Honeycomb Paper Market Outlook - 2030

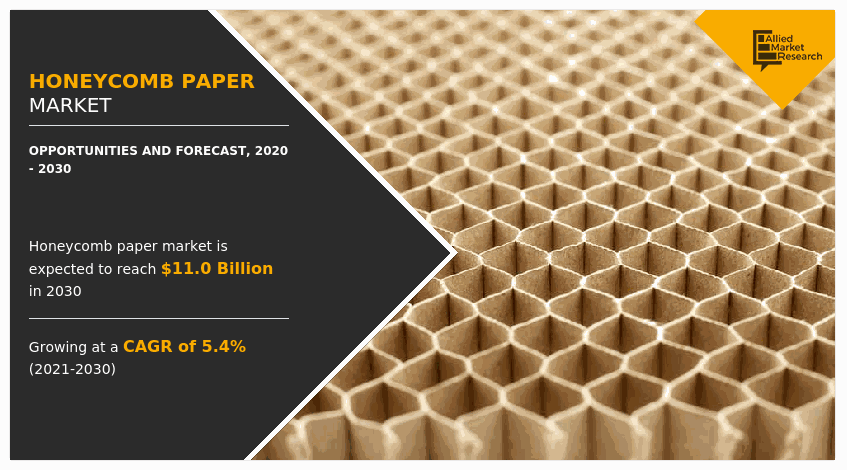

The global honeycomb paper market size was valued at $6.5 billion in 2020, and is projected to reach $11.0 billion by 2030, growing at a CAGR of 5.4% from 2021 to 2030. Honeycomb is a type of structure that can be found in nature or is created artificially. Honeycomb paper is sandwiched between two thin sheets to create honeycomb packaging materials. Honeycomb paper panels, honeycomb paper core, honeycomb paper pallets, and honeycomb paper boards are a few products that are available in the market.

Introduction

Honeycomb paper is a lightweight, eco-friendly material used in packaging, furniture, and construction. It consists of a core structure made of hexagonal cells, resembling a honeycomb, which provides high strength while using minimal material. The outer layers, often made of kraft paper, add rigidity and protection. This design optimizes the use of paper, making honeycomb paper both cost-effective and sustainable. It is commonly used for protective packaging, cushioning delicate items, creating lightweight furniture panels, and as a core in doors or partitions. Its recyclability and energy-efficient production make it an environmentally responsible alternative to materials such as plastic or foam in various industries.

Report Key Highlighters

The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

The honeycomb paper market is fragmented in nature among prominent companies such as EcoGlobe Packaging Private Limited, YOJ Pack-Kraft, Greencore Packaging, Honicel Nederland B.V., Schütz GmbH & Co. KGaA, Crown Holdings Inc., Helios Packaging, Axxor, Lsquare Eco Products Pvt. Ltd., and MAC PACK.

The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), key regulation analysis, pricing analysis, and Porter’s five forces analysis across North America, Europe, Asia-Pacific, LAMEA regions.

Latest trends in the global honeycomb paper market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

More than 3,500 honeycomb paper-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for the global honeycomb paper market.

Market Dynamics

Expanded paper honeycomb (EPH) is a type of paper honeycomb that is expanded and de-moisturized and then cut to size pieces of paper honeycomb. This type of paper honeycomb is used as a core-filling material in applications such as interior doors, partition walls, and automotive components. Factors such as high pressure strength, improved deformation properties, and 100% recyclable, makes paper honeycomb a widely used product as a core material and a sandwich material between the facings of softwood, hardboard plywood, plasterboard, and others. Expanded paper honeycomb is a handy and cost-effective product used as a core filling material in interior doors. In addition, it can also be used as a core material for flat surfaced and molded interior doors. Use of expanded paper honeycomb as a substitute over traditional filling materials such as solid fillings, chipboard stripes and tube board in interior doors and partition walls, is driving its demand in the global honeycomb paper market. In addition, block paper honeycombs are low-cost and versatile core materials that are used in applications such as doors, partition walls, and automotive. Deforming properties, high pressure strength, and ability to adapt to any shape makes block paper honeycomb viable to be used in diverse applications serving to building & construction, protective packaging, and transport & logistic end-use industries All these factors collectively surge the demand for honeycomb paper, thereby augmenting the global honeycomb paper market growth.

However, minimal breakage resistance & folding resistance, susceptible to puncture, and poor processing performance of paper honeycomb paperboard limit the application of honeycomb paper in certain end-use industries, which is expected to hamper the market growth.

On the contrary, paper honeycomb pallets are a widely used and preferred product for air shipments owing to their low weight and durability. In addition, honeycomb paper pallets added with water resistance coatings can be used during sea shipments. Transport & logistic end-users require solid and high strength support material for increasing their storage capability and protective packaging during transportation. Moreover, reduced weight of packaging material further contributes toward increasing profit. Light weight and strength of honeycomb paper makes it viable to be used in the transport and logistical end-use industry. In addition, hygienic production process followed during production of honeycomb paper makes it ideal during transport and packaging of food and pharmaceutical products. Key-players in the honeycomb pallets market are engaged in the production of paper pallets for transport and logistics that are approved and designed by EURO standards, provide additional support that comes into play during forklifting of packed products, and ability to lift the packaged products in four ways. Transport & logistic end-use industry includes transport and shipment of electronic gadgets & products, automobile spare parts, and other industrial control units. Honeycomb paper edge protectors and corners are widely used to safeguard goods during transportation. This factor is anticipated to offer new growth opportunities during the forecast period.

Segments Overview

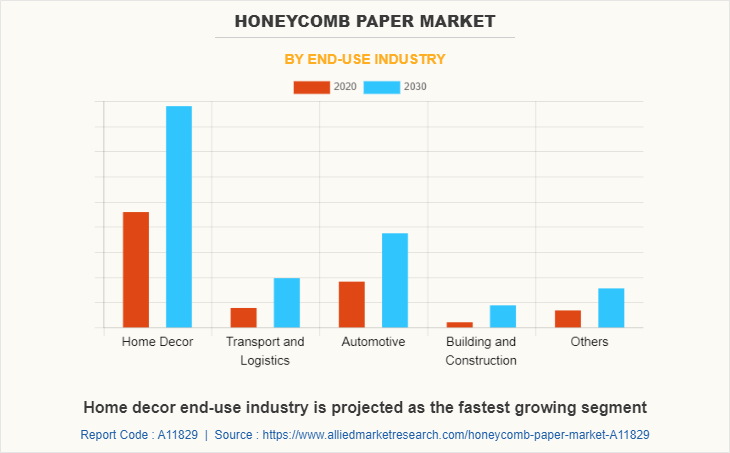

The honeycomb paper market is segmented on the basis of core type, cell size, end-use industry, and region. On the basis of core type, the market is categorized into expanded paper honeycomb, blocks paper honeycomb, continuous paper honeycomb, and others. By cell size, the global honeycomb paper market is classified into up to 10mm, 10-30 mm, and above 30 mm. The end-use industries covered in the report include home decor, transport & logistics, automotive, building & construction, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Source: AMR Analysis

Honeycomb Paper Market By Region

The Asia-Pacific honeycomb paper market accounted for 43.2% of the market share in 2020, and is projected to grow at the highest CAGR of 6.2% during the forecast period. Paper honeycomb panels are used in home décor applications such as portable sofas and other furniture products. Strength-to-weight ratio and stiffness of paper honeycomb makes it an ideal product to be used in the home décor end-use industry. China home décor sector is gaining importance owing to rise in demand and adoption of eco-friendly products. In addition, key-players in the home décor industry are adopting innovative yet versatile products.

Source: AMR Analysis

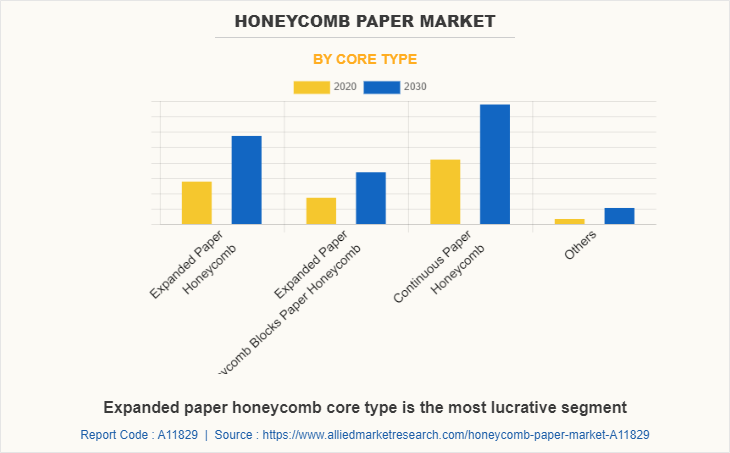

Honeycomb Paper Market By Core Type

In 2020, the continuous paper honeycomb core type was the largest revenue generator, and is anticipated to grow at a CAGR of 5.4% during the forecast period. Use of continuous paper honeycomb in automotive applications such as trunk plates and hat boards is the key market trend. In addition, it can also be used in applications such as desks, shelves, wardrobe sliding doors, cabinet carcass, and kitchen worktops drive the demand of the global market.

Source: AMR Analysis

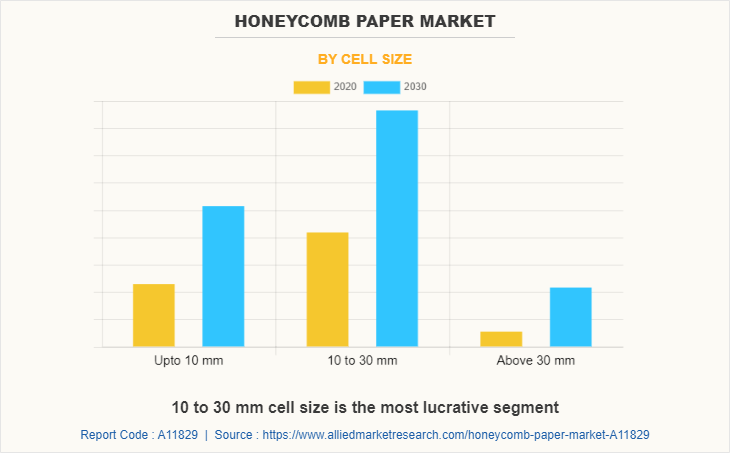

Honeycomb Paper Market By Cell Size

The 10-30 mm cell size segment accounted for 47% of the market share in 2020, and is projected to grow at the highest CAGR of 5.6% during the forecast period. Honeycomb paper cell size ranging from 10 mm to 30 mm is used in doors lined with ply, high density fiberboard (HDF), flush, skin and sliding doors. Generally, standard cell size of 15 mm, 21 mm, and 28 mm are widely preferred by furniture manufacturers, architecture designers, transport & logistics industry, and automotive manufacturers.

Source: AMR Analysis

Honeycomb Paper Market By End Use Industry

By end-use industry, the home decor end-use industry dominated the global market in 2020, and is anticipated to grow at a CAGR of 5.8% during the forecast period. Paper honeycomb core is widely adopted for wide home décor applications such as interior doors and interior furniture products is the key market trend. In addition, high strength ratio of honeycomb core materials make them an ideal substitute over other traditional chipboard strips and tube boards for home décor applications. Honeycomb core materials serve the purpose of low-cost and firm filling material for production of furniture sandwich panels and help to reduce the overall weight without compromising the aesthetic look and durability of the furniture.

Competitive Analysis

The major companies profiled in this report include Lsquare Eco-Products Pvt. Ltd. (Honecore), EcoGlobe Packaging Private Limited (EcoGlobe), Greencore Packaging, Crown Holdings Inc., Schütz GmbH & Co. KGaA, Honicel Nederland B.V., Axxor, YOJ Pack-Kraft (YOJ), Helios Packaging, and Macpack.

Industry Trends:

The honeycomb paper market is experiencing steady growth, driven by increasing demand for eco-friendly and sustainable packaging solutions across industries. Companies are shifting towards sustainable alternatives, such as honeycomb paper, due to rising environmental concerns and regulations that promote the reduction of plastic and non-recyclable materials. In packaging, honeycomb paper offers high strength with low material usage, making it ideal for protective and cushioning applications. The growth of e-commerce has also amplified the need for efficient, sustainable packaging materials, boosting the demand for honeycomb paper.

The construction and furniture industries are also significant contributors to market growth. Honeycomb paper is used in lightweight furniture panels, doors, and partitions due to its high strength-to-weight ratio. The Indian government, under initiatives such as the National Green Tribunal’s rulings, promotes the use of environmentally sustainable products. This aligns with global trends, where government regulations in Europe and North America encourage the adoption of recyclable materials in construction and packaging.

According to the Ministry of Commerce and Industry in India, the paper packaging industry is expected to grow at a rate of 6.5% annually, with increased usage of sustainable materials such as honeycomb paper. Furthermore, government incentives to promote the use of recyclable materials and reduce single-use plastics have accelerated the market's expansion. Similar statistics from global agencies such as the European Commission indicate a shift toward paper-based solutions, backed by legislative support for circular economies.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the honeycomb paper market analysis from 2020 to 2030 to identify the prevailing honeycomb paper market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the honeycomb paper market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global honeycomb paper market trends, key players, market segments, application areas, and market growth strategies.

Honeycomb Paper Market Report Highlights

| Aspects | Details |

| By Core Type |

|

| By Cell Size |

|

| By End-use Industry |

|

| By Region |

|

| Key Market Players | YOJ Pack-Kraft, Axxor, Helios Packaging, Honicel Nederland B.V., EcoGlobe Packaging Private Limited, Greencore Packaging, Crown Holdings Inc., MAC PACK, Schütz GmbH & Co. KGaA, Lsquare Eco Products Pvt. Ltd. |

Analyst Review

The global honeycomb paper market is expected to exhibit high growth owing to its use in marine, aerospace, healthcare, and food packaging sector. High strength ratio of honeycomb core materials makes them an ideal substitute over other traditional chipboard strips and tube boards for home décor applications. Honeycomb core materials serve the purpose of low-cost and firm filling material for production of furniture sandwich panels and help to reduce the overall weight without compromising the aesthetic look and durability of the furniture. In addition, paper honeycomb furniture is gaining importance owing to portability, cost-effectiveness, easy to assemble, and environment friendly is anticipated to augment the demand for the global honeycomb paper market.

Export certification is of utmost importance during packaging and export of expensive automotive parts. Traditional protective materials require export certification that in turn increases hassle and cost of transport. To overcome this problem, paper honeycombs are used as these do not require any certification and hassle free export activities can be carried out in the international automotive market. This factor is anticipated to offer new growth opportunities during the forecast period.

The increasing expenditure in aerospace sectors for upgrading aircrafts with modern armor facilities where honeycomb paper is used in ballistic body armor and as a substitute over asbestos may fuel the growth of the honeycomb paper market. Moreover, the sales of electronic and home appliances have shown an impressive growth in recent years owing to factors such as increased consumer purchasing power, digitalization, sustainability, consolidation and rise in middle class income. Thus, the use of honeycomb paper boards for protective packaging of electronics and home appliances may create lucrative opportunities for the market.

The use of continuous paper honeycomb in automotive applications such as trunk plates and hat boards is the key market trend.

Paper honeycomb core is widely adopted for wide home décor applications such as interior doors and interior furniture products. In addition, the high strength ratio of honeycomb core materials makes them an ideal substitute for other traditional chipboard strips and tube boards for home décor applications.

Asia-Pacific honeycomb paper market accounted for the largest market share in 2020 and is projected to grow at the highest CAGR of 6.2% during the forecast period.

The global honeycomb paper market was valued at $6.5 billion in 2020 and is projected to reach $11.0 billion by 2030.

The top companies to hold the market share are Lsquare, Eco-Products Pvt. Ltd. (Honecore), EcoGlobe Packaging Private Limited (EcoGlobe), Greencore Packaging, Crown Holdings Inc., Schütz GmbH & Co. KGaA, Honicel Nederland B.V., Axxor, YOJ Pack-Kraft (YOJ), Helios Packaging, Macpack

Loading Table Of Content...