Home Care Products Market Research, 2032

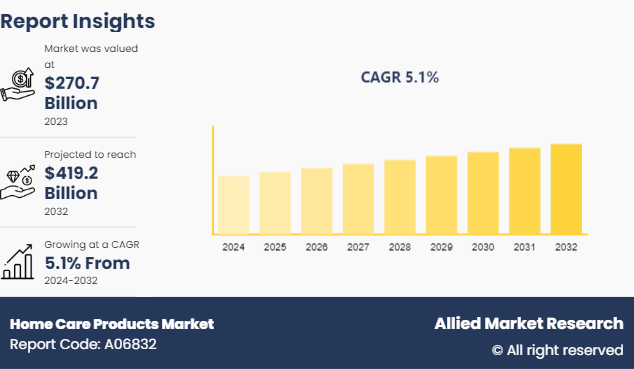

The global home care products market was valued at $270.7 billion in 2023, and is projected to reach $419.2 billion by 2032, growing at a CAGR of 5.1% from 2024 to 2033.

Home care products refer to a broad category of consumer goods used for cleaning, maintaining, and enhancing the appearance of residential spaces, as well as providing care for personal items within the home. These products play a key role in ensuring cleanliness, hygiene, comfort, and overall aesthetic appeal in a domestic environment. Moreover, the surface and furniture care items sch as furniture polish, metal cleaners, and carpet cleaners helps to maintain and enhance the appearance of home interiors. Air care products, such as air fresheners and odor neutralizers, improve indoor air quality and ambiance. Home maintenance items, including lubricants, adhesives, and pest control products, support household repairs and pest management. In addition, personal care products for the home, such as dishwashing detergent and hand soap, ensure proper hygiene.

Key Takeaways

The Home Care Products industry study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The Home Care Products industry has grown steadily due to multiple factors. Key drivers include heightened awareness of hygiene and cleanliness, spurred by the COVID-19 pandemic, alongside technological advancements that offer convenient and efficient cleaning solutions. Changing lifestyles and urbanization also contribute to market expansion as consumers seek multi-purpose and easy-to-use products. However, the market faces restraints such as stringent regulatory requirements, supply chain disruptions, and environmental concerns, which can increase production costs and limit growth. Opportunities for market expansion exist in sustainability, with eco-friendly and green products gaining traction among environmentally conscious consumers.

In addition, smart home technology offers innovative pathways, and emerging markets present substantial growth prospects due to increasing urbanization and rising disposable incomes. Collaborations and partnerships across industries, such as with technology or e-commerce, can further drive market innovation and reach. These dynamics shape the strategies and approaches of companies within the home care products market size.

Parent Market Overview of Global Home Care Products Market

The home care products market maintains consistent demand for essential items such as cleaning agents, personal care products, and home appliances. These products fulfill basic needs for cleanliness, hygiene, and convenience, making them indispensable for daily life.

There is a notable trend towards sustainability and innovation within the household products market. Consumers increasingly seek eco-friendly options with natural ingredients and recyclable packaging. Concurrently, companies are innovating with smart home technologies, enhancing efficiency and convenience in household chores. These trends reflect evolving consumer preferences and drive product development in the industry.

Market Segmentation

The market is segmented into product, type, distribution channel, and region. By product, it is divided into air care, toilet care, surface care, home insecticides, laundry care, dishwashing, and others. By type, it is bifurcated into organic and conventional. By distribution channel, it is categorized into online and offline. By region, it is analyzed across North America, Europe, Asia- Pacific and LAMEA.

Country Outlook

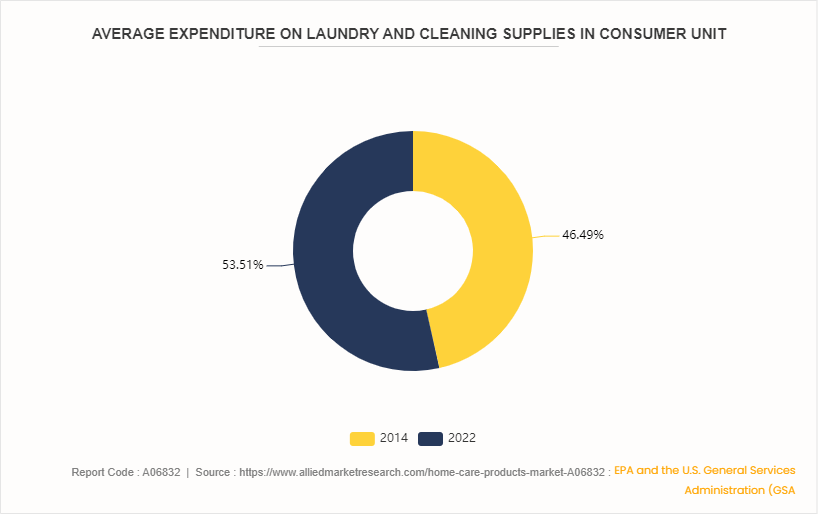

In 2022, the average expenditure on laundry and cleaning supplies in the U.S. amounted to $169.83 consumer unit. In comparison, the country's average expenditure on laundry and cleaning supplies amounted to $147.55 U.S. dollars per consumer unit in 2014. The consumers' increasing focus on health, wellness, and sustainability has driven interest in natural, eco-friendly options. Innovation in convenient, time-saving solutions, alongside the growth of e-commerce, has reshaped consumer purchasing habits. According to home care products market forecast, premiumization is evident with the rise of luxury and specialty products, while sustainability initiatives have become a focal point for brands, responding to heightened environmental consciousness. Regulatory changes continue to shape product development and marketing strategies. The cleaning industry is roughly divided into residential, commercial, specialty, and laundry services. In 2020, household cleaner products had sales totaling approximately $1.25 billion. Consumers are increasingly conscious of the chemicals used in their homes; 17 percent of consumers from the United States stated that they always looked out for ecofriendly labels when buying cleaning and laundry products, increasing the home care products market demand.

In April 2024, the EPA and the U.S. General Services Administration (GSA) announced that all cleaning products provided through new custodial service contracts overseen by GSA must now be certified to ecolabels, including EPA’s Safer Choice label, that do not allow PFAS.

In April 2023, Austin American Technology merged with Aqua Klean Systems to make them the World's Best and Largest Full-Service Electrical Cleaning Equipment tools .

Industry Trends

A rise in consumer preference for home care products that are environmentally friendly, biodegradable, and use natural ingredients has been witnessed recently. This trend is driven by an increase in awareness of environmental issues, sustainability concerns, and health consciousness among consumers. Companies respond by introducing eco-friendly packaging, reducing the use of harsh chemicals, and offering plant-based or organic formulations. According to the round Group Organization, sustainable products have an overall 17% market share and a 32% share of growth. This shift towards sustainability is not only driven by consumer demand but also by regulatory pressures and corporate social responsibility initiatives. This has increased home care products market share.

The integration of technology into home care products has become increasingly common, with the rise of smart home devices and connected appliances, which has resulted into home care products market growth. Consumers are embracing smart home technologies that offer convenience, efficiency, and enhanced functionality. In the home care products market, this trend is evident in the development of connected cleaning devices, such as robotic vacuum cleaners, smart air purifiers, and app-controlled home monitoring systems. These technologies offer features like remote operation, automated scheduling, and real-time monitoring, providing consumers with greater control over their home care routines and allowing for more efficient use of resources, presenting home care products market opportunities.

Competitive Landscape

The major players operating in the home care products market are Unilever, Godrej Consumer Products Ltd., The Procter & Gamble Company, Henkel AG & Company, Church & Dwight Co Ltd., S.C. Johnson & Son Inc., Kao Corp., Reckitt Benckiser Group Plc. Other players in the home care products market include The Clorox Company, Colgate-Palmolive Company, Seventh Generation, Method Products, PBC, Ecover, Mrs. Meyer's Clean Day and Lysol (RB subsidiary) .

Key Sources Referred

1. Kline Group

2. Johnson & Son Inc

3. U.S. Department of home care

4. Croda Home care

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the home care products market analysis to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the home care products market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global home care products market trends, key players, market segments, application areas, and market growth strategies.

Home Care Products Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 419.2 Billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2024 - 2032 |

| Report Pages | 298 |

| By Product |

|

| By Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | The Procter & Gamble Company, Church & Dwight Co Ltd, Unilever, Reckitt Benckiser Group Plc., Godrej Consumer Products Ltd., Henkel AG & Company, Kao Corp., S.C. Johnson & Son Inc. |

The leading application of the home care products market is surface cleaning.

The global home care products market is experiencing several transformative trends driven by consumer preferences, technological advancements, and increased awareness of health and sustainability.

The largest regional market for home care products is North America.

The major players operating in the home care products market are Unilever, Godrej Consumer Products Ltd., The Procter & Gamble Company, Henkel AG & Company, Church & Dwight Co Ltd., S.C. Johnson & Son Inc., Kao Corp., Reckitt Benckiser Group Plc. Other players in the home care products market include The Clorox Company, Colgate-Palmolive Company, Seventh Generation, Method Products, PBC, Ecover, Mrs. Meyer's Clean Day and Lysol (RB subsidiary).

The home care products market was valued at $270.7 billion in 2023, and is estimated to reach $419.2 billion by 2032, growing at a CAGR of 5.1% from 2024 to 2032.

Loading Table Of Content...