Honeycomb Core Materials Market Size & Insights: 2032

The global honeycomb core materials market was valued at $2.5 billion in 2022, and is projected to reach $5.2 billion by 2032, growing at a CAGR of 7.8% from 2023 to 2032.

Introduction

Honeycomb core materials are integral components in a wide variety of modern engineering and manufacturing applications. These materials mimic the hexagonal structure of a natural honeycomb, known for its optimal strength-to-weight ratio. The key attributes of honeycomb cores, such as their excellent energy absorption, impact resistance, thermal insulation, and vibration damping, make them highly desirable in numerous high-performance engineering applications.

One of the most prominent and long-standing applications of honeycomb core materials is in the aerospace and aviation sectors. Aircraft manufacturers utilize these materials extensively in the construction of fuselage panels, interior components, flooring systems, doors, flaps, spoilers, and control surfaces. Their lightweight nature significantly reduces the overall weight of the aircraft, contributing to improved fuel efficiency and reduced carbon emissions.

Key Takeaways:

- The report outlines the current honeycomb core materials market trends and future scenario of the market from 2023 to 2032 to understand the prevailing opportunities and potential investment pockets.

- The global honeycomb core materials market has been analyzed in terms of value ($Million) and volume (Kilotons). The analysis in the report is provided on the basis of type, end use industry, 4 major regions, and more than 15 countries.

- The battery packaging market is fragmented in nature with few players such as Plascore, MC Gill (The Gill Corporation), Schutz Composites, Hexcel Corporation, Toray Advanced Composites, Corex Honeycomb, Argosy International, Euro-Composites, Showa Aircraft Industry Co., Ltd, Honylite, RelCore Composites Inc., REYNOARCH, and Fabrinox, which hold significant share of the market.

- The report proivdes strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the honeycomb core materials industry.

- Countries such as China, U.S., India, Germany, and Brazil hold a significant share in the global honeycomb core materials market.

Market Dynamics

The growing demand for honeycomb core materials in the aerospace and defense sector is expected to drive the growth of the honeycomb core materials market. Honeycomb core materials have emerged as a critical component in the aerospace and defense sector due to their unique combination of lightweight structure and high mechanical strength. These materials are primarily used in aircraft fuselages, flooring, overhead compartments, bulkheads, doors, flaps, and satellite components. Their honeycomb-like geometry provides excellent stiffness and strength-to-weight ratios, which are essential in aerospace applications where every kilogram of weight saved translates into significant fuel efficiency and performance benefits. In September 2022, the U.S. Defense Logistics Agency (DLA) awarded Honeycomb Company of America a small-business set-aside Indefinite Delivery/Indefinite Quantity (IDIQ) contract (contract number SPE4A722D0322) for the supply of structural aerospace panels. The contract, valued at up to $2 million over a five-year period, saw initial task orders worth approximately $411,800 issued between late 2022 and early 2023.

However, environmental and recycling concerns are expected to restrain the growth of the honeycomb core materials market. Honeycomb sandwich structures are susceptible to environmental degradation, particularly from moisture ingress. Water can cause permanent loss of adhesive bond strength and corrosion of the core in aluminum cores, reducing the lifespan and reliability of honeycomb panels in critical applications. This environmental vulnerability raises concerns about the long-term sustainability and lifecycle impacts of these materials. The production of honeycomb cores, those made from composites, generates substantial waste. For example, major aerospace manufacturers like Boeing and Airbus generate up to 4 million pounds of carbon fiber prepreg waste annually from aircraft production alone. Although efforts are underway to recycle this waste, the lack of mature markets for recycled composites and the complexity of the recycling process hinder widespread adoption.

Moreover, increased focus on sustainable construction is expected to provide lucrative opportunities in the honeycomb core materials market. The construction industry is undergoing a significant transformation as it increasingly embraces sustainability and green building practices. This shift is driven by growing environmental awareness, stricter regulatory frameworks, and the rising demand from clients for eco-friendly structures that minimize energy consumption and carbon footprints. In January 2024, Plascore, Inc. introduced fire-resistant aluminum honeycomb panels for commercial aircraft. These panels enhance safety and regulatory compliance, reflecting the industry's commitment to integrating sustainable materials in various sectors.

Segments Analysis

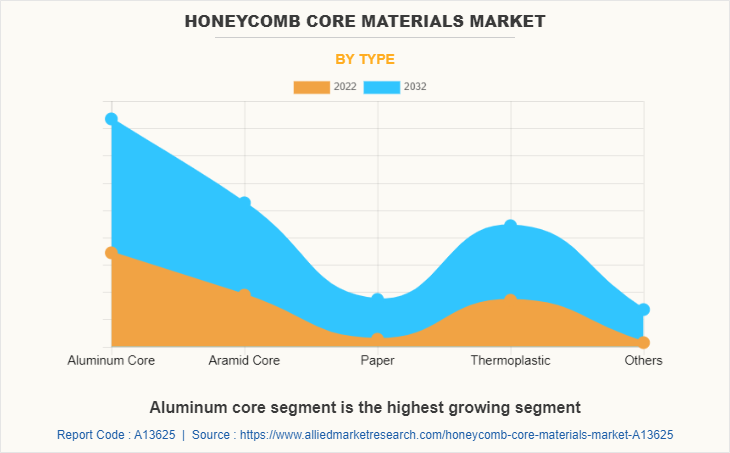

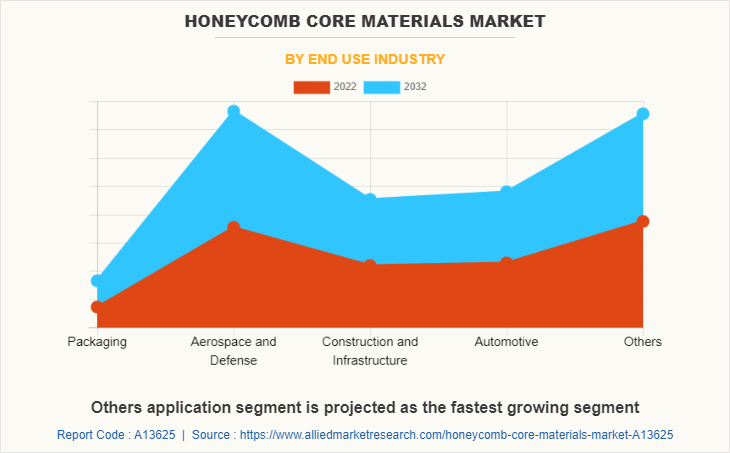

The global honeycomb core materials industry is segmented into type, end-use industry, and region. By type, the market is fragmented into aluminum core, aramid core, paper, thermoplastic, and others. Depending on end-use industry, it is segregated into packaging, aerospace & defense, construction and infrastructure, automotive, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

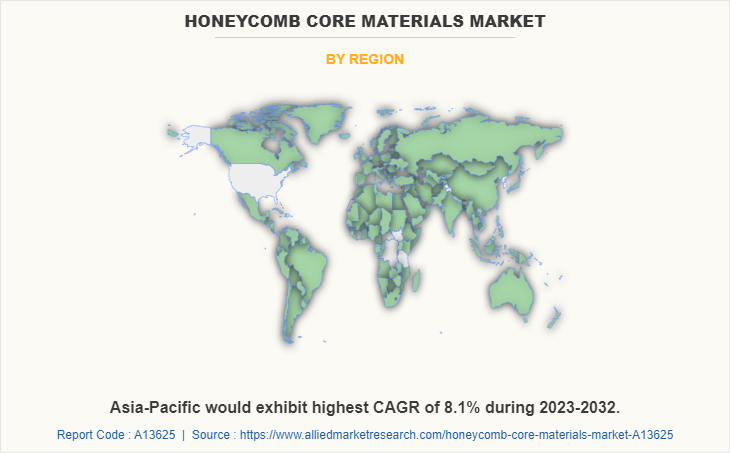

Asia-Pacific was the major shareholder in 2022, garnering 37% share in the global honeycomb core materials market, and is projected to grow at the highest CAGR during the forecast period. This is attributed to the fact that China, Japan, and India serve as the potential manufacturing hubs of automobile in Asia-Pacific with presence of major automotive giants such as Honda, Toyota, TATA, Suzuki, Ashok Leyland, and Mitsubishi. In addition, surge in demand and production of commercial and passenger vehicles across the developing economies, such China and India, has boosted the demand for honeycomb core materials as they are widely used in interior and body panels, spoilers, floors, chassis components, diffusers, and energy absorbers of automobiles. Under the National Investment Plan, India allocated $1.4 trillion for infrastructure development, with significant portions dedicated to renewable energy, roads, urban infrastructure, and railways. This investment is expected to drive the demand for honeycomb core materials in construction applications.

Furthermore, North America was the second major shareholder in 2022, growing at a CAGR of 7.8% during the forecast period. In North America, the aerospace and defense sectors have been among the leading adopters of honeycomb core materials. The region's robust aerospace industry, comprising major players like Boeing, Lockheed Martin, and Raytheon Technologies, relies heavily on these materials for manufacturing aircraft components, interior panels, and structural parts. Honeycomb cores offer weight savings which translate into improved fuel efficiency and performance, a critical factor in commercial and military aviation. Moreover, In December 2022, Hexcel entered a joint venture with Toray Advanced Composites to produce honeycomb core materials for the aerospace industry, aiming to meet the increasing demand for lightweight composite materials.

In 2022, the aluminum core segment was the largest revenue generator and is anticipated to grow at a CAGR of 8.0% during the forecast period. Aluminum honeycomb core materials have become a pivotal component in a variety of industries due to their exceptional combination of lightweight properties, high strength, and structural rigidity. These materials consist of a core made from thin aluminum foil formed into a honeycomb structure, sandwiched between two face sheets, usually also aluminum or composite panels. In 2024, Hexcel launched a new fire-resistant aluminum honeycomb panel designed for commercial aircraft interiors, enhancing safety and regulatory compliance.

Furthermore, the Aramid core type segment was the second largest revenue generating sector, growing at a CAGR of 7.7% during the forecast period. Aramid honeycomb cores are extensively utilized in aircraft interiors, flooring, control surfaces, and radomes due to their lightweight nature combined with the ability to withstand mechanical stresses and impact. These cores provide excellent damage tolerance and vibration damping, which are essential for improving the longevity and safety of aerospace components.

By end-use industry, the aerospace & defense segment dominated the global market, in terms of revenue in 2022, with a 42% share in the global market. In aerospace, honeycomb core materials are extensively used in aircraft structures, including fuselage panels, wings, floors, and control surfaces. Their lightweight nature helps reduce the overall weight of the aircraft, leading to improved fuel efficiency and reduced emissions, which are major concerns in modern aviation. In April 2022, HAL Tejas Mark 1A, an Indian multirole light fighter, incorporated advanced composite materials developed by the National Aerospace Laboratories (NAL). For instance, the engine bay door is manufactured using Carbon-BMI Prepreg to withstand temperatures up to 200°C. Defense applications leverage honeycomb core materials for armored vehicles, naval vessels, and missile components. In armored vehicles, honeycomb panels serve as lightweight ballistic protection layers, helping to absorb and dissipate impact energy from blasts or projectiles while keeping the vehicle agile.

Competitive Analysis

The major companies profiled in this report include Plascore, MC Gill (The Gill Corporation), Schutz Composites, Hexcel Corporation, Toray Advanced Composites, Corex Honeycomb, Argosy International, Euro-Composites, Showa Aircraft Industry Co., Ltd, Honylite, RelCore Composites Inc., REYNOARCH, and Fabrinox.

In January 2022, The Gill Corporation introduced the Gillcore HF fiberglass honeycomb core, designed to meet stringent aerospace requirements with enhanced moisture resistance and compliance with AMS 3715 standards.

In November 2023, awarded a contract by SONACA to develop and manufacture machined honeycomb parts for various Airbus programs, including A321, A320, A330NEO, and A350.

In May 2022, Showa Aircraft Industry Co., Ltd. began shipping Aluminum 5056 alloy honeycomb cores, manufactured to AMS-C-7438 standards, suitable for various aerospace applications.

Recent Key Developments in the Honeycomb Core Materials Market

In March 2023, Teijin Automotive Technologies developed Hexacore, a honeycomb core product compatible with various fibers and resins, designed for lightweight automotive applications.

In December 2024, Toray Industries expanded its carbon fiber honeycomb production to meet the rising demand from the defense and motorsport sectors, indicating a strategic move to support lightweight and high-strength materials in specialized applications.

Trump's Tariff Impact on Honeycomb Core Materials Market

The U.S. imposed a 145% tariff on Chinese imports, which directly impacted the honeycomb core materials market. China is a significant supplier of aramid honeycomb cores, commonly used in aerospace applications. The steep tariffs disrupted the supply chain, leading to shortages and increased prices for these specialized materials. This disruption forced manufacturers to seek alternative suppliers, often at higher costs, further escalating production expenses.

The U.S. International Trade Commission reported a $2.8 billion increase in production within industries protected by steel and aluminum tariffs. However, this was offset by a $3.4 billion decrease in production in downstream industries affected by higher input costs, highlighting the net negative effect on sectors like honeycomb core manufacturing.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the honeycomb core materials market analysis from 2022 to 2032 to identify the prevailing honeycomb core materials market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the honeycomb core materials market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global honeycomb core materials market trends, key players, market segments, application areas, and market growth strategies.

Honeycomb Core Materials Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5.2 billion |

| Growth Rate | CAGR of 7.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 671 |

| By Type |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | Corex Honeycomb, Argosy International, The Gill Corporation, TCCORE APPLIED HONEYCOMB TECHNOLOGY CO., LTD., Toray Advanced Composites, Honylite, Showa Aircraft Industry Co., Ltd, RelCore Composites Inc., Hexcel Corporation, Plascore, Schtz GmbH & Co. KGaA, Euro-Composites, fabrinox |

Analyst Review

According to CXOs of leading companies, the global honeycomb core materials market is expected to exhibit high growth due to rise in demand for lightweight, high-strength materials across various end-use industries such as aerospace & defense, automotive, and building & construction. Moreover, surge in demand for lightweight, fuel-efficient cars is encouraging automotive manufacturers to adopt honeycomb core materials.

Honeycomb cores enable the manufacturers to considerably reduce the weight of the vehicle without compromising on strength. The product is being utilized to produce a variety of automotive components, including interior body panels, floors, chassis components, diffusers, and spoilers.

The CXOs further added that aerospace-grade honeycomb core materials are progressively replacing traditional materials, including laminated panels and aluminum sheets on account of their lightweight and high-strength attributes. The product is being increasingly adopted in the production of a variety of aerospace components such as helicopter blades, fuselage components, aircraft flooring, and antennas. Thus, the rapid expansion of the automotive and aerospace industries across the developing economies, such as China, India, and Brazil, is expected to significantly contribute toward the growth of the global honeycomb core materials market during the forecast period.

Ongoing research and development efforts were aimed at improving the performance and manufacturing processes of honeycomb core materials. Advancements in material science and manufacturing techniques could lead to enhanced properties, cost reductions, and wider applications.

The honeycomb core materials market was valued at $2.5 billion in 2022, and is estimated to reach $5.2 billion by 2032, growing at a CAGR of 7.8% from 2023 to 2032.

Aerospace and defense segment is the leading in honeycomb core materials market.

Plascore, MC Gill (The Gill Corporation), Schutz Composites, Hexcel Corporation, Toray Advanced Composites, Corex Honeycomb, Argosy International, Euro-Composites, Showa Aircraft Industry Co., Ltd, Honylite, RelCore Composites Inc., REYNOARCH, and Fabrinox.

Asia-Pacific is the largest regional market for honeycomb core materials.

The global honeycomb core materials market is segmented into type, end-use industry, and region. By type, the ma end-use industry, it is segregated into packaging, aerospace & defense, construction and infrastructure, automotive, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Honeycomb core material is obtained from composite materials such as glass-reinforced plastic, aluminum, meta-aramid, and paper through expansion and corrugation processes. Honeycomb cores are fabricated with a large number of hexagon-shaped cells assembled into a honeycomb structure. They have been used for several decades to manufacture composite sandwich structures, as they provide stiffness to the composite structure with minimum weight. Thus, honeycomb core materials find their application in including aerospace & defense, building & infrastructure, automotive, marine, railway, and industrial sectors.

Loading Table Of Content...

Loading Research Methodology...