Home Decor Market Summary, 2032

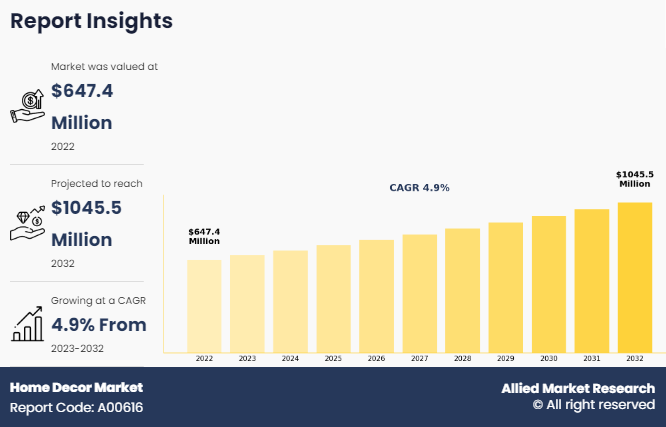

The global home decor market size was valued at $647.4 million in 2022, and is projected to reach $1.1 billion by 2032, growing at a CAGR of 4.9% from 2023 to 2032. Home decor products such as furniture and textiles are installed across various settings, including spa, office, clean room, restaurants, camping, bedroom, outdoor, library, and stores. The home decor products include various items such as furniture, home textiles and floor coverings. Depending on end use, furniture designs can be modified through machine-based processes and handcrafting. The adoption of home decor products has been considerably high in the developed regions such as the U.S., Canada, and Germany, while emerging countries such as China, Brazil, and India are witnessing steady increase.

The global home decor industry is highly fragmented due to the presence of multiple vendors in both international and regional players. The developing real estate industry is driving the growth of the global market in the current scenario. The global home decor market has witnessed significant growth over the years and is expected to grow at a steady pace during the forecast period. This is attributed to the surge in popularity of home decor products such as furniture, home textiles, and floor covering among consumers.

Moreover, the rise in the number of small-size houses has encouraged the use of products having facilities for extra storage along with enhancing the aesthetical appearance of homes. In addition, the rise in popularity of eco-friendly home decor products among consumers, owing to an increase in environmental concerns significantly contributes toward the home decor market growth.

Furthermore, an increase in disposable income and improvement in living standards in emerging countries such as China and India along with the rise in the affinity of consumers toward luxury home decor products augment the growth of the market. The presence of low-cost home decor producers in China and Vietnam is further anticipated to drive the growth of the global market. However, the availability of low-quality and counterfeit products restricts the growth of the global market.

In addition, dearth of skilled labor, ineffective transportation, and lack of infrastructure facilities may act as a hindrance for the global home decor market. On the contrary, an upsurge in home decor market Demand for trendy, customized, and fashionable designs for home decor products and increase in popularity of home decor products among high-income consumers are anticipated to provide lucrative growth opportunities for the global market.

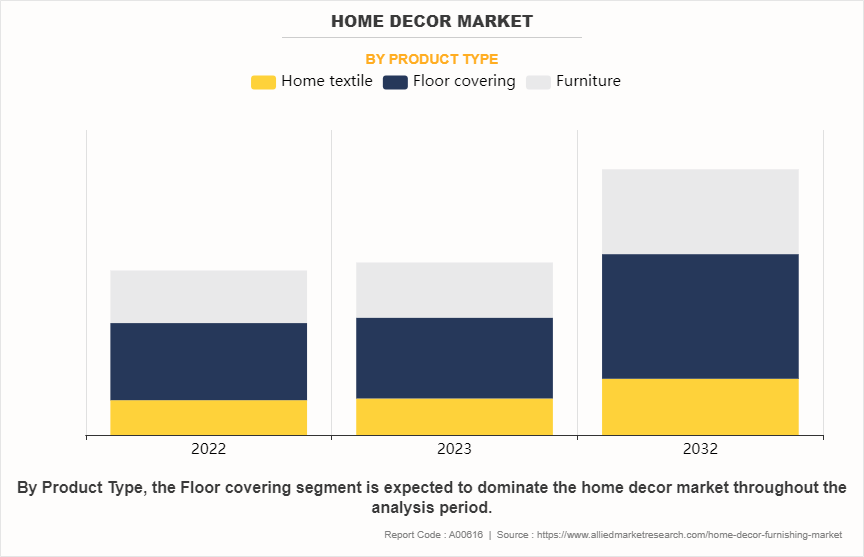

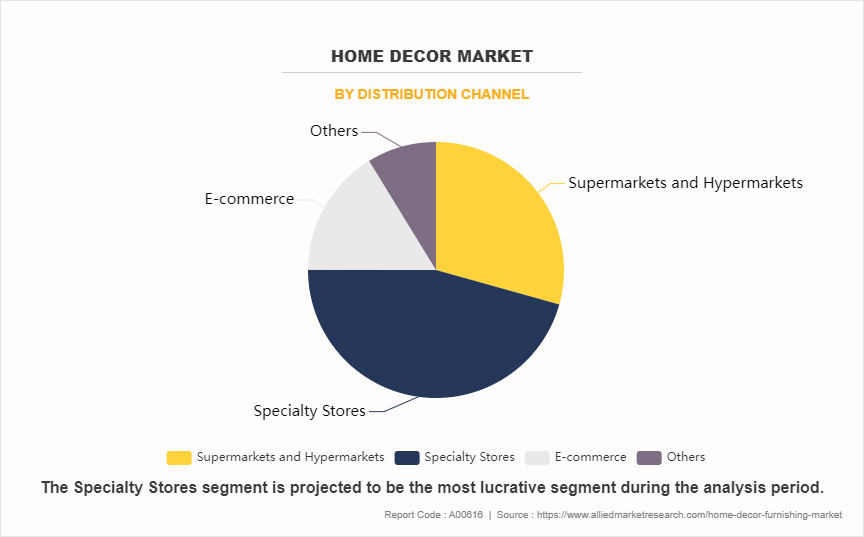

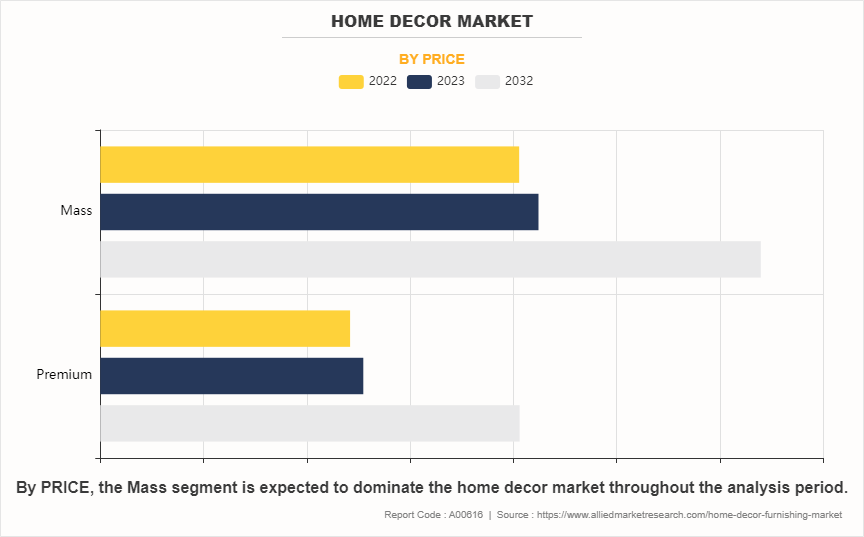

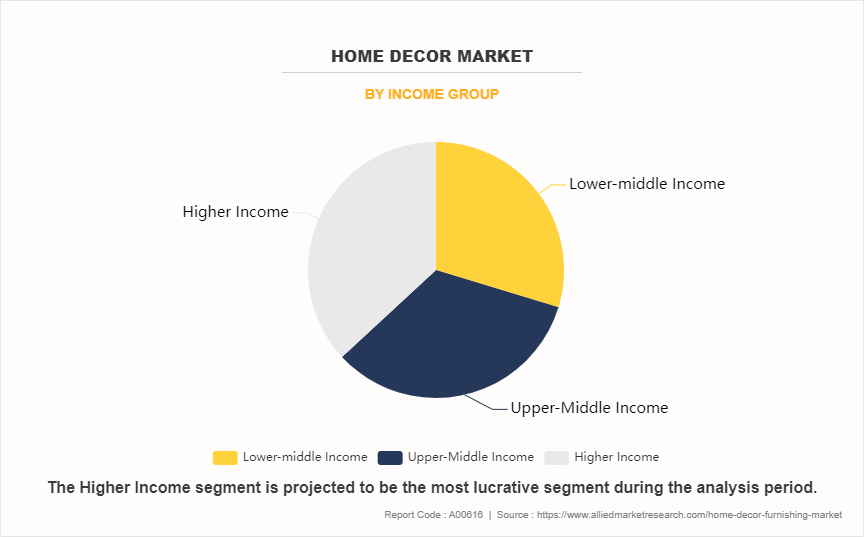

The global home decor market forecast is segmented into product type, Income group, price point, distribution channel, and region. On the basis of product type, the market is divided into furniture, home textile, and floor covering. Depending on the distribution channel, it is segregated into supermarkets, hypermarkets, specialty stores, e-commerce, and others. By income group, it is fragmented into lower-middle income, upper-middle income, and higher income. As per price point, it is categorized into mass and premium. Region wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

By Product

By product type, the market is segmented into furniture, home textiles, and floor covering. The floor covering segment accounted for a major home decor market Share in 2022 and is expected to grow at a significant CAGR during the forecast period.

Further, the furniture segment is segmented into Kitchen Living and Bedroom, Bathroom, Outdoor, and Lighting. The Living and Bedroom segment accounted for a major share of the home decor market in 2022 and is expected to grow at a significant CAGR during the forecast period.

Further, the home textiles segment is segmented into Rugs textiles, Bath Textiles, Bed Textiles, Kitchen, Dining Textiles, and Living Room Textiles. The Living Room Textiles segment accounted for a major share of the home decor market in 2022 and is expected to grow at a significant CAGR during the forecast period.

Further, the floor covering segment is segmented into Tiles, Wood & Laminate, Vinyl & Rubber, Carpets & Rugs, and Others. The Carpets & Rugs segment accounted for a major share of the home decor market in 2022 and is expected to grow at a significant CAGR during the forecast period.

By Distribution Channel

By distribution channel, the market is segmented into supermarkets and hypermarkets, specialty stores, e-commerce, and others. The supermarkets and hypermarkets segment accounted for a major share of the home decor market in 2022 and is expected to grow at a significant CAGR during the forecast period.

By Price

By price, the market is segmented into Premium and Mass. The mass segment accounted for a major share of the home decor market in 2022 and is expected to grow at a significant CAGR during the forecast period.

By Income Group

By income group, the market is segmented into lower-middle income, upper-middle income, and higher income. The higher income segment accounted for a major share of the home decor market in 2022 and is expected to grow at a significant CAGR during the forecast period.

The key players profiled in this report include Inter IKEA Group, Forbo International SA, Armstrong World Industries, Inc., Mannington Mills, Inc., Mohawk Industries Inc., Shaw Industries Group, Inc., Herman Miller, Inc., Ashley Furniture Industries Ltd., Kimball International, and Duresta Upholstery Ltd. These players are focusing on the development of eco-friendly home decor products.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the home decor market analysis from 2022 to 2032 to identify the prevailing home decor market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the home decor market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global home decor market trends, key players, market segments, application areas, and market growth strategies.

Home Decor Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.1 billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 444 |

| By Product Type |

|

| By PRICE |

|

| By Distribution Channel |

|

| By Income Group |

|

| By Region |

|

| Key Market Players | MillerKnoll, Inc., Inter IKEA Holding B.V., Forbo Management SA, Kimball International Inc., Ashley Furniture Industries, LLC., Shaw Industries Group, Inc., Mohawk Industries, Inc., Duresta Upholstery Ltd., Mannington Mills, Inc., Armstrong World Industries, Inc. |

Analyst Review

According to the insights of the CXOs, the global home decor market is expected to witness robust Home Decor Market Growth during the forecast period. This is attributed to the increase in consumer interest toward home décor. Globally, consumer interest toward home décor has increased significantly in the recent past. Considering the statistics, consumers in the U.S. are now focusing on home renovation. Furthermore, in the emerging economies such as India and China, the real estate industry has grown at a significant rate. Consumers in such countries have exhibited their interest in spending on home décor products, such as furniture, textiles, and floor coverings, which has boosted the global market growth.

However, the escalating cost of raw materials presents a substantial constraint on the growth of the home decor market. With the global economy experiencing fluctuations and supply chain disruptions, the cost of materials such as wood, metals, textiles, and plastics has surged, significantly impacting the production and pricing of home decor items. For instance, in the past year, lumber prices witnessed a dramatic increase, impacting the production of wooden furniture and decor. The cost of metal-based decor items like lighting fixtures and hardware has also risen due to increased metal prices. These higher raw material costs place pressure on manufacturers to either absorb the increased expenses or pass them on to consumers, potentially leading to reduced affordability and decreased Home Decor Market Demand for home decor products.

Sustainable and Eco-friendly Designs: Consumers are increasingly concerned about the environment, so sustainable and eco-friendly home decor options are expected to remain a strong trend. This includes items made from recycled materials, sustainable sourcing, and energy-efficient products. Biophilic Design: Biophilic design incorporates natural elements into interior spaces, such as indoor plants, natural materials, and natural light. This trend is expected to continue as it promotes well-being and a connection to nature. Vintage and Retro Styles: Vintage and retro designs from different eras are making a comeback. Mid-century modern, Art Deco, and other vintage styles are popular choices for those looking to add a touch of nostalgia to their decor. Maximalism: After years of minimalism and neutral color palettes, maximalism is gaining ground. It involves bold, eclectic, and vibrant designs with a mix of patterns, colors, and textures.

Asia-Pacific

The leading application of the home decor market is the decoration and enhancement of residential spaces.

The global home decor market was valued at $303.5 million in 2022, and is projected to reach $490.5 million by 2032, registering a CAGR of 4.9% from 2023 to 2032.

Duresta Upholstery Ltd., Forbo International SA, Ashley Furniture Industries Ltd., Kimball International, Shaw Industries Group, Inc., Inter IKEA Systems BV, Armstrong World Industries, Inc., Mohawk Industries Inc., Mannington Mills Inc., Herman Miller Inc.

Loading Table Of Content...

Loading Research Methodology...