, installation type, application, and region. On the basis of type, the market is fragmented into plastic film capacitor, aluminum electrolytic capacitor, ceramic capacitor, tantalum wet capacitor, reconstituted mica paper capacitor, glass capacitor, and others.

The plastic film capacitor segment dominated the market, in terms of revenue in 2020, and is expected to follow the same trend during the forecast period. On the basis of technology, the market is segregated into line commutated convertors (LCC), and voltage-sourced convertors (VCC). The LCC segment dominated the market, in terms of revenue in 2020, however, VCC segment is projected to witness high growth rate during the forecast period.

By installation type, the market is divided into open rack capacitor banks, enclosed rack capacitor banks, and pole mounted capacitor banks. The open rack capacitor banks is further categorized as internally fused capacitor banks, externally fused capacitor banks, and fuseless capacitor banks. The enclosed rack capacitor banks are further bifurcated into fixed capacitor banks, and automatic capacitor banks. The market share for the open rack capacitor banks segment was highest in 2020, and is expected to grow at a high CAGR from 2021 to 2030.

By Type

Ceramic Capacitors segment will grow at a highest CAGR of 17.4% during 2021 - 2030

By application, the market is divided into commercial, industrial, energy & power, defense, and others. The market share for the energy & power segment was highest in 2020, and the industrial segment is expected to grow at a high CAGR from 2021 to 2030. By region, the market is analyzed across North America, Europe Asia-pacific, and LAMEA. North America dominated the HVDC market in 2020.

By Application

Energy & power segment is expected to secure leading position during forecast period.

Top Impacting Factors

Significant factors that impact the growth of the high voltage direct current (HVDC) capacitor market include increasing adoption of high voltage capacitors in ultra-high voltage (UHV) and extra high voltage (EHV) transmission, and demand to enhance grid infrastructure for increasing the electricity accessibility. However, high voltage hazards related to the HVDC capacitor hampers the market growth. On the contrary, innovation in energy and power sector is expected to offer lucrative opportunities for the high voltage direct current (HVDC) capacitor market during the forecast period.

By Region

North America would exhibit the highest CAGR of 16.9% during 2021-2030

Competitive Analysis

Competitive analysis and profiles of the major high voltage direct current (HVDC) capacitor market players such as Eaton Corporation PLC, General Atomics, Inc., General Electric Company, Hitachi Ltd., Murata Manufacturing, Samwha Capacitor Co Ltd., Siemens AG, TDK Corporation, UCAP Power, Inc., and Vishay Intertechnology are provided in this report.

Key Benefits For Stakeholders

- This study comprises analytical depiction of the high voltage direct current (HVDC) capacitor market trends along with the current trends and future estimations to depict the imminent investment pockets.

- The overall high voltage direct current (HVDC) capacitor market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current high voltage direct current (HVDC) capacitor market forecast is quantitatively analyzed from 2020 to 2030 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the market.

- The report includes the high voltage direct current (HVDC) capacitor market share of key vendors and market trends.

Key Market Segments

By Type

- Plastic Film Capacitor

- Aluminum Electrolytic capacitor

- Ceramic Capacitor

- Tantalum Wet Capacitor

- Reconstituted Mica Paper Capacitor

- Glass Capacitor

- Others

By Technology

- Line Commutated Convertors (LCC)

- Voltage-sourced Convertors (VSC)

By Installation Type

- Open Rack Capacitor Banks

- Internally Fused Capacitor Banks

- Externally Fused Capacitor Banks

- Fuseless Capacitor Banks

- Enclosed Rack Capacitor Banks

- Fixed Capacitor Banks

- Automatic Capacitor Banks

- Pole Mounted Capacitor Banks

By Application

- Commercial

- Industrial

- Energy & Power

- Defense

- Others

Key Players

- Eaton Corporation PLC

- General Atomics, Inc.

- General Electric Company

- Hitachi Ltd.

- Murata Manufacturing

- Samwha Capacitor Co Ltd

- Siemens AG

- TDK Corporation

- UCAP Power, Inc.

- Vishay Intertechnology

High Voltage Direct Current (HVDC) Capacitor Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Technology |

|

| By Installation Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Samwha Capacitor Co., Ltd., UCAP Power, Inc. (Maxwell Technologies), General Atomics, Inc., Eaton Corporation PLC, Vishay Intertechnology, Inc., TDK Corporation, General Electric Company, Siemens AG, Hitachi, Ltd. (Hitachi ABB Power Grids Ltd), Murata Manufacturing Co., Ltd. |

Analyst Review

The rising demand for electricity has overloaded the existing power generation infrastructure. In addition, demand and supply irregularity has caused tremendous transmission losses in the current AC transmission. Subsequently, HVDC transmission has become an option across the globe because of various elements such as unconventional interconnection, low transmission losses, and ability to convey bulk power for significant distance transmissions. Low innovation cost and developing government schemes is assisting the deployment of the HVDC technology. Consequently, there is a significant demand for HVDC capacitor market during the forecast period.

Because of the niche application segments, there are abundant opportunities for existing market players as well as new entrants to innovate and distinguish the products in price and design. Developed economies such as the U.S., Germany, and the UK, are focused on improving and replacing the existing power infrastructure. Many countries in the Asia-Pacific regions are also working on consolidating environmentally friendly power sources in power grids. This is estimated to upgrade the adoption of HVDC systems across the globe.

The key players profiled in the report include Eaton Corporation PLC, General Atomics, Inc., General Electric Company, Hitachi Ltd., Murata Manufacturing, Samwha Capacitor Co Ltd., Siemens AG, TDK Corporation, UCAP Power, Inc., and Vishay Intertechnology.

The High Voltage Direct Current (HVDC) Capacitor Market is estimated to grow at a CAGR of 15.1% from 2021 to 2030.

The High Voltage Direct Current (HVDC) Capacitor Market is projected to reach $17.96 billion by 2030.

To get the latest version of sample report

Factors such as rising demand to enhance grid infrastructure for increasing the electricity accessibility drives the growth of the High Voltage Direct Current (HVDC) Capacitor market

The key players profiled in the report include Eaton Corporation PLC, General Atomics, Inc., General Electric Company, Hitachi Ltd., Murata Manufacturing, Samwha Capacitor Co Ltd., Siemens AG, TDK Corporation, UCAP Power, Inc., and many more.

On the basis of top growing big corporations, we select top 10 players.

The High Voltage Direct Current (HVDC) Capacitor Market is segmented on the basis of type, technology, installation type, application, and region.

The key growth strategies of High Voltage Direct Current (HVDC) Capacitor market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Subsegments of Application of High Voltage Direct Current (HVDC) Capacitor Market are commercial, industrial, energy & power, defense, and others.

Ceramic Capacitors segment will grow at a highest CAGR of 17.4% during 2021 - 2030.

Loading Table Of Content...