Hot-dip Galvanized Steel Market Research, 2032

The global hot-dip galvanized steel market was valued at $47.0 billion in 2022, and is projected to reach $83.7 billion by 2032, growing at a CAGR of 6.1% from 2023 to 2032.Hot-dip galvanized steel is a corrosion-resistant material created by immersing steel in a bath of molten zinc. This process forms a metallurgical bond between the zinc coating and the steel substrate, offering durable protection against rust and corrosion. The steel is thoroughly cleaned and pre-treated before immersion, ensuring proper adhesion of the zinc layer. Hot-dip galvanizing provides a uniform coating thickness, promoting longevity and reducing maintenance costs. This method is commonly employed to safeguard steel structures, such as buildings, bridges, and pipelines, in various industries.

Hot-dip galvanized steel is a corrosion-resistant material created by immersing steel in a bath of molten zinc. This process forms a metallurgical bond between the zinc coating and the steel substrate, offering durable protection against rust and corrosion. The steel is thoroughly cleaned and pre-treated before immersion, ensuring proper adhesion of the zinc layer. Hot-dip galvanizing provides a uniform coating thickness, promoting longevity and reducing maintenance costs. This method is commonly employed to safeguard steel structures, such as buildings, bridges, and pipelines, in various industries.

Key Takeaways

- The hot-dip galvanized steel market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) and volume (Kilotons) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The hot-dip galvanized steel market is highly fragmented, with several players including JMT Steel, Jain Steel Industries, Manaksia Steels Limited, Dana Steel, Sanghvi Metal, YIEH, Steel Tubes India, Tianjin Tianyingtai Steel Pipe Co. Ltd., Hebei Shengtian Group Seamless Steel Pipe Co., Ltd, Thyssenkrupp AG, and Dinesh Metal Industries.

Market Dynamics

The growth of the construction industry is a significant driver for the demand for hot-dip galvanized steel. As economies expand and urbanization accelerates, there is an increasing need for infrastructure development, including residential, commercial, and industrial projects. The building and construction sector is growing quickly as a result of major developments in infrastructure projects, a focus on affordable housing, and the application of modular building technology.

The Department for Promotion of Industry and Internal Trade (DPIIT) reports that foreign direct investment (FDI) in India's development and construction activity sectors reached $26.17 billion and $26.30 billion, respectively, between April 2000 and December 2021. In 2021, infrastructure operations accounted for $81.72 billion, or 13% of all FDI inflows. Hot-dip galvanized steel is favored in construction due to its exceptional corrosion resistance, ensuring longevity and durability even in harsh environments. The increasing investment in infrastructure is expected to boost hot-dip galvanized steel market growth in the near future. Builders and developers rely on hot-dip galvanized steel for a wide range of applications, such as structural components, roofing, fencing, and utility poles, among others. In addition, stringent building codes and regulations often require materials with proven durability and safety, further boosting the demand for hot-dip galvanized steel.

The escalating utilization of hot-dip galvanized steel in automotive industry stands as a pivotal driver for the growth of the hot-dip galvanized steel market. Hot dip galvanized steel is increasingly favored in automotive manufacturing due to its exceptional properties. The continual expansion of automotive sector is driven by factors such as increase in population, rise in disposable incomes, and urbanization. Automakers are increasingly adopting hot-dip galvanized steel in vehicle construction to meet stringent safety and environmental regulations while enhancing vehicle performance and longevity.

Moreover, the shift towards electric vehicles (EVs) and the demand for lightweight materials to improve fuel efficiency further amplify the need for hot-dip galvanized steel, which offers both strength and weight advantages. The sale of electric vehicles is rising globally. For instance, According to Pwc, the U.S. battery electric vehicle market increased by 62% in the third quarter of 2023 in comparison with the same quarter in 2022. China’s BEV sales increased by 16% in the third quarter of 2023 from the corresponding quarter last year. The rise in shift toward electric vehicles and increase in its sale is beneficial for hot-dip galvanized steel market as it is primarily used in electric vehicles for EV chassis, body panels, battery enclosures, and safety components.

Fluctuations in zinc prices directly influence the cost structure of hot-dip galvanized steel production, impacting profit margins and pricing competitiveness. For instance, according to trading economics on January 26, 2023, zinc prices reached the highest zinc price of 2023, which was US $3,486.5. However, falling demand and rising supply decreased the price of zinc to $2,248.50 on May 31, 2023, which was the lowest price of zinc in 2023. In the rest of the year, the zinc price fluctuated between $ 2,400 to $ 2,700.

As a primary component in galvanization, any increase in zinc prices elevates production expenses, squeezing margins unless manufacturers can pass these costs onto consumers. Conversely, when zinc prices decline, it can enhance profitability and potentially enable competitive pricing strategies. However, the volatility inherent in zinc markets poses challenges for long-term planning and budgeting, necessitating proactive risk management strategies such as hedging or supplier diversification to mitigate the adverse effects of price fluctuations on the hot-dip galvanized steel industry.

Advancements in coating technologies continually enhance the effectiveness and attractiveness of hot-dip galvanized steel. Innovations focus on improving durability, and aesthetic appeal to meet the evolving demands of various industries. One key advancement involves the development of alloying elements and coating compositions. By incorporating elements like aluminum, zinc-magnesium, or rare earth metals, manufacturers can customize coatings to provide superior corrosion protection, even in harsh environments such as marine or industrial settings. These alloys create denser, more robust protective layers, extending the lifespan of galvanized steel products.

Additionally, advancements in surface preparation techniques and post-treatment processes contribute to coating longevity and durability. Treatments like chemical passivation or chromate conversion coatings enhance adhesion and provide additional corrosion resistance. Furthermore, improvements in application methods ensure uniform coating thickness and quality across large-scale production runs. Techniques such as continuous galvanizing lines and in-line annealing processes enhance product consistency and reliability, meeting the stringent requirements of diverse applications. Overall, ongoing innovations in coating technologies bolster the performance, longevity, and visual appeal of hot-dip galvanized steel, maintaining its position as a versatile and cost-effective solution for numerous industries.

Various leading manufacturers in the steel industry are focusing on producing and launching advanced high strength and corrosion resistant galvanized products. For instance, in November 2021, Wuppermann partnered with Tata Steel to expand its selection of high-strength steel, renowned for its exceptional corrosion resistance, particularly for chassis applications. Tata Steel and Wuppermann agreed to jointly increase capabilities of producing thicker high-strength galvanized steels (thickness 2-4mm) meeting stringent automotive requirements. In April 2021, Nippon Steel Corporation, a leading steel producer, launched ZAM-EX, a line of highly corrosion-resistant coated steel sheets designed specifically for overseas markets. These sheets offer advanced protection against corrosion, meeting the stringent requirements of various industries.

Segments Overview

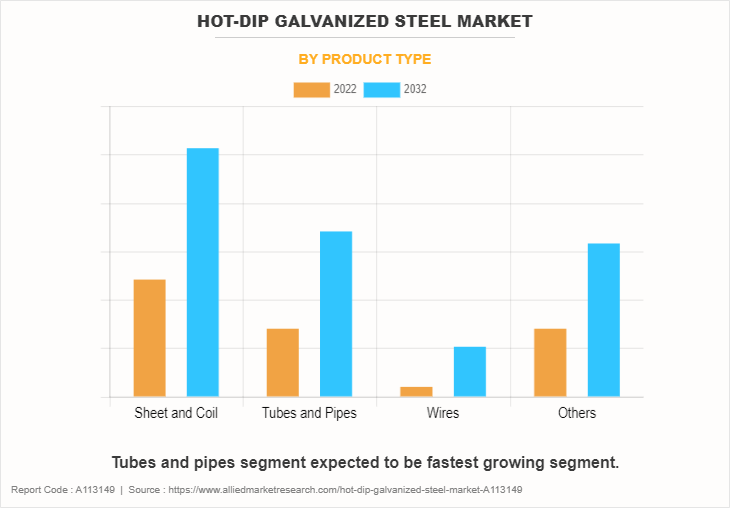

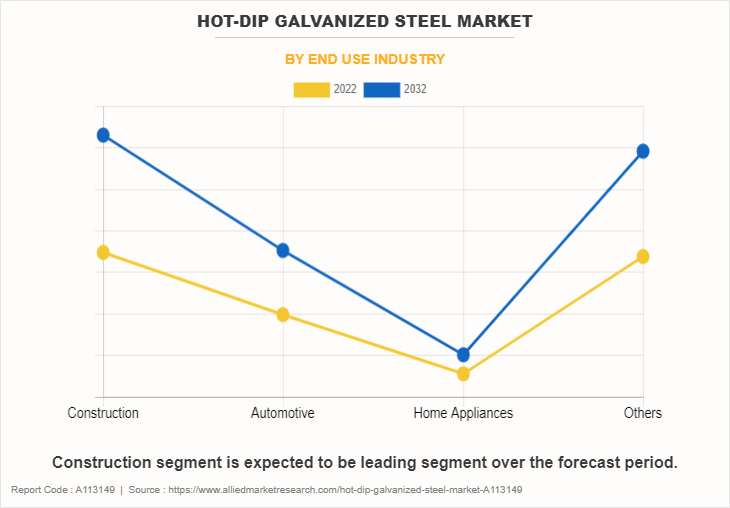

The hot-dip galvanized steel market is segmented on the basis of product type, end-use industry, and region. By product type, the market is divided into sheet and coil, tubes and pipes, wires, and others. By end-use industry, it is categorized into construction, automotive, home appliances and others. Region-wise, the hot-dip galvanized steel market is studied across North America, Europe, Asia-Pacific, and LAMEA.

By product type, the sheet and coil segment accounted for the largest share in 2022 due to its versatility in various applications such as roofing, cladding, and automotive parts. Offering efficient manufacturing, easy transportation, and customization options, sheets and coils cater to diverse customer needs. Their ability to be formed into different shapes and sizes while maintaining durability and corrosion resistance makes them indispensable in industries ranging from construction to manufacturing. According to India Brand Equity Foundation, by 2025, 4 million EVs are expected to be sold each year and 10 million by 2030. The market is expected to reach $206 billion by 2030. Auto component exports are expected to grow and reach $30 billion in FY26. The increasing EV’s demand will boost the growth rate of hot-galvanized steel in the near future as it is widely used in EVs components production.

The tube and pipe segment is expected to register the highest CAGR of 6.4%. Tubes and pipes are preferred for various applications, including water and gas distribution networks, construction projects, and industrial applications. Hot dip galvanized steel's ability to withstand harsh environmental conditions and its low maintenance requirements make it an attractive choice, driving increase in adoption and demand in diverse sectors worldwide. According to USAFact Inc., around 39% of 2022 federal transportation and infrastructure spending was for highway transportation and 28% was for rail and mass transit. The rest was for air travel and water (9%). The rising spending on infrastructure development by developed as well as developing countries is helping boost the growth rate of the tube and pipe segment, as it is primarily used in infrastructure and construction projects.

By end-use industry, the construction segment accounted for the largest share in 2022. The hot-dip galvanized steel’s versatility allows it to be used in a wide range of applications such as roofing, framing, and structural components, contributing to its widespread adoption. The rising government spending on construction and infrastructure projects is helping to increase the demand for hot-dip galvanized steel in the construction segment. For instance, according to India brand equity foundation, the Dubai government and India signed a contract in October 2021 to build infrastructure in Jammu and Kashmir, including industrial parks, IT towers, multipurpose towers, logistics centers, medical colleges, and specialized hospitals.

The home appliances segment is expected to register the highest CAGR of 6.5%. This growth is driven by the increasing demand for durable and corrosion-resistant materials in the manufacturing of appliances such as refrigerators, washing machines, and ovens. Hot dip galvanized steel's ability to withstand moisture and corrosion coupled with its cost-effectiveness and ease of fabrication, makes it an attractive choice for manufacturers aiming to enhance product longevity and performance.

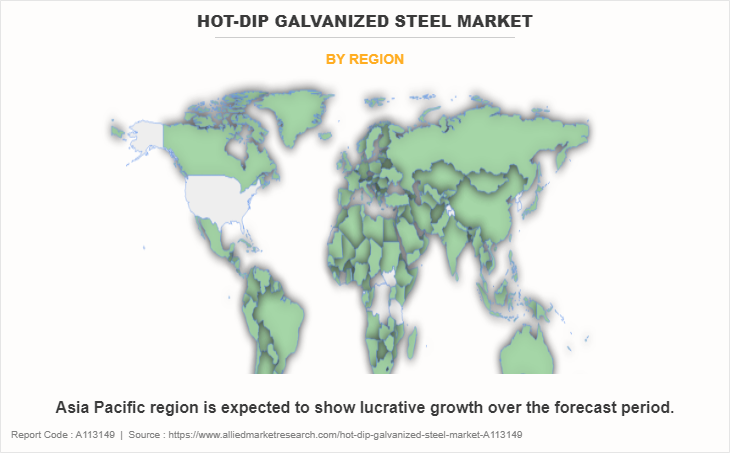

By region, Asia-Pacific garnered the largest share in 2022 and is expected to witness significant growth rate over the forecast period due to increasing construction activities, automotive production, and investments in renewable energy projects that drive the demand for hot-dip galvanized steel. Moreover, favorable government initiatives, expanding manufacturing capabilities, and rising consumer purchasing power further bolster the market in the Asia-Pacific region, consolidating its position as the primary hub for galvanized steel production and consumption.

For instance, according to National bureau of statistics, in China, in 2021, investment increased by 13.5% from a 2.2% decline in 2020 in the manufacturing sector. In the mining sector, investment grew by 10.9%, from 14.1% decline in 2020, while investment in electricity, heat, gas, and water production and supply increased by just 1.1%, which was a significant slowdown from the 17.6% growth in 2020.

Competitive landscape

The players operating in the global hot-dip galvanized steel market are JMT Steel, Jain Steel Industries, Manaksia Steels Limited, Dana Steel, Sanghvi Metal, YIEH, Steel Tubes India, Tianjin Tianyingtai Steel Pipe Co. Ltd., Hebei Shengtian Group Seamless Steel Pipe Co., Ltd, ThyssenKrupp AG, and Dinesh Metal Industries. The companies are focusing on expanding or launching new production lines to increase the production capacity of the hot-dip galvanized steel market. For instance, in October 2022, Thyssenkrupp AG, an industrial and technology company introduced a new hot-dip galvanizing production line at Dortmund, Germany. The line is expected to produce around 600,000 metric tons of hot-dip galvanized steel per year.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hot-dip galvanized steel market analysis from 2022 to 2032 to identify the prevailing hot-dip galvanized steel market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hot-dip galvanized steel market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hot-dip galvanized steel market trends, key players, market segments, application areas, and market growth strategies.

Hot-dip Galvanized Steel Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 83.7 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Product Type |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | UNITED STEEL INDUSTRY CO., LTD, YIEH, JMT Steel , Jain Steel Industries, Tianjin Tianyingtai Steel Pipe Co.Ltd, Manaksia Steels Limited, Sanghvi Metal, Hebei Shengtian Group Seamless Steel Pipe Co., Ltd, Steel tubes india, DANA Steel |

Analyst Review

According to the insights of the CXOs of leading companies, the hot-dip galvanized steel market is propelled by factors such as increase in infrastructure development, automotive industry expansion, and stringent regulations favoring corrosion-resistant materials. Additionally, the demand for sustainable solutions and the growth of emerging economies contribute to the market's steady growth trajectory. However, fluctuating raw material prices, particularly zinc, can impact profit margins and pricing competitiveness, posing a restraint.

The CXOs further added that the construction of new residential and commercial buildings, as well as the expansion of transportation networks, creates a sustained demand for hot-dip galvanized steel. In addition, advancements in technology and innovation in the galvanization process are opening doors for enhanced product offerings, further expanding the market's reach.

The hot-dip galvanized steel market attained $47.0 billion in 2022 and is projected to reach $83.7 billion by 2032, growing at a CAGR of 6.1% from 2023 to 2032.

Upcoming trends in the hot-dip galvanized steel market include increased adoption of renewable energy projects, technological advancements for enhanced performance, and expanding applications across diverse industries.

Construction is the leading end-use industry segment in the hot-dip galvanized steel market.

Asia Pacific is the largest regional market for Hot-dip galvanized steel market.

The major players operating in the global hot-dip galvanized steel market are JMT Steel, Jain Steel Industries, Manaksia Steels Limited, Dana Steel, Sanghvi Metal, YIEH, Steel Tubes India, Tianjin Tianyingtai Steel Pipe Co. Ltd., Hebei Shengtian Group Seamless Steel Pipe Co., Ltd, Thyssenkrupp AG, and Dinesh Metal Industries.

The primary driver of the hot-dip galvanized steel market is the growing demand for durable, corrosion-resistant materials across various industries, particularly in construction, automotive, and infrastructure sectors.

Primary opportunities for the hot-dip galvanized steel market include expanding applications into new sectors, leveraging technological advancements for improved performance, and capitalizing on government initiatives promoting infrastructure and renewable energy projects.

Loading Table Of Content...

Loading Research Methodology...