Hospital Services Market Size & Trends

Hospital services refer to the wide range of medical, diagnostic, therapeutic, and surgical treatments provided to patients within a hospital setting. These services are designed to cater to both inpatients, who are admitted for extended care, and outpatients, who receive treatment and leave on the same day. Hospitals offer a variety of specialized services, such as emergency care, intensive care units (ICUs), surgery, maternity, pediatrics, oncology, cardiology, and rehabilitation, among others.

Market Value Projections and Insights

- The global hospital services market size was valued at $4.2 trillion in 2022, and is projected to reach $7.4 trillion by 2032, growing at a CAGR of 5.8% from 2023 to 2032.

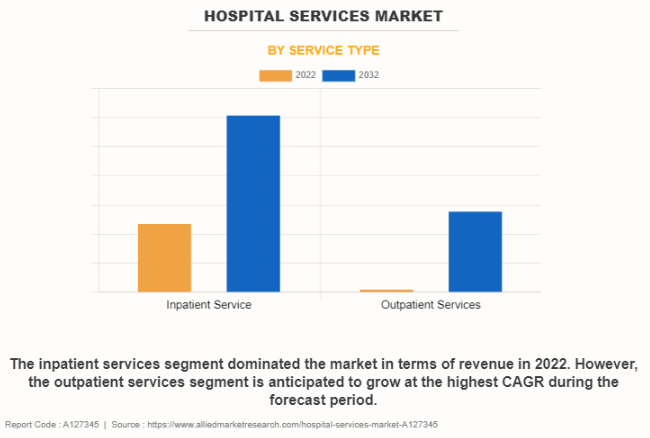

- By service type, the inpatient services segment dominated the market in terms of revenue in 2022. However, the outpatient services segment is anticipated to grow at the highest CAGR during the forecast period.

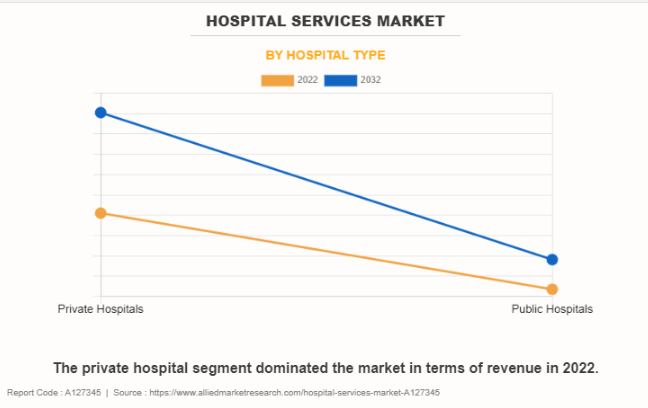

- On the basis of hospital type, the private hospital segment dominated the market in terms of revenue in 2022.

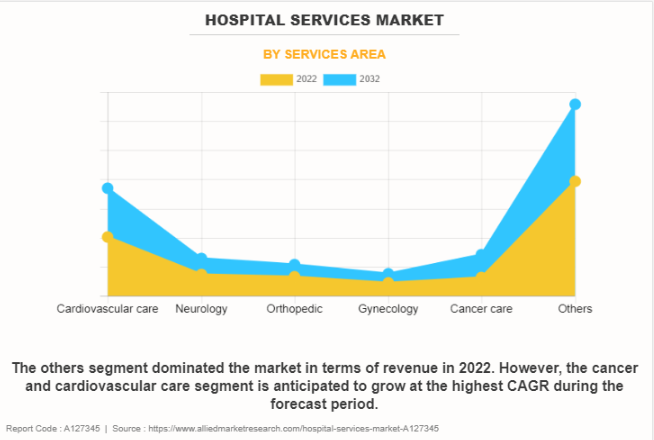

- By service area, the others segment dominated the hospital services market in terms of revenue in 2022. However, the cancer and cardiovascular care segment is anticipated to grow at the highest CAGR during the forecast period.

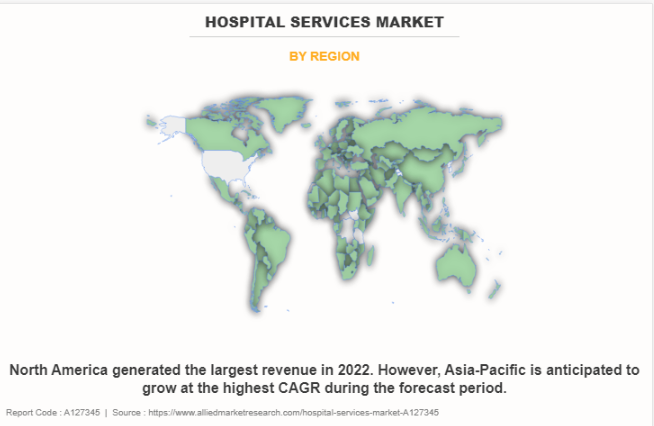

- Region wise, North America generated the largest revenue in 2022. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

The hospital services market is witnessing significant growth due to increasing demand for healthcare services, driven by rising chronic diseases, aging populations, and advancements in medical technology. A key trend is the shift towards outpatient care and telemedicine, reducing hospital stays and enhancing convenience for patients. Moreover, digital transformation, including AI and electronic health records (EHRs), is improving operational efficiency and patient outcomes. Key drivers include government initiatives to improve healthcare infrastructure and rising healthcare expenditure globally.

The markets face challenges such as high operational costs, staff shortages, and regulatory pressures. Additionally, hospitals must adapt to shifting patient expectations for personalized care. Market opportunities lie in expanding telehealth services, adopting precision medicine, and improving patient management systems. Hospitals that invest in innovative technology and value-based care models will position themselves strongly in the evolving healthcare landscape.

Industry Highlights

- The hospital services market continues to grow due to rising healthcare needs driven by aging populations, chronic diseases, and increasing health awareness.

- Hospitals are increasingly focusing on outpatient care, telehealth, and home-based treatments, allowing for better patient convenience and reduced hospitalization costs.

- The adoption of advanced technologies such as AI, electronic health records (EHR), and robotic surgery is driving operational efficiencies and improving patient care outcomes.

- The hospital sector faces high costs in maintaining facilities, medical equipment, and workforce, compounded by a shortage of skilled healthcare professionals.

- The affordability of advanced treatments in emerging countries such as India boosts medical tourism, contributing to hospital services market growth.

Hospital services have long been essential to healthcare systems, valued for their critical role in patient care, advanced medical treatments, and life-saving interventions. Hospitals are central to managing complex health conditions, providing a wide range of services from emergency care to specialized surgeries. Certain hospitals, known for their cutting-edge technologies, renowned specialists, or groundbreaking treatments, can become highly sought after by patients globally, enhancing their prestige and appeal. Hospitals that play pivotal roles in medical advancements or are associated with significant healthcare milestones gain recognition and attract both patients and healthcare professionals. People often recall the importance of hospitals during critical moments in their lives, underscoring their emotional and practical significance. Hospitals continue to evolve, embracing technological advancements and patient-centered care, making them indispensable institutions within the healthcare landscape.

Key Areas Covered in the Report

- Hospital services encompass a broad range of critical healthcare offerings, including inpatient and outpatient care, surgical procedures, emergency services, and diagnostic testing.

- The market faces competition from alternative healthcare delivery models such as outpatient clinics, urgent care centers, and telemedicine services.

- Technological advancements, such as electronic health records (EHRs) and robotic-assisted surgeries, are driving innovation and improving the efficiency and quality of hospital services.

- The growing prevalence of chronic diseases, aging populations, and increasing healthcare expenditure continue to drive demand for comprehensive hospital services.

Hospital services play a crucial role in providing comprehensive and critical healthcare across various levels of care, including emergency, acute, and elective treatments. The sector is experiencing heightened competition from alternative healthcare delivery models such as outpatient clinics, urgent care centers, and telemedicine services, which offer more convenience and can sometimes reduce costs.

Technological advancements are a significant driver of innovation in hospital services. The integration of electronic health records (EHRs) has improved patient management and data accuracy, while robotic-assisted surgeries and other high-tech solutions are enhancing surgical precision and recovery times. These innovations are making hospital services more efficient and effective, catering to the increasing expectations for high-quality care.

The growing prevalence of chronic diseases, coupled with an aging population, is contributing to the rising demand for hospital services. Chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders require ongoing management and specialized care, which drives patient visits and hospital admissions. Additionally, the increase in healthcare expenditure reflects a broader commitment to improving health outcomes and expanding access to quality care.

The shift towards digital health solutions, including telemedicine, is also influencing the hospital services market. As patients seek more accessible and flexible care options, hospitals are integrating these technologies to enhance their service offerings. Furthermore, the rise of online health platforms and pharmacies is providing patients with more choices and convenience, further shaping the market dynamics.

As the hospital services sector evolves, continued advancements in technology and a focus on patient-centered care are expected to create new opportunities and drive growth in the industry.

Topics discussed in the report

- Analysis of market trends, drivers, and opportunities across key segments.

- Competitive landscape and strategic initiatives of key market players.

- Regional analysis highlighting the dominance of North America in the global market.

- Insights into the role of outpatient services in the future of the industry.

- Growth prospects for cancer and cardiovascular care as a key application area for hospital services.

Segment Overview

The hospital services market is segmented into service type, hospital type, service area, and region. On the basis of service type, the market is divided into inpatient services and outpatient services. On the basis of hospital type, the market is categorized into private hospitals and public hospitals. On the basis of service area, the market is categorized into cardiovascular care, neurology, orthopedic, gynecology, cancer care, and others. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, Sweden, Austria, Luxembourg and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By service type, the inpatient services segment occupied the largest share in 2022 and is anticipated to remain dominant during the forecast period owing to several key factors. These include the continued demand for comprehensive, round-the-clock medical care that inpatient services offer, particularly for acute conditions and surgeries. In addition, By hospital type, the private hospitals segment occupied largest share in 2022 and is anticipated to remain dominant during the forecast period. This is attributed to the increasing emphasis of private hospitals on enhancing their specialized capabilities to cater to patients with critical care needs, such as those requiring cancer or cardiovascular care. By service area, the cancer and the cardiovascular care segment is expected to register the fastest CAGR during the forecast period owing to prevalence of cancer and cardiovascular diseases, which necessitate specialized and often long-term medical attention.

Comparative Matrix of Key Segments

Parameters | Inpatient Services | Outpatient Services |

Market Share | Largest share due to emergency care, surgeries, and complex procedures. | Growing rapidly due to rise in telemedicine and outpatient clinics. |

Distribution Channels | Hospitals, Specialty Clinics, and Emergency Care Centers | Outpatient Centers, Clinics, Telehealth Platforms |

Challenges | High operational costs, hospital-acquired infections, longer patient stays. | Limited insurance coverage, patient compliance issues, competition. |

Key Players | HCA Healthcare, Mayo Clinic, Cleveland Clinic | CVS Health, DaVita, Fresenius Medical Care |

Regional Dynamics and Competition

The hospital services market is witnessing notable growth across various regions due to the increasing demand for comprehensive healthcare solutions, driven by rising populations, aging demographics, and expanding healthcare infrastructure.

North America holds a leading position in the hospital services market, primarily due to the advanced healthcare infrastructure and high expenditure on healthcare services. The U.S. is a key player, supported by its extensive network of hospitals, state-of-the-art facilities, and high consumer awareness of health services. The presence of numerous leading hospital networks and significant investments in healthcare technology further bolster the region's dominance.

In Europe, the hospital services market growth is characterized by a strong focus on high-quality care and adherence to stringent regulations. Countries like Germany, the U.K., and France are at the forefront, benefiting from well-established healthcare systems and substantial investments in hospital infrastructure and technology. The emphasis on patient safety, quality standards, and regulatory compliance drives the development of innovative hospital services in these nations.

The Asia-Pacific region offers substantial growth opportunities due to rapid urbanization, rising healthcare awareness, and increasing disposable incomes. Countries such as India, China, and Japan are leading the way, with significant advancements in healthcare infrastructure and technology. The growing population and expanding middle class are contributing to higher demand for hospital services, supported by the proliferation of both public and private healthcare facilities. Additionally, the region is seeing considerable investment in healthcare development and the expansion of healthcare networks.

Emerging economies in Latin America and the Middle East also present promising growth potential. In Latin America, countries like Brazil and Mexico are expanding their healthcare infrastructure, driven by increasing healthcare needs and investments in hospital services. Similarly, the Middle East is experiencing growth in healthcare services, with countries such as the United Arab Emirates and Saudi Arabia enhancing their healthcare systems and infrastructure to cater to a growing population and higher healthcare demands.

Some of the major players analyzed in this report are UT Health San Antonio, Ascension, Mayo Clinic, HCA Healthcare, Inc., Spire Healthcare Group Plc, The Cleveland Clinic, Ramsay Health Care Limited, Tenet Healthcare Corp., Community Health Systems Inc., IHH Healthcare.

Hospital services market News Release

- In September 2023, Spire St. Anthony's Hospital in Cheam, announced that it has installed a second, $1.75 million state-of-the-art MRI scanner, which will speed up diagnosis for people suffering from damage to bones, injuries to internal organs, problems with blood flow, stroke, cancer, and cardiac problems. Both NHS and private patients will benefit from this new equipment. This new scanner is part of the ongoing investment at Spire St. Anthony's Hospital to increase capacity and improve the quality of care and patient comfort.

- In August 2023, IHH Healthcare announced that it has upped its stake in Ravindranath GE Medical Associates Private Ltd (RGE) to 98.17% from 73.64%, following the shares acquisition for a cash consideration of $88.8 million. This will strengthen RGE group's operations and expand its leading market position, as part of IHH's commitment to the Indian healthcare sector.

- In March 2023, Spire Yale Hospital, announced a new $11.8 million outpatient and diagnostic center at Wrexham's. This opening of the new Chesney Court Imaging, Orthopaedic, and Outpatient Center will increase the number of patients the hospital can treat, expand the range of patient services available, and provide faster care for day-case patients.

- In February 2023, IHH Healthcare Bhd, via its subsidiary Acibadem Healthcare Group, announced that it is acquiring the entire stake in Kent Health Group, a private healthcare service provider in Izmir, Turkey. The acquisition by Acibadem validates the strategic value generated by Kent through these investments and ensures the continuity of focus on medical and service excellence for the benefit of patients.

- In February 2023, Community Health Systems, Inc., announced that subsidiaries of the Company have signed a definitive agreement to sell 123-bed Lake Norman Regional Medical Center, an acute care hospital in Mooresville, NC, and Davis Regional Medical Center in Statesville, NC, which is in the process of transitioning from a general acute care hospital to an inpatient behavioral health hospital, and their associated assets, to subsidiaries of Novant Health for cash consideration of approximately $320 million.

- In February 2022, Community Health Systems, Inc. and health technology company, Cadence, announced a partnership to implement an innovative digital healthcare infrastructure for patients managing chronic conditions. The partnership will deploy and scale Cadence's remote patient monitoring (RPM) and virtual care solution across CHS' national footprint, enhancing clinical care for thousands of patients.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hospital services market analysis from 2022 to 2032 to identify the prevailing hospital services market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hospital services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global hospital services industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hospital services market trends, key players, market segments, application areas, and market growth strategies.

Hospital Services Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.4 trillion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 259 |

| By Service Type |

|

| By Hospital Type |

|

| By Services Area |

|

| By Region |

|

| Key Market Players | UT Health San Antonio, HCA Healthcare, Inc., Ramsay Health Care Limited, Mayo Clinic, Ascension, The Cleveland Clinic, IHH Healthcare, Community Health Systems Inc., Tenet Healthcare Corp., Spire Healthcare Group Plc |

Analyst Review

The rise in prevalence of chronic diseases, a surge in demand for high-quality care services, and the increase in elderly population are driving the growth of hospital services market.

Hospitals' proactive engagement in medical research and education is further propelling market expansion. This commitment to advancing medical knowledge and fostering innovation not only benefits patient care but also enhances the overall healthcare ecosystem.

Furthermore, North America is expected to witness highest growth, in terms of revenue, owing to ongoing technological advancements, a well-established and advanced healthcare infrastructure, and presence of robust healthcare insurance system and government-funded healthcare programs. However, Asia-Pacific is anticipated to witness notable growth, owing to rise in geriatric population and increase in initiative to expand the healthcare facilities in the region, thus driving the growth of the market during the forecast period.

A wide range of medical and non-medical activities are provided by healthcare professionals and organizations like healthcare institutes to diagnose, treat, prevent, and manage illnesses, injuries, and overall health conditions. Hospitals serve as vital hubs for delivering comprehensive healthcare, staffed by a diverse team of healthcare professionals.

The major factor that fuels the growth of the hospital services market are increase in prevalence of chronic diseases, growing demand for quality care and presence of reimbursement policies drive the growth of the global hospital services market .

Top companies such as HCA Healthcare, Inc, Tenet Healthcare Corp., Mayo clinic and Ramsay Health Care Limited held a high market position in 2022. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, and LAMEA.

The inpatient segment is the most influencing segment in hospital services market.These include the continued demand for comprehensive, round-the-clock medical care that inpatient services offer, particularly for acute conditions and surgeries. Additionally, the aging population and the prevalence of chronic diseases often require extended hospital stays and specialized inpatient care.

The base year is 2022 in hospital services market .

The forecast period for hospital services market is 2023 to 2032

The market value of hospital services market in 2032 is $7,407.67 billion

The total market value of hospital services market is $4,206.94 billion in 2022.

Loading Table Of Content...

Loading Research Methodology...