Hosting Infrastructure Services Market Overview

The global hosting infrastructure services market was valued at USD 14.5 billion in 2021, and is projected to reach USD 32.5 billion by 2031, growing at a CAGR of 8.4% from 2022 to 2031.

Growth in demand for low-cost IT infrastructure and faster data accessibility, increase in number of small & medium businesses is boosting the growth of the global hosting infrastructure services market. In addition, rapid growth of cloud technology is positively impacts growth of the hosting infrastructure services market.

Hosted services are applications, IT infrastructure components or functions that organizations access from external service providers, typically through an internet connection. Hosted services cover a wide spectrum of offerings, including web hosting, off-site backup, and virtual desktops. Cloud services also fall within the hosted services category, although not every hosted service resides in the cloud. A customer, for example, may access an application from a hosting provider's dedicated server. Hosting infrastructure services provides a combination of IT solutions such as web development, web hosting and email, infrastructure, and application, over the internet. It helps organizations to reduce operational cost that they incur to set up enterprise infrastructure.

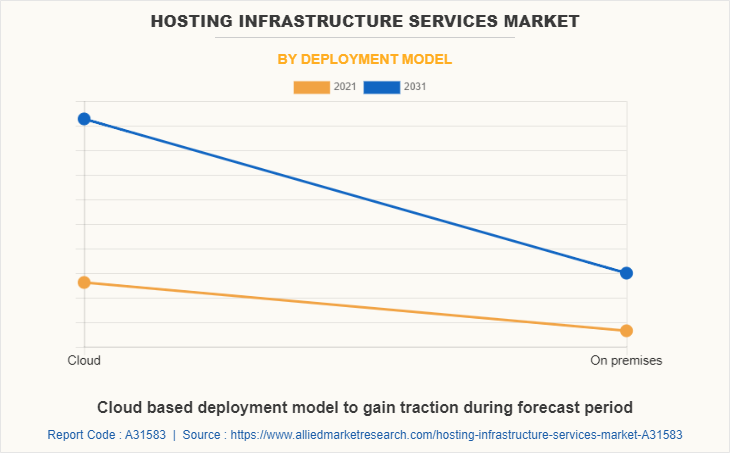

However, security concerns over private cloud deployment is hampering the hosting infrastructure services market growth. On the contrary, growth in cloud adoption among SMEs is expected to offer remunerative opportunities for expansion during the hosting infrastructure services market forecast.

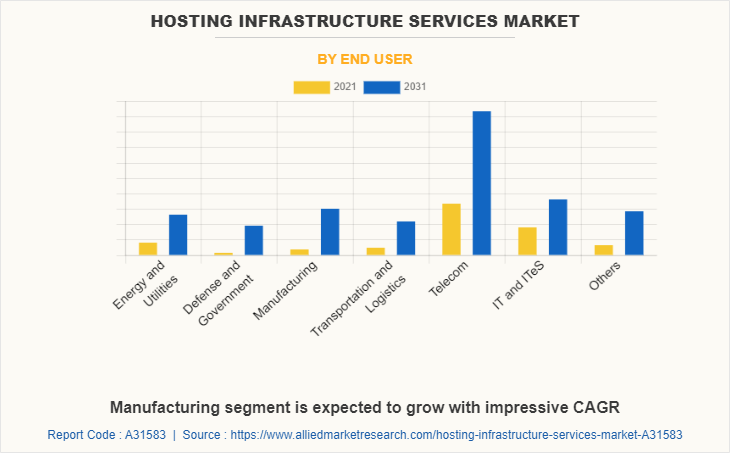

On the basis of end user, the energy and utilities segment dominated the hosting infrastructure services market in 2021, and is expected to maintain its dominance in the upcoming years. In the energy and utilities sector, legacy systems relying on human involvement are extensively being replaced by automated systems. In addition, rise in demand for web applications in this sector is increasing adoption of hosting infrastructure services in this segment. Hence, surge in need for networking infrastructure fuels demand for hosting infrastructure services in the energy and utilities sector.

In addition, unique requirements of petroleum seismic processing energy production and oil & gas data management have boosted the demand for hosting infrastructure that offers specific energy industry expertise. Moreover, hosting infrastructure services reliably support software applications as well as huge data volume behind critical activities, such as well-path planning seismic interpretation, and unconventional systems engineering. Hence the energy & utility industry players are collaborating with hosting infrastructure services providers to improve stability of and networks, which augments growth of the hosting infrastructure services market.

Depending on the region, North America dominated the hosting infrastructure services market in 2021. North America offers adequate infrastructural development to adopt hosting infrastructure services technology. In addition, leading vendors are focused on the development of novel solutions, strategic alliances, and geographical expansion to strengthen their market presence globally. The BFSI and government industries are expected to dominate the hosting infrastructure services market during the forecast period. The key factors that drive the North American market include growth in demand for low-cost cloud infrastructure development and faster network accessibility.

Asia-Pacific is expected to witness highest growth in hosting infrastructure services industry, owing to increase in adoption of fast internet connectivity including 4G connections, large population base, rise in competition among telecom& IT service providers, increase in GDP.

Top Impacting Factors

Growth in demand for low-cost IT infrastructure and faster data accessibility

Enterprises across the globe are focused to create mobile workforce, where employees can access data from distant places through internet services, hence requiring virtual sets of IT offerings such as servers, storage, networks, and others. Infrastructure services enables faster data access irrespective of data center location due to common IT infrastructure installation. In addition, infrastructure services incur low investment cost, as it does not require on-premise data center and additional services and maintenance costs.

Managed service providers including Amazon Web Services, Inc., Microsoft Corporation, and IBM Corporation provide continuously available cloud service throughout the year as a part of their integrated cloud service offering. With the most responsive scalability characteristic of pooled cloud servers, the end users find hosting infrastructure services a significant cost savings services where a client pay only for what they use. In addition, end users also avoid the setup costs, which otherwise are incurred by bringing individual servers online. This is a major factor expected to drive the growth of the marker during the forecast period.

Increase in the number of small & medium businesses

The number of small & medium enterprises (SMEs) is rapidly increasing, owing to improving funding and investments. Governments across countries are encouraging small and medium enterprises by offering growth opportunities and business expansion policies. The G-20 countries, for instance, are primarily focusing on boosting small and medium business opportunities as they help the national economy in creating more job opportunities.

Thus, the G-20 countries are supporting investments and trade opportunities for small and medium businesses. For instance, the Government of India has launched the Start-up India scheme to raise the number of start-ups across the country. The growing number of SMEs will, thus, drive the demand for domain names and hosting infrastructure services in the coming years. Moreover, the increasing competition and challenges are driving SMEs to focus on their online presence and activities. To expand the customer base and provide better customer experiences, these businesses are adopting different online expansion strategies. For enhancing online presence, having a domain name and website is essential. Thus, the growing number of small and medium businesses is likely to surge the demand for hosting infrastructure services.

KEY BENEFITS FOR STAKEHOLDERS

The study provides an in-depth analysis of the hosting infrastructure services market along with the current Hosting Infrastructure Services Market Trends and future estimations to elucidate the imminent investment pockets.

Information about key drivers, restrains, and opportunities and their impact analysis on the hosting infrastructure services market size is provided in the report along with the Hosting Infrastructure Services Market Share.

The Porter’s five forces for Hosting Infrastructure Services Market Analysis illustrates the potency of buyers and suppliers operating in the hosting infrastructure services market.

The quantitative analysis of the global sports management market for the period 2021–2031 is provided to determine the Hosting Infrastructure Services Industry.

Hosting Infrastructure Services Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 32.5 billion |

| Growth Rate | CAGR of 8.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 210 |

| By Offering |

|

| By Deployment Model |

|

| By End User |

|

| By Region |

|

| Key Market Players | GoDaddy Operating Company, LLC, . International Business Machines Corporation, HPE, AT&T Inc., NetApp, Inc., Equinix Inc., CoreSite, Google, Rackspace Inc., Microsoft Corporation |

Analyst Review

In accordance with insights by CXOs of leading companies, increasing technological proliferation, rise in demand for smart devices, increasing demand from small businesses, rising preference towards cloud services, increase in adoption of BYOD (bring your own device) trend, increasing digitization, and rapid urbanization are some of the major factors driving the hosting infrastructure service demand over the forecast period. Moreover, file sharing and file hosting have become crucial aspects of cloud infrastructure and as the use of cloud-based services increases these aspects are expected to become more important and hosting infrastructure service providers would have to focus on these to enhance their operational capabilities.

In the digital era where artificial intelligence and internet of things have taken over the world, there seems to be a comparatively less growth rate of the hosting infrastructure services market than digital marketing. Through various studies it has been observed that hosting infrastructure services market is expanding as a result of the quickening pace of digital transformation in all parts of the world. Industries such as e-commerce or retail has been more focused on gathering data on consumers for better understanding and predicting the purchasing behavior of the consumers. Cloud-based services are being adopted by businesses because they enable on-demand access to a wide range of services and applications, as well as agility and self-service at a cheaper cost.

The global hosting infrastructure services market was valued at $14.5 billion in 2021 and is projected to reach $32.5 billion by 2031.

The hosting infrastructure services market is projected to grow at a compound annual growth rate of 8.4% from 2022 to 2031.

The key players that operate in the cloud gaming market such as International Business Machines Corporation, Equinix Inc., AT&T Inc., CoreSite, GoDaddy Operating Company, LLC, Microsoft Corporation, Rackspace Inc., NetApp, Inc., Google, HPE

North America dominated the hosting infrastructure services market

Growth in demand for low-cost IT infrastructure and faster data accessibility Increase in the number of small & medium businesses

Loading Table Of Content...