The global hill-start assist system market size was valued at $2.7 billion in 2021, and is projected to reach $5.4 billion by 2031, growing at a CAGR of 7.2% from 2022 to 2031.

Hill-start assist system is a driver assistance feature that is integrated into vehicles to prevent rollback on inclined and uphill roads. A vehicle usually rolls back when it is moved from a standstill position on an uphill surface during the switch from brake and clutch to the accelerator.

The hill start assist system applies brakes for a few seconds longer to enable the driver to move the vehicle with ease, thus offering greater security in such scenarios. The brakes are released after the driver presses the accelerator. Hill-start assist also decreases wear and tear on other vehicle parts, such as the handbrake, which performs the same task manually. It also lowers the strain on the engine and drivetrain by preventing the car from rolling backward. Hill-start assist system is increasingly being integrated into vehicles to prevent potential accidents while driving in hilly regions.

The growth of the global hill-start assist system market is driven by increased adoption of driver assistance systems, high demand for vehicles equipped with safety features, and implementation of stringent safety rules and regulations by governments across the world. However, complexity associated with aftermarket integration of hill-start assist systems, and unavailability of raw materials are factors hampering the growth of the market. Furthermore, increase in adoption of electric vehicles, and surge in demand from emerging countries are expected to offer growth opportunities during the forecast period.

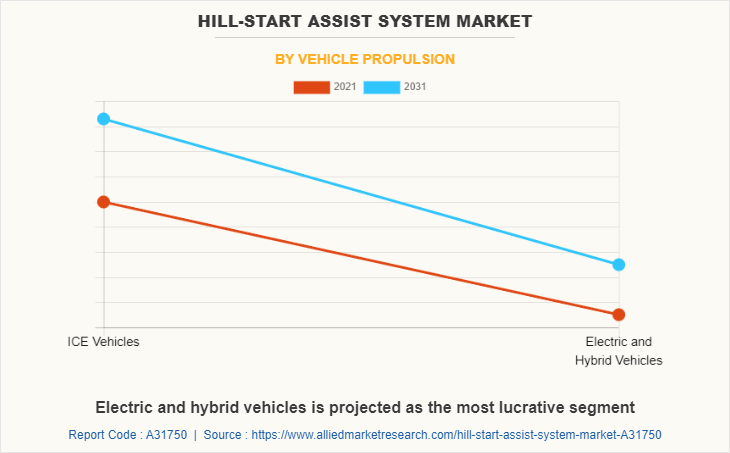

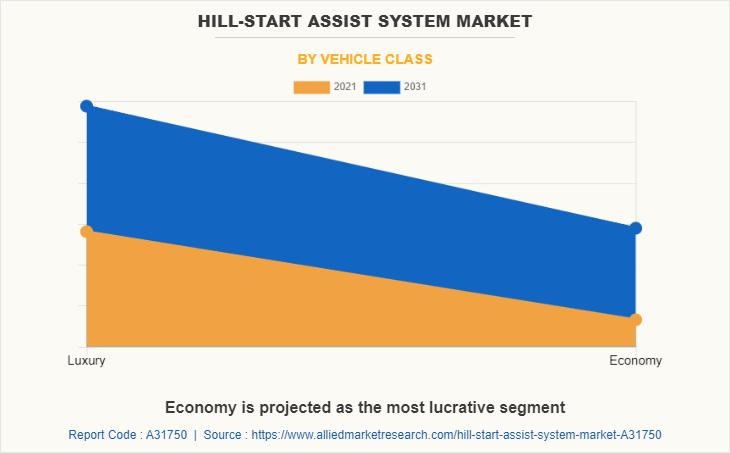

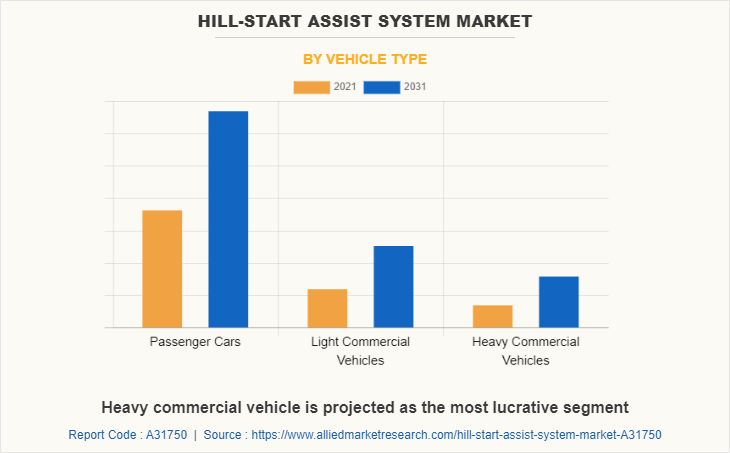

The hill-start assist system market is segmented on the basis of vehicle type, vehicle propulsion, vehicle class, and region. By vehicle type, it is fragmented into passenger cars, light commercial vehicles, and heavy commercial vehicles. By vehicle propulsion, it is categorized into internal combustion engine (ICE) vehicles, and electric and hybrid vehicles. By vehicle class, it is classified into luxury and economy. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

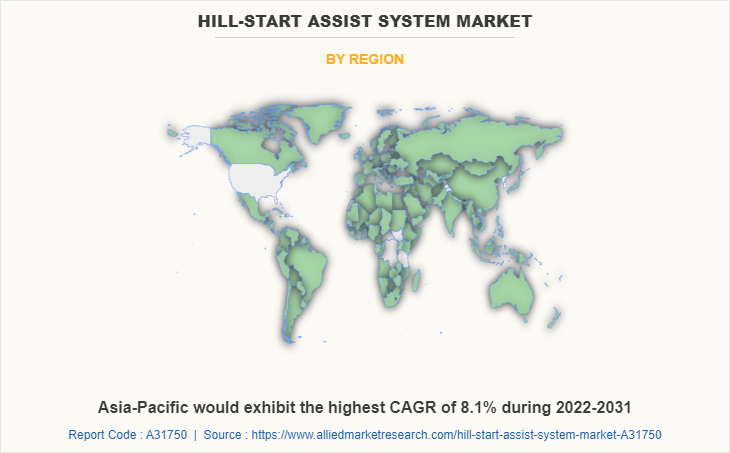

Asia-Pacific includes China, Japan, India, South Korea, and rest of Asia-Pacific. Rest of Asia-Pacific includes Australia, New Zealand, Indonesia, Singapore, Malaysia, Vietnam, and others. The hill-start assist systems market has great prospects in the Asia-Pacific, owing to changing automotive outlook, supportive government policies, growth in penetration of the high-end safety technology enabled vehicles, and increase in inclination toward electrified mobility in various countries in the region. Increase in sale of passenger cars across the Asia-Pacific region has been observed. Countries in the region such as China, and India, have recorded a rise in sale of passenger cars. For instance, in 2021, China recorded a growth of 6.6% in sale of passenger cars. In India, car sales increased by 27% to 3,082,400 cars compared to 2,435,100 cars in 2020. This increase in sales of passenger cars is further expected to boost the growth of hill-start assist system market.

Automobile production outlook, integration of high-end technology into vehicles, and entry of new manufacturers of hill-start assist system are factors expected to drive the market growth in China. In recent years, new generation vehicles are being equipped with hill-start assist system, which is expected to drive the market growth during the forecast period. For instance, in September 2022, SAIC-GM-Wuling Automobile, which is a joint venture between SAIC Motor, General Motors, and Liuzhou Wuling Motors Co Ltd. based in Liuzhou, China launched Hongguang MINI EV 2-seater cabriolet edition enabled with hill assist control system.

Europe includes countries such as UK, Germany, France, Italy, and rest of Europe. Rest of Europe includes Spain, the Netherlands, Sweden, Poland, and others. The European hill-start assist system market is anticipated to grow during the forecast period, owing to factors such as growth in concern towards safety in vehicle and emphasis on reducing road accidents. The growth of hill-start assist system market in the region is fueled by rapidly changing customer demand for advanced safety technologies in vehicle. In addition, increasing sale of passenger cars and commercial vehicles across Europe has further increased the demand for hill-assist system systems across the region. For instance, according to data release by ACEA, in 2022, in Europe, new passenger car registrations rose 9.6% year on year.

The outbreak of the COVID-19 pandemic has disrupted most supply chains and manufacturing activities across the globe, directly impacting macroeconomic conditions. To overcome this decline, governments across the globe are taking several initiatives to help the auto industry face this crisis. For instance, in May 2020, the French government announced $8.8 billion aid package to help the auto industry recover from this COVID-19 crisis. This aid includes promoting scrapping programs to remove older model vehicles that bring more pollution from public roads and increased incentives for new electric vehicles. Such incentives are boosting the production activities, which support the growth of hill-start assist system market.

In addition, several automobile manufacturers are launching new electric vehicles across France, which is contributing to the growth of the market. For instance, in October 2022, BYD launched three new electric vehicles at the Paris Motor Show. Three new electric vehicles include BYD ATTO 3, BYD TANG, and BYD HAN. BYD ATTO 3 is a C-segment SUV designed for European customers, and includes several safety features such as forward collision warning, traction control, hill decent control, lane keep assistance, and others.

Some leading companies profiled in the report include BorgWarner Inc., Robert Bosch GmbH, Continental AG, Murata Manufacturing Co., Ltd., ZF Friedrichshafen AG, Knorr-Bremse AG, BWI Group, Fujitsu Limited, HELLA GmbH & Co. KGaA, and Aisin Corporation. The leading companies are adopting strategies such as product launch and collaboration to strengthen their market position.

Increase in adoption of driver assistance systems

Advanced driver assistance systems are intelligent systems which are installed in the vehicle to assist the driver with safe and comfortable driving experience. These systems are used to provide vital information such as traffic congestion level, suggested routes, blockage & closure of roads ahead, and others. In addition, ADAS is used to analyze the fatigue and distraction of human driver and make precautionary alerts to make suggestions regarding same and alert the driver about potentially dangerous situation. Furthermore, these systems take over the control from the human driver if required and also allows short range communication with the other vehicles.

Advanced driver assistance systems (ADAS) are electronic components in vehicles that provide the driver with an intelligent driving experience. These systems comprise unique sensors such as ultrasonic sensor, image sensor, radar, LiDAR, infrared sensor, laser, and others. Deployment of ADAS in vehicles to enhance comfort and ensure safety on road are anticipated to be one of the major trends being witnessed in the automotive industry. Moreover, factors such as adoption of autonomous and semi-autonomous vehicles, high demand for safety features, and increased requirement for comfort drive the demand for advanced driver assistance systems.

High demand for vehicles equipped with safety features

The demand for safety features, such as parking assistance, collision avoidance systems, lane departure warnings, traction control, hill-start assist system, electronic stability control, tire pressure monitors, airbags, and telematics is experiencing an increase due to surge in number of road accidents across the globe. Vehicles with installed hill-start assist system aid the vehicle to move forward on an uphill road by preventing rolling back of the vehicle on an incline. Furthermore, it is observed that there is an increase in the death rates due to road accidents.

Moreover, road traffic injuries leading to death are higher among teenagers. These factors are leading to the growing demand for safety features in vehicles. Automobile companies are developing and introducing safety features to meet the needs of the customers. Thus, high demand for safety features drives the growth of the hill-start assist system market.

Increasing adoption of electric vehicles

Governments of various countries are taking initiatives to reduce carbon footprints by encouraging use of electric vehicles, owing to increase in awareness toward hazardous effects of using vehicles running on fossil fuels. Moreover, governments across the globe are putting pressure on vehicle manufacturers to reduce carbon emissions caused by diesel fuel combustion and tackle greenhouse gas emissions, in turn, pushing them to invest in developing electric vehicles. In addition, governments across the globe are supporting purchase of electric mobility, in terms of tax credits and incentives. Moreover, central governments of some countries are providing exemption from highway toll tax for electric vehicles.

For instance, for faster adoption of electric vehicles, the government of India plans to lower the Goods & Service Tax (GST) on e-vehicles from 12% to 5%. Moreover, around $2,101.5 tax exemptions will be given on loan taken for purchase of an e-mobility. Similarly, the government of South Korea has announced that it will be providing $900 million tax exemptions and subsidies for development and purchase of electric and fuel cell vehicles.

Thus, increase in government support for development and purchase of electric mobility, in terms of tax credits, subsidies and incentives, is one of the major factors that propel demand for electric vehicles. Furthermore, this increased demand for electric vehicles is expected to continue in near future and demand for integration of safety systems in electric vehicles is also expected to increase simultaneously, which in turn is anticipated to provide remarkable opportunities for the key players in the hill-start assist system market during the forecast period.

The hill-start assist system market is segmented into Vehicle Type, Vehicle Propulsion and Vehicle Class.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hill-start assist system market analysis from 2021 to 2031 to identify the prevailing hill-start assist system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hill-start assist system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hill-start assist system market trends, key players, market segments, application areas, and market growth strategies.

Hill-Start Assist System Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 5.4 billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 231 |

| By Vehicle Type |

|

| By Vehicle Propulsion |

|

| By Vehicle Class |

|

| By Region |

|

| Key Market Players | Continental AG, Robert Bosch GmbH, Aisin Corporation, ZF Friedrichshafen AG, BWI Group, HELLA GmbH & Co. KGaA, Borgwarner Inc., Knorr-Bremse AG, Fujitsu, Murata Manufacturing Co., Ltd. |

Analyst Review

The global hill-start assist system market is expected to witness growth due to rise in safety concerns and introduction of safety regulations. In addition, several market players such as Robert Bosch GmbH, Murata Manufacturing Co., Ltd., and others offer a wide range of sensors for hill-start assist system. For instance, Robert Bosch GmbH offers SMI860 inertial sensor, which is specifically designed to support ADAS functions, roll-over sensing, hill-hold control, and other functions. It also offers various sensors such as brake booster pressure sensor, brake fluid pressure sensor, and others for hill-start assist system.

Rise in instances of road accidents and greater concerns regarding road safety has increased the demand for hill-start assist system in vehicles. Greater numbers of emerging countries are introducing regulations to ensure integration of advanced safety features such as hill-start assist system, ABS, and others in new vehicles.

The leading companies in the market include BorgWarner Inc., Robert Bosch GmbH, Continental AG, Murata Manufacturing Co., Ltd., ZF Friedrichshafen AG, Knorr-Bremse AG, BWI Group, Fujitsu Limited, HELLA GmbH & Co. KGaA, and Aisin Corporation.

The global hill-start assist system market was valued at $2.7 billion in 2021 and is projected to reach $5.4 billion in 2031, registering a CAGR of 7.2%.

The largest regional market for hill-start assist system is Asia-Pacific.

The leading application of hill-start assist system is passenger cars.

The upcoming trends include greater integration of hill-start assist system in economy & budget vehicles and significant rise in demand for vehicles equipped with advanced safety features from developing countries.

Loading Table Of Content...